- US: US consumers will bear a larger share of tariffs burden as trade diversion becomes less effective with across-the-board tariffs

- Japan: BOJ anticipated to raise interest rates by 25 bps to 0.50% due to strong wage and inflation data in Japan

- China: Initial signs of stabilisation shown throughout 4Q as ongoing stimulus measures took effect

- India: FY26 budget likely to focus on fiscal stability and consumption amid inflationary pressures

- ASEAN-6: Continued foreign investment attractiveness due to region’s political non-alignment and tailwinds from potential US-China tariffs

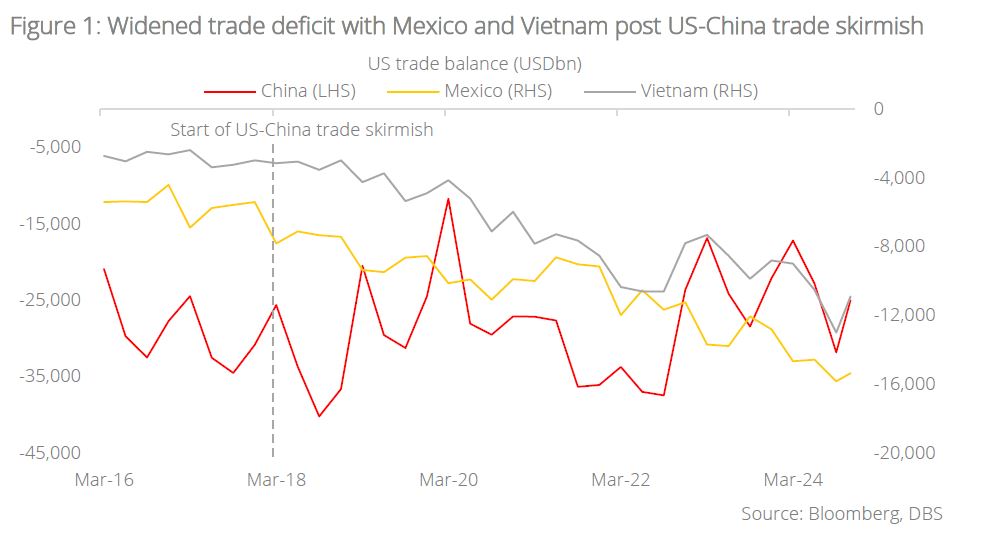

US: Higher tariffs loom with Trump 2.0. With Trump 2.0, higher tariffs are guaranteed. Beyond going after China, US trade and commerce officials will go after Mexico and Vietnam to restrict China’s attempts to divert trade. There may well be a 10% (some have even floated 20%) across-the-board tariff on all US imports. Beyond tariffs, restrictions on investments and market access are all likely to be ramped up further. Countries trading intensively with the US are about to step into unchartered waters. Over the last half a century, the average US tariff rate on all dutiable imports has been below 4%. Despite eight years of trade wars, the current average tariff is below 3%. A trebling of that rate would be a substantial shock.

Back in 2018, certain products, such as washing machines, saw their demand decline after tariffs were imposed by the Trump administration. The prices of these products jumped immediately. In response, South Korean manufacturers diverted some of their production to the US, creating some jobs, though at the expense of US consumers. As soon as these tariffs were allowed to expire by the Biden administration in 2023, washing machine prices began to decline in the US, demonstrating that shielding domestic industries from competition is a tax on consumers.

The last eight years have shown that once tariffs are imposed, a complex web of responses take place between producers, importers, and consumers, beyond the dynamics of the washing machine case. When pricing power is limited, as was likely the case pre-pandemic, a three-way split of burden sharing takes place. Additionally, over time, trade is diverted, some to the US, a lot to partner countries like Mexico and Vietnam.

We doubt a similar dynamic would prevail at the current juncture, given the experience of the pandemic and sustained strength of the US labour market. We think that much more of the tariff would be passed along to customers this time, especially as trade diversions would make less sense with across-the-board tariffs.

Download the PDF to read the full report which includes coverage on Credit, FX, Rates, and Thematics.

Topic

The information published by DBS Bank Ltd. (company registration no.: 196800306E) (“DBS”) is for information only. It is based on information or opinions obtained from sources believed to be reliable (but which have not been independently verified by DBS, its related companies and affiliates (“DBS Group”)) and to the maximum extent permitted by law, DBS Group does not make any representation or warranty (express or implied) as to its accuracy, completeness, timeliness or correctness for any particular purpose. Opinions and estimates are subject to change without notice. The publication and distribution of the information does not constitute nor does it imply any form of endorsement by DBS Group of any person, entity, services or products described or appearing in the information. Any past performance, projection, forecast or simulation of results is not necessarily indicative of the future or likely performance of any investment or securities. Foreign exchange transactions involve risks. You should note that fluctuations in foreign exchange rates may result in losses. You may wish to seek your own independent financial, tax, or legal advice or make such independent investigations as you consider necessary or appropriate.

The information published is not and does not constitute or form part of any offer, recommendation, invitation or solicitation to subscribe to or to enter into any transaction; nor is it calculated to invite, nor does it permit the making of offers to the public to subscribe to or enter into any transaction in any jurisdiction or country in which such offer, recommendation, invitation or solicitation is not authorised or to any person to whom it is unlawful to make such offer, recommendation, invitation or solicitation or where such offer, recommendation, invitation or solicitation would be contrary to law or regulation or which would subject DBS Group to any registration requirement within such jurisdiction or country, and should not be viewed as such. Without prejudice to the generality of the foregoing, the information, services or products described or appearing in the information are not specifically intended for or specifically targeted at the public in any specific jurisdiction.

The information is the property of DBS and is protected by applicable intellectual property laws. No reproduction, transmission, sale, distribution, publication, broadcast, circulation, modification, dissemination, or commercial exploitation such information in any manner (including electronic, print or other media now known or hereafter developed) is permitted.

DBS Group and its respective directors, officers and/or employees may have positions or other interests in, and may effect transactions in securities mentioned and may also perform or seek to perform broking, investment banking and other banking or financial services to any persons or entities mentioned.

To the maximum extent permitted by law, DBS Group accepts no liability for any losses or damages (including direct, special, indirect, consequential, incidental or loss of profits) of any kind arising from or in connection with any reliance and/or use of the information (including any error, omission or misstatement, negligent or otherwise) or further communication, even if DBS Group has been advised of the possibility thereof.

The information is not intended for distribution to, or use by, any person or entity in any jurisdiction or country where such distribution or use would be contrary to law or regulation. The information is distributed (a) in Singapore, by DBS Bank Ltd.; (b) in China, by DBS Bank (China) Ltd; (c) in Hong Kong, by DBS Bank (Hong Kong) Limited; (d) in Taiwan, by DBS Bank (Taiwan) Ltd; (e) in Indonesia, by PT DBS Indonesia; and (f) in India, by DBS Bank Ltd, Mumbai Branch.