Related Insights

- FX: DEER strategy evaluation and risks17 Jan 2025

- Trade and Policy Shifts17 Jan 2025

- FX Tactical Ideas: Inauguration Day is a Risk Event17 Jan 2025

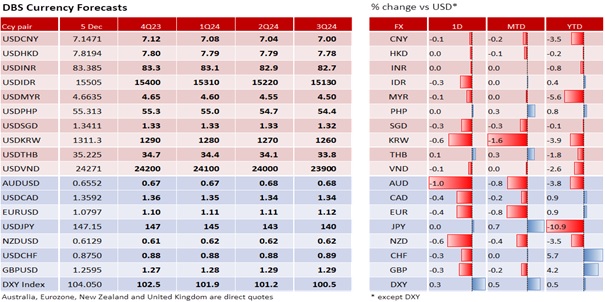

DXY appreciated by 0.2% to 103.94 as a haven. The 10-year US Treasury yield eased 9 bps to 4.16% from interest rate futures pricing in a 61% chance of an earlier Fed cut in March 2024. The bond market is steering from a Goldilocks outlook for the US economy towards a faster slowdown. The Atlanta Fed GDPNow model predicts US GDP growth slowing from an exceptional 5.2% QoQ saar in 3Q23 to 1.2% in the final quarter of the year, weaker than the 2.1% projected on 22 November.

However, we see the DXY possibly capped around 104 after recovering in four out of the five past sessions. Although the S&P 500 Index was modestly lower by 0.1% to 4567, it has been consolidating primarily between 4540 and 4570 since 22 November. The larger-than-expected drop in October’s US JOLTS jobs opening data was more about the weaker-than-expected nonfarm payrolls (NFP) that month. Consensus sees Friday’s NFP recovering to 187k in November after its plunge to 150k in October from 297k in September. The ISM services employment improved to 50.7 from 50.2 for services, though manufacturing slowed to 45.8 from 46.8. Also, ISM prices paid rose to 52.7 from 51.8 for services and 49.9 from 45.1 for manufacturing, suggesting next week’s US CPI data may be sticky around current levels, underpinning the Fed’s belief that it has yet to win the fight against inflation.

AUD/USD depreciated 1% to 0.6552, its lowest close since 22 November. The Reserve Bank of Australia kept the cash rate target unchanged at 4.30% at the final meeting for 2023. When it returns in February 2024, it will shift from meeting once a month to twice a quarter in 2024, aligning with US, Eurozone, and UK practices. RBA’s decision was a reminder that the Fed was not the only central bank expected to pause in December. Today, we expect the Bank of Canada to keep its overnight lending rate at 5% for a fourth consecutive meeting. Next week, the European Central Bank and the Bank of England will likely keep rates unchanged one day after the FOMC meeting on 12-13 December. Following the drop in the Eurozone’s CPI inflation to below the US, ECB Executive Board Member Isabel Schnabel, a renowned hawk, said another hike would now be unlikely. Interest rate futures subsequently priced in a higher chance of the ECB cutting rates before the Fed. The fact that central banks are on the same page regarding the direction of monetary policy amid a softer growth outlook suggests that their currencies are more likely to consolidate than a trend in either direction.

USD/CNH rose a second session by 0.3% to 7.1734. Moody’s downgraded China’s sovereign debt rating outlook to “negative” from “stable” yesterday. The international ratings agency sees the economy slowing from the government’s projected 5% growth this year to 4% in 2024 and 3.5% by 2030. Earlier Monday, Goldman Sachs reported net outflows from Chinese equities from long/short fund managers for a fourth consecutive month in November. Last weekend, US Commerce Secretary Gina Raimondo stressed that China was “not our friend,” dampening optimism from the Xi-Biden meeting that relations between the two largest economies may stabilize. However, USD/CNH is still confined in the 7.1120-7.1760 range set on 22 November. China’s top leaders are holding a closed-door meeting in December to determine the 2024 GDP growth target which will be announced later at the Chinese People's Political Consultative Conference (CPPCC) in March. Given the dampened sentiment, many wonder if Beijing can convince investors of its goal to double China’s economy by 2035 from 2020 levels. On the other hand, growth worries are no longer confined to China alone and are becoming a concern for the US and other Western economies, too.

