- Equities: Global equities surged as the tech sector and jobs data drove optimism, strengthening the outlook for a soft landing

- Credit: Since the Fed’s September rate cut, IG credit yields hovered at 15-year highs with the risk-free rate component also maintaining a 15-year peak; with upside potential through further compression still palpable, investors should deploy cash toward quality credit

- FX: EUR/USD to set its sights lower at 1.04 after failing to rise sustainably above 1.06; EUR/GBP to decline and test critical trendline support at around 0.82

- Rates: Fed biased to cut in December despite firm data; potential January pause as policymakers await new policies from Trump administration

- The Week Ahead: Keep a lookout for US Change in Initial Jobless Claims; Japan Industrial Production Number

Related Insights

- Alternatives 1Q25: Gold – Resilience with Alternatives20 Dec 2024

- CIO Insights 1Q25: Game Changers20 Dec 2024

- Bank of America19 Dec 2024

A soft landing outlook strengthened global equities. US equities hit record highs last week. The S&P 500 rose about 1%, while NASDAQ jumped 3.3%. November nonfarm payrolls (NFP) increased by 227K, and the unemployment rate edged up to 4.25%, signalling a moderating labour market and driving rate cut expectations. Fed Chair Jerome Powell’s comments reinforced the view of a resilient economy, allowing for a cautious approach to rate cuts. This, along with robust earnings from tech companies, heightened investor optimism, pushing expectations for a 25 bps rate cut in December and strengthening the outlook for a soft landing.

The STOXX Europe 600 Index increased by 2% and FTSE 100 ended 0.26% higher despite political instability in France triggering the forced resignation of the country’s prime minister. Japan’s Nikkei 225 rose 2.3% as the weakness of the yen supported the profit outlooks for Japan’s export-heavy industries. Chinese markets rallied with both the Shanghai Composite and Hang Seng Index adding 2.3% as market expectations were high on hopes that China would roll out additional measures to ward off the growth risks posed by the incoming Trump administration’s trade policies.

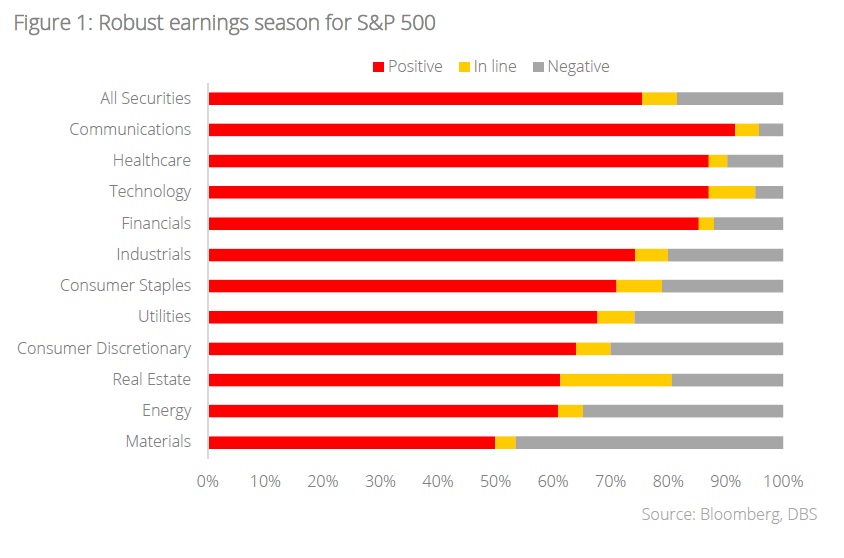

Topic in focus: S&P 500 ends the year with robust earnings performance. The US earnings season is coming to an end with c.99.2% of the companies having reported their earnings (as of 6 Dec 2024). The results are reassuring, highlighting continued strength, with c.76% of the companies reporting positive earnings surprises. This robust performance continues to demonstrate the ongoing resilience of US corporate earnings. Communication services, healthcare, and technology sectors produced the highest positive earnings surprises at 92%, 87%, and 87% respectively.

