- The trend of capex discipline in the O&G industry is likely to persist in 2025, especially with expectations of moderating oil prices; there have been recent indicators of potential capex scale back from Chevron, Petrobras, and Petronas

- Despite potential near term slowdown, the long term outlook for OFS remains constructive, driven by robust exploration and production activities as well as digitalisation and low carbon transition

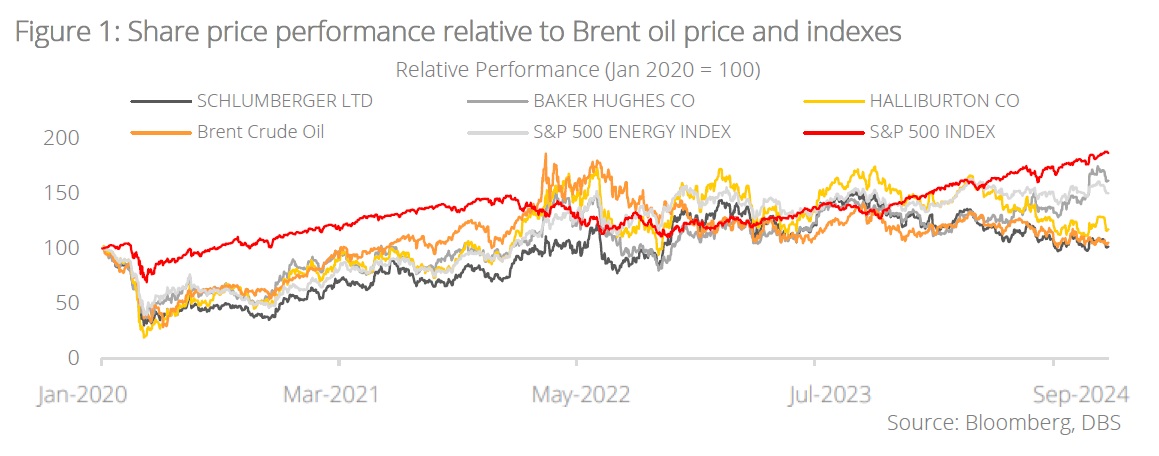

- SLB and HAL have corrected c.20% YTD, while BKR outperformed with over 20% YTD price increase, thanks to its diversified portfolio and strong orders

Related Insights

- Global Credit 1Q25 – Making Bonds Great Again23 Dec 2024

- Alternatives 1Q25: Gold – Resilience with Alternatives20 Dec 2024

- CIO Insights 1Q25: Game Changers20 Dec 2024

Capex discipline trend to continue in 2025. The trend of capex discipline in the oil and gas (O&G) industry is likely to persist in 2025, especially with expectations of moderating oil prices. Oil majors remain focused on returning capital to shareholders via dividends and buybacks, thus the low reinvestment rates, further aided by cost reduction and efficiency gains over the past decade. Some signals of capex scale back have been observed. In early December, Chevron unveiled plans to reduce 2025 capex by ~USD1bn or c.6-7% to the USD14.5-15.5bn range (vs USD15.5-16.5bn for 2024), including investment cuts in the US Permian basin, in favour of free cash flow. Petrobras indicated an intention to lower 2025 capex from USD21bn to USD17bn, citing rising equipment cost and financing limitations. Over in Asia, Petronas’ capex may also decline in 2025 due to greenfield project delays and loss of Sarawak gas income. There will be more clarity in the next few months as other supermajors and national oil companies (NOCs) release their annual strategies.

Oilfield services’ medium-term outlook remains constructive. Despite the likelihood of a slight slowdown in the near term, we believe the longer term outlook remains constructive with low single digit growth expected for global oilfield services (OFS) through 2030, driven by still robust production and exploration activities, particularly in the gas segment, and the deployment of new technologies, aimed at optimising production costs and decarbonisation. Digitalisation and low carbon technology investment will continue to be the bright spots of OFS market with 25-30% of key oil majors’ capex spent on low carbon products/technology (comprising hydrogen production and carbon capture). OFS giants, Schlumberger and Baker Hughes, are the industry leaders in this regard—taking the leap and transforming into energy technology companies that develop critical technologies for the transition. The North American market is also expected to see an uptick in activities with Trump promising to raise O&G lease sales and expedite approvals for LNG export permits. The consolidation trend in the oilfield service sector is also set to intensify under Trump.

