- Positive earnings momentum and sustained wage growth continue to buoy Japan equities

- BOJ normalisation benefits the semiconductor and IT services sectors, as well as the financial sector

- Increased defence spending allows the heavy machinery sub-sector within industrials to pick up pace

- Elevated uncertainties and currency volatility will weigh on risk appetites and corporate investments in the near term

Related Insights

- ECB Eases Amid Disinflation25 Oct 2024

- Singapore Equity Picks25 Oct 2024

- Bank of Communications25 Oct 2024

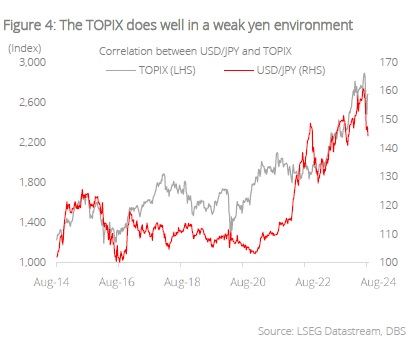

There and back again. The BOJ’s surprise rate hike, resurgent recessionary fears, and a sharp unwinding of the yen carry trade sent Japan equities on a whipsaw, returning them to historic highs after briefly wiping out their gains for the year. Global financial markets have since rebounded, and the meltdown earlier this month now looks more like a brief tremor – though the way it unfolded underscores the vulnerability of Japanese markets to currency risks and how panicked investors could exacerbate wild swings in the foreign exchange and stock markets.

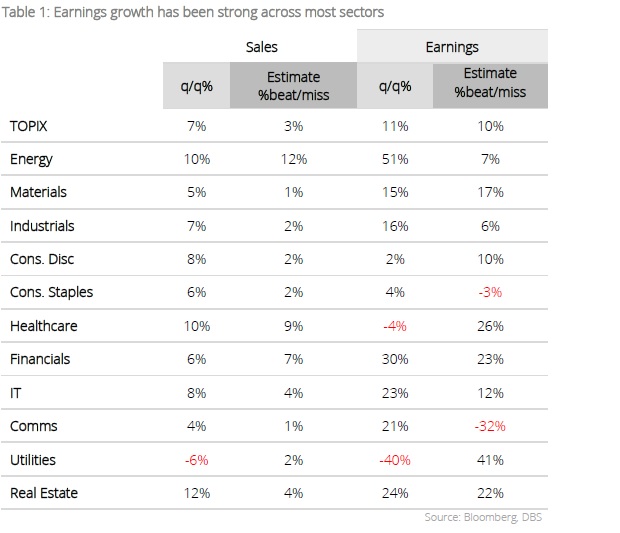

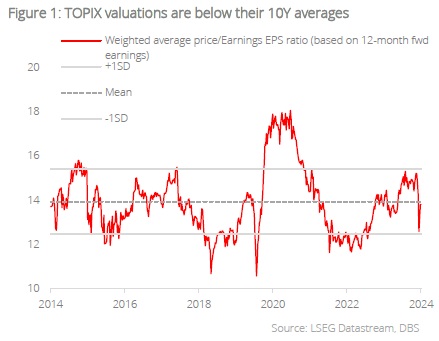

Positive earnings momentum. Japan’s equity market continues to outperform, with earnings surprises bolstering valuations that currently trade below their 10Y averages. Aggregated 1QFY24 results by Bloomberg show a 6.7% y/y increase in sales and a 10.8% rise in recurring profits for companies in the TOPIX index, surpassing expectations by 3.1% and 9.5% respectively. This suggests that earnings upgrades are likely. Full-year EPS growth is projected at 13% for this year and 18% for the next, outpacing historical averages. We believe Japan’s reflation is fuelling a broad-based recovery; earnings growth has been strong across most sectors with the exception of the utilities and consumer sectors, which should strengthen in the second half of the year on the back of continued wage growth.

Near-term volatility. In the fourth quarter, Japan faces several key challenges, from BOJ policy decisions to leadership changes in both Japan and the US; and to the resurgence of yen carry trades. Once the heightened uncertainties abate and carry trades normalise, we expect Japanese markets to pick up pace, driven by underlying structural forces that continue to reshape its economy. We discuss the key issues below.

