- Equities: Global equities declined as rising yields, strong US job data, and ongoing inflationary pressures heightened market uncertainty

- Credit: While out of the norm from historical policy cycles, the recent spike in 10Y US yields is appropriate under the expected impact of Trump’s proposals. To manage duration concerns, investors should stay in a duration Barbell strategy

- FX: Blowout labour market data outcomes drove the DXY Index another leg higher towards the 110.00 resistance

- Rates: PBOC to suspend CGBs buying program in January amid falling 10Y yields and CNY weakness; This halt expected to be temporary as weak inflation and lackluster asset markets necessitate monetary easing

- The Week Ahead: Keep a lookout for US Initial Jobless Claims; China GDP

Related Insights

- US CPI and Rubio’s confirmation hearing today 15 Jan 2025

- CNY rates: Weak credit data and easing bias 15 Jan 2025

- Global Oil & Gas: Resurgence of US Upstream Players 15 Jan 2025

Global equities face pressure from rising yields. US equities retreated as inflation concerns resurfaced and political uncertainty lingered. The S&P 500 dropped 1.9%, while Nasdaq fell 2.3%. The US labour market remained robust, with December’s nonfarm payrolls rising by 256,000, surpassing expectations, while the unemployment rate fell to 4.1%. This data led to reduced expectations for Federal Reserve rate cuts, prompting higher Treasury yields and a stronger dollar. Small-cap stocks underperformed, and the S&P 500 erased its early-year gains.

The STOXX Europe 600 Index increased by 0.65% and FTSE 100 ended 0.3% higher, with expectations for European Central Bank rate cuts despite rising inflation. Japan’s Nikkei 225 down 1.8% amid speculation over the Bank of Japan’s tightening plans and concerns over U.S. policies. Chinese markets declined, with the Shanghai Composite and Hang Seng Index off 1.3% and 3.5% respectively, as deflationary pressures persisted, highlighted by weak inflation and ongoing PPI declines.

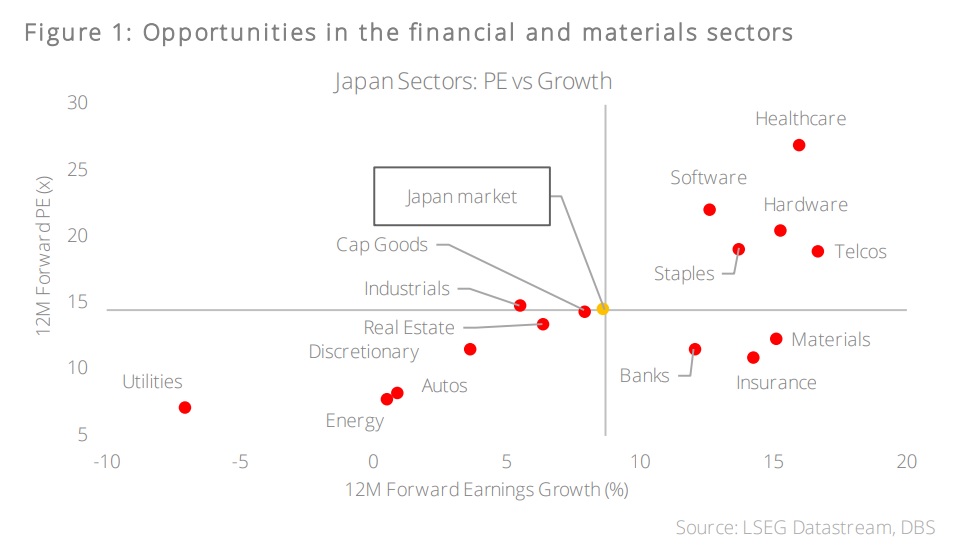

Topic in focus: Japan equities – earnings outlook remains robust in 2025. Consensus forecasts project an aggregate earnings growth of 9% for Japanese companies this year. Sectors currently trading at valuations below the market average — such as banks, insurance, materials, autos, energy, utilities, and real estate — hold potential for rerating. This rerating could be driven by corporate restructuring efforts in response to the Japan Exchange Group’s ongoing calls for market reforms, aimed at enhancing efficiency and shareholder value.

