- Oil prices jump as tighter sanctions on Russia expected over the next few months

- Gas prices are also hovering above our expectations on the back of a cold winter and tighter supplies

- US players in the upstream O&G space are expected to remain in favour under the new Trump administration

- Share prices could benefit from a potential uplift in underlying commodity prices, enhanced shareholder distributions amid chances of further industry consolidation

Related Insights

- Asia ex-Japan Equities20 Jan 2025

- Digital Realty Trust Inc20 Jan 2025

- Multi-Asset Weekly: Global Equities Rise on the Back of Improved Economic Data20 Jan 2025

Good start to the year for oil prices. After a rather muted trading range in 2H-2024, Brent crude oil prices have moved up sharply in recent days to above USD80/bbl, largely driven by the increasing risk of tighter sanctions on countries like Russia and Iran under the upcoming Trump administration. It is speculated that new sanctions on Russia’s oil industry could range much wider than before and will specifically target tankers, traders, and ship insurers that move Russian oil. This could severely disrupt Russian oil exports to China and India, the biggest buyers of Russian oil. Russia exports around 4-5mmbpd of oil currently. In addition, the unofficial flows of oil from Iran to China may also face tighter scrutiny under the new US President. Without these developments, we expect Brent crude oil prices to rangebound at USD70-75/bbl in the near to medium term, with strong downside support at USD70/bbl. Given these uncertainties, upside risks are outweighing any potential demand concerns within the market. Upstream exploration & production (E&P) players are thus well-positioned to ride on this.

Gas focused players also stand to gain from higher export potential. Gas price benchmarks are holding up better than earlier expected. With a colder winter in Europe and pipeline outages in Ukraine, spot liquefied natural gas (LNG) prices in Europe and Asia hover in the mid-teens in recent weeks, with 2024 averages coming in at the higher end of our forecast range. Henry Hub prices have also recovered from the lows earlier in 2024 on the back of tighter supplies. Given that the ban on export terminals may be lifted under a Trump administration, increased exports should be beneficial for shale gas producers, both from a volume and price perspective. If consolidation in the shale gas space continues, after the Chesapeake-Southwestern deal last year, optimism in the sector is likely to increase further.

