- US December inflation edged up 2.9% y/y with urban food and beverage prices up 2.4%; Trump’s potential tariff policies could further intensify inflationary pressure

- Cautious and value-driven consumer sentiment will favour retailers like Walmart and Costco which dominate the affordable grocery segment

- Diversified supply chains and a reduced dependence on Chinese suppliers help cushion the impact of tariffs

- Favour leading major players for their strengths in groceries, expanding private-label offerings, and robust omni-channel growth

A resurgence of inflation? US inflation rose 2.9% y/y in Dec 2024 with urban food and beverage prices up 2.4%, following a 25 bps Fed rate cut in Dec 2025. Trump’s potential tariff policies could also lay further pressure on inflation. Market projections of 2.5% inflation for 2025/2026 may be overly optimistic, given that the National Retail Federation estimated price hikes (ranging from 6.4% to 36.3% in key categories like apparel, toys, furniture, household appliances, footwear, and travel goods) under a milder tariff scenario.

On a positive note, Trump’s tariff increases are expected to be implemented gradually amid recent decision to delay full tariffs on China which suggest that the new administration will adopt a less aggressive approach than previously proposed. Furthermore, Trump’s administration has proposed corporate tax cuts (from 21% to 15%) and reductions in individual income taxes; measures that could potentially boost business activities and consumer spending.

Rising consumer demand for affordable goods; retailers diversifying supply chain amid rising tariff threats. Given the potential resurgence of inflation, consumers are likely to shift spending from discretionary items to essentials and groceries, mirroring a trend seen during 2H21 till 1H23. Given prevailing economic uncertainties, cautious and value-focused consumers favour players like Walmart and Costco which dominate the affordable grocery category and are steadily gaining market share from higher-income households.

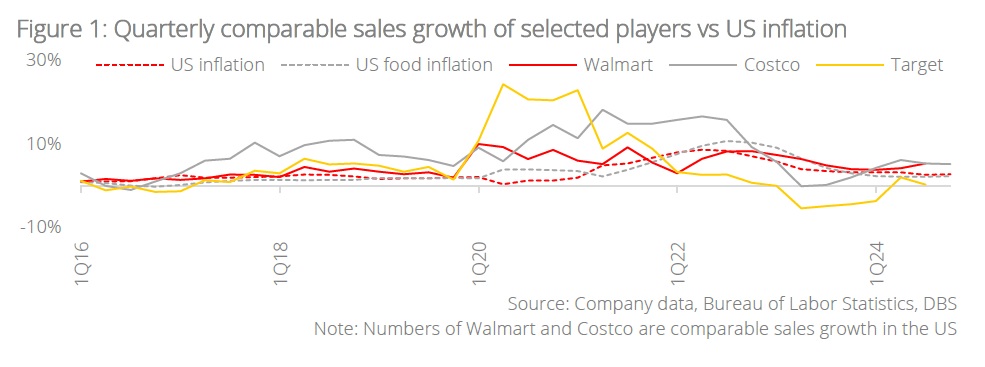

Historically, excluding COVID panic-buying effects, Walmart and Costco’s comp sales had shown strong positive correlation with US inflation (0.8 and 0.7 respectively), while Target’s correlation is slightly negative. Since 2021, Walmart and Costco have been gaining market share from other US retailers. This shift has driven growth in private labels which enhance customer loyalty and offer higher gross margins (up to 11% higher, per CB Insights). Walmart, for example, also recorded growing private-label penetration in 2023.

In preparation for tariff impacts, Walmart has diversified its supply chain, increasingly sourcing from India instead of China since Trump’s last term. Its exposure to Chinese suppliers has declined from 80% in 2018 to 60% in 2023 with further reduction expected in 2024. Additionally, two-thirds of goods are now made, grown, or assembled in the US. Similarly, less than 25% of Costco’s non-food business is sourced from China. Given these adjustments, the overall impact on earnings will remain manageable for these players.

Omni-channel growth. E-commerce continues to thrive in the US, driven by delivery convenience. Costco posted a 13% y/y growth in e-commerce comp sales in the quarter ending Nov 2024, while Walmart’s e-commerce grew 25% y/y in the quarter ending Oct 2024. Leading retailers are also embracing AI, moving beyond basic item searches to advanced tools that enhance demand forecasting, inventory management, and supply chain infrastructure. We favour major players with strong grocery presence and omni-channel capabilities as they are better positioned to navigate inflation and the shift in consumer behaviours.

Topic

The information published by DBS Bank Ltd. (company registration no.: 196800306E) (“DBS”) is for information only. It is based on information or opinions obtained from sources believed to be reliable (but which have not been independently verified by DBS, its related companies and affiliates (“DBS Group”)) and to the maximum extent permitted by law, DBS Group does not make any representation or warranty (express or implied) as to its accuracy, completeness, timeliness or correctness for any particular purpose. Opinions and estimates are subject to change without notice. The publication and distribution of the information does not constitute nor does it imply any form of endorsement by DBS Group of any person, entity, services or products described or appearing in the information. Any past performance, projection, forecast or simulation of results is not necessarily indicative of the future or likely performance of any investment or securities. Foreign exchange transactions involve risks. You should note that fluctuations in foreign exchange rates may result in losses. You may wish to seek your own independent financial, tax, or legal advice or make such independent investigations as you consider necessary or appropriate.

The information published is not and does not constitute or form part of any offer, recommendation, invitation or solicitation to subscribe to or to enter into any transaction; nor is it calculated to invite, nor does it permit the making of offers to the public to subscribe to or enter into any transaction in any jurisdiction or country in which such offer, recommendation, invitation or solicitation is not authorised or to any person to whom it is unlawful to make such offer, recommendation, invitation or solicitation or where such offer, recommendation, invitation or solicitation would be contrary to law or regulation or which would subject DBS Group to any registration requirement within such jurisdiction or country, and should not be viewed as such. Without prejudice to the generality of the foregoing, the information, services or products described or appearing in the information are not specifically intended for or specifically targeted at the public in any specific jurisdiction.

The information is the property of DBS and is protected by applicable intellectual property laws. No reproduction, transmission, sale, distribution, publication, broadcast, circulation, modification, dissemination, or commercial exploitation such information in any manner (including electronic, print or other media now known or hereafter developed) is permitted.

DBS Group and its respective directors, officers and/or employees may have positions or other interests in, and may effect transactions in securities mentioned and may also perform or seek to perform broking, investment banking and other banking or financial services to any persons or entities mentioned.

To the maximum extent permitted by law, DBS Group accepts no liability for any losses or damages (including direct, special, indirect, consequential, incidental or loss of profits) of any kind arising from or in connection with any reliance and/or use of the information (including any error, omission or misstatement, negligent or otherwise) or further communication, even if DBS Group has been advised of the possibility thereof.

The information is not intended for distribution to, or use by, any person or entity in any jurisdiction or country where such distribution or use would be contrary to law or regulation. The information is distributed (a) in Singapore, by DBS Bank Ltd.; (b) in China, by DBS Bank (China) Ltd; (c) in Hong Kong, by DBS Bank (Hong Kong) Limited; (d) in Taiwan, by DBS Bank (Taiwan) Ltd; (e) in Indonesia, by PT DBS Indonesia; and (f) in India, by DBS Bank Ltd, Mumbai Branch.