- Equities: Global stocks gain, following the conclusion of US elections and Fed rate cut

- Credit: FOMC's less dovish tone last week intensifies rate uncertainty; we favour a short- and medium-term duration barbell in IG credit, avoiding ultra-long maturities due to heightened duration risk

- FX: Forecast for FFR floor revised up; DXY to stay near lower boundary of 99-107 range by mid-2025 (vs previous forecast of 95-100 range)

- Rates: A cooling of Trump trade fervour and return of inflation worries could hold back UST yield curve steepening in the short run

- The Week Ahead: Keep a lookout for US Initial Jobless Claims; Japan Industrial Production

Related Insights

- Hong Kong 2025 macro outlook: A cloudy weather20 Nov 2024

- Research Library19 Nov 2024

- ST Engineering19 Nov 2024

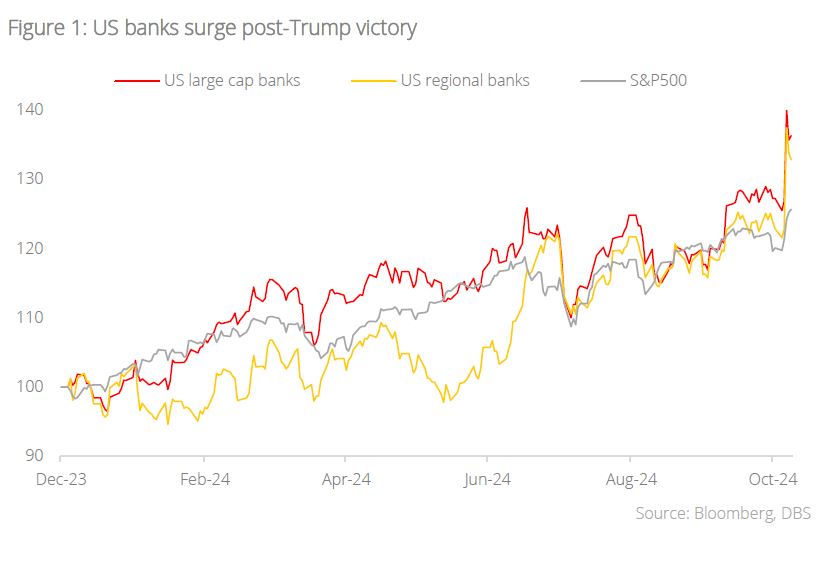

Global stocks rally on growth hopes. The conclusion of the US elections saw most major equity benchmarks rising to fresh highs on the back of expectations that policies under a red sweep would contribute to less stringent regulations, lower taxes, and higher growth. Following the 50 bps cut in September, the Federal Reserve lowered the Fed Funds rate (FFR) by 25 bps to a range of 4.5% to 4.75%. The S&P 500 Index and Dow Jones both gained 4.72% over the past week, while the NASDAQ Composite surged 5.85%. Europe markets slipped amid concerns on the impact of new US policies on the region’s trade and economic growth and political uncertainty in Germany. The STOXX 600 and FTSE weakened 0.75% and 1.28% respectively. Japan equities rose over the week with the Nikkei 225 gaining 3.8% and the broader TOPIX up 3.7%. Chinese stocks surged as Beijing’s unveiling of fresh stimulus measures offset concerns about potential US tariff hikes. The Shanghai Composite jumped 5.51% while the Hang Seng added 1.08%.

Topic in focus: US banks set to benefit from looser regulations under Trump. The US financial services sector is expected to be a key beneficiary of Trump’s re-election due to expectations of looser financial regulations. While the President-elect has yet to announce who will assume the top financial roles in his administration, it is widely expected that easing capital rules and more liberal merger approvals are on the cards. In particular, the Basel III endgame proposal necessitating large lenders to hold more capital is likely to be diluted which should in turn boost lending for banks. This expected shift in regulatory stance has given the sector an immediate boost post-election.

Beyond providing a short-term lift, a Trump administration is expected to boost financial services in more lasting ways as well. For example, the merger and acquisition landscape, which has been largely dormant over the past few years due to the tight regulatory backdrop, is expected to see a revival with potentially less stringent anti-trust policy and shorter approval timeframes back in play. This will be a huge positive for large banks and their investment banking divisions which have seen slumping deal flows of late.

Download the PDF to read the full report which includes coverage on Credit, FX, Rates, and Thematics.

Topic

The information published by DBS Bank Ltd. (company registration no.: 196800306E) (“DBS”) is for information only. It is based on information or opinions obtained from sources believed to be reliable (but which have not been independently verified by DBS, its related companies and affiliates (“DBS Group”)) and to the maximum extent permitted by law, DBS Group does not make any representation or warranty (express or implied) as to its accuracy, completeness, timeliness or correctness for any particular purpose. Opinions and estimates are subject to change without notice. The publication and distribution of the information does not constitute nor does it imply any form of endorsement by DBS Group of any person, entity, services or products described or appearing in the information. Any past performance, projection, forecast or simulation of results is not necessarily indicative of the future or likely performance of any investment or securities. Foreign exchange transactions involve risks. You should note that fluctuations in foreign exchange rates may result in losses. You may wish to seek your own independent financial, tax, or legal advice or make such independent investigations as you consider necessary or appropriate.

The information published is not and does not constitute or form part of any offer, recommendation, invitation or solicitation to subscribe to or to enter into any transaction; nor is it calculated to invite, nor does it permit the making of offers to the public to subscribe to or enter into any transaction in any jurisdiction or country in which such offer, recommendation, invitation or solicitation is not authorised or to any person to whom it is unlawful to make such offer, recommendation, invitation or solicitation or where such offer, recommendation, invitation or solicitation would be contrary to law or regulation or which would subject DBS Group to any registration requirement within such jurisdiction or country, and should not be viewed as such. Without prejudice to the generality of the foregoing, the information, services or products described or appearing in the information are not specifically intended for or specifically targeted at the public in any specific jurisdiction.

The information is the property of DBS and is protected by applicable intellectual property laws. No reproduction, transmission, sale, distribution, publication, broadcast, circulation, modification, dissemination, or commercial exploitation such information in any manner (including electronic, print or other media now known or hereafter developed) is permitted.

DBS Group and its respective directors, officers and/or employees may have positions or other interests in, and may effect transactions in securities mentioned and may also perform or seek to perform broking, investment banking and other banking or financial services to any persons or entities mentioned.

To the maximum extent permitted by law, DBS Group accepts no liability for any losses or damages (including direct, special, indirect, consequential, incidental or loss of profits) of any kind arising from or in connection with any reliance and/or use of the information (including any error, omission or misstatement, negligent or otherwise) or further communication, even if DBS Group has been advised of the possibility thereof.

The information is not intended for distribution to, or use by, any person or entity in any jurisdiction or country where such distribution or use would be contrary to law or regulation. The information is distributed (a) in Singapore, by DBS Bank Ltd.; (b) in China, by DBS Bank (China) Ltd; (c) in Hong Kong, by DBS Bank (Hong Kong) Limited; (d) in Taiwan, by DBS Bank (Taiwan) Ltd; (e) in Indonesia, by PT DBS Indonesia; and (f) in India, by DBS Bank Ltd, Mumbai Branch.

Related Insights

- Hong Kong 2025 macro outlook: A cloudy weather20 Nov 2024

- Research Library19 Nov 2024

- ST Engineering19 Nov 2024

Related Insights

- Hong Kong 2025 macro outlook: A cloudy weather20 Nov 2024

- Research Library19 Nov 2024

- ST Engineering19 Nov 2024