- Global: US CPI data point to stall disinflation but we do not see December’s Fed cut being derailed; ECB cuts by another 25 bps

- Hong Kong: Retail sales forecast to modestly rebound in 2025; exports remain a key growth pillar

- Indonesia: Effort to boost growth above the steady state of 5% would likely comprise of three “C”s framework

- Taiwan: Growth projected to slow in 2025 but still consistent with long-term growth trends; subdued prices expected

Related Insights

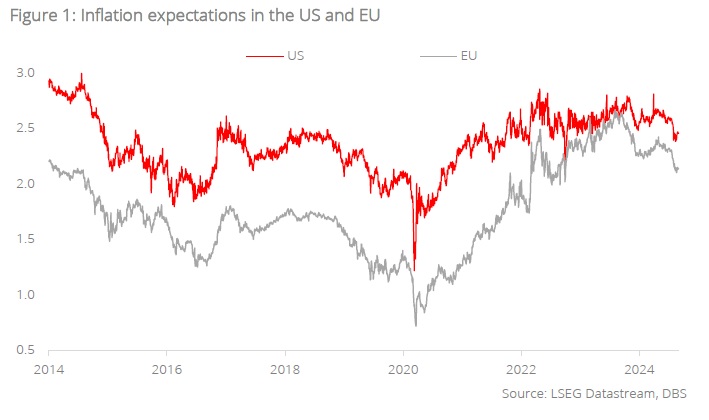

Global: Rate cut outlook on track. US headline and core CPI both came in at 0.3% m/m sa, in line with consensus estimates. From our perspective, the sequence of firm inflation prints over the past four months increasingly suggests that disinflation may have stalled. Some caution in the pace of easing is warranted, but we do not see December’s Fed cut being derailed. Despite oil prices staying depressed over the past few months, market participants are increasingly cognisant that the decline in US inflation may already be behind us.

The market is pricing in the odds of a December’s cut at 98%, up from 85% before the CPI data was released. We are not convinced that the Fed would pause just yet—labour market weakness fears (which were responsible for the 50 bps Fed cut in September) have ebbed amid growing optimism in the US economy. US nonfarm payrolls rebounded to 227k in November, more than the 220k anticipated. October was also revised to 36k from 12k. The likelihood has increased for the Fed to pause after delivering its third consecutive rate cut expected at the 18 Dec Federal Open Market Committee meeting. Post-December, the Fed will want to assess the actual policies of US President-elect Donald Trump after his inauguration on 20 Jan 2025 before further adjustments are made.

After 100 bps worth of cuts (since June), the European Central Bank (ECB) have cut rates by another 25 bps, in line with expectations. ECB President Lagarde’s tone was dovish, saying that the Eurozone economy is losing momentum and that there are risks of greater friction in global trade. During her hearing at the EU Parliament on 4 Dec, ECB President Christine Lagarde expects inflation to be temporarily higher in 4Q24 before returning to the 2% inflation target in 2025. Lagarde will likely urge EU leaders for a fiscal union and a capital markets union. Unfortunately, Germany and France have weak economies, and their governments have collapsed due to disagreements over debt.

Download the PDF to read the full report which includes coverage on Credit, FX, Rates, and Thematics.

Topic

The information published by DBS Bank Ltd. (company registration no.: 196800306E) (“DBS”) is for information only. It is based on information or opinions obtained from sources believed to be reliable (but which have not been independently verified by DBS, its related companies and affiliates (“DBS Group”)) and to the maximum extent permitted by law, DBS Group does not make any representation or warranty (express or implied) as to its accuracy, completeness, timeliness or correctness for any particular purpose. Opinions and estimates are subject to change without notice. The publication and distribution of the information does not constitute nor does it imply any form of endorsement by DBS Group of any person, entity, services or products described or appearing in the information. Any past performance, projection, forecast or simulation of results is not necessarily indicative of the future or likely performance of any investment or securities. Foreign exchange transactions involve risks. You should note that fluctuations in foreign exchange rates may result in losses. You may wish to seek your own independent financial, tax, or legal advice or make such independent investigations as you consider necessary or appropriate.

The information published is not and does not constitute or form part of any offer, recommendation, invitation or solicitation to subscribe to or to enter into any transaction; nor is it calculated to invite, nor does it permit the making of offers to the public to subscribe to or enter into any transaction in any jurisdiction or country in which such offer, recommendation, invitation or solicitation is not authorised or to any person to whom it is unlawful to make such offer, recommendation, invitation or solicitation or where such offer, recommendation, invitation or solicitation would be contrary to law or regulation or which would subject DBS Group to any registration requirement within such jurisdiction or country, and should not be viewed as such. Without prejudice to the generality of the foregoing, the information, services or products described or appearing in the information are not specifically intended for or specifically targeted at the public in any specific jurisdiction.

The information is the property of DBS and is protected by applicable intellectual property laws. No reproduction, transmission, sale, distribution, publication, broadcast, circulation, modification, dissemination, or commercial exploitation such information in any manner (including electronic, print or other media now known or hereafter developed) is permitted.

DBS Group and its respective directors, officers and/or employees may have positions or other interests in, and may effect transactions in securities mentioned and may also perform or seek to perform broking, investment banking and other banking or financial services to any persons or entities mentioned.

To the maximum extent permitted by law, DBS Group accepts no liability for any losses or damages (including direct, special, indirect, consequential, incidental or loss of profits) of any kind arising from or in connection with any reliance and/or use of the information (including any error, omission or misstatement, negligent or otherwise) or further communication, even if DBS Group has been advised of the possibility thereof.

The information is not intended for distribution to, or use by, any person or entity in any jurisdiction or country where such distribution or use would be contrary to law or regulation. The information is distributed (a) in Singapore, by DBS Bank Ltd.; (b) in China, by DBS Bank (China) Ltd; (c) in Hong Kong, by DBS Bank (Hong Kong) Limited; (d) in Taiwan, by DBS Bank (Taiwan) Ltd; (e) in Indonesia, by PT DBS Indonesia; and (f) in India, by DBS Bank Ltd, Mumbai Branch.