Related Insights

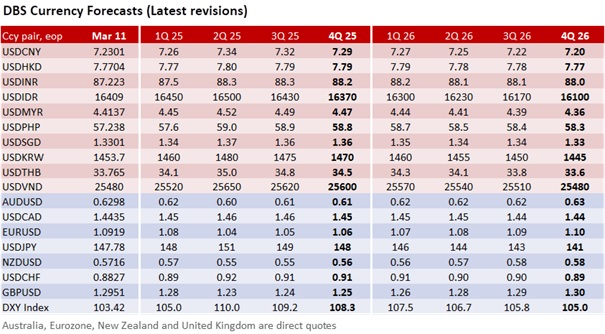

We have recalibrated our currency forecasts. Having examined why the “Trump Put” disappointed in 1Q25, we maintain that the USD should reinstate its haven status in 2Q25. Like it or not, currency markets fluctuated from one theme to another in the past few quarters. The greenback weakened in 3Q24 into the Fed’s 50 bps cut in September, gained strength in 4Q24 on the Trump Trade, and has been removing the Trump Put this quarter.

Contrary to expectations, the USD did not appreciate as a haven on Trump’s tariffs in the first quarter. Following his inauguration as the 41st US President on January 20th, Donald Trump frustrated investors, businesses, and consumers with sudden tariff escalations and rollbacks, which heightened uncertainty, making it difficult to plan or manage risks in the medium term. For example, the Nasdaq Composite Index fell most by 9.7% YTD as of March 11th because tariffs lifted costs and led to disruptions for companies with supply chains.

Fears of a US recession eroded the American exceptionalism narrative in early March. The Atlanta Fed’s GDPNow model flagged that US GDP growth would turn negative in 1Q25, driven by a significant widening in the trade deficit. Following Trump’s victory in the November elections, US businesses accelerated imports to avoid new tariffs, which are significantly higher than those in Trump 1.0, in America’s top three import partners – Canada, Mexico, and China. Hopefully, this surge in US imports will be transitory and taper off once the tariffs are in place.

Nonetheless, a US recession would not necessarily imply a weak USD because of its significant negative effects on global growth. This was evident by the struggles of the commodity-led currencies – AUD, NZD, AND CAD – and the export-led KRW to recover this quarter despite the soft USD. Trump’s reciprocal tariffs coming on April 2nd will extend beyond Canada, Mexico, and China with a comprehensive plan to match tariffs and trade barriers with those of other countries.

Trump’s surprise initiative for peace in Ukraine through direct negotiations with Russia turned out to be a blessing in disguise for the EUR in March. The European Commission responded with a “ReArm Europe” plan that targeted up to EUR800bn to reduce dependence on external allies and enhance the EU’s defence infrastructure and capabilities against external threats. The plan also positioned the stagnant German economy for renewed growth and lifted EU bond yields against their lacklustre US counterparts.

However, Germany must approve the plan before the new Bundestag session starts on March 25th.Following the February 23rd national elections, the CDU/CSU, Social Democrats, and the (wavering) Green Party lack the super or two-thirds majority to support a constitutional amendment to relax the debt brake. The far-right Alternative for Germany (AfD) Party, which has doubled its representation in the new Bundestag, does not support the ReArm EU plan if it involves relaxing fiscal constraints or increasing the national debt. The AfD has filed a motion with the Federal Constitutional Court that the outgoing Bundestag should not make such significant fiscal decisions, which will bypass the electorate’s latest choices.

Moreover, a US-led peace plan for Ukraine and Russia in the context of ReArm EU remains challenging, i.e., how to negotiate a settlement that satisfies the security concerns of Ukraine and Russia – all without escalating into a broader NATO-Russia confrontation.

Meanwhile, Ukraine has supported a US proposal for a 30-day ceasefire with Russia at the meeting between their officials in Saudi Arabia. The US would immediately lift the pause on intelligence sharing and resume security assistance to Ukraine, which is amenable to concluding a rare minerals deal as soon as possible. Washington will now direct diplomatic efforts to secure Moscow’s agreement to the truce and facilitate subsequent peace negotiations. The US will likely need to engage their European and NATO allies to discuss their defence and peacekeeping initiatives. Achieving peace between Ukraine and Russia remains extremely complicated because of deep-rooted geopolitical, historical, and security issues. The ceasefire is only a first step. Realising lasting peace will require painful compromises, strong diplomatic efforts, and long-term binding security agreements that both sides and their backers can accept.