Stay with the industry leaders. Weak macroeconomics and muted oil market fundamentals have taken a toll on share price performance of OFS stocks this year with Schlumberger (SLB) and Halliburton (HAL) having corrected ~20% YTD. Baker Hughes (BKR) outperformed its two peers with share price rising over 20% YTD, thanks to its steadier diversified portfolio and gas leverage which are expected to continue driving the outperformance. We believe downside has been priced in to a large extent. The O&G capex and OFS outlook remain constructive as long as oil price remains above USD70/bbl.

Topic

The information published by DBS Bank Ltd. (company registration no.: 196800306E) (“DBS”) is for information only. It is based on information or opinions obtained from sources believed to be reliable (but which have not been independently verified by DBS, its related companies and affiliates (“DBS Group”)) and to the maximum extent permitted by law, DBS Group does not make any representation or warranty (express or implied) as to its accuracy, completeness, timeliness or correctness for any particular purpose. Opinions and estimates are subject to change without notice. The publication and distribution of the information does not constitute nor does it imply any form of endorsement by DBS Group of any person, entity, services or products described or appearing in the information. Any past performance, projection, forecast or simulation of results is not necessarily indicative of the future or likely performance of any investment or securities. Foreign exchange transactions involve risks. You should note that fluctuations in foreign exchange rates may result in losses. You may wish to seek your own independent financial, tax, or legal advice or make such independent investigations as you consider necessary or appropriate.

The information published is not and does not constitute or form part of any offer, recommendation, invitation or solicitation to subscribe to or to enter into any transaction; nor is it calculated to invite, nor does it permit the making of offers to the public to subscribe to or enter into any transaction in any jurisdiction or country in which such offer, recommendation, invitation or solicitation is not authorised or to any person to whom it is unlawful to make such offer, recommendation, invitation or solicitation or where such offer, recommendation, invitation or solicitation would be contrary to law or regulation or which would subject DBS Group to any registration requirement within such jurisdiction or country, and should not be viewed as such. Without prejudice to the generality of the foregoing, the information, services or products described or appearing in the information are not specifically intended for or specifically targeted at the public in any specific jurisdiction.

The information is the property of DBS and is protected by applicable intellectual property laws. No reproduction, transmission, sale, distribution, publication, broadcast, circulation, modification, dissemination, or commercial exploitation such information in any manner (including electronic, print or other media now known or hereafter developed) is permitted.

DBS Group and its respective directors, officers and/or employees may have positions or other interests in, and may effect transactions in securities mentioned and may also perform or seek to perform broking, investment banking and other banking or financial services to any persons or entities mentioned.

To the maximum extent permitted by law, DBS Group accepts no liability for any losses or damages (including direct, special, indirect, consequential, incidental or loss of profits) of any kind arising from or in connection with any reliance and/or use of the information (including any error, omission or misstatement, negligent or otherwise) or further communication, even if DBS Group has been advised of the possibility thereof.

The information is not intended for distribution to, or use by, any person or entity in any jurisdiction or country where such distribution or use would be contrary to law or regulation. The information is distributed (a) in Singapore, by DBS Bank Ltd.; (b) in China, by DBS Bank (China) Ltd; (c) in Hong Kong, by DBS Bank (Hong Kong) Limited; (d) in Taiwan, by DBS Bank (Taiwan) Ltd; (e) in Indonesia, by PT DBS Indonesia; and (f) in India, by DBS Bank Ltd, Mumbai Branch.

Related Insights

- Global Credit 1Q25 – Making Bonds Great Again23 Dec 2024

- Alternatives 1Q25: Gold – Resilience with Alternatives20 Dec 2024

- CIO Insights 1Q25: Game Changers20 Dec 2024

Related Insights

- Global Credit 1Q25 – Making Bonds Great Again23 Dec 2024

- Alternatives 1Q25: Gold – Resilience with Alternatives20 Dec 2024

- CIO Insights 1Q25: Game Changers20 Dec 2024