While short-term market volatility may persist, our focus remains on long-term, irreversible structural trends that will drive sustainable growth and returns. Thematic drivers include Japan’s ageing population, ongoing digitalisation, as well as its competitive advantages in the export sector. Beneficiaries of these trends include:

- i. Semiconductors and IT services: Growing artificial intelligence (AI) commercialisation, digital transformation, and an aging population will drive productivity gains, fuelling growth in semiconductors and IT service providers.

- ii. Automobile and automation exporters: These export sectors will continue to enjoy competitiveness via the weak yen.

- iii. Financial sector: Japanese banks are benefitting from interest rate normalisation and a recovery in corporate activity. They remain undervalued, trading at a P/B ratio of 0.9x, well below pre-GFC levels and global peers, making them attractive to international investors.

Download the PDF to read the full report which includes coverage on Credit, FX, Rates, and Thematics.

Topic

The information published by DBS Bank Ltd. (company registration no.: 196800306E) (“DBS”) is for information only. It is based on information or opinions obtained from sources believed to be reliable (but which have not been independently verified by DBS, its related companies and affiliates (“DBS Group”)) and to the maximum extent permitted by law, DBS Group does not make any representation or warranty (express or implied) as to its accuracy, completeness, timeliness or correctness for any particular purpose. Opinions and estimates are subject to change without notice. The publication and distribution of the information does not constitute nor does it imply any form of endorsement by DBS Group of any person, entity, services or products described or appearing in the information. Any past performance, projection, forecast or simulation of results is not necessarily indicative of the future or likely performance of any investment or securities. Foreign exchange transactions involve risks. You should note that fluctuations in foreign exchange rates may result in losses. You may wish to seek your own independent financial, tax, or legal advice or make such independent investigations as you consider necessary or appropriate.

The information published is not and does not constitute or form part of any offer, recommendation, invitation or solicitation to subscribe to or to enter into any transaction; nor is it calculated to invite, nor does it permit the making of offers to the public to subscribe to or enter into any transaction in any jurisdiction or country in which such offer, recommendation, invitation or solicitation is not authorised or to any person to whom it is unlawful to make such offer, recommendation, invitation or solicitation or where such offer, recommendation, invitation or solicitation would be contrary to law or regulation or which would subject DBS Group to any registration requirement within such jurisdiction or country, and should not be viewed as such. Without prejudice to the generality of the foregoing, the information, services or products described or appearing in the information are not specifically intended for or specifically targeted at the public in any specific jurisdiction.

The information is the property of DBS and is protected by applicable intellectual property laws. No reproduction, transmission, sale, distribution, publication, broadcast, circulation, modification, dissemination, or commercial exploitation such information in any manner (including electronic, print or other media now known or hereafter developed) is permitted.

DBS Group and its respective directors, officers and/or employees may have positions or other interests in, and may effect transactions in securities mentioned and may also perform or seek to perform broking, investment banking and other banking or financial services to any persons or entities mentioned.

To the maximum extent permitted by law, DBS Group accepts no liability for any losses or damages (including direct, special, indirect, consequential, incidental or loss of profits) of any kind arising from or in connection with any reliance and/or use of the information (including any error, omission or misstatement, negligent or otherwise) or further communication, even if DBS Group has been advised of the possibility thereof.

The information is not intended for distribution to, or use by, any person or entity in any jurisdiction or country where such distribution or use would be contrary to law or regulation. The information is distributed (a) in Singapore, by DBS Bank Ltd.; (b) in China, by DBS Bank (China) Ltd; (c) in Hong Kong, by DBS Bank (Hong Kong) Limited; (d) in Taiwan, by DBS Bank (Taiwan) Ltd; (e) in Indonesia, by PT DBS Indonesia; and (f) in India, by DBS Bank Ltd, Mumbai Branch.

Related Insights

- US CPI and Rubio’s confirmation hearing today 15 Jan 2025

- CNY rates: Weak credit data and easing bias 15 Jan 2025

- Global Oil & Gas: Resurgence of US Upstream Players 15 Jan 2025

Related Insights

- US CPI and Rubio’s confirmation hearing today 15 Jan 2025

- CNY rates: Weak credit data and easing bias 15 Jan 2025

- Global Oil & Gas: Resurgence of US Upstream Players 15 Jan 2025