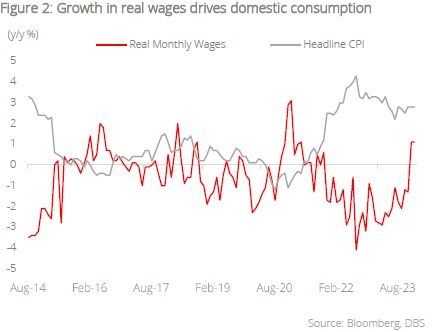

Gradual tightening on the cards. The stepping down of Prime Minister Kishida has come at a crucial turning point for Japan. Economic growth surprised on the upside in the second quarter, expanding much faster-than-expected by an annualised 3.1%. This was a remarkable rebound from the -2.3% contraction at the start of the year, thanks to a strong rise in consumption backed by real wage growth as inflation-adjusted wages in June rose for the first time in more than two years. On prices, headline inflation has stabilised at 2.8% as of June, and is expected to ease towards 2.0% in the coming months.

Aligned with Kishida, most leadership candidates have endorsed the central bank’s gradual policy normalisation. BOJ Governor Ueda had reaffirmed in the parliamentary meeting on 23 Aug that the BOJ remains on track for higher interest rates, provided that inflation and economic data align with its forecasts. We do not expect significant policy differences that will derail the long-term outlook for Japan.

Leadership transition. Japan’s Prime Minister Fumio Kishida will be passing the baton to the newly elected Shigeru Ishiba. Through his three - year term, Kishida had championed the concept of ‘New Capitalism’ which emphasised structural wage growth, the revitalisation of domestic investments, and the transition to a digital society. Under his watch, Japan saw wage increases from labour negotiations hit their highest level in 30 years; he had also pushed for corporate reform to alleviate years of capital inefficiency, improving returns for shareholders at a time where renewed investor interest saw Japan’s stock market indexes surpass historic highs.

The next PM will continue to face challenges from higher costs of living amid slowing global growth and a challenging geopolitical environment. Key policy concerns surround supportive stimulus for Japan’s semiconductor sector, and the normalisation of interest rates. Against this backdrop, we continue to favour Japan’s bank and semiconductor sectors.

Easing yen volatility. The BOJ’s unexpected rate hike in July had led to a sharp unwinding of yen carry trades, resulting in a sudden yen appreciation and steep selloff in financial markets. Though the unwinding process is not fully complete, indicators such as non-commercial net yen positions and USD/JPY and UST-JGB yield gaps suggest that the most severe phase of the carry trade unwinding should be over. With speculative short yen positions turning neutral, the risks of JPY-buying interventions by the government has lessened. We believe the yen has largely stabilised, and could gradually appreciate amid narrowing yield differentials.

US elections overhang. Leadership changes in the US may have large implications on Japan as they affect policies surrounding global trade, national security, currency stability, investor sentiment, and overall economic conditions. Four key areas to watch are:

- Trade policies: Changes in US trade policies could affect Japan’s exports and imports, especially if a more protectionist stance is adopted.

- Security and foreign policy: The US-Japan alliance is vital for Japan’s national security. Policy pivots in US defence and international relations may in turn influence Japan’s security strategy and spending.

- Currency fluctuations: US elections often create heightened market volatility, impacting the yen. A stronger yen could hurt Japan’s export competitiveness.

- Monetary policy: Fed policies which may be influenced by the US elections affect global interest rates and capital flows, influencing Japan’s economy and monetary policy.

Selective themes prevail. We continue to maintain our neutral stance on Japan, recognising that current elevated uncertainties and currency volatility will weigh on risk appetites and corporate investments in the near term. We stay constructive on Japan in the long-term, with a focus on the semiconductor and IT services sector. Meanwhile, the financials sector will benefit from the BOJ’s rate normalisation. In addition, we expect the heavy machinery sub-sector in the industrials space to benefit from increased defence spending. We discuss the catalysts below.

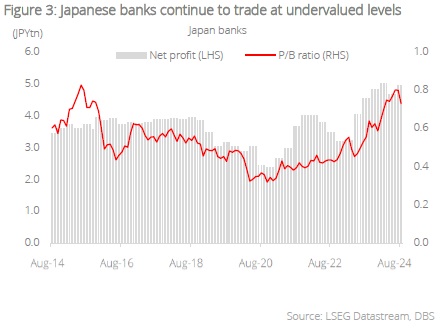

BOJ regime shift a tailwind for Japanese banks. After years of being by bound by near-zero rates, we expect healthier NIMs for Japan’s banks as interest rates normalise. In particular, Japanese megabanks with broader deposit bases stand to benefit more from widening lending spreads. Net income and ROE continue to show steady expansion, and we see further upside given better returns from higher rates and more optimised balance sheet. Nudged by the government, Japanese banks have started selling off their large holdings of equity stakes in other Japanese companies. For example, MUFG and SMFG Inc have announced plans to divest JPY1.32tn (USD8.5bn) worth of strategic shareholdings in Toyota.