Concluding remarks

While the USD did not initially strengthen in response to Trump’s tariffs this quarter, the volatility has reinforced the complex interplay between US trade and geopolitical policies, European politics, and global growth dynamics. Despite the risk of a US recession, we cannot rule out global risk aversion underpinning the USD. The sustainability of the EUR’s support from Trump’s peace initiative in Ukraine depends on Germany overcoming the constitutional hurdles to onboard the ReArm Europe plan. Looking ahead, the FX landscape should continue to hinge on the implementation of Trump’s reciprocal tariffs, Germany’s fiscal path, and the still uncertain path toward peace in Ukraine.

Quote of the Day

“The weak can never forgive. Forgiveness is the attribute of the strong.”

Mahatma Gandhi

March 12 in history

In 1930, Mahatma Gandhi started his famous 200 mile protest march against the widely hated British salt tax.

Topic

GENERAL DISCLOSURE/ DISCLAIMER (For Macroeconomics, Currencies, Interest Rates)

The information herein is published by DBS Bank Ltd and/or DBS Bank (Hong Kong) Limited (each and/or collectively, the “Company”). It is based on information obtained from sources believed to be reliable, but the Company does not make any representation or warranty, express or implied, as to its accuracy, completeness, timeliness or correctness for any particular purpose. Opinions expressed are subject to change without notice. This research is prepared for general circulation. Any recommendation contained herein does not have regard to the specific investment objectives, financial situation and the particular needs of any specific addressee. The information herein is published for the information of addressees only and is not to be taken in substitution for the exercise of judgement by addressees, who should obtain separate legal or financial advice. The Company, or any of its related companies or any individuals connected with the group accepts no liability for any direct, special, indirect, consequential, incidental damages or any other loss or damages of any kind arising from any use of the information herein (including any error, omission or misstatement herein, negligent or otherwise) or further communication thereof, even if the Company or any other person has been advised of the possibility thereof. The information herein is not to be construed as an offer or a solicitation of an offer to buy or sell any securities, futures, options or other financial instruments or to provide any investment advice or services. The Company and its associates, their directors, officers and/or employees may have positions or other interests in, and may effect transactions in securities mentioned herein and may also perform or seek to perform broking, investment banking and other banking or financial services for these companies. The information herein is not directed to, or intended for distribution to or use by, any person or entity that is a citizen or resident of or located in any locality, state, country, or other jurisdiction (including but not limited to citizens or residents of the United States of America) where such distribution, publication, availability or use would be contrary to law or regulation. The information is not an offer to sell or the solicitation of an offer to buy any security in any jurisdiction (including but not limited to the United States of America) where such an offer or solicitation would be contrary to law or regulation.

[#for Distribution in Singapore] This report is distributed in Singapore by DBS Bank Ltd (Company Regn. No. 196800306E) which is Exempt Financial Advisers as defined in the Financial Advisers Act and regulated by the Monetary Authority of Singapore. DBS Bank Ltd may distribute reports produced by its respective foreign entities, affiliates or other foreign research houses pursuant to an arrangement under Regulation 32C of the Financial Advisers Regulations. Where the report is distributed in Singapore to a person who is not an Accredited Investor, Expert Investor or an Institutional Investor, DBS Bank Ltd accepts legal responsibility for the contents of the report to such persons only to the extent required by law. Singapore recipients should contact DBS Bank Ltd at 65-6878-8888 for matters arising from, or in connection with the report.

DBS Bank Ltd., 12 Marina Boulevard, Marina Bay Financial Centre Tower 3, Singapore 018982. Tel: 65-6878-8888. Company Registration No. 196800306E.

DBS Bank Ltd., Hong Kong Branch, a company incorporated in Singapore with limited liability. 18th Floor, The Center, 99 Queen’s Road Central, Central, Hong Kong SAR.

DBS Bank (Hong Kong) Limited, a company incorporated in Hong Kong with limited liability. 11th Floor, The Center, 99 Queen’s Road Central, Central, Hong Kong SAR.

Virtual currencies are highly speculative digital "virtual commodities", and are not currencies. It is not a financial product approved by the Taiwan Financial Supervisory Commission, and the safeguards of the existing investor protection regime does not apply. The prices of virtual currencies may fluctuate greatly, and the investment risk is high. Before engaging in such transactions, the investor should carefully assess the risks, and seek its own independent advice.