Equities Trading Club

The DBS Equities Trading Club is an exclusive programme for stock investors. By maintaining a Wealth Management Account, you are automatically enrolled in the Club to enjoy a range of exclusive brokerage rates and privileges designed to support your trading activities.

Benefits

- Exclusive brokerage rate - Enjoy exclusive brokerage rate on your equities trading. The more you trade, the lower your rate.

- Market insights - Gain access to trading ideas, market commentary, stock analysis reports, and more from our expert research team.

- Invitations to events - Receive invites to our seminars and market outlook forums.

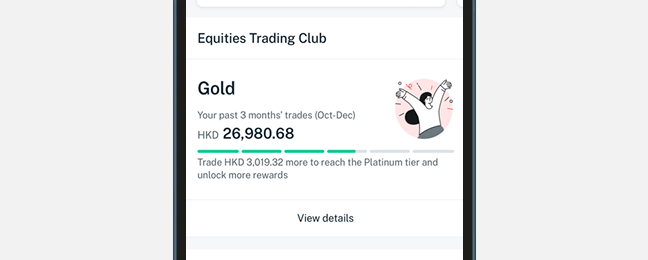

Membership Tiers

The club has 6 membership tiers offering increasing benefits:

| Tier | Requirement of 3- month Accumulated Trading Volume (HK$ or equivalent in foreign currency) | Hong Kong Securities Brokerage Commission | U.S. Securities Brokerage Commission |

|---|---|---|---|

| Diamond | 20,000,000 or above | 0.10% |

0.15% |

| Platinum | From 10,000,000 to below 20,000,000 | 0.12% |

0.20% |

| Gold | From 5,000,000 to below 10,000,000 | 0.14% |

0.23% |

| Silver | From 2,000,000 to below 5,000,000 | 0.16% |

0.28% |

| Bronze | From 1,000,000 to below 2,000,000 | 0.18% |

0.32% |

| Standard | Below 1,000,000 | 0.20% |

0.35% |

For details, please refer to our Equities Trading Club Terms and Conditions and Notice of Amendment to the Bank Charges Schedule.

Equities Trading Club on Online Equity Trading platform

How it works

- As a Treasures customer, you are automatically joining the club once you have the Wealth Management Account (WMA).

- Membership tiers are reviewed and updated on the first calendar day of each month, based on the Member's past 3 months accumulated trading volume (“3- month Accumulated Trading Volume”). The membership tier may be further updated on the second calendar day of each month if any Eligible Transactions in overseas markets have been made on the last calendar day of the previous month. The corresponding brokerage commission rates are applicable from the calendar day of the membership tier update.

- The 3-month Accumulated Trading Volume refers to the accumulated securities transactions made on the Hong Kong Stock Exchange and overseas markets by the Member in the past 3 calendar months (“Eligible Transactions”). To calculate the transaction amount of Eligible Transaction in overseas markets, the Bank will convert the transaction to Hong Kong Dollars at the exchange rate determined by the Bank and will take the exchange rate on the relevant settlement date as the final exchange rate of such Eligible Transaction for the purpose of calculating the 3-month Accumulated Trading Volume. Due to exchange rate fluctuations after making of the Eligible Transaction, there may be slight changes in the 3-month Accumulated Trading Volume on or before the settlement date. For overseas transactions made on the last day of a calendar month, exchange rates fluctuations on or before the settlement date may result in updates to the membership tiers on the first two calendar days of the next calendar month. All transaction values relevant for calculation of the 3-month Accumulated Trading Volume are determined according to the Bank’s record.

- In order for the Eligible Transactions to be included in the 3-month Accumulated Trading Volume on the first calendar day of each month, the Eligible Transactions must be executed on or before the last day of the previous calendar month. Please note that for non-Asia market Eligible Transactions (i.e. Eligible Transactions made in United States, Canada, United Kingdom stock markets and any stock markets other than Hong Kong, Singapore, Japan and Australia), such Eligible Transactions will only be reflected in the 3-month Accumulated Trading Volume on T+2 day. In other words, for non-Asia market Eligible Transactions made on the last calendar day of the previous month, the membership tier may be further updated on the second calendar day of the month.

- Transactions made in respect of initial public offerings will not count towards your “Past 3-month accumulated trading volume”.

Ready to take your equities trading to the next level? Open a Wealth Management Account today to start trading towards DBS Equities Trading Club membership tiers.

Risk Disclosure and Important Notice

- Investment involves risks. The above information does not constitute any offer or solicitation of offer to subscribe, transact or redeem any investment product. Past performances are not indicative of future performances. You should carefully read the product offering documentation, the account terms and conditions and the product terms and conditions for detailed product information and risk factors prior to making any investment. If you have any doubt on this material or any product offering documentation, you should seek independent professional advice.

- Securities trading is an investment. The prices of stocks fluctuate, sometimes dramatically. The price of a stock may move up or down and may become valueless. It is as likely that losses will be incurred rather than profits made as a result of trading stocks. The investment decision is yours but you should not invest in any stock unless you have taken into account that the relevant stock is suitable for you having regard to your financial situation, investment experience and investment objectives.

- Customers should be aware that the prices of the Callable Bull / Bear Contracts and Warrants may fall in value as rapidly as they may rise and holders may sustain a total loss of their investment. The Bank does not provide securities advisory service. Any person considering an investment should seek independent advice on the investment suitability when considered necessary.

- Foreign exchange involves risk. Customers should note that foreign exchange may incur loss due to the fluctuation of exchange rate.

- RMB currently may not be freely convertible and is subject to exchange controls and restrictions. There is no guarantee that RMB will not depreciate. If you convert Hong Kong Dollar or any other currency into RMB so as to invest in a RMB product and subsequently convert the RMB sale proceeds back into Hong Kong Dollar or any other currency, you may suffer a loss if RMB depreciates against Hong Kong Dollar or other currency.

Thank you. Your feedback will help us serve you better.

Was this information useful?

Useful Links

Market Update and Tools

Talk to our Staff

24-hour Hotline:

(852) 2961 2338

Or let us contact you

Other hotlines

©Copyright. DBS Bank (Hong Kong) Limited 星展銀行 (香港) 有限公司