- With Biden stepping down, the US Presidential election has unexpectedly pivoted from a Biden-Trump rematch to a contest featuring Kamala Harris as the frontrunner for the Democratic Party

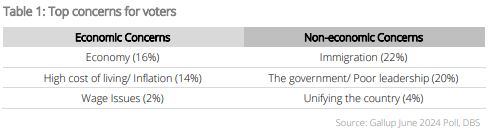

- According to the latest Gallup poll, the key concerns on voters’ minds are: Immigration (22%), Government/Poor leadership (20%), Economy (16%), and High cost of living/Inflation (14%)

- A potential Trump presidency could boost tax-sensitive sectors like retail, energy, transportation, and financial services through corporate tax cuts and deregulation, while increased tariffs will benefit US manufacturing and industrial sectors

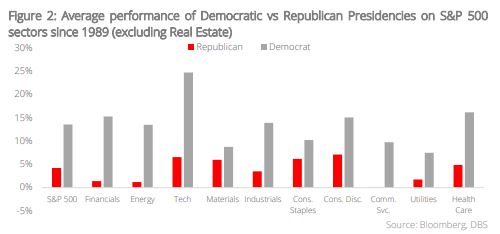

- The S&P 500 has historically performed better under Democratic presidencies; Since 1989, Technology has been the top-performing sector under both parties

- Technology’s outperformance is expected to continue (especially for Big Tech) given their market dominance and the growing importance of AI

Related Insights

- Equinix Inc 26 Jul 2024

- Strong 2Q GDP Highlights Economic Resilience26 Jul 2024

- Research Library26 Jul 2024

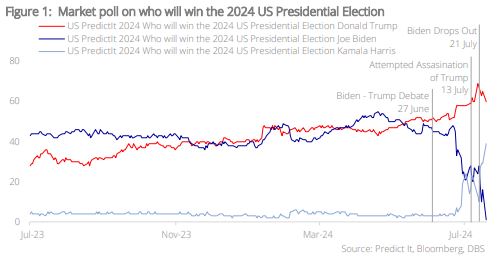

Trump vs Biden’s Legacy. The past few weeks has been a whirlwind of unprecedented events in American politics. From the Presidential debate between Biden and Trump on 27 Jun, to the shocking assassination attempt on Trump on 13 Jul, and now Biden's unexpected withdrawal from the race on 21 Jul, the political landscape has changed dramatically.

In this tumultuous atmosphere, the Democratic nomination race has unexpectedly shifted from a Biden-Trump rematch to a contest featuring Kamala Harris as the frontrunner for the Democratic Party. Despite the change in candidate, it is likely that Harris will maintain significant continuity with Biden's policy agenda which encompasses a continued focus on climate change initiatives, maintaining a firm stance on China, and advancing other core Democratic policy objectives.

Essentially, voters should expect a "Biden 2.0" platform from Harris with some unique approaches reflecting her own political identity and strategic priorities. However, the overall direction of the Democratic campaign would remain largely consistent with the vision Biden had been promoting for his second term.

The Key Agenda: What are the top voters’ concerns? Recent polls from online prediction market, PredictIt, shows that Trump has gained a significant lead over Biden, particularly after the 27 Jun presidential debate. The failed assassination attempt on Trump on 13 Jul has also likely bolstered his support in the polls (at least in the short term).

But with Biden dropping out of the Presidential race and with Kamala Harris stepping in, the polling dynamics will change yet again and developments in the coming weeks (such as who Harris chooses as her running mate should she be nominated) will be crucial.

When the dust eventually settles on the nomination front, attention will redivert back to the key agenda, which is - What are the top voter’s concerns? According to the latest Gallup poll, the top economic and non-economic concerns for Americans are:

- Economy: The overall state of the economy remains a significant concern for Americans. Despite positive indicators like GDP growth, many Americans remain uneasy about the economy. This stems from global economic uncertainties, trade tensions, and lingering effects of recent disruptions. The perceived disconnect between official economic statistics and personal experiences resulted in many feeling that economic benefits are not evenly distributed.

- High cost of living/Inflation: Inflation continues to be a major issue for Americans. Although inflation has moderated from its peak, it remains higher than the Federal Reserve's 2% target. Sticky inflation affects purchasing power and creates financial stress for American households.