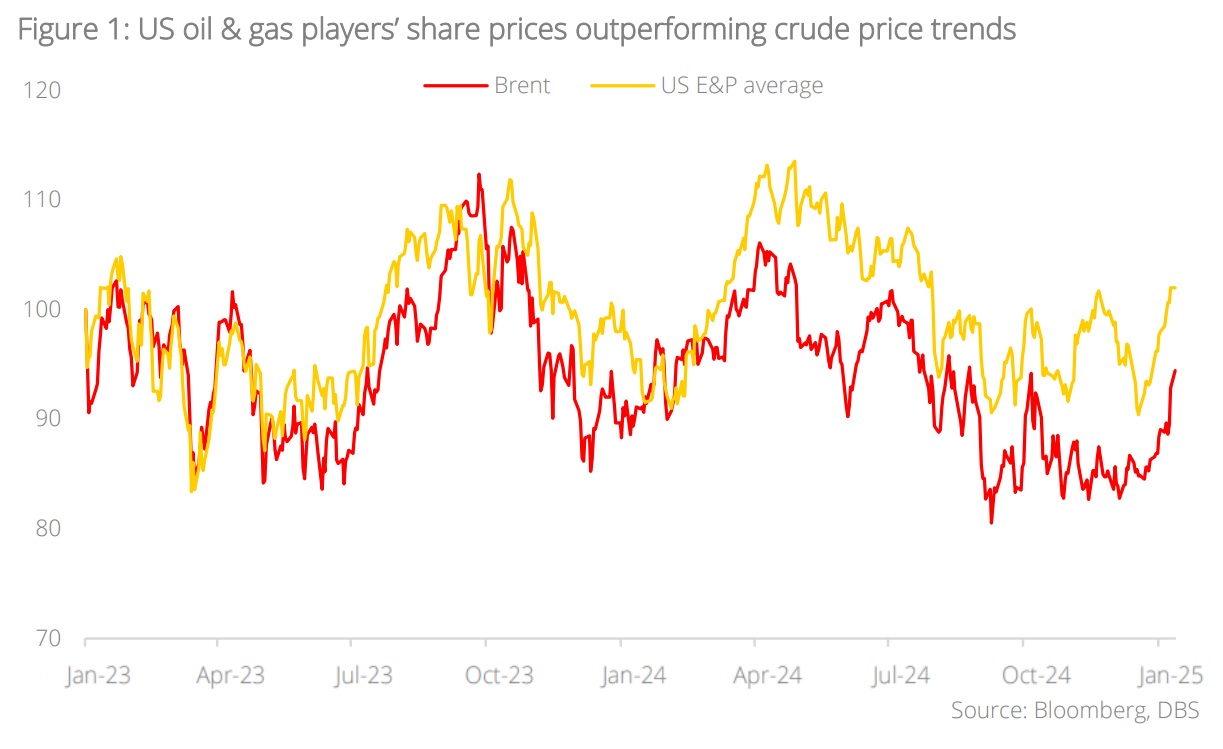

Trump trade is driving the resurgence of US upstream oil & gas players. Share prices of US upstream oil & gas players have rebounded by c.15% on average over the last month, ahead of President Trump’s inauguration next week. The rerating momentum started even before the recent rally in oil prices, demonstrating investors’ confidence in this sector as a key beneficiary of the new administration’s pro-fossil fuel stance. While “drill baby drill” as a rallying call sounds ominous from a supply perspective, US shale oil & gas production rely more on market factors rather than politics, and we believe that the focus on capital discipline, efficiency gains, and free cash flows are set to continue, driving returns for shareholders in 2025.

Topic

The information published by DBS Bank Ltd. (company registration no.: 196800306E) (“DBS”) is for information only. It is based on information or opinions obtained from sources believed to be reliable (but which have not been independently verified by DBS, its related companies and affiliates (“DBS Group”)) and to the maximum extent permitted by law, DBS Group does not make any representation or warranty (express or implied) as to its accuracy, completeness, timeliness or correctness for any particular purpose. Opinions and estimates are subject to change without notice. The publication and distribution of the information does not constitute nor does it imply any form of endorsement by DBS Group of any person, entity, services or products described or appearing in the information. Any past performance, projection, forecast or simulation of results is not necessarily indicative of the future or likely performance of any investment or securities. Foreign exchange transactions involve risks. You should note that fluctuations in foreign exchange rates may result in losses. You may wish to seek your own independent financial, tax, or legal advice or make such independent investigations as you consider necessary or appropriate.

The information published is not and does not constitute or form part of any offer, recommendation, invitation or solicitation to subscribe to or to enter into any transaction; nor is it calculated to invite, nor does it permit the making of offers to the public to subscribe to or enter into any transaction in any jurisdiction or country in which such offer, recommendation, invitation or solicitation is not authorised or to any person to whom it is unlawful to make such offer, recommendation, invitation or solicitation or where such offer, recommendation, invitation or solicitation would be contrary to law or regulation or which would subject DBS Group to any registration requirement within such jurisdiction or country, and should not be viewed as such. Without prejudice to the generality of the foregoing, the information, services or products described or appearing in the information are not specifically intended for or specifically targeted at the public in any specific jurisdiction.

The information is the property of DBS and is protected by applicable intellectual property laws. No reproduction, transmission, sale, distribution, publication, broadcast, circulation, modification, dissemination, or commercial exploitation such information in any manner (including electronic, print or other media now known or hereafter developed) is permitted.

DBS Group and its respective directors, officers and/or employees may have positions or other interests in, and may effect transactions in securities mentioned and may also perform or seek to perform broking, investment banking and other banking or financial services to any persons or entities mentioned.

To the maximum extent permitted by law, DBS Group accepts no liability for any losses or damages (including direct, special, indirect, consequential, incidental or loss of profits) of any kind arising from or in connection with any reliance and/or use of the information (including any error, omission or misstatement, negligent or otherwise) or further communication, even if DBS Group has been advised of the possibility thereof.

The information is not intended for distribution to, or use by, any person or entity in any jurisdiction or country where such distribution or use would be contrary to law or regulation. The information is distributed (a) in Singapore, by DBS Bank Ltd.; (b) in China, by DBS Bank (China) Ltd; (c) in Hong Kong, by DBS Bank (Hong Kong) Limited; (d) in Taiwan, by DBS Bank (Taiwan) Ltd; (e) in Indonesia, by PT DBS Indonesia; and (f) in India, by DBS Bank Ltd, Mumbai Branch.

Related Insights

- Asia ex-Japan Equities20 Jan 2025

- Digital Realty Trust Inc20 Jan 2025

- Multi-Asset Weekly: Global Equities Rise on the Back of Improved Economic Data20 Jan 2025

Related Insights

- Asia ex-Japan Equities20 Jan 2025

- Digital Realty Trust Inc20 Jan 2025

- Multi-Asset Weekly: Global Equities Rise on the Back of Improved Economic Data20 Jan 2025