- The global ride-hailing industry is exhibiting resilience against inflation and post Covid-19 normalisation

- Key catalysts are: a) reduction in driver supply and b) pick-up in food delivery orders

- Food delivery and ride-hailing industries are projected to grow at CAGR of 10.3% and 9.6% between 2024 and 2029

- Dominant players in both US and Southeast Asia continue to gain market shares on scale advantage

- Improvement in profitability and encouraging earnings outlook are among the key drivers for rerating

Related Insights

- Research Library03 Jul 2024

- India rates: INR yields bounce as focus returns on other cues 03 Jul 2024

- Indonesia: Easing inflation but limited policy leeway 03 Jul 2024

Ride hailing 1Q24 results: Ahead of market expectations. US ride hailing players beat market expectations on both revenue and margin in 1Q24, led by strong traction in key international markets while Grab followed suit by beating market expectations on cost controls and ride-hailing (Mobility) segment performance. The latter expects more growth to stem from Tier-1 cities driven by increasing the frequency of retention.

Guidance among US players for 2Q24F has been in line with market expectations on profitability, driven by efficient pricing, matching, and incentives. In Southeast Asia, Grab revised up its FY24F guidance on the back of strong ride-hailing demand and further cost structure optimisation.

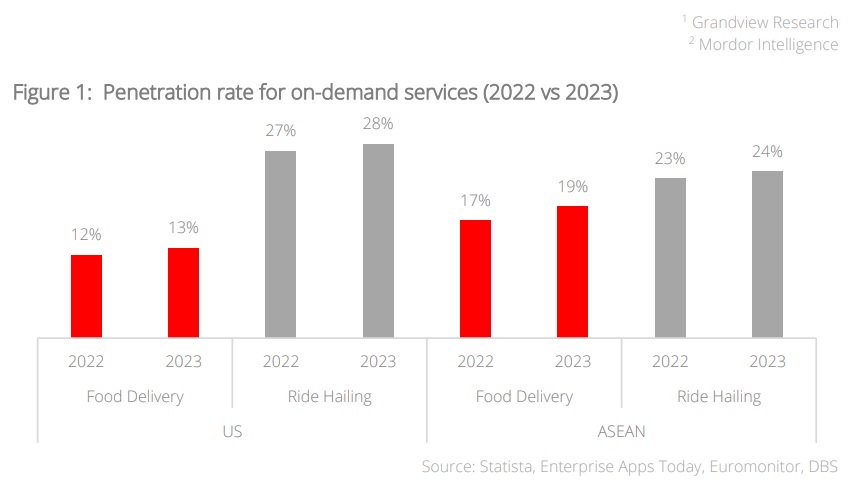

Double-digit growth expected in the medium term; Big potential upside for penetration rates. According to independent industry research, global food delivery1 and ride-hailing markets2 are expected to grow at a CAGR of 10.3% and 9.6% respectively over 2024-2029 on rising penetration rates off low base. As US industry players do not distribute big incentives to drivers, they are able to command superior EBITDA margins for two key reasons:

- Firstly, most US drivers own their cars and do not bear the car-leasing fee unlike drivers in Southeast Asia who usually spend 30-50% of their daily earnings on car leases.

- Secondly, US consumers tend to pay an additional 15-20% of their order value in tips to the drivers for food-delivery services compared to less than 5-10% who do so in Southeast Asia. As such US companies generally pay relatively lower commissions to drivers.

Prefer companies with dominant market share in ride-hailing and delivery services. Players offering both ride-hailing and delivery services can (i) broaden their appeal to younger customer base who are more frequent users of food delivery services, (ii) deploy their delivery resources for ride-hailing service outside the peak hours, and (iii) offer cross-selling benefits from the use of loyalty points and other promotions.

On-demand players in Southeast Asia have ventured into fintech services where huge untapped potentials remain for digital lending services. While not currently profitable, fintech services are likely to see reduction in losses as marketing expenses have peaked.

Topic

The information published by DBS Bank Ltd. (company registration no.: 196800306E) (“DBS”) is for information only. It is based on information or opinions obtained from sources believed to be reliable (but which have not been independently verified by DBS, its related companies and affiliates (“DBS Group”)) and to the maximum extent permitted by law, DBS Group does not make any representation or warranty (express or implied) as to its accuracy, completeness, timeliness or correctness for any particular purpose. Opinions and estimates are subject to change without notice. The publication and distribution of the information does not constitute nor does it imply any form of endorsement by DBS Group of any person, entity, services or products described or appearing in the information. Any past performance, projection, forecast or simulation of results is not necessarily indicative of the future or likely performance of any investment or securities. Foreign exchange transactions involve risks. You should note that fluctuations in foreign exchange rates may result in losses. You may wish to seek your own independent financial, tax, or legal advice or make such independent investigations as you consider necessary or appropriate.

The information published is not and does not constitute or form part of any offer, recommendation, invitation or solicitation to subscribe to or to enter into any transaction; nor is it calculated to invite, nor does it permit the making of offers to the public to subscribe to or enter into any transaction in any jurisdiction or country in which such offer, recommendation, invitation or solicitation is not authorised or to any person to whom it is unlawful to make such offer, recommendation, invitation or solicitation or where such offer, recommendation, invitation or solicitation would be contrary to law or regulation or which would subject DBS Group to any registration requirement within such jurisdiction or country, and should not be viewed as such. Without prejudice to the generality of the foregoing, the information, services or products described or appearing in the information are not specifically intended for or specifically targeted at the public in any specific jurisdiction.

The information is the property of DBS and is protected by applicable intellectual property laws. No reproduction, transmission, sale, distribution, publication, broadcast, circulation, modification, dissemination, or commercial exploitation such information in any manner (including electronic, print or other media now known or hereafter developed) is permitted.

DBS Group and its respective directors, officers and/or employees may have positions or other interests in, and may effect transactions in securities mentioned and may also perform or seek to perform broking, investment banking and other banking or financial services to any persons or entities mentioned.

To the maximum extent permitted by law, DBS Group accepts no liability for any losses or damages (including direct, special, indirect, consequential, incidental or loss of profits) of any kind arising from or in connection with any reliance and/or use of the information (including any error, omission or misstatement, negligent or otherwise) or further communication, even if DBS Group has been advised of the possibility thereof.

The information is not intended for distribution to, or use by, any person or entity in any jurisdiction or country where such distribution or use would be contrary to law or regulation. The information is distributed (a) in Singapore, by DBS Bank Ltd.; (b) in China, by DBS Bank (China) Ltd; (c) in Hong Kong, by DBS Bank (Hong Kong) Limited; (d) in Taiwan, by DBS Bank (Taiwan) Ltd; (e) in Indonesia, by PT DBS Indonesia; and (f) in India, by DBS Bank Ltd, Mumbai Branch.

Related Insights

- Research Library03 Jul 2024

- India rates: INR yields bounce as focus returns on other cues 03 Jul 2024

- Indonesia: Easing inflation but limited policy leeway 03 Jul 2024

Related Insights

- Research Library03 Jul 2024

- India rates: INR yields bounce as focus returns on other cues 03 Jul 2024

- Indonesia: Easing inflation but limited policy leeway 03 Jul 2024