- Equities: Global equity markets in green thanks to easing inflation in the US; core inflation in June (+3.3% y/y) fell to lowest since Apr 2021

- Credit: A barbell duration strategy in IG credit (1-3Y and 7-10Y) will be well-poised for gains when rate cuts ensue

- FX: Polls are skewed towards Trump at the US Presidential elections; but a replay of USD’s rally into Trump’s victory in the 2016 elections is unlikely

- Rates: Market leaning deeper into Fed easing bets after recent CPI prints with 2.5 cuts factored for this year

- The Week Ahead: Keep a lookout for US Change in Initial Jobless Claims; Singapore Non-oil Domestic Exports

Related Insights

Global equities buoyed by fresh US inflation data. Equity markets across the board had a positive week ending 12 Jul thanks to US inflation data, which came in lower than expected for the month of June. The headline figure declined 0.1% m/m; this was the first time since May 2020 that the monthly rate was negative. On a y/y basis, prices were up 3.0%. Excluding food and energy, core inflation was up 3.3% y/y, the smallest it has been since Apr 2021.

This has set up growing expectations of a Fed rate cut in September and put markets in risk on mode during the past week. The Dow advanced 1.6% during the week to a new record high, while the S&P 500 and NASDAQ gained 0.9% and 0.2% respectively. Europe, Japan, and AxJ equities also rose during the week; Stoxx 600 +1.4%, Nikkei-225 +0.7%, HSCEI +2.4%, Hang Seng +2.8%.

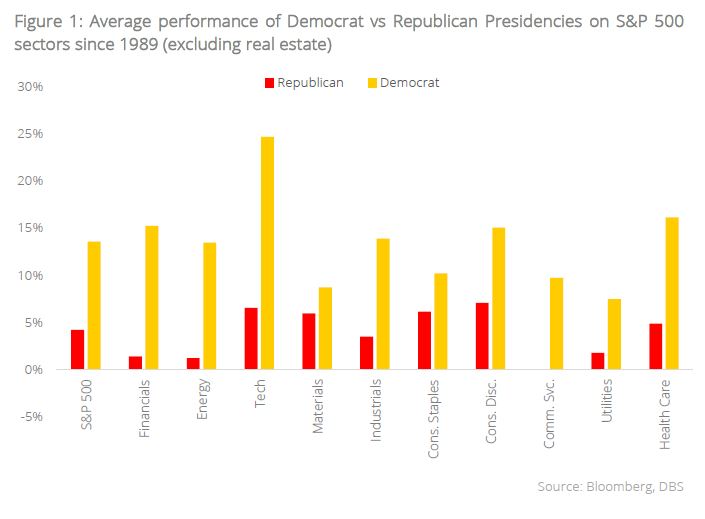

Topic in focus: US equities – S&P 500 performance across party lines. The relationship between political leadership and stock market performance has long been a subject of interest for investors. Since the S&P 500’s inception in 1957, the index has delivered an average annual return of c.8.5%. Closer examination reveals that the S&P 500 achieves a higher return under a Democratic presidency with an average of c.11.4% annual return vs c.6.0% annual return from a Republican presidency.

Breaking it down into individual sectors (excluding Real Estate), since 1989, the best performing sector under a democratic presidency was technology (c.24.7%), followed by healthcare (c.16.2%) and financials (c.15.3%). Under a republican presidency, the best performing sector was consumer discretionary (c.7.1%), followed by technology (c.6.5%) and consumer staples (c.6.2%). Notably, the tech sector demonstrates strong performance regardless of the party in power.

We believe that this election will see the same trend for the tech sector, especially for Big Tech. Their dominant market positions and robust cash flow generation abilities position them favourably. Moreover, the Tech sector is poised to be a key beneficiary as the world embarks on the transformative journey of Artificial Intelligence (AI), solidifying the sector's importance in the economy.

Download the PDF to read the full report which includes coverage on Credit, FX, Rates, and Thematics.

Topic

The information published by DBS Bank Ltd. (company registration no.: 196800306E) (“DBS”) is for information only. It is based on information or opinions obtained from sources believed to be reliable (but which have not been independently verified by DBS, its related companies and affiliates (“DBS Group”)) and to the maximum extent permitted by law, DBS Group does not make any representation or warranty (express or implied) as to its accuracy, completeness, timeliness or correctness for any particular purpose. Opinions and estimates are subject to change without notice. The publication and distribution of the information does not constitute nor does it imply any form of endorsement by DBS Group of any person, entity, services or products described or appearing in the information. Any past performance, projection, forecast or simulation of results is not necessarily indicative of the future or likely performance of any investment or securities. Foreign exchange transactions involve risks. You should note that fluctuations in foreign exchange rates may result in losses. You may wish to seek your own independent financial, tax, or legal advice or make such independent investigations as you consider necessary or appropriate.

The information published is not and does not constitute or form part of any offer, recommendation, invitation or solicitation to subscribe to or to enter into any transaction; nor is it calculated to invite, nor does it permit the making of offers to the public to subscribe to or enter into any transaction in any jurisdiction or country in which such offer, recommendation, invitation or solicitation is not authorised or to any person to whom it is unlawful to make such offer, recommendation, invitation or solicitation or where such offer, recommendation, invitation or solicitation would be contrary to law or regulation or which would subject DBS Group to any registration requirement within such jurisdiction or country, and should not be viewed as such. Without prejudice to the generality of the foregoing, the information, services or products described or appearing in the information are not specifically intended for or specifically targeted at the public in any specific jurisdiction.

The information is the property of DBS and is protected by applicable intellectual property laws. No reproduction, transmission, sale, distribution, publication, broadcast, circulation, modification, dissemination, or commercial exploitation such information in any manner (including electronic, print or other media now known or hereafter developed) is permitted.

DBS Group and its respective directors, officers and/or employees may have positions or other interests in, and may effect transactions in securities mentioned and may also perform or seek to perform broking, investment banking and other banking or financial services to any persons or entities mentioned.

To the maximum extent permitted by law, DBS Group accepts no liability for any losses or damages (including direct, special, indirect, consequential, incidental or loss of profits) of any kind arising from or in connection with any reliance and/or use of the information (including any error, omission or misstatement, negligent or otherwise) or further communication, even if DBS Group has been advised of the possibility thereof.

The information is not intended for distribution to, or use by, any person or entity in any jurisdiction or country where such distribution or use would be contrary to law or regulation. The information is distributed (a) in Singapore, by DBS Bank Ltd.; (b) in China, by DBS Bank (China) Ltd; (c) in Hong Kong, by DBS Bank (Hong Kong) Limited; (d) in Taiwan, by DBS Bank (Taiwan) Ltd; (e) in Indonesia, by PT DBS Indonesia; and (f) in India, by DBS Bank Ltd, Mumbai Branch.