- Big Tech continues to outperform global equities, buoyed by consistent q/q earnings growth

- New paradigm of AI commercialisation a key growth driver

- Semiconductors, cloud computing, and cybersecurity among key beneficiaries within technology complex

- AI also set to transform a myriad of sectors and verticals, including financial services, healthcare, energy, robotics, education, military applications, supply chain management, human resources etc.

- Stick with Big Tech for quality growth-at-reasonable-price; valuations remain undemanding on growth-adjusted basis

Related Insights

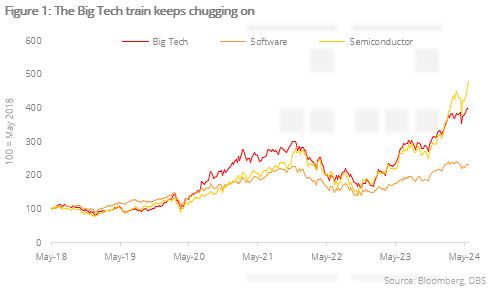

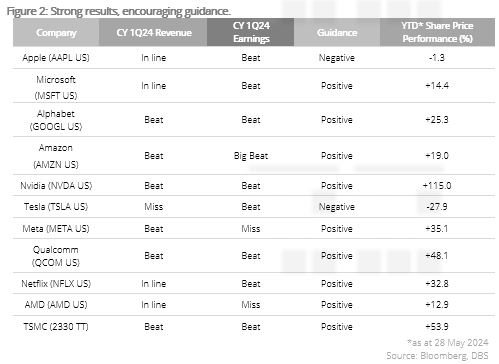

The gift that keeps on giving. Except for short periods of consolidation, Big Tech has grown from strength to strength in 2023 and 2024. On a YTD basis, it is up 22%. This stellar run has, unsurprisingly, raised concerns that Big Tech is overbought. But thus far, each new rally and high has been backed by quarter after quarter of robust sales and earnings growth, with the majority of industry stalwarts beating expectations on both fronts. The latest earnings season (CY1Q24) has been more of the same; beats on both sales and earnings, and largely positive forward guidance from management. Accordingly, the share prices of Big Tech have re-rated to reflect these positive results. In particular, companies within the semiconductor sub-complex have done exceptionally well, outperforming the broader Big Tech index.

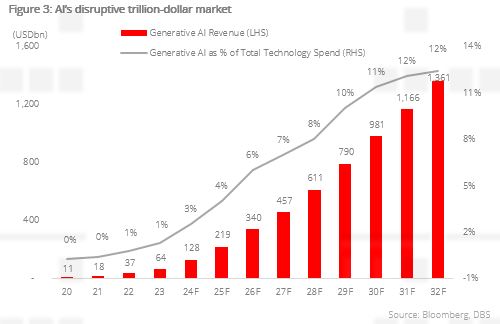

AI continues to drive Big Tech growth. What is driving this relentless wave of robust Tech Leaders earnings growth? While the individual drivers will vary across different companies, they can mostly be traced back to artificial intelligence (AI), specifically, the increasing adoption and nascent commercialisation of AI. Following the release of ChatGPT to the public in November 2022, generative-AI (GenAI) has taken the world by storm. In under two years, AI has evolved from a novelty to a must-have feature across a wide swathe of devices, applications, and platforms. In other words, we have entered a new paradigm where AI is a necessity and key area of focus for all companies. The dawn of this new era has precipitated a scramble by companies along the entire technology value chain to shore up efforts to cultivate AI-related capabilities.

Non-tech sectors to benefit as well. This AI-led growth wave is affecting not just companies in the technology space; AI adoption has also been rampant in other industries such as healthcare, where it is being used to aid drug discovery and diagnostic efforts, and financial services, where it is prominently utilised in fraud detection and service personalisation. Having said that, we believe that the following verticals and sub-sectors, both within the technology and non-technology-related space, will be overt beneficiaries of the second leg of this AI-led tech boom:

In the first of this three-part feature on AI commercialisation, we will focus on Semiconductor & Integrated Circuits and Cloud.

Semiconductors – The ultimate enablers. Semiconductor chips are the backbone of modern technology, powering everything from smartphones and computers to medical devices and smart home systems. AI is no exception – AI models and applications require specialised semiconductor chipsets and integrated circuits to run, and the recent acceleration in AI adoption will see increasing demand for these chips.