- Unemployment/Jobs: While unemployment is relatively low compared to historical standards, concerns about job security and quality of employment persist. This may reflect worries about potential economic slowdowns or shifts in the job market due to factors like automation and changing industry landscapes.

A potential Trump Presidency: What is the impact on risk assets? With polls showing a strong likelihood of a Trump presidency in the coming years, it is only logical that we analyse how this would plausibly impact financial markets:

- Opportunities for tax sensitive sectors: A Trump presidency would create short-term opportunities for several tax sensitive sectors. Based on his last term and recent campaign statements, Trump would most likely push for corporate tax rate cuts (15% corporate tax rates), deregulation across various industries (He has mentioned reducing the power of US financial regulators, easing investor protections, and scaling back ESG disclosures), and increased tariffs on imports, particularly from China.

Sectors such as energy, transportation, and financial services might experience a boost from lower corporate tax rates and reduced regulatory burdens.

- Opportunities from additional tariffs on imports: Additional tariffs on imports offers a competitive boost to US companies, potentially benefitting multinationals in pharmaceuticals, semiconductors, and renewable energy sectors through short-term gains and tax cuts. However, these benefits are likely to be fleeting due to the retaliatory nature of global trade, as seen in past tariff exchanges with China. For companies reliant on global supply chains, higher tariffs increase costs and potentially disrupt production.

Investing in Long-Term Secular Trends Beyond Political Shifts

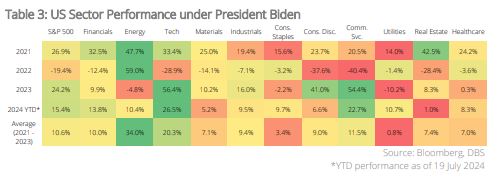

Historical S&P 500 performance across party lines. The relationship between political leadership and stock market performance has long been a subject of interest for investors. Since the S&P 500’s inception in 1957, the index has delivered an average annual return of c.8.5%. Closer examination reveals that the S&P 500 achieves a higher return under a Democratic presidency with an average of c.11.4% annual return vs c.6.0% annual return from a Republican presidency.

Breaking it down into individual sectors (excluding Real Estate), since 1989, the best performing sector under a Democratic presidency was Technology (c.24.7%), followed by Healthcare (c.16.2%) and Financials (c.15.3%). Under a Republican presidency, the best performing sector was Consumer Discretionary (c.7.1%), followed by Technology (6.5%) and Consumer Staples (c.6.2%). Notably, Technology demonstrates strong performance regardless of the party in power.

We believe that this election will see the same trend for the Technology space, particularly in Big Tech. Their dominant market positions and robust cash flow generation abilities position them favorably. Moreover, Tech is poised to be a key beneficiary as the world embarks on the transformative journey of Artificial Intelligence (AI) which will solidifying its importance in the global economy.

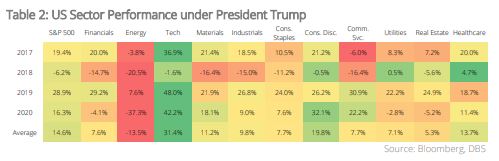

Curb Your Enthusiasm: Policy Promises vs Market Reality. When it comes to the relationship between political rhetoric, policy implementation, and market performance, there’s often more than meets the eye. Conventional wisdom may assume a straightforward correlation between a president’s stated policies and the performance of related market sectors. However, history has shown that this relationship can be far more complex and even counterintuitive.

During Trump’s presidency, he championed a pro-fossil fuel agenda, marked by policies to expand domestic drilling, approving the Keystone XL pipeline, deregulating the energy sector, and pulling the US out of the Paris agreement. Despite this clear pro-fossil fuel stance, the energy sector paradoxically became the worst-performing sector on the S&P 500 throughout his four-year term, averaging a dismal -13.5% annual return.

Instead, the top performing sectors during Trump’s presidency were the Tech-related ones like Technology (+31.4% on average) and Consumer Discretionary (+19.8% on average).

Biden, on the other hand, is anti-fossil fuel in his rhetoric and has implemented several policies aimed at transitioning away from oil and gas. Early in his presidency, he revoked the permit for the Keystone XL pipeline project and temporarily paused new oil and gas leasing on federal lands and waters. Biden has also pushed for regulations to reduce methane emissions from the oil and gas industry and implemented a methane emissions fee for certain facilities.

