- The emergence of DeepSeek will accelerate the adoption of AI-enabled devices and increase demand for computing power.

- Lower-cost, open-source AI models will be key in empowering businesses to develop customised models.

- China is set to see a surge in demand for computing power and AI-enabled devices, with promising prospects for data centres and smartphone brands.

Related Insights

- Research Library21 Feb 2025

- CNY rates: Rebounding CGB yields 21 Feb 2025

- Eurozone rates: Crucial Germany elections 21 Feb 2025

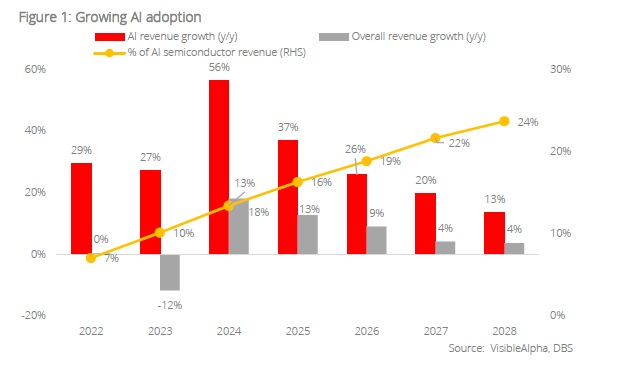

DeepSeek is accelerating the AI race and adoption. The emergence of DeepSeek will prompt the success of smaller AI models, shifting the demand towards lower-cost chips in two to three years. Meanwhile, demand for computing power will rise much faster in China, benefitting data centres and cloud providers.

A game changer and threat to high-end chips? DeepSeek represents a significant advancement in the already rapid growth of computing efficiency (4x-10x annually). Going forward, lower-cost, open-source AI models, even those with initial limited capabilities, are likely to empower businesses in developing customised models. This could challenge the dominance of higher-cost, closed-source models over time. While street has not changed Nvidia’s FY26F (Jan YE) projections due to its existing solid order book, its longer-term demand projections could be under pressure as smaller AI models shift the demand towards its lower-end H100 chips and potentially reduce the demand or pricing for its cutting-edge Blackwell chips.

Proprietary chips are likely to chip away at Nvidia’s shares in the longer-term. A big increase in capex by US hyperscalers in 2025, focusing on inferencing with their proprietary chips, also supports this shift. Fit-for-purpose custom AI chips that yield far more efficient outcomes are viable alternatives to Nvidia GPUs.

Beneficiaries of wider adoption of AI. Microsoft projects that the rising needs for AI may result in an even higher demand for computing power as per Jevon’s Paradox. Against this backdrop, we believe that computer demand would rise rapidly in China due to a lower reliance on high-end chips. We see further rerating for (i) data centre players GDS who are trading far below US data centre peers trading at 23-24 EV/EBITDA, despite offering higher growth, (ii) Alibaba whose cloud business will benefit from rising popularity of its AI model, and (iii) Xiaomi which will benefit from a rising sale of premium AI-smartphones that are integrated with advanced LLM such as DeepSeek.

Topic

The information published by DBS Bank Ltd. (company registration no.: 196800306E) (“DBS”) is for information only. It is based on information or opinions obtained from sources believed to be reliable (but which have not been independently verified by DBS, its related companies and affiliates (“DBS Group”)) and to the maximum extent permitted by law, DBS Group does not make any representation or warranty (express or implied) as to its accuracy, completeness, timeliness or correctness for any particular purpose. Opinions and estimates are subject to change without notice. The publication and distribution of the information does not constitute nor does it imply any form of endorsement by DBS Group of any person, entity, services or products described or appearing in the information. Any past performance, projection, forecast or simulation of results is not necessarily indicative of the future or likely performance of any investment or securities. Foreign exchange transactions involve risks. You should note that fluctuations in foreign exchange rates may result in losses. You may wish to seek your own independent financial, tax, or legal advice or make such independent investigations as you consider necessary or appropriate.

The information published is not and does not constitute or form part of any offer, recommendation, invitation or solicitation to subscribe to or to enter into any transaction; nor is it calculated to invite, nor does it permit the making of offers to the public to subscribe to or enter into any transaction in any jurisdiction or country in which such offer, recommendation, invitation or solicitation is not authorised or to any person to whom it is unlawful to make such offer, recommendation, invitation or solicitation or where such offer, recommendation, invitation or solicitation would be contrary to law or regulation or which would subject DBS Group to any registration requirement within such jurisdiction or country, and should not be viewed as such. Without prejudice to the generality of the foregoing, the information, services or products described or appearing in the information are not specifically intended for or specifically targeted at the public in any specific jurisdiction.

The information is the property of DBS and is protected by applicable intellectual property laws. No reproduction, transmission, sale, distribution, publication, broadcast, circulation, modification, dissemination, or commercial exploitation such information in any manner (including electronic, print or other media now known or hereafter developed) is permitted.

DBS Group and its respective directors, officers and/or employees may have positions or other interests in, and may effect transactions in securities mentioned and may also perform or seek to perform broking, investment banking and other banking or financial services to any persons or entities mentioned.

To the maximum extent permitted by law, DBS Group accepts no liability for any losses or damages (including direct, special, indirect, consequential, incidental or loss of profits) of any kind arising from or in connection with any reliance and/or use of the information (including any error, omission or misstatement, negligent or otherwise) or further communication, even if DBS Group has been advised of the possibility thereof.

The information is not intended for distribution to, or use by, any person or entity in any jurisdiction or country where such distribution or use would be contrary to law or regulation. The information is distributed (a) in Singapore, by DBS Bank Ltd.; (b) in China, by DBS Bank (China) Ltd; (c) in Hong Kong, by DBS Bank (Hong Kong) Limited; (d) in Taiwan, by DBS Bank (Taiwan) Ltd; (e) in Indonesia, by PT DBS Indonesia; and (f) in India, by DBS Bank Ltd, Mumbai Branch.

Related Insights

- Research Library21 Feb 2025

- CNY rates: Rebounding CGB yields 21 Feb 2025

- Eurozone rates: Crucial Germany elections 21 Feb 2025

Related Insights

- Research Library21 Feb 2025

- CNY rates: Rebounding CGB yields 21 Feb 2025

- Eurozone rates: Crucial Germany elections 21 Feb 2025