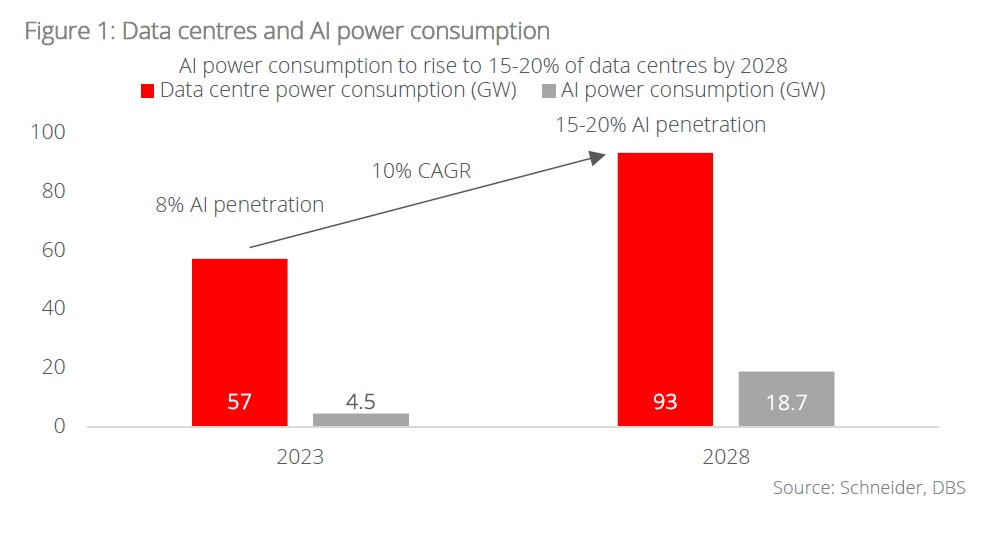

- Global data centre power consumption will grow by CAGR of 10% over 2023-2028, driven by surging AI demand

- The increase in adoption of AI-led workload for inferencing will drive demand for edge data centres

- The projected five-to-seven-year cycle of strong revenue growth and high capex requirement will lead to lower free cash flow in the industry

- Maintain preference on US names, given their diversified market exposure, stable dividend yield, and better liquidity, while Chinese players are showing improving prospects riding on demand recovery

Related Insights

AI inferencing to reshape data centre power use and infrastructure. Schneider projects that data centre power consumption will increase from 57GW in 2023 to 93GW by 2028 at 10% CAGR. This will be driven by AI power usage, expected to grow from 4.5GW to 14-19GW at a 25-33% CAGR over the same period. Currently, 35-40% of AI computing goes to inference and 60-65% to training. The training of AI models today will be crucial to fulfill AI inferencing, which is expected to rise to 75-80% of AI workload due to real-time large-scale usage across billions of devices. Edge data centres, which are closer to the end customers, are increasingly used for inferencing due to lower latency on higher bandwidth. Additionally, hybrid data centres, where one centre handles large language model (LLM) training and another focuses on model inferencing, will become the next area of growth. This dual-structure approach will enhance efficiency, catering for the growing energy demands and computational needs of AI deployment. However, AI-ready data centres will require larger cooling systems to support higher power density (5-15x higher than traditional data centres) and predictive maintenance systems.

3Q24 results show strong adj EBITDA improvements. In 3Q24, US data centre players registered an average 11%-12% y/y growth in adj EBITDA, surpassing consensus estimates. These players have projected 7-11% growth in adj EBITDA for FY2024, compared with 7-12% growth rate guided by Chinese operators, supported by bottoming-out of wholesale data-centre pricing in China and the emergence of AI-led demand. Meanwhile, Chinese AI firms are also capitalising on generative AI demand and developing new AI-embedded chips with potential clients to address the issue of chip shortages. US data centre operators have mentioned that about 50% of overall bookings came from AI in 3Q24 and highlighted that currently, training workloads have been dominating total kilowatts leased. This offers tremendous new opportunities as customers moved through the stages of AI adoption at a much faster pace in 3Q24. Equinix raised its FY24F adjusted EBITDA guidance slightly by 0.3% while Digital Realty raised the lower end of the FY24F adjusted EBITDA guidance by 4%, guiding for an overall growth rate of 6-8%.

Prefer data centre players for growth, rising capex may cap dividends going forward. We prefer operators with strong balance sheets who can fund the remodeling of existing data centres to fulfill the rising demand for inferencing. Owing to rising capex requirement, the 100% payout ratios (on adjusted fund flows) among industry leaders will have to be toned down. In this backdrop, we see a five-to-seven-year cycle of higher revenue growth and lower free cash flow in the data centre sector. We prefer players who can raise funds via assert-sale, equity and debt issuances to invest in the next leg of AI-ready data centres.

Topic

The information published by DBS Bank Ltd. (company registration no.: 196800306E) (“DBS”) is for information only. It is based on information or opinions obtained from sources believed to be reliable (but which have not been independently verified by DBS, its related companies and affiliates (“DBS Group”)) and to the maximum extent permitted by law, DBS Group does not make any representation or warranty (express or implied) as to its accuracy, completeness, timeliness or correctness for any particular purpose. Opinions and estimates are subject to change without notice. The publication and distribution of the information does not constitute nor does it imply any form of endorsement by DBS Group of any person, entity, services or products described or appearing in the information. Any past performance, projection, forecast or simulation of results is not necessarily indicative of the future or likely performance of any investment or securities. Foreign exchange transactions involve risks. You should note that fluctuations in foreign exchange rates may result in losses. You may wish to seek your own independent financial, tax, or legal advice or make such independent investigations as you consider necessary or appropriate.

The information published is not and does not constitute or form part of any offer, recommendation, invitation or solicitation to subscribe to or to enter into any transaction; nor is it calculated to invite, nor does it permit the making of offers to the public to subscribe to or enter into any transaction in any jurisdiction or country in which such offer, recommendation, invitation or solicitation is not authorised or to any person to whom it is unlawful to make such offer, recommendation, invitation or solicitation or where such offer, recommendation, invitation or solicitation would be contrary to law or regulation or which would subject DBS Group to any registration requirement within such jurisdiction or country, and should not be viewed as such. Without prejudice to the generality of the foregoing, the information, services or products described or appearing in the information are not specifically intended for or specifically targeted at the public in any specific jurisdiction.

The information is the property of DBS and is protected by applicable intellectual property laws. No reproduction, transmission, sale, distribution, publication, broadcast, circulation, modification, dissemination, or commercial exploitation such information in any manner (including electronic, print or other media now known or hereafter developed) is permitted.

DBS Group and its respective directors, officers and/or employees may have positions or other interests in, and may effect transactions in securities mentioned and may also perform or seek to perform broking, investment banking and other banking or financial services to any persons or entities mentioned.

To the maximum extent permitted by law, DBS Group accepts no liability for any losses or damages (including direct, special, indirect, consequential, incidental or loss of profits) of any kind arising from or in connection with any reliance and/or use of the information (including any error, omission or misstatement, negligent or otherwise) or further communication, even if DBS Group has been advised of the possibility thereof.

The information is not intended for distribution to, or use by, any person or entity in any jurisdiction or country where such distribution or use would be contrary to law or regulation. The information is distributed (a) in Singapore, by DBS Bank Ltd.; (b) in China, by DBS Bank (China) Ltd; (c) in Hong Kong, by DBS Bank (Hong Kong) Limited; (d) in Taiwan, by DBS Bank (Taiwan) Ltd; (e) in Indonesia, by PT DBS Indonesia; and (f) in India, by DBS Bank Ltd, Mumbai Branch.