Despite Biden's apparent anti-fossil fuel stance, US oil production has increased during his presidency. In 2023, crude oil production averaged 12.9mn barrels per day, solidifying the US’ position as the world's largest oil producer by a significant margin. Energy was also the best performing sector during the first three years of Biden’s tenure, averaging 34% annual return.

The contrasting outcomes of the energy sector under the Trump and Biden administrations highlight the complex interplay of global supply and demand, investor sentiments, and broader economic trends, which often outweigh domestic policy influences. These examples demonstrate the fact that market realities can significantly deviate from policy promises and political narratives, emphasising the necessity for investors and analysts to consider a wide array of factors beyond campaign slogans and policy declarations when predicting market trends.

Above all, these divergences challenge the relevancy of making simplistic assumptions on how presidential election outcomes can impact the performance of risk assets. Instead, it is evident that long-term secular trends, such as the unparalleled growth in innovation and technological advancements, are bigger drivers of risk assets.

Topic

The information published by DBS Bank Ltd. (company registration no.: 196800306E) (“DBS”) is for information only. It is based on information or opinions obtained from sources believed to be reliable (but which have not been independently verified by DBS, its related companies and affiliates (“DBS Group”)) and to the maximum extent permitted by law, DBS Group does not make any representation or warranty (express or implied) as to its accuracy, completeness, timeliness or correctness for any particular purpose. Opinions and estimates are subject to change without notice. The publication and distribution of the information does not constitute nor does it imply any form of endorsement by DBS Group of any person, entity, services or products described or appearing in the information. Any past performance, projection, forecast or simulation of results is not necessarily indicative of the future or likely performance of any investment or securities. Foreign exchange transactions involve risks. You should note that fluctuations in foreign exchange rates may result in losses. You may wish to seek your own independent financial, tax, or legal advice or make such independent investigations as you consider necessary or appropriate.

The information published is not and does not constitute or form part of any offer, recommendation, invitation or solicitation to subscribe to or to enter into any transaction; nor is it calculated to invite, nor does it permit the making of offers to the public to subscribe to or enter into any transaction in any jurisdiction or country in which such offer, recommendation, invitation or solicitation is not authorised or to any person to whom it is unlawful to make such offer, recommendation, invitation or solicitation or where such offer, recommendation, invitation or solicitation would be contrary to law or regulation or which would subject DBS Group to any registration requirement within such jurisdiction or country, and should not be viewed as such. Without prejudice to the generality of the foregoing, the information, services or products described or appearing in the information are not specifically intended for or specifically targeted at the public in any specific jurisdiction.

The information is the property of DBS and is protected by applicable intellectual property laws. No reproduction, transmission, sale, distribution, publication, broadcast, circulation, modification, dissemination, or commercial exploitation such information in any manner (including electronic, print or other media now known or hereafter developed) is permitted.

DBS Group and its respective directors, officers and/or employees may have positions or other interests in, and may effect transactions in securities mentioned and may also perform or seek to perform broking, investment banking and other banking or financial services to any persons or entities mentioned.

To the maximum extent permitted by law, DBS Group accepts no liability for any losses or damages (including direct, special, indirect, consequential, incidental or loss of profits) of any kind arising from or in connection with any reliance and/or use of the information (including any error, omission or misstatement, negligent or otherwise) or further communication, even if DBS Group has been advised of the possibility thereof.

The information is not intended for distribution to, or use by, any person or entity in any jurisdiction or country where such distribution or use would be contrary to law or regulation. The information is distributed (a) in Singapore, by DBS Bank Ltd.; (b) in China, by DBS Bank (China) Ltd; (c) in Hong Kong, by DBS Bank (Hong Kong) Limited; (d) in Taiwan, by DBS Bank (Taiwan) Ltd; (e) in Indonesia, by PT DBS Indonesia; and (f) in India, by DBS Bank Ltd, Mumbai Branch.

Related Insights

- Equinix Inc 26 Jul 2024

- Strong 2Q GDP Highlights Economic Resilience26 Jul 2024

- Research Library26 Jul 2024

Related Insights

- Equinix Inc 26 Jul 2024

- Strong 2Q GDP Highlights Economic Resilience26 Jul 2024

- Research Library26 Jul 2024