- US: Conditions have aligned sufficiently for the Fed to begin easing in September – CPI fell 0.1% m/m in June, while gradual cooling of the labour market supports view of two Fed rate cuts this year

- China: Weaker-than-expected inflation continues to weigh on sentiment with consumer durables seeing clearer decreases; state sectors fixed asset investments continue to be a key driver of economic recovery

- Taiwan: Strong exports-driven recovery in 1H24 aligns closely with our forecast for a global tech sector rebound, but growth recovery should remain uneven in 2H between tech and non-tech traditional sectors

Related Insights

- FX Daily: JPY and RMB strengthen amid carry unwind 25 Jul 2024

- CNY rates: Strong demand for short-end CGB 25 Jul 2024

- USD Rates: Steepening still the core trade 25 Jul 2024

US: Brace for Fed easing in 2H. US CPI fell 0.1% m/m in June, in an encouraging sign for the first Fed rate cut to take place in September. The decline from last month was the first time in more than four years that the monthly rate showed a decrease, probably sufficient for the Fed to gain confidence that the downtrend in inflation is intact.

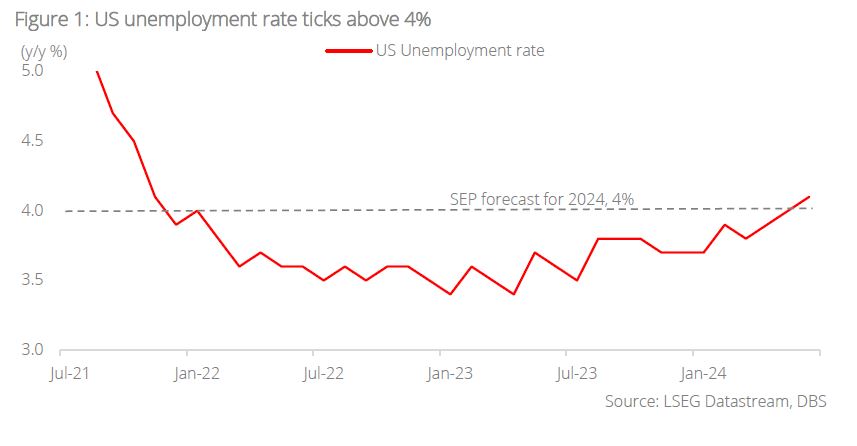

Additionally, the US unemployment rate ticked above 4.0% in June for the first time in this economic cycle. Notably, the household survey has been generally showing a weaker pace of jobs growth over the past year, diverging from the nonfarm payroll (NFP) which draws data from the establishment survey. There has been a steady grind higher in the unemployment rate from a low of 3.4% in early 2023. A gradual cooling of the labour market supports the view that the Fed would cut twice in 2024.

Conditions have aligned sufficiently for the Fed to begin easing in September and this would probably be followed through with another cut in December, taking the Fed Funds rate (upper bound) to 5.00%. We expect the Fed to verbally guide the market towards calibrated cuts at the Federal Open Market Committee meeting in end July.

In any case, the Fed has a dual mandate – full employment and stable prices. As the economic cycle ages, we argue that the employment component would play an increasingly important role. Inflation at 3% (down from as high as 9% in 2022) is no longer that big of an issue. Our Taylor Rule model estimates indicate that the Fed Funds rate is already too restrictive and has been the case for a few months. Recent labour market data is supportive of calibrated easing.

We note that a large proportion of the jobs created appear to be in the government, education, and health services sectors. With signs of weakness in continuing claims, it does seem that parts of the economy may not be doing as well as NFP (which has stayed resilient) suggests. In any case, the ratio of jobs per unemployed persons has dipped to 1.2, consistent with pre-pandemic levels. An inflection point in Fed policy setting is probably upon us.

Download the PDF to read the full report which includes coverage on Credit, FX, Rates, and Thematics.

Topic

The information published by DBS Bank Ltd. (company registration no.: 196800306E) (“DBS”) is for information only. It is based on information or opinions obtained from sources believed to be reliable (but which have not been independently verified by DBS, its related companies and affiliates (“DBS Group”)) and to the maximum extent permitted by law, DBS Group does not make any representation or warranty (express or implied) as to its accuracy, completeness, timeliness or correctness for any particular purpose. Opinions and estimates are subject to change without notice. The publication and distribution of the information does not constitute nor does it imply any form of endorsement by DBS Group of any person, entity, services or products described or appearing in the information. Any past performance, projection, forecast or simulation of results is not necessarily indicative of the future or likely performance of any investment or securities. Foreign exchange transactions involve risks. You should note that fluctuations in foreign exchange rates may result in losses. You may wish to seek your own independent financial, tax, or legal advice or make such independent investigations as you consider necessary or appropriate.

The information published is not and does not constitute or form part of any offer, recommendation, invitation or solicitation to subscribe to or to enter into any transaction; nor is it calculated to invite, nor does it permit the making of offers to the public to subscribe to or enter into any transaction in any jurisdiction or country in which such offer, recommendation, invitation or solicitation is not authorised or to any person to whom it is unlawful to make such offer, recommendation, invitation or solicitation or where such offer, recommendation, invitation or solicitation would be contrary to law or regulation or which would subject DBS Group to any registration requirement within such jurisdiction or country, and should not be viewed as such. Without prejudice to the generality of the foregoing, the information, services or products described or appearing in the information are not specifically intended for or specifically targeted at the public in any specific jurisdiction.

The information is the property of DBS and is protected by applicable intellectual property laws. No reproduction, transmission, sale, distribution, publication, broadcast, circulation, modification, dissemination, or commercial exploitation such information in any manner (including electronic, print or other media now known or hereafter developed) is permitted.

DBS Group and its respective directors, officers and/or employees may have positions or other interests in, and may effect transactions in securities mentioned and may also perform or seek to perform broking, investment banking and other banking or financial services to any persons or entities mentioned.

To the maximum extent permitted by law, DBS Group accepts no liability for any losses or damages (including direct, special, indirect, consequential, incidental or loss of profits) of any kind arising from or in connection with any reliance and/or use of the information (including any error, omission or misstatement, negligent or otherwise) or further communication, even if DBS Group has been advised of the possibility thereof.

The information is not intended for distribution to, or use by, any person or entity in any jurisdiction or country where such distribution or use would be contrary to law or regulation. The information is distributed (a) in Singapore, by DBS Bank Ltd.; (b) in China, by DBS Bank (China) Ltd; (c) in Hong Kong, by DBS Bank (Hong Kong) Limited; (d) in Taiwan, by DBS Bank (Taiwan) Ltd; (e) in Indonesia, by PT DBS Indonesia; and (f) in India, by DBS Bank Ltd, Mumbai Branch.

Related Insights

- FX Daily: JPY and RMB strengthen amid carry unwind 25 Jul 2024

- CNY rates: Strong demand for short-end CGB 25 Jul 2024

- USD Rates: Steepening still the core trade 25 Jul 2024

Related Insights

- FX Daily: JPY and RMB strengthen amid carry unwind 25 Jul 2024

- CNY rates: Strong demand for short-end CGB 25 Jul 2024

- USD Rates: Steepening still the core trade 25 Jul 2024