From a sectoral perspective, we continue to advocate exposure to communication services and technology, especially on Big Tech (i.e. Alphabet, Apple, Amazon, Meta Platforms, and Microsoft), given their strong market positioning and robust cash flow generation abilities. Technology is poised to be a key beneficiary as the world embarks on the transformational journey of artificial intelligence (AI). AI is currently still in its infancy phase and expands beyond hardware (including semiconductor companies), which most investors currently focus on, to encompass software (including cloud services, enterprise solutions, and cybersecurity) and diverse industry-specific applications. This broadening landscape presents a multitude of investment opportunities across the entire AI value chain.

Download the PDF to read the full report which includes coverage on Credit, FX, Rates, and Thematics.

Topic

The information published by DBS Bank Ltd. (company registration no.: 196800306E) (“DBS”) is for information only. It is based on information or opinions obtained from sources believed to be reliable (but which have not been independently verified by DBS, its related companies and affiliates (“DBS Group”)) and to the maximum extent permitted by law, DBS Group does not make any representation or warranty (express or implied) as to its accuracy, completeness, timeliness or correctness for any particular purpose. Opinions and estimates are subject to change without notice. The publication and distribution of the information does not constitute nor does it imply any form of endorsement by DBS Group of any person, entity, services or products described or appearing in the information. Any past performance, projection, forecast or simulation of results is not necessarily indicative of the future or likely performance of any investment or securities. Foreign exchange transactions involve risks. You should note that fluctuations in foreign exchange rates may result in losses. You may wish to seek your own independent financial, tax, or legal advice or make such independent investigations as you consider necessary or appropriate.

The information published is not and does not constitute or form part of any offer, recommendation, invitation or solicitation to subscribe to or to enter into any transaction; nor is it calculated to invite, nor does it permit the making of offers to the public to subscribe to or enter into any transaction in any jurisdiction or country in which such offer, recommendation, invitation or solicitation is not authorised or to any person to whom it is unlawful to make such offer, recommendation, invitation or solicitation or where such offer, recommendation, invitation or solicitation would be contrary to law or regulation or which would subject DBS Group to any registration requirement within such jurisdiction or country, and should not be viewed as such. Without prejudice to the generality of the foregoing, the information, services or products described or appearing in the information are not specifically intended for or specifically targeted at the public in any specific jurisdiction.

The information is the property of DBS and is protected by applicable intellectual property laws. No reproduction, transmission, sale, distribution, publication, broadcast, circulation, modification, dissemination, or commercial exploitation such information in any manner (including electronic, print or other media now known or hereafter developed) is permitted.

DBS Group and its respective directors, officers and/or employees may have positions or other interests in, and may effect transactions in securities mentioned and may also perform or seek to perform broking, investment banking and other banking or financial services to any persons or entities mentioned.

To the maximum extent permitted by law, DBS Group accepts no liability for any losses or damages (including direct, special, indirect, consequential, incidental or loss of profits) of any kind arising from or in connection with any reliance and/or use of the information (including any error, omission or misstatement, negligent or otherwise) or further communication, even if DBS Group has been advised of the possibility thereof.

The information is not intended for distribution to, or use by, any person or entity in any jurisdiction or country where such distribution or use would be contrary to law or regulation. The information is distributed (a) in Singapore, by DBS Bank Ltd.; (b) in China, by DBS Bank (China) Ltd; (c) in Hong Kong, by DBS Bank (Hong Kong) Limited; (d) in Taiwan, by DBS Bank (Taiwan) Ltd; (e) in Indonesia, by PT DBS Indonesia; and (f) in India, by DBS Bank Ltd, Mumbai Branch.

Related Insights

- Alternatives 1Q25: Gold – Resilience with Alternatives20 Dec 2024

- CIO Insights 1Q25: Game Changers20 Dec 2024

- Bank of America19 Dec 2024

Related Insights

- Alternatives 1Q25: Gold – Resilience with Alternatives20 Dec 2024

- CIO Insights 1Q25: Game Changers20 Dec 2024

- Bank of America19 Dec 2024