- Forecasts of a hot and dry European summer in 2024 will boost higher beer consumption as people spend more time outdoors, contrasting with last year’s dampened sales due to unusually wet weather

- Major sporting events to boost beer consumption and raise awareness of non-alcoholic beer

- Upcoming Paris Olympics to feature non-alcoholic beer for the first time, providing a great platform to increase adoption of the new beer category

- Brewers with greater exposure to Europe to see outsized sales uplift in 2024 in anticipation of higher beer demand from the region

Related Insights

- Heineken’s (HEIN NA) reported volume growth of 1.6% y/y

- Aneheuser-Busch InBev (ABI BB) indicated mid-single digit growth

- Carlsberg (CARLB DC) saw its Western Europe sales up by 0.2% y/y, while its Central and Eastern Europe and India volumes were up 2.2%

- Asahi’s (2502 JP) sales volume was also up by 0.8% in Europe (matching that of Japan) which outperformed its Oceania region which dipped by 9.3% y/y

Unlike 2023 where European sales were dampened by wet weather, forecasts of a hotter, drier summer, coupled with major sporting events, are expected to boost outdoor social activities and beer consumption this year. This has led to major breweries expressing optimism for their sales outlook.

Major sporting events poised to boost beer sales and raise global awareness of non-alcoholic beers. Historical trends suggest that beer sales volume tends to increase during major sporting events. We expect this pattern to hold true this year and drive an uplift in sales. The UEFA Euro 2024 tournament in Germany is expected to significantly boost European sales given soccer's popularity and beer's status as the go-to beverage for match viewing.

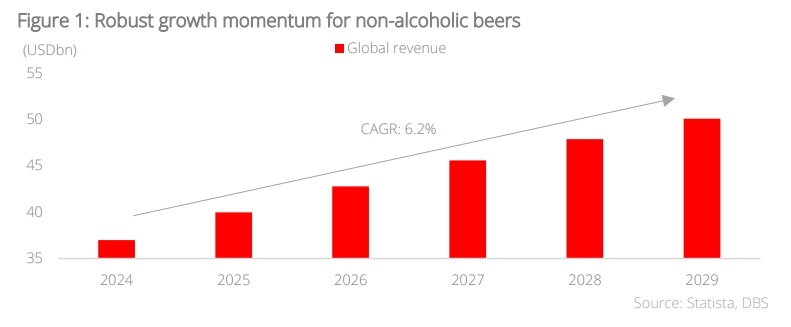

Meanwhile, the upcoming Olympics Games in Paris will feature non-alcoholic beer for the first time ever. Indeed, ABI’s alcohol-free Corona Cero has signed on to be the Worldwide Olympic Partner for three Olympic games starting with Paris in 2024. With an estimated viewership of over 3bn, the Olympics provides a unique platform to elevate non-alcoholic beer in consumers' minds and accelerate the adoption of this emerging beer category.

According to industry players, non-alcoholic beer shares in the US and Europe are at c.1% and c.5%, respectively, and with increased investment and focus lie growth opportunities ahead. Similarly, Heineken has also shared its optimism in alcohol-free beer where its Heineken 0.0 has been a growth driver for the brand.

Brewers with greater exposure to Europe to experience better uplift in sales. Given anticipated increase in demand due to favourable weather conditions and major sporting events, the beer industry in Europe is expected to experience a sales uplift. Consequently, companies with higher European exposure (Heineken and Asahi with 39% and 25% of 2023 sales revenue from Europe, respectively) are well-positioned to benefit from increased sales volumes in the region.

Topic

The information published by DBS Bank Ltd. (company registration no.: 196800306E) (“DBS”) is for information only. It is based on information or opinions obtained from sources believed to be reliable (but which have not been independently verified by DBS, its related companies and affiliates (“DBS Group”)) and to the maximum extent permitted by law, DBS Group does not make any representation or warranty (express or implied) as to its accuracy, completeness, timeliness or correctness for any particular purpose. Opinions and estimates are subject to change without notice. The publication and distribution of the information does not constitute nor does it imply any form of endorsement by DBS Group of any person, entity, services or products described or appearing in the information. Any past performance, projection, forecast or simulation of results is not necessarily indicative of the future or likely performance of any investment or securities. Foreign exchange transactions involve risks. You should note that fluctuations in foreign exchange rates may result in losses. You may wish to seek your own independent financial, tax, or legal advice or make such independent investigations as you consider necessary or appropriate.

The information published is not and does not constitute or form part of any offer, recommendation, invitation or solicitation to subscribe to or to enter into any transaction; nor is it calculated to invite, nor does it permit the making of offers to the public to subscribe to or enter into any transaction in any jurisdiction or country in which such offer, recommendation, invitation or solicitation is not authorised or to any person to whom it is unlawful to make such offer, recommendation, invitation or solicitation or where such offer, recommendation, invitation or solicitation would be contrary to law or regulation or which would subject DBS Group to any registration requirement within such jurisdiction or country, and should not be viewed as such. Without prejudice to the generality of the foregoing, the information, services or products described or appearing in the information are not specifically intended for or specifically targeted at the public in any specific jurisdiction.

The information is the property of DBS and is protected by applicable intellectual property laws. No reproduction, transmission, sale, distribution, publication, broadcast, circulation, modification, dissemination, or commercial exploitation such information in any manner (including electronic, print or other media now known or hereafter developed) is permitted.

DBS Group and its respective directors, officers and/or employees may have positions or other interests in, and may effect transactions in securities mentioned and may also perform or seek to perform broking, investment banking and other banking or financial services to any persons or entities mentioned.

To the maximum extent permitted by law, DBS Group accepts no liability for any losses or damages (including direct, special, indirect, consequential, incidental or loss of profits) of any kind arising from or in connection with any reliance and/or use of the information (including any error, omission or misstatement, negligent or otherwise) or further communication, even if DBS Group has been advised of the possibility thereof.

The information is not intended for distribution to, or use by, any person or entity in any jurisdiction or country where such distribution or use would be contrary to law or regulation. The information is distributed (a) in Singapore, by DBS Bank Ltd.; (b) in China, by DBS Bank (China) Ltd; (c) in Hong Kong, by DBS Bank (Hong Kong) Limited; (d) in Taiwan, by DBS Bank (Taiwan) Ltd; (e) in Indonesia, by PT DBS Indonesia; and (f) in India, by DBS Bank Ltd, Mumbai Branch.