- Europe power demand has declined by c.10% cumulatively over the past 15 years, driven in part by high power prices from Europe’s energy crisis in 2022-2023

- The decline is set to reverse from 2024 amid lower power prices and tailwinds from decarbonisation and electrification efforts

- AI megatrend could drive stronger power demand than current near-term projection of c.2% CAGR

- As power prices normalise, we believe that the network sub-segment is the bright spot for utilities, given significant growth needs and steadier returns

Related Insights

Europe power demand back on track; will AI drive strong growth ahead? Over the past 15 years, European electricity demand has registered cumulative decline of c.10% and this was exacerbated by the energy crisis of 2022-2023 which saw demand falling c.6% on the back of higher prices. The decline was due to weaker industrial demand, milder weather conditions, and improved efficiencies, which collectively more than offset the increase in demand arising from growing electrification and data centres. The trend, however, is set to reverse this year as decarbonisation and electrification translate to lower gas and power prices.

While demand growth projections appear moderate at this juncture (c.2% p.a. in 2024-2026 based on US Energy Information Administration estimates), the Artificial Intelligence (AI) megatrend could drive further expansion of data centres, potentially boosting Europe’s power demand growth at >4% CAGR over the next decade. Key beneficiaries of the AI data centre boom in Europe include countries with cheap and abundant green power, such as the Nordics, Spain, and France; as well as those with large financial and tech company clusters such as Ireland, UK, and Germany.

Power prices could stay soft in the near-term; network investment to scale up. While power demand is expected to return to growth territory, power prices could stay soft in the near term as renewable capacity remains oversupplied and gas prices remain muted. This may be a drag on power producers’ earnings. We believe the bright spot lies in the network sub-segment, which is seeing rapid expansion. Electricity networks, the backbone of energy transition, are vital in integrating renewables, enabling reliable electricity flow and the creation of new services for consumers.

Investment needs in electricity networks are projected to double in the next 5 years (Eurelectric forecasts growth from an average of EUR33bn per year to EUR67bn per year from 2025 to 2050), and gas networks are also seeing rising demand for hydrogen/biogas conversions. The investment return for network investment is likely to be steadier given less competition and inflation adjustments. Regulatory support is also in place to facilitate the upgrading of distribution grids.

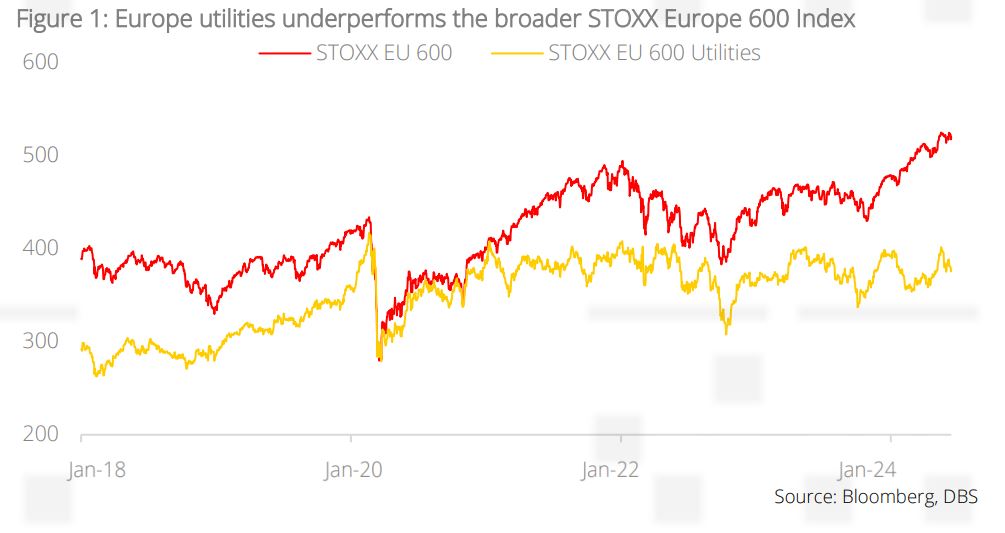

Prefer integrated providers and network players. Utilities stocks in Europe have underperformed the broad market YTD in 2024, with the STOXX EU 600 Utilities Index down c.4% vs a c.8.5% increase in the STOXX EU 600 Index at the time of writing. This is mainly driven by the higher-for-longer interest rate environment and fall in power prices. However, we believe the tide should be turning, with improving power demand expectations and potential Fed rate cuts later in the year.

Topic

The information published by DBS Bank Ltd. (company registration no.: 196800306E) (“DBS”) is for information only. It is based on information or opinions obtained from sources believed to be reliable (but which have not been independently verified by DBS, its related companies and affiliates (“DBS Group”)) and to the maximum extent permitted by law, DBS Group does not make any representation or warranty (express or implied) as to its accuracy, completeness, timeliness or correctness for any particular purpose. Opinions and estimates are subject to change without notice. The publication and distribution of the information does not constitute nor does it imply any form of endorsement by DBS Group of any person, entity, services or products described or appearing in the information. Any past performance, projection, forecast or simulation of results is not necessarily indicative of the future or likely performance of any investment or securities. Foreign exchange transactions involve risks. You should note that fluctuations in foreign exchange rates may result in losses. You may wish to seek your own independent financial, tax, or legal advice or make such independent investigations as you consider necessary or appropriate.

The information published is not and does not constitute or form part of any offer, recommendation, invitation or solicitation to subscribe to or to enter into any transaction; nor is it calculated to invite, nor does it permit the making of offers to the public to subscribe to or enter into any transaction in any jurisdiction or country in which such offer, recommendation, invitation or solicitation is not authorised or to any person to whom it is unlawful to make such offer, recommendation, invitation or solicitation or where such offer, recommendation, invitation or solicitation would be contrary to law or regulation or which would subject DBS Group to any registration requirement within such jurisdiction or country, and should not be viewed as such. Without prejudice to the generality of the foregoing, the information, services or products described or appearing in the information are not specifically intended for or specifically targeted at the public in any specific jurisdiction.

The information is the property of DBS and is protected by applicable intellectual property laws. No reproduction, transmission, sale, distribution, publication, broadcast, circulation, modification, dissemination, or commercial exploitation such information in any manner (including electronic, print or other media now known or hereafter developed) is permitted.

DBS Group and its respective directors, officers and/or employees may have positions or other interests in, and may effect transactions in securities mentioned and may also perform or seek to perform broking, investment banking and other banking or financial services to any persons or entities mentioned.

To the maximum extent permitted by law, DBS Group accepts no liability for any losses or damages (including direct, special, indirect, consequential, incidental or loss of profits) of any kind arising from or in connection with any reliance and/or use of the information (including any error, omission or misstatement, negligent or otherwise) or further communication, even if DBS Group has been advised of the possibility thereof.

The information is not intended for distribution to, or use by, any person or entity in any jurisdiction or country where such distribution or use would be contrary to law or regulation. The information is distributed (a) in Singapore, by DBS Bank Ltd.; (b) in China, by DBS Bank (China) Ltd; (c) in Hong Kong, by DBS Bank (Hong Kong) Limited; (d) in Taiwan, by DBS Bank (Taiwan) Ltd; (e) in Indonesia, by PT DBS Indonesia; and (f) in India, by DBS Bank Ltd, Mumbai Branch.