- Telcos in the US and APAC reported 1Q24 earnings that were broadly in line with consensus after years of earnings pressure due to high 5G capex

- Mobile tariff hikes were observed globally, particularly in the US, Australia, and India, while China maintained stable pricing

- 5G capex peaked in DMs; US telcos capex on the decline since FY2022

- Peaking capex and higher mobile tariff translating to higher free cash flow

- Telcos are expected to see low to mid-single digit growth in their core telecom business

Related Insights

- Singapore Equity Picks02 Aug 2024

- Rate Cuts in Play02 Aug 2024

- HKD rates: HIBORs movement in rate cut cycles 02 Aug 2024

Global telcos met market expectations, providing much-needed relief after years of disappointment. In the US and Asia Pacific (APAC), telcos’ 1Q24 earnings were broadly inline with street expectations, marking a positive shift following years of earnings pressure due to high 5G capex that raised depreciation expenses without boosting revenue. Notably, Singapore telcos have issued the most bullish guidance, projecting double-digit growth in core operating profit.

Global mobile tariff hikes and declining 5G capex in DMs translating to higher free cash flow. In 2024, telcos in APAC (especially India and Australia), have raised mobile tariffs, driving improvement in average revenue per user (ARPU). Between January and June 2024, all major US telcos raised prices, particularly on their legacy plans, citing rising costs and encouraging users to switch to newer plans with higher data allowance. While Chinese telcos have not implemented any notable price increase during this period, we can still expect revenue growth to be driven by 5G ARPU, which commands a 5-10% premium over 4G ARPU.

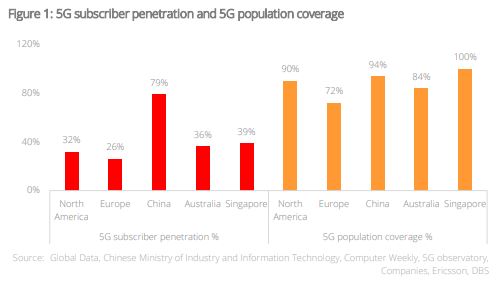

Furthermore, 5G capex (including spectrum cost) has already peaked in developed markets (DM). US telcos capex has been on a decline since FY2022, following the deployment of mid-band spectrums deployment (3GHz - 4GHz) that optimise speed and coverage. Similarly, overall capex in China also peaked in 2022, due a decline in 5G investment. Chinese telcos have achieved a 79% 5G subscriber penetration rate in 2023 (vs 65% in 2022) and surpassed the rest of the world. This is largely due to their high capex intensity between 2019 and 2022. APAC telcos in Australia and Singapore also saw their capex peak in 2022, after achieving high-population coverage and utilising efficient mid-band spectrum.

Favour mobile-market leaders with attractive dividend yields and additional growth drivers from adjacent opportunities. Most telcos are expected to see low to mid-single digit growth in their core telecom business. US telcos are more conservative than others in pursuing non-telecom adjacent opportunities which is also reflected in their lower P/E multiples. In contrast, Singapore telcos are expanding into data centre and information and communication technology (ICT) businesses in the region. Chinese telcos are also capitalising on the digital transformation of enterprises, gaining market share from non-telco public cloud service providers, and boosting their own cloud businesses. With regard to dividends, Singapore telcos have committed to 75-80% payout ratio compared to 70-75% for Chinese telcos and 55%-60% for US telcos.

Topic

The information published by DBS Bank Ltd. (company registration no.: 196800306E) (“DBS”) is for information only. It is based on information or opinions obtained from sources believed to be reliable (but which have not been independently verified by DBS, its related companies and affiliates (“DBS Group”)) and to the maximum extent permitted by law, DBS Group does not make any representation or warranty (express or implied) as to its accuracy, completeness, timeliness or correctness for any particular purpose. Opinions and estimates are subject to change without notice. The publication and distribution of the information does not constitute nor does it imply any form of endorsement by DBS Group of any person, entity, services or products described or appearing in the information. Any past performance, projection, forecast or simulation of results is not necessarily indicative of the future or likely performance of any investment or securities. Foreign exchange transactions involve risks. You should note that fluctuations in foreign exchange rates may result in losses. You may wish to seek your own independent financial, tax, or legal advice or make such independent investigations as you consider necessary or appropriate.

The information published is not and does not constitute or form part of any offer, recommendation, invitation or solicitation to subscribe to or to enter into any transaction; nor is it calculated to invite, nor does it permit the making of offers to the public to subscribe to or enter into any transaction in any jurisdiction or country in which such offer, recommendation, invitation or solicitation is not authorised or to any person to whom it is unlawful to make such offer, recommendation, invitation or solicitation or where such offer, recommendation, invitation or solicitation would be contrary to law or regulation or which would subject DBS Group to any registration requirement within such jurisdiction or country, and should not be viewed as such. Without prejudice to the generality of the foregoing, the information, services or products described or appearing in the information are not specifically intended for or specifically targeted at the public in any specific jurisdiction.

The information is the property of DBS and is protected by applicable intellectual property laws. No reproduction, transmission, sale, distribution, publication, broadcast, circulation, modification, dissemination, or commercial exploitation such information in any manner (including electronic, print or other media now known or hereafter developed) is permitted.

DBS Group and its respective directors, officers and/or employees may have positions or other interests in, and may effect transactions in securities mentioned and may also perform or seek to perform broking, investment banking and other banking or financial services to any persons or entities mentioned.

To the maximum extent permitted by law, DBS Group accepts no liability for any losses or damages (including direct, special, indirect, consequential, incidental or loss of profits) of any kind arising from or in connection with any reliance and/or use of the information (including any error, omission or misstatement, negligent or otherwise) or further communication, even if DBS Group has been advised of the possibility thereof.

The information is not intended for distribution to, or use by, any person or entity in any jurisdiction or country where such distribution or use would be contrary to law or regulation. The information is distributed (a) in Singapore, by DBS Bank Ltd.; (b) in China, by DBS Bank (China) Ltd; (c) in Hong Kong, by DBS Bank (Hong Kong) Limited; (d) in Taiwan, by DBS Bank (Taiwan) Ltd; (e) in Indonesia, by PT DBS Indonesia; and (f) in India, by DBS Bank Ltd, Mumbai Branch.

Related Insights

- Singapore Equity Picks02 Aug 2024

- Rate Cuts in Play02 Aug 2024

- HKD rates: HIBORs movement in rate cut cycles 02 Aug 2024

Related Insights

- Singapore Equity Picks02 Aug 2024

- Rate Cuts in Play02 Aug 2024

- HKD rates: HIBORs movement in rate cut cycles 02 Aug 2024