Rejuvenation of Japan’s semiconductors. We continue to favour the semiconductor and IT services sectors as beneficiaries of rapid AI adoption across industries supported by strong government support. Japan has already earmarked some JPY2tn (USD13.7bn) to rejuvenate its semiconductor sector, a significant increase from the JPY1.3tn (c.USD8.9bn) allocated previously. For example, Rapidus is one of its most ambitious efforts yet, with plans to manufacture advanced 2-nanometer chips to compete with TSMC and Samsung Electronics.

Increased defence spending. Highlights from Japan’s FY24 budget show the government plans to enhance national security through the deployment of an additional JPY1.1tn to its defence capabilities. Japan’s leading defence contractors have reported strong order books for military and space equipment in FY24, with expectations of rapid revenue expansion on the back of the country’s growing defence budget. The government’s commitment to nearly doubling its defence spending through FY27 to approximately 2% of its GDP is a marked departure from its traditional limit of defence spending at about 1% of GDP. Amid geopolitical instability, these factors could provide support for notable players in the heavy industrials and machinery sectors.

Topic

The information published by DBS Bank Ltd. (company registration no.: 196800306E) (“DBS”) is for information only. It is based on information or opinions obtained from sources believed to be reliable (but which have not been independently verified by DBS, its related companies and affiliates (“DBS Group”)) and to the maximum extent permitted by law, DBS Group does not make any representation or warranty (express or implied) as to its accuracy, completeness, timeliness or correctness for any particular purpose. Opinions and estimates are subject to change without notice. The publication and distribution of the information does not constitute nor does it imply any form of endorsement by DBS Group of any person, entity, services or products described or appearing in the information. Any past performance, projection, forecast or simulation of results is not necessarily indicative of the future or likely performance of any investment or securities. Foreign exchange transactions involve risks. You should note that fluctuations in foreign exchange rates may result in losses. You may wish to seek your own independent financial, tax, or legal advice or make such independent investigations as you consider necessary or appropriate.

The information published is not and does not constitute or form part of any offer, recommendation, invitation or solicitation to subscribe to or to enter into any transaction; nor is it calculated to invite, nor does it permit the making of offers to the public to subscribe to or enter into any transaction in any jurisdiction or country in which such offer, recommendation, invitation or solicitation is not authorised or to any person to whom it is unlawful to make such offer, recommendation, invitation or solicitation or where such offer, recommendation, invitation or solicitation would be contrary to law or regulation or which would subject DBS Group to any registration requirement within such jurisdiction or country, and should not be viewed as such. Without prejudice to the generality of the foregoing, the information, services or products described or appearing in the information are not specifically intended for or specifically targeted at the public in any specific jurisdiction.

The information is the property of DBS and is protected by applicable intellectual property laws. No reproduction, transmission, sale, distribution, publication, broadcast, circulation, modification, dissemination, or commercial exploitation such information in any manner (including electronic, print or other media now known or hereafter developed) is permitted.

DBS Group and its respective directors, officers and/or employees may have positions or other interests in, and may effect transactions in securities mentioned and may also perform or seek to perform broking, investment banking and other banking or financial services to any persons or entities mentioned.

To the maximum extent permitted by law, DBS Group accepts no liability for any losses or damages (including direct, special, indirect, consequential, incidental or loss of profits) of any kind arising from or in connection with any reliance and/or use of the information (including any error, omission or misstatement, negligent or otherwise) or further communication, even if DBS Group has been advised of the possibility thereof.

The information is not intended for distribution to, or use by, any person or entity in any jurisdiction or country where such distribution or use would be contrary to law or regulation. The information is distributed (a) in Singapore, by DBS Bank Ltd.; (b) in China, by DBS Bank (China) Ltd; (c) in Hong Kong, by DBS Bank (Hong Kong) Limited; (d) in Taiwan, by DBS Bank (Taiwan) Ltd; (e) in Indonesia, by PT DBS Indonesia; and (f) in India, by DBS Bank Ltd, Mumbai Branch.

Related Insights

- ECB Eases Amid Disinflation25 Oct 2024

- Singapore Equity Picks25 Oct 2024

- Bank of Communications25 Oct 2024

Related Insights

- ECB Eases Amid Disinflation25 Oct 2024

- Singapore Equity Picks25 Oct 2024

- Bank of Communications25 Oct 2024