Quote of the day

“If misery loves company, misery has company enough.”

Henry David Thoreau

6 December in history

In 2010, a record price for a printed book was achieved when a first edition of "The Birds of America" by John James Audubon auctioned at Sotheby's, London, England, for £7,321,250.

Topic

GENERAL DISCLOSURE/ DISCLAIMER (For Macroeconomics, Currencies, Interest Rates)

The information herein is published by DBS Bank Ltd and/or DBS Bank (Hong Kong) Limited (each and/or collectively, the “Company”). It is based on information obtained from sources believed to be reliable, but the Company does not make any representation or warranty, express or implied, as to its accuracy, completeness, timeliness or correctness for any particular purpose. Opinions expressed are subject to change without notice. This research is prepared for general circulation. Any recommendation contained herein does not have regard to the specific investment objectives, financial situation and the particular needs of any specific addressee. The information herein is published for the information of addressees only and is not to be taken in substitution for the exercise of judgement by addressees, who should obtain separate legal or financial advice. The Company, or any of its related companies or any individuals connected with the group accepts no liability for any direct, special, indirect, consequential, incidental damages or any other loss or damages of any kind arising from any use of the information herein (including any error, omission or misstatement herein, negligent or otherwise) or further communication thereof, even if the Company or any other person has been advised of the possibility thereof. The information herein is not to be construed as an offer or a solicitation of an offer to buy or sell any securities, futures, options or other financial instruments or to provide any investment advice or services. The Company and its associates, their directors, officers and/or employees may have positions or other interests in, and may effect transactions in securities mentioned herein and may also perform or seek to perform broking, investment banking and other banking or financial services for these companies. The information herein is not directed to, or intended for distribution to or use by, any person or entity that is a citizen or resident of or located in any locality, state, country, or other jurisdiction (including but not limited to citizens or residents of the United States of America) where such distribution, publication, availability or use would be contrary to law or regulation. The information is not an offer to sell or the solicitation of an offer to buy any security in any jurisdiction (including but not limited to the United States of America) where such an offer or solicitation would be contrary to law or regulation.

[#for Distribution in Singapore] This report is distributed in Singapore by DBS Bank Ltd (Company Regn. No. 196800306E) which is Exempt Financial Advisers as defined in the Financial Advisers Act and regulated by the Monetary Authority of Singapore. DBS Bank Ltd may distribute reports produced by its respective foreign entities, affiliates or other foreign research houses pursuant to an arrangement under Regulation 32C of the Financial Advisers Regulations. Where the report is distributed in Singapore to a person who is not an Accredited Investor, Expert Investor or an Institutional Investor, DBS Bank Ltd accepts legal responsibility for the contents of the report to such persons only to the extent required by law. Singapore recipients should contact DBS Bank Ltd at 65-6878-8888 for matters arising from, or in connection with the report.

DBS Bank Ltd., 12 Marina Boulevard, Marina Bay Financial Centre Tower 3, Singapore 018982. Tel: 65-6878-8888. Company Registration No. 196800306E.

DBS Bank Ltd., Hong Kong Branch, a company incorporated in Singapore with limited liability. 18th Floor, The Center, 99 Queen’s Road Central, Central, Hong Kong SAR.

DBS Bank (Hong Kong) Limited, a company incorporated in Hong Kong with limited liability. 11th Floor, The Center, 99 Queen’s Road Central, Central, Hong Kong SAR.

Virtual currencies are highly speculative digital "virtual commodities", and are not currencies. It is not a financial product approved by the Taiwan Financial Supervisory Commission, and the safeguards of the existing investor protection regime does not apply. The prices of virtual currencies may fluctuate greatly, and the investment risk is high. Before engaging in such transactions, the investor should carefully assess the risks, and seek its own independent advice.

Related Insights

- FX: DEER strategy evaluation and risks17 Jan 2025

- Trade and Policy Shifts17 Jan 2025

- FX Tactical Ideas: Inauguration Day is a Risk Event17 Jan 2025

Related Insights

- FX: DEER strategy evaluation and risks17 Jan 2025

- Trade and Policy Shifts17 Jan 2025

- FX Tactical Ideas: Inauguration Day is a Risk Event17 Jan 2025