- Equities: Global equities declined as the market rotated away from tech giants and toward value and small-cap stocks

- Credit: Credit investors have a unique opportunity to lock in high yields and benefit from price gains as the market anticipates Fed easing and a steepening yield curve

- FX: DXY’s outlook becoming less predictable given low visibility on Fed’s policy timing and Trump Trade; possibility of MAS slightly easing the slope of SGD NEER policy band

- Rates: Caution needed as USTs sell off with stocks; more market volatility appears inevitable as US elections draw near

- The Week Ahead: Keep a lookout for US Change in Initial Jobless Claims; Singapore Inflation

Related Insights

- Singapore Equity Picks02 Aug 2024

- Rate Cuts in Play02 Aug 2024

- HKD rates: HIBORs movement in rate cut cycles 02 Aug 2024

Volatility and uncertainty drive global equity weekly declines. In the US market, there has been a notable shift in market dynamics for the week, characterized by a pronounced rotation out of technology megacaps and into cyclical and small-cap stocks. This led to the S&P 500's largest weekly drop since April, with the index shedding around 2%. The tech-heavy Nasdaq 100 bore the brunt of the sell-off, plummeting nearly 4% while the Russell 2000 small-cap index outperformed, gaining 1.7% for the week. This divergence underscores the market's evolving sentiment and the potential for a broadening rally beyond the leadership of megacap tech stocks.

Adding to the volatility were concerns over a global cyber outage that disrupted multiple industries. The Europe Stoxx 600 Tech Index ended the week 2.7% lower, and Japan's Nikkei 225 fell 2.7% due to concerns over tighter US restrictions on semiconductor exports to China. During China's third plenum, the Hang Seng Index retreated 0.5% for the week due to a lack of clarity on the execution of initiatives, alongside a concerning downside surprise in 2Q GDP.

Topic in focus: Japan equities – Benefits and challenges of a weak yen. The yen's depreciation to a 38-year low against the dollar has made Japan an attractive destination for overseas travellers. The tourism industry is expected to become Japan's second-largest export sector in 2024, trailing only the automotive industry and surpassing electronic components. While a weaker yen boosts export revenues, corporate profits, and wage growth, several issues persist.

Export volumes remain stagnant and real wages are declining. Additionally, the weaker yen accelerates imported inflation, complicating the Bank of Japan's efforts to normalise monetary policy. Both core and wholesale inflation had risen in June, keeping alive market expectations of a near-term interest rate hike, while both business and consumer sentiments remain weak. The country is also facing an “overtourism” crisis with crowded trails and excessive littering at popular tourist spots. It also puts pressure on Prime Minister Kishida’s government, as declining purchasing power weakens domestic sentiment. The Japanese government has reduced its growth forecast for this year to 0.9% as rising import costs – arising from the weak yen – have impacted consumption, highlighting the patchy nature of Japan’s economic recovery.

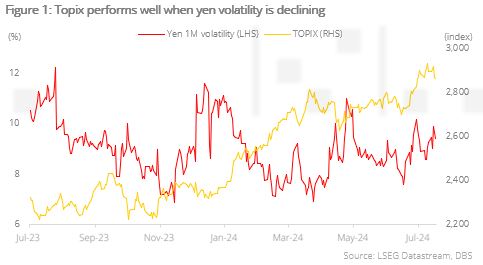

Yen volatility, driven by extensive carry trades and intervention risks, has unsettled Japan’s equity markets. Previously fuelled by "Kishidanomics," the market is likely to pause and shift towards themes that generate alpha, such as AI beneficiaries and the financial sector.

Download the PDF to read the full report which includes coverage on Credit, FX, Rates, and Thematics.

Topic

The information published by DBS Bank Ltd. (company registration no.: 196800306E) (“DBS”) is for information only. It is based on information or opinions obtained from sources believed to be reliable (but which have not been independently verified by DBS, its related companies and affiliates (“DBS Group”)) and to the maximum extent permitted by law, DBS Group does not make any representation or warranty (express or implied) as to its accuracy, completeness, timeliness or correctness for any particular purpose. Opinions and estimates are subject to change without notice. The publication and distribution of the information does not constitute nor does it imply any form of endorsement by DBS Group of any person, entity, services or products described or appearing in the information. Any past performance, projection, forecast or simulation of results is not necessarily indicative of the future or likely performance of any investment or securities. Foreign exchange transactions involve risks. You should note that fluctuations in foreign exchange rates may result in losses. You may wish to seek your own independent financial, tax, or legal advice or make such independent investigations as you consider necessary or appropriate.

The information published is not and does not constitute or form part of any offer, recommendation, invitation or solicitation to subscribe to or to enter into any transaction; nor is it calculated to invite, nor does it permit the making of offers to the public to subscribe to or enter into any transaction in any jurisdiction or country in which such offer, recommendation, invitation or solicitation is not authorised or to any person to whom it is unlawful to make such offer, recommendation, invitation or solicitation or where such offer, recommendation, invitation or solicitation would be contrary to law or regulation or which would subject DBS Group to any registration requirement within such jurisdiction or country, and should not be viewed as such. Without prejudice to the generality of the foregoing, the information, services or products described or appearing in the information are not specifically intended for or specifically targeted at the public in any specific jurisdiction.

The information is the property of DBS and is protected by applicable intellectual property laws. No reproduction, transmission, sale, distribution, publication, broadcast, circulation, modification, dissemination, or commercial exploitation such information in any manner (including electronic, print or other media now known or hereafter developed) is permitted.

DBS Group and its respective directors, officers and/or employees may have positions or other interests in, and may effect transactions in securities mentioned and may also perform or seek to perform broking, investment banking and other banking or financial services to any persons or entities mentioned.

To the maximum extent permitted by law, DBS Group accepts no liability for any losses or damages (including direct, special, indirect, consequential, incidental or loss of profits) of any kind arising from or in connection with any reliance and/or use of the information (including any error, omission or misstatement, negligent or otherwise) or further communication, even if DBS Group has been advised of the possibility thereof.

The information is not intended for distribution to, or use by, any person or entity in any jurisdiction or country where such distribution or use would be contrary to law or regulation. The information is distributed (a) in Singapore, by DBS Bank Ltd.; (b) in China, by DBS Bank (China) Ltd; (c) in Hong Kong, by DBS Bank (Hong Kong) Limited; (d) in Taiwan, by DBS Bank (Taiwan) Ltd; (e) in Indonesia, by PT DBS Indonesia; and (f) in India, by DBS Bank Ltd, Mumbai Branch.

Related Insights

- Singapore Equity Picks02 Aug 2024

- Rate Cuts in Play02 Aug 2024

- HKD rates: HIBORs movement in rate cut cycles 02 Aug 2024

Related Insights

- Singapore Equity Picks02 Aug 2024

- Rate Cuts in Play02 Aug 2024

- HKD rates: HIBORs movement in rate cut cycles 02 Aug 2024