Interest Rate Linked Investments

Illustration example

Illustration example

Illustration example | |

|---|---|

Investment Currency | USD |

Principal Redemption | 100% at maturity (subject to the credit and insolvency risks of the issuer) |

Underlying Interest Rate Benchmark | SOFR |

Interest Payment Period | Quarterly |

Trade Date | 14-Oct-2025 |

Value Date | 21-Oct-2025 |

Maturity Date | 21-Oct-2028 |

Tenor | 3-Year |

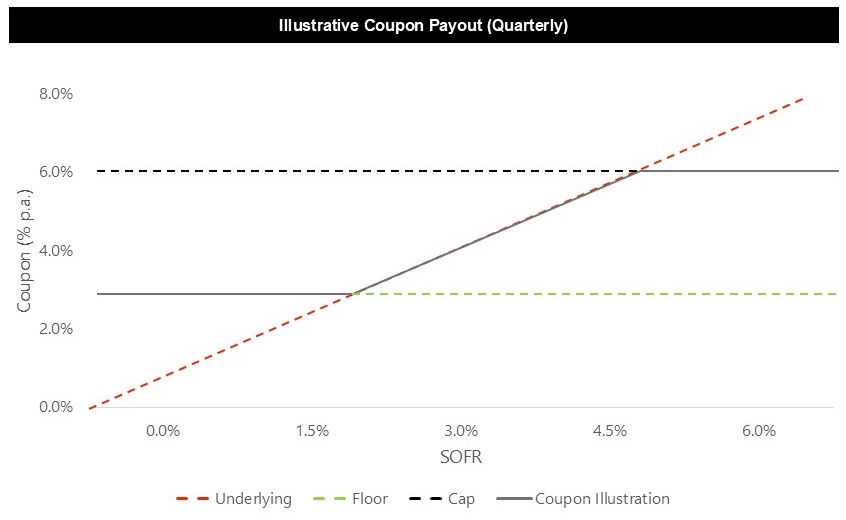

Cap Rate | 6.00% p.a. |

Floor Rate | 3.00% p.a. |

Bonus Coupon | 0.10% |

Day Count Fraction | Actual/360 |

Risk Rating: Subject to issuer’s credit rating | |

Payoff feature example:

- Offer periodic coupon subject to a minimum of the floor level and/or maximum of the cap level. Coupon is calculated with reference to the underlying interest rate during each interest period

- Enjoy a fixed bonus coupon on the first payment date if specific condition is met on the Interest Determination Date

Rationale

- The floating rate coupon feature allows for Investors to benefit in the current rising interest rate environment.

- The coupon floor feature gives investors an attractive higher minimum coupon rate, which is above cash deposit rates.

- However, with the coupon cap, should interest rates rise aggressively and above market expectations then the investment will underperform

All Pricing shown is purely indicative.

Illustration example | |

|---|---|

Trade Date | 14-Oct-2025 |

Value Date | 21-Oct-2025 |

Maturity Date | 21-Oct-2028 |

Tenor | 3-Year |

Investment Currency | USD |

Settlement Currency | USD |

Linked Currency | HKD |

Interest Rate (p.a.) | 4.00% |

Day Count Fraction | Actual/360 |

Risk Rating: Subject to issuer’s credit rating | |

Payoff feature example:

- Offer periodic coupon which is fixed upfront

Rationale

- Get peace of mind knowing your wealth is growing with a fixed interest amount payable upon the maturity date

- The fixed coupon feature gives investors an attractive higher minimum coupon rate, which is above cash deposit rates.

- However, with the coupon cap, should interest rates rise aggressively and above market expectations then the investment will underperform

All Pricing shown is purely indicative. The example is for illustration purpose only and is not indicative of the future or likely performance of the Product, it does not constitute any offer, invitation or recommendation to any person to purchase any Products. The example should not be relied on as an indication of actual performance of the reference asset or the total payout of the Product.

Useful Links

Market Update and Tools

Talk to our Staff

24-hour Hotline:

(852) 2961 2338

Or let us contact you

Other hotlines