Related Insights

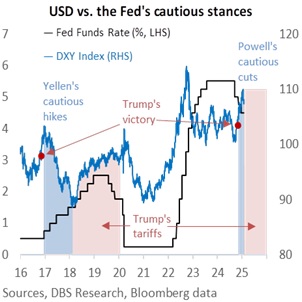

Our belief in US President Donald Trump’s tariffs driving the USD’s haven appeal paid off. US President Donald Trump announced 25% tariffs on imports from Canada and Mexico and an additional 10% tariff on Chinese imports taking effect from February 4. During Trump 1.0, the US-China tit-for-tat tariff war that started in 2018 maintained the USD’s haven status until it became clear that the Phase One Trade deal was coming in January 2020. Due to the retaliatory nature of the trade war, the USD’s uptrend also ended up choppy after its initial surge in 2Q18.

US-led trade tensions today will likely be worse than Trump 1.0. Trump is imposing tariffs faster, at higher rates, and with a broader scope, targeting most goods from both rivals and allies alike. The universal tariff policy under Trump 2.0 extends beyond its previous role as a leverage tool for negotiation in Trump 1.0. First, Trump has adopted a more protectionist stance that aims to boost domestic production apart from reducing the trade deficit. Second, the tariffs are positioned as a revenue source to offset the extension of tax cuts set to expire at the end of 2025. Third, Trump’s tariff threat against the Eurozone aligns with his objective of boosting US oil and gas exports.

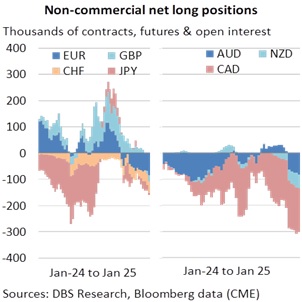

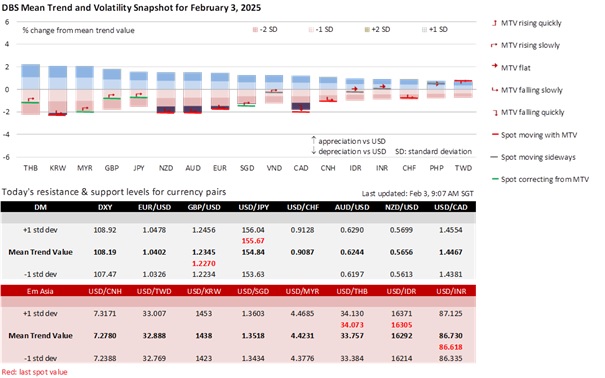

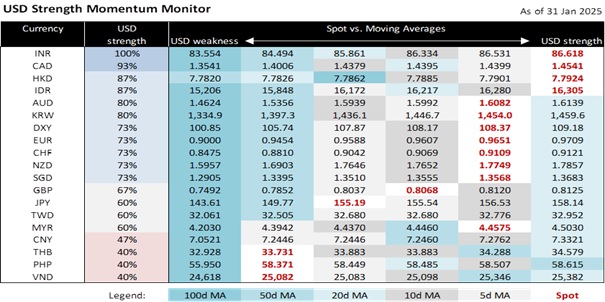

Speculators held on to their net short currency positions, underscoring the USD’s fall in January as a correction in the uptrend established during the Trump Trades in 4Q24. Last week’s FOMC decision to keep rates unchanged affirmed the Fed’s concerns over inflation’s slow progress towards the 2% target due to Trump’s policy mix of tariffs, tax cuts, and mass deportation of illegal migrants. Hence, the Fed’s congressional semi-annual testimonies on monetary policy on February 12 could be a significant event rolling back Fed cut expectations. Conversely, many central banks continued to ease monetary policy to support their less resilient economies in anticipation of heightening global trade tensions. Markets have also increased their bets for 25 bps cuts in the UK on February 6, Australia on February 18, and a 50 bps cut in New Zealand on February 19.

Quote of the Day

“Nobody ever lost a dollar by underestimating the taste of the American public.”

P,T. Barnum

February 3 in history

P.T. Barnum purchased the world-famous circus elephant Jumbo in 1882.

Topic

GENERAL DISCLOSURE/ DISCLAIMER (For Macroeconomics, Currencies, Interest Rates)

The information herein is published by DBS Bank Ltd and/or DBS Bank (Hong Kong) Limited (each and/or collectively, the “Company”). It is based on information obtained from sources believed to be reliable, but the Company does not make any representation or warranty, express or implied, as to its accuracy, completeness, timeliness or correctness for any particular purpose. Opinions expressed are subject to change without notice. This research is prepared for general circulation. Any recommendation contained herein does not have regard to the specific investment objectives, financial situation and the particular needs of any specific addressee. The information herein is published for the information of addressees only and is not to be taken in substitution for the exercise of judgement by addressees, who should obtain separate legal or financial advice. The Company, or any of its related companies or any individuals connected with the group accepts no liability for any direct, special, indirect, consequential, incidental damages or any other loss or damages of any kind arising from any use of the information herein (including any error, omission or misstatement herein, negligent or otherwise) or further communication thereof, even if the Company or any other person has been advised of the possibility thereof. The information herein is not to be construed as an offer or a solicitation of an offer to buy or sell any securities, futures, options or other financial instruments or to provide any investment advice or services. The Company and its associates, their directors, officers and/or employees may have positions or other interests in, and may effect transactions in securities mentioned herein and may also perform or seek to perform broking, investment banking and other banking or financial services for these companies. The information herein is not directed to, or intended for distribution to or use by, any person or entity that is a citizen or resident of or located in any locality, state, country, or other jurisdiction (including but not limited to citizens or residents of the United States of America) where such distribution, publication, availability or use would be contrary to law or regulation. The information is not an offer to sell or the solicitation of an offer to buy any security in any jurisdiction (including but not limited to the United States of America) where such an offer or solicitation would be contrary to law or regulation.

[#for Distribution in Singapore] This report is distributed in Singapore by DBS Bank Ltd (Company Regn. No. 196800306E) which is Exempt Financial Advisers as defined in the Financial Advisers Act and regulated by the Monetary Authority of Singapore. DBS Bank Ltd may distribute reports produced by its respective foreign entities, affiliates or other foreign research houses pursuant to an arrangement under Regulation 32C of the Financial Advisers Regulations. Where the report is distributed in Singapore to a person who is not an Accredited Investor, Expert Investor or an Institutional Investor, DBS Bank Ltd accepts legal responsibility for the contents of the report to such persons only to the extent required by law. Singapore recipients should contact DBS Bank Ltd at 65-6878-8888 for matters arising from, or in connection with the report.

DBS Bank Ltd., 12 Marina Boulevard, Marina Bay Financial Centre Tower 3, Singapore 018982. Tel: 65-6878-8888. Company Registration No. 196800306E.

DBS Bank Ltd., Hong Kong Branch, a company incorporated in Singapore with limited liability. 18th Floor, The Center, 99 Queen’s Road Central, Central, Hong Kong SAR.

DBS Bank (Hong Kong) Limited, a company incorporated in Hong Kong with limited liability. 11th Floor, The Center, 99 Queen’s Road Central, Central, Hong Kong SAR.

Virtual currencies are highly speculative digital "virtual commodities", and are not currencies. It is not a financial product approved by the Taiwan Financial Supervisory Commission, and the safeguards of the existing investor protection regime does not apply. The prices of virtual currencies may fluctuate greatly, and the investment risk is high. Before engaging in such transactions, the investor should carefully assess the risks, and seek its own independent advice.