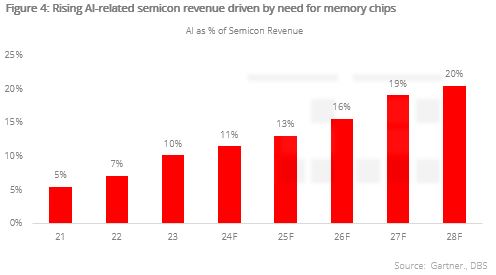

More memory. One area that is expected to see a significant demand spike is memory chips. This is because memory chips are a key component in data centers and servers, which are crucial in the proper housing and running of AI models and applications – AI servers have six to eight times the dynamic random-access memory (DRAM) content of regular servers, and three times the NAND content. Due to the sudden surge in demand, propelled by AI, for these high-bandwidth memory chips, there is currently a supply shortage, which is expected to persist for the remainder of 2024. Overall, AI-related revenue as a proportion of total semiconductor revenue will only increase with time.

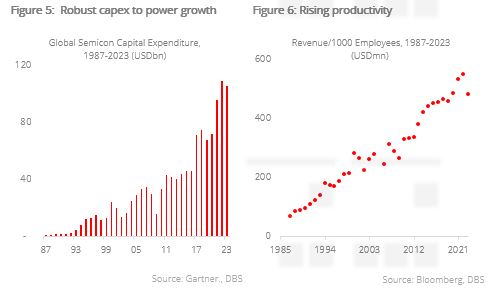

Robust capex and rising productivity. The AI-led growth wave in the semiconductor industry will be enhanced by robust capital expenditure (capex) from tech firms with deep pockets. Research and development will ensure a strong pipeline of chipsets from integrated circuit (IC) design companies while spending to diversify and shore up manufacturing capacity by foundries will ensure supply can keep up with growing demand. The sector’s healthy investment has also brought about a steadily rising level of productivity; revenue per 1,000 employees has reached USD500mn in 2023, up from just USD60mn in the mid-1980s. This is a positive sign that profitability within the sector will remain buoyant.

PC a new focus area for semiconductor industry. Another area of growth for the semiconductor industry is demand for a new generation of AI-enabled computing processors. This will drive a new PC replacement cycle over the 2025–26 period and provide a new revenue stream for integrated circuit (IC)-design companies. Notably, computing behemoth Intel introduced its latest AI-supportive processor named Gaudi 3. Not to be outdone, Qualcomm has done the same with Snapdragon X Elite, and AMD with its Ryzen Pro 8040 series of chips. This wave of PC-driven AI growth could potentially be a 30-year opportunity that will see an increasing proportion of PCs becoming AI capable, allowing for hyper-personalisation, local processing of AI tasks, and modification of privacy and security.

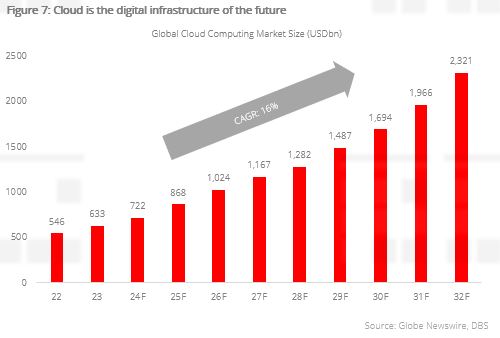

Cloud computing – GenAI’s natural infrastructure. Due to the massive computing power and huge data volumes needed to power GenAI models, cloud solutions are the only real option for housing and running these models as building and maintaining the infrastructure required is prohibitively expensive for many organisations. Moreover, many cloud service providers operate on a Pay-as-You-Go model, allowing companies to pay only for the computing resources they use. This augments the cost efficiency of cloud solutions for companies and further enhances the affinity between AI and cloud computing. With AI driving increasing demand for cloud computing services, it is projected that the global cloud computing market will grow by a 10-year CAGR of 16%, reaching massive USD2.3tn by 2032.

