Related Insights

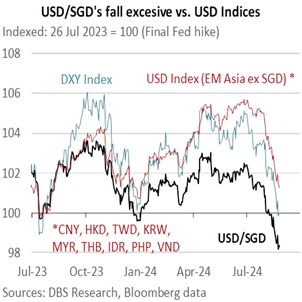

In the short term, USD/SGD could consolidate after its rapid decline to 1.30 this month. Per the 14-day RSI indicator, the DXY Index is oversold, and the SGD and most Asian currencies are overbought. Compared to levels of the final Fed hike in July, USD/SGD has outpaced the declines in the USD Indices for the Developed Market and Emerging Asian currencies, in line with Singapore’s appreciating SGD NEER policy.

Looking ahead, we see the door opening for the Monetary Authority of Singapore to slightly ease the appreciation pace of its SGD NEER policy band in October after the Fed’s telegraphed rate cut in September. Singapore’s core inflation averaged 3.1% in the first seven months after descending to 2.5% YoY in July, its lowest level since January 2022. Full-year core inflation should fall into the lower half of this year’s official 2.5-3.5% forecast range based on the MAS’s expectation to drop discernibly in the fourth quarter. At the last policy review in July, the central bank lowered the forecast for CPI inflation to 2-3% from 2.5-3.5%. Meanwhile, the futures market has started reducing the odds of a 50 bps Fed cut at the FOMC meeting on September 18. Consensus expects incoming US data to affirm a soft landing in the US economy, namely, the US unemployment rate easing to 4.2% in August from 4.3% in July.

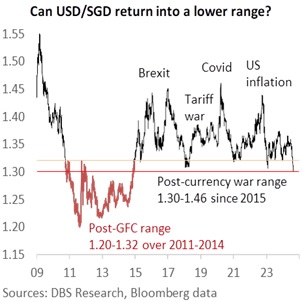

Over the medium term, barring shocks to the global economy and financial markets, we are assessing if USD/SGD can return to 1.20-1.32, its post-GFC range in 2011-2014. The crucial factors that lifted USD/SGD into a 1.31-1.46 range in 2015 have reversed. First, contrary to its Three Arrows launched in 2012 to weaken the JPY, the Bank of Japan wants to support the JPY with more interest rate hikes through FY2025. Second, the Fed is not hiking rates like in 2017-2018. At Jackson Hole last week, Fed Chair Jerome Powell said it was time to start lowering rates from September. Unlike other central banks, the Fed has an apparent rate cut trajectory. Per its Summary of Economic Projections in June, the Fed pencilled 25-50 bps cuts in 2024, followed by 100 bps in 2025 and another 100 bps in 2026. Third, there is no repeat of the currency war in 2015. Unlike its one-off devaluation in August 2015, China has been maintaining a balanced approach to support growth while preventing excessive volatility in the CNY. Emerging Asian currencies have recovered strongly, relieved that the high US interest rates that kept the USD strong in the past couple of years would reverse.

However, we also noted the events that led USD/SGD to rebound from 1.30-1.32 – the shock vote in the UK to exit the EU and the Trump rally in 2016, the US-China tariff war in 2018, the Covid-19 outbreak that led a global recession in 2020, and high inflation driving US interest rates significantly higher in 2022.

Today’s landscape is a mixed bad. The UK Labour Party wants to repair ties with the EU after assuming power at the July general elections. Canada joined the US and the EU in imposing tariffs on China’s Electric Vehicles. Former President Donald Trump has fallen behind Vice President Kamala Harris at the polls ahead of US presidential elections in November. The World Health Organisation believed that the mpox viral outbreak could be stopped with a comprehensive and coordinated plan of action and funding. The Fed is focused on rates cuts to prevent a further cooling in the US labour market now that inflation has fallen significantly from its peak near the 2% target. Finally, a broadening conflict in the Middle East and the Ukraine-Russia war remain the top geopolitical risks that could significantly impact the global economic outlook.

Quote of the day

”Being positive doesn’t mean ignoring the negative. Being positive means overcoming the negative. There’s a big difference between the two.”

marcandangel (Marc and Angel Chernoff)

27 August in history

In 1918, the Spanish flu arrived in Boston and started the second and deadliest wave in the US.

Topic

The information herein is published by DBS Bank Ltd and/or DBS Bank (Hong Kong) Limited (each and/or collectively, the “Company”). This report is intended for “Accredited Investors” and “Institutional Investors” (defined under the Financial Advisers Act and Securities and Futures Act of Singapore, and their subsidiary legislation), as well as “Professional Investors” (defined under the Securities and Futures Ordinance of Hong Kong) only. It is based on information obtained from sources believed to be reliable, but the Company does not make any representation or warranty, express or implied, as to its accuracy, completeness, timeliness or correctness for any particular purpose. Opinions expressed are subject to change without notice. This research is prepared for general circulation. Any recommendation contained herein does not have regard to the specific investment objectives, financial situation and the particular needs of any specific addressee. The information herein is published for the information of addressees only and is not to be taken in substitution for the exercise of judgement by addressees, who should obtain separate legal or financial advice. The Company, or any of its related companies or any individuals connected with the group accepts no liability for any direct, special, indirect, consequential, incidental damages or any other loss or damages of any kind arising from any use of the information herein (including any error, omission or misstatement herein, negligent or otherwise) or further communication thereof, even if the Company or any other person has been advised of the possibility thereof. The information herein is not to be construed as an offer or a solicitation of an offer to buy or sell any securities, futures, options or other financial instruments or to provide any investment advice or services. The Company and its associates, their directors, officers and/or employees may have positions or other interests in, and may effect transactions in securities mentioned herein and may also perform or seek to perform broking, investment banking and other banking or financial services for these companies. The information herein is not directed to, or intended for distribution to or use by, any person or entity that is a citizen or resident of or located in any locality, state, country, or other jurisdiction (including but not limited to citizens or residents of the United States of America) where such distribution, publication, availability or use would be contrary to law or regulation. The information is not an offer to sell or the solicitation of an offer to buy any security in any jurisdiction (including but not limited to the United States of America) where such an offer or solicitation would be contrary to law or regulation.

This report is distributed in Singapore by DBS Bank Ltd (Company Regn. No. 196800306E) which is Exempt Financial Advisers as defined in the Financial Advisers Act and regulated by the Monetary Authority of Singapore. DBS Bank Ltd may distribute reports produced by its respective foreign entities, affiliates or other foreign research houses pursuant to an arrangement under Regulation 32C of the Financial Advisers Regulations. Singapore recipients should contact DBS Bank Ltd at 65-6878-8888 for matters arising from, or in connection with the report.

DBS Bank Ltd., 12 Marina Boulevard, Marina Bay Financial Centre Tower 3, Singapore 018982. Tel: 65-6878-8888. Company Registration No. 196800306E.

DBS Bank Ltd., Hong Kong Branch, a company incorporated in Singapore with limited liability. 18th Floor, The Center, 99 Queen’s Road Central, Central, Hong Kong SAR.

DBS Bank (Hong Kong) Limited, a company incorporated in Hong Kong with limited liability. 13th Floor One Island East, 18 Westlands Road, Quarry Bay, Hong Kong SAR

Virtual currencies are highly speculative digital "virtual commodities", and are not currencies. It is not a financial product approved by the Taiwan Financial Supervisory Commission, and the safeguards of the existing investor protection regime does not apply. The prices of virtual currencies may fluctuate greatly, and the investment risk is high. Before engaging in such transactions, the investor should carefully assess the risks, and seek its own independent advice.