- US: Despite stronger-than-expected inflation and US jobs data, we believe the Fed will maintain its path of easing monetary policy

- Taiwan: Overall expansion cycle remains intact although some softening is expected; we remain optimistic on the electronics sector

- India: Despite signs of a slowdown in cyclical indicators, the RBI maintains an optimistic view on growth, adopting a less hawkish stance

- Vietnam: Real GDP growth accelerates to two-year high despite damage from Typhoon Yagi; we raise our 2024 growth forecast

Related Insights

- ECB Eases Amid Disinflation25 Oct 2024

- Mapletree Industrial Trust25 Oct 2024

- Singapore Equity Picks25 Oct 2024

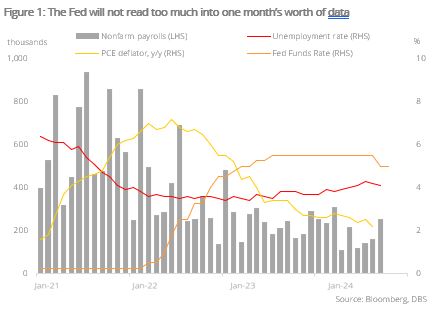

US: Inflation slows less than expected. Following the stronger-than-expected US jobs data last Friday, the futures market rescinded its bet for a second 50 bps rate cut at the next Federal Open Market Committee (FOMC) meeting on 7 Nov, opting instead for a reduction of 25 bps. The September FOMC minutes released this week showed there was a preference among some officials to cut rates at a more gradual pace, possibly because the economy remains remarkably resilient even in the face of what Fed officials call a “restrictive” policy.

Underlying inflation rose more than forecast in September, signalling a pause in recent progress toward moderating price pressures. The US consumer price index (CPI) rose 2.4% y/y, down from 2.5% in August, marginally above consensus estimates of 2.3%. That said, consumer prices registered the smallest annual rise since Feb 2021. US core CPI, which excludes food and energy costs, increased 3.3% on a y/y basis, compared to expectations of 3.2%.

We believe Fed officials will not read too much into one month’s worth of data and will most likely maintain the path of reducing monetary policy restrictions. Fed officials have played down the data and stuck with the narrative that the US economy and labour market are in a better balance today, compared to two years ago, increasing confidence for inflation to return to the 2% target in 2025 and the plan to lower rates towards neutral.

Taiwan: Supportive factors for growth. Taiwan’s economy performed well in the first half of this year with GDP growth averaging 5.8% y/y in real terms and 10.1% in nominal terms. While recent data show signs of softening growth momentum, we believe the overall cycle of economic expansion will remain intact.

Download the PDF to read the full report which includes coverage on Credit, FX, Rates, and Thematics.

Topic

The information published by DBS Bank Ltd. (company registration no.: 196800306E) (“DBS”) is for information only. It is based on information or opinions obtained from sources believed to be reliable (but which have not been independently verified by DBS, its related companies and affiliates (“DBS Group”)) and to the maximum extent permitted by law, DBS Group does not make any representation or warranty (express or implied) as to its accuracy, completeness, timeliness or correctness for any particular purpose. Opinions and estimates are subject to change without notice. The publication and distribution of the information does not constitute nor does it imply any form of endorsement by DBS Group of any person, entity, services or products described or appearing in the information. Any past performance, projection, forecast or simulation of results is not necessarily indicative of the future or likely performance of any investment or securities. Foreign exchange transactions involve risks. You should note that fluctuations in foreign exchange rates may result in losses. You may wish to seek your own independent financial, tax, or legal advice or make such independent investigations as you consider necessary or appropriate.

The information published is not and does not constitute or form part of any offer, recommendation, invitation or solicitation to subscribe to or to enter into any transaction; nor is it calculated to invite, nor does it permit the making of offers to the public to subscribe to or enter into any transaction in any jurisdiction or country in which such offer, recommendation, invitation or solicitation is not authorised or to any person to whom it is unlawful to make such offer, recommendation, invitation or solicitation or where such offer, recommendation, invitation or solicitation would be contrary to law or regulation or which would subject DBS Group to any registration requirement within such jurisdiction or country, and should not be viewed as such. Without prejudice to the generality of the foregoing, the information, services or products described or appearing in the information are not specifically intended for or specifically targeted at the public in any specific jurisdiction.

The information is the property of DBS and is protected by applicable intellectual property laws. No reproduction, transmission, sale, distribution, publication, broadcast, circulation, modification, dissemination, or commercial exploitation such information in any manner (including electronic, print or other media now known or hereafter developed) is permitted.

DBS Group and its respective directors, officers and/or employees may have positions or other interests in, and may effect transactions in securities mentioned and may also perform or seek to perform broking, investment banking and other banking or financial services to any persons or entities mentioned.

To the maximum extent permitted by law, DBS Group accepts no liability for any losses or damages (including direct, special, indirect, consequential, incidental or loss of profits) of any kind arising from or in connection with any reliance and/or use of the information (including any error, omission or misstatement, negligent or otherwise) or further communication, even if DBS Group has been advised of the possibility thereof.

The information is not intended for distribution to, or use by, any person or entity in any jurisdiction or country where such distribution or use would be contrary to law or regulation. The information is distributed (a) in Singapore, by DBS Bank Ltd.; (b) in China, by DBS Bank (China) Ltd; (c) in Hong Kong, by DBS Bank (Hong Kong) Limited; (d) in Taiwan, by DBS Bank (Taiwan) Ltd; (e) in Indonesia, by PT DBS Indonesia; and (f) in India, by DBS Bank Ltd, Mumbai Branch.

Related Insights

- ECB Eases Amid Disinflation25 Oct 2024

- Mapletree Industrial Trust25 Oct 2024

- Singapore Equity Picks25 Oct 2024

Related Insights

- ECB Eases Amid Disinflation25 Oct 2024

- Mapletree Industrial Trust25 Oct 2024

- Singapore Equity Picks25 Oct 2024