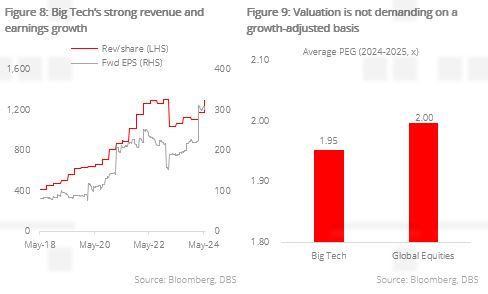

Stay invested in Big Tech as it rides the second wave of AI growth. Big Tech continues to ride the AI growth wave. It is arguable that its value proposition is now more compelling than ever. While the hype has faded somewhat, the real commercialisation and growth opportunities are more visible than ever. Even though some may argue that Big Tech’s valuations are stretched (~35x), we believe that its robust revenue and EPS growth justifies its relatively premium valuations. Big Tech’s 2-year average PE/G of 2.0x is on par with the 2.0x of global equities. When considering Big Tech’s superior growth, quality, pricing power, and presence of economic moats, such valuation levels seem very reasonable. We had previously expounded on the virtues of Big Tech investing in our Thematic 2Q24 Strategy: Big Tech’s New Paradigm. Investors should consider relevant frameworks and strategies such as the DBS CIO I.D.E.A (innovators, disruptors, enablers, and adapters) and “Q-GARP” (Quality Growth-at-a-Reasonable-Price) to identify players within the verticals listed in this report.

Topic

The information published by DBS Bank Ltd. (company registration no.: 196800306E) (“DBS”) is for information only. It is based on information or opinions obtained from sources believed to be reliable (but which have not been independently verified by DBS, its related companies and affiliates (“DBS Group”)) and to the maximum extent permitted by law, DBS Group does not make any representation or warranty (express or implied) as to its accuracy, completeness, timeliness or correctness for any particular purpose. Opinions and estimates are subject to change without notice. The publication and distribution of the information does not constitute nor does it imply any form of endorsement by DBS Group of any person, entity, services or products described or appearing in the information. Any past performance, projection, forecast or simulation of results is not necessarily indicative of the future or likely performance of any investment or securities. Foreign exchange transactions involve risks. You should note that fluctuations in foreign exchange rates may result in losses. You may wish to seek your own independent financial, tax, or legal advice or make such independent investigations as you consider necessary or appropriate.

The information published is not and does not constitute or form part of any offer, recommendation, invitation or solicitation to subscribe to or to enter into any transaction; nor is it calculated to invite, nor does it permit the making of offers to the public to subscribe to or enter into any transaction in any jurisdiction or country in which such offer, recommendation, invitation or solicitation is not authorised or to any person to whom it is unlawful to make such offer, recommendation, invitation or solicitation or where such offer, recommendation, invitation or solicitation would be contrary to law or regulation or which would subject DBS Group to any registration requirement within such jurisdiction or country, and should not be viewed as such. Without prejudice to the generality of the foregoing, the information, services or products described or appearing in the information are not specifically intended for or specifically targeted at the public in any specific jurisdiction.

The information is the property of DBS and is protected by applicable intellectual property laws. No reproduction, transmission, sale, distribution, publication, broadcast, circulation, modification, dissemination, or commercial exploitation such information in any manner (including electronic, print or other media now known or hereafter developed) is permitted.

DBS Group and its respective directors, officers and/or employees may have positions or other interests in, and may effect transactions in securities mentioned and may also perform or seek to perform broking, investment banking and other banking or financial services to any persons or entities mentioned.

To the maximum extent permitted by law, DBS Group accepts no liability for any losses or damages (including direct, special, indirect, consequential, incidental or loss of profits) of any kind arising from or in connection with any reliance and/or use of the information (including any error, omission or misstatement, negligent or otherwise) or further communication, even if DBS Group has been advised of the possibility thereof.

The information is not intended for distribution to, or use by, any person or entity in any jurisdiction or country where such distribution or use would be contrary to law or regulation. The information is distributed (a) in Singapore, by DBS Bank Ltd.; (b) in China, by DBS Bank (China) Ltd; (c) in Hong Kong, by DBS Bank (Hong Kong) Limited; (d) in Taiwan, by DBS Bank (Taiwan) Ltd; (e) in Indonesia, by PT DBS Indonesia; and (f) in India, by DBS Bank Ltd, Mumbai Branch.