- US: 30-day pause on tariffs against Canada and Mexico; 10% levy on goods from China implemented

- Europe: ECB lowered interest rates by 25 bps to 2.75%, prioritising growth over inflation concerns

- India: GOI plans to maintain fiscal deficit such that their debt declines towards c.50% debt to GDP level by 31 Mar 2031

- Singapore: Expect cumulative overall fiscal surplus from FY2021 to FY2024 to exceed SGD1.8bn, reaching SGD6.6bn, providing greater fiscal ammunition for FY2025

Related Insights

- Research Library21 Feb 2025

- CNY rates: Rebounding CGB yields 21 Feb 2025

- Eurozone rates: Crucial Germany elections 21 Feb 2025

US: Trade war tensions on the rise. The Biden administration has handed over a US economy on the march to the Trump team. GDP grew by a robust 2.8% in 2024 with consumption, investment, and public spending firing on all cylinders. Strong demand fuelled imports, pushing up the trade deficit and making net exports a negative contributor to growth. A mix of protectionism, deregulation, tax/spending cuts, and immigration restrictions would influence the economy in the coming years; we think around 2% growth await.

Earlier this week, Trump had agreed on a 30-day delay on tariffs against Canada and Mexico. While Trump has temporarily averted tariffs on Canada and Mexico, a 10% levy on goods from China has been implemented with hints that tariffs against the UK and EU are up next. We remain cautious about the optimism for the UK to avoid US tariffs. While the US does not have a goods trade deficit with the UK, it does have a significant services deficit. Trump’s recent comments—calling the UK “out of line” despite describing the UK’s trading relationship with the US as “fair and balanced”—suggested that negotiations may be needed to avoid tariffs.

Given that Trump has talked about his belief in the potency of tariffs, actual and threatened, for four decades, we are sceptical that this four-year term would somehow begin and end with minimal application of his favourite tool. More critically, the current macro juncture does not lend much room for policy volatility. Economic momentum has been strong for years, and Trump’s actions to deregulate and cut taxes, in combination with desire to tighten labour supply and lower borrowing costs, are a recipe for economic overheating.

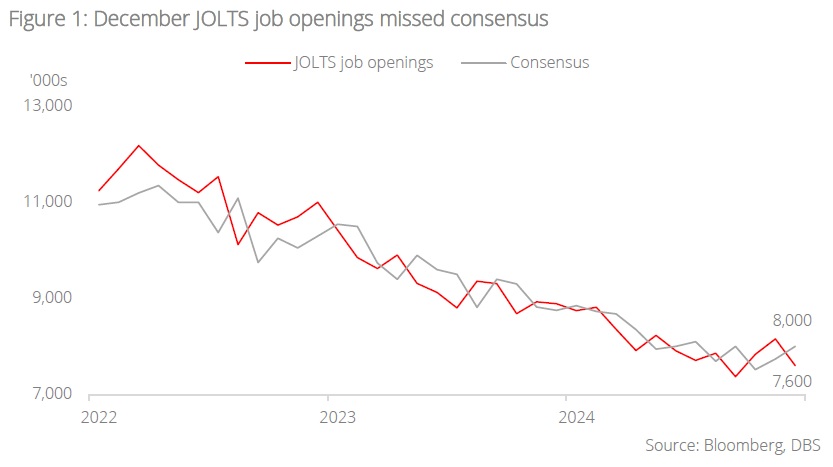

Based off recent data, there are no signs of a slowdown. Initial jobless claims and continuing claims are both still low, and JOLTs job openings missed (7.6mn vs consensus of 8.0mn). We also note that ISM manufacturing climbed above 50 for the first time since Oct 2022. Against this backdrop, we expect a reasonably firm nonfarm payroll print today (7 Feb; consensus: 170k). However, this might get muddled by the annual benchmark revision from the Bureau of Labor Statistics (BLS). Back in August last year, the BLS flagged that there would be 818k worth of downward revision. We suspect that the headline figure would probably garner more attention than the revisions.

Download the PDF to read the full report which includes coverage on Credit, FX, Rates, and Thematics.

Topic

The information published by DBS Bank Ltd. (company registration no.: 196800306E) (“DBS”) is for information only. It is based on information or opinions obtained from sources believed to be reliable (but which have not been independently verified by DBS, its related companies and affiliates (“DBS Group”)) and to the maximum extent permitted by law, DBS Group does not make any representation or warranty (express or implied) as to its accuracy, completeness, timeliness or correctness for any particular purpose. Opinions and estimates are subject to change without notice. The publication and distribution of the information does not constitute nor does it imply any form of endorsement by DBS Group of any person, entity, services or products described or appearing in the information. Any past performance, projection, forecast or simulation of results is not necessarily indicative of the future or likely performance of any investment or securities. Foreign exchange transactions involve risks. You should note that fluctuations in foreign exchange rates may result in losses. You may wish to seek your own independent financial, tax, or legal advice or make such independent investigations as you consider necessary or appropriate.

The information published is not and does not constitute or form part of any offer, recommendation, invitation or solicitation to subscribe to or to enter into any transaction; nor is it calculated to invite, nor does it permit the making of offers to the public to subscribe to or enter into any transaction in any jurisdiction or country in which such offer, recommendation, invitation or solicitation is not authorised or to any person to whom it is unlawful to make such offer, recommendation, invitation or solicitation or where such offer, recommendation, invitation or solicitation would be contrary to law or regulation or which would subject DBS Group to any registration requirement within such jurisdiction or country, and should not be viewed as such. Without prejudice to the generality of the foregoing, the information, services or products described or appearing in the information are not specifically intended for or specifically targeted at the public in any specific jurisdiction.

The information is the property of DBS and is protected by applicable intellectual property laws. No reproduction, transmission, sale, distribution, publication, broadcast, circulation, modification, dissemination, or commercial exploitation such information in any manner (including electronic, print or other media now known or hereafter developed) is permitted.

DBS Group and its respective directors, officers and/or employees may have positions or other interests in, and may effect transactions in securities mentioned and may also perform or seek to perform broking, investment banking and other banking or financial services to any persons or entities mentioned.

To the maximum extent permitted by law, DBS Group accepts no liability for any losses or damages (including direct, special, indirect, consequential, incidental or loss of profits) of any kind arising from or in connection with any reliance and/or use of the information (including any error, omission or misstatement, negligent or otherwise) or further communication, even if DBS Group has been advised of the possibility thereof.

The information is not intended for distribution to, or use by, any person or entity in any jurisdiction or country where such distribution or use would be contrary to law or regulation. The information is distributed (a) in Singapore, by DBS Bank Ltd.; (b) in China, by DBS Bank (China) Ltd; (c) in Hong Kong, by DBS Bank (Hong Kong) Limited; (d) in Taiwan, by DBS Bank (Taiwan) Ltd; (e) in Indonesia, by PT DBS Indonesia; and (f) in India, by DBS Bank Ltd, Mumbai Branch.

Related Insights

- Research Library21 Feb 2025

- CNY rates: Rebounding CGB yields 21 Feb 2025

- Eurozone rates: Crucial Germany elections 21 Feb 2025

Related Insights

- Research Library21 Feb 2025

- CNY rates: Rebounding CGB yields 21 Feb 2025

- Eurozone rates: Crucial Germany elections 21 Feb 2025