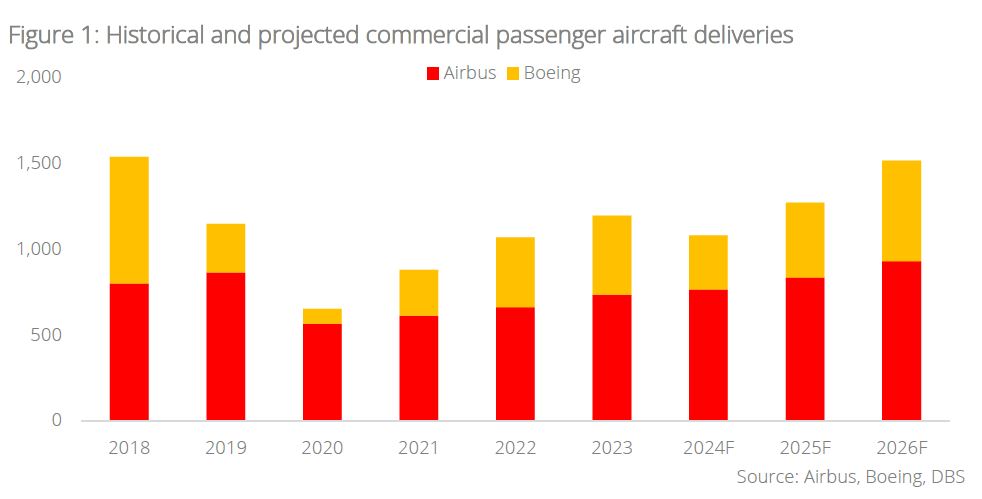

- Airbus and Boeing passenger aircraft deliveries are projected to decline by approximately 10% y/y in 2024 amid supply chain challenges, marking the first drop since the pandemic

- Engine OEMs have capitalised on the airframers’ struggles and consistently raised their earnings guidance through 2024, benefiting from surging aftermarket demand as airlines increased aircraft utilisation and extended the use of older fleets

- With the progressive easing of supply chain bottlenecks, total passenger aircraft deliveries are expected to rise by 15–20% in 2025, driving stronger earnings growth for aircraft OEMs

- While the overall outlook for the aerospace sector remains positive, 2025 could mark a turning point, with aircraft OEMs poised for stronger growth, while engine OEMs may face moderating earnings momentum

Related Insights

- Delta Air Lines Inc14 Jan 2025

- DBS Stock Pulse: Equity Picks - Add SembCorp Industries to Blue Chips14 Jan 2025

- Asia ex-Japan Equities13 Jan 2025

While 2024 proved challenging for aircraft OEMs, engine OEMs enjoyed a standout year. In the final quarter, Boeing (BA US) faced a seven-week strike at its West Coast facilities, crippling B737-MAX production and requiring potentially up to six months of recovery to pre-strike output levels. Meanwhile, Airbus (AIR FP) grappled with its own supply chain setbacks—specifically engine and cabin component shortages—which caused the airframer to narrowly miss its revised 2024 delivery target of 770 aircraft. As a result, combined passenger aircraft deliveries from Airbus and Boeing are projected to decline by 10% in 2024. Although engine OEMs also faced delivery shortfalls due to supply chain disruptions, they performed notably better, buoyed by strong aftermarket demand with an increase in aircraft utilisation by airlines pushing their mature fleets harder.

3Q24 marked another strong quarter for engine OEMs but was a slightly underwhelming one for airframers. GE Aerospace (GE US) and RTX (RTX US) posted solid results, driven by robust aftermarket momentum and positive revenue that boosted margins. This led both companies to raise their FY24 adjusted EPS guidance by 4.9% and 2.6% respectively, marking the third consecutive quarter that they have raised guidance. While Airbus's adjusted EPS beat expectations by 16%, the airframer struck a cautious tone regarding supply chain pressures, maintaining its 2024 guidance, and tempering market expectations for delivery growth. Meanwhile, Boeing faced a challenging quarter due to work stoppages, posting negative free cash flow of USD2.0bn, with its defence segment continuing to suffer from cost overruns in several fixed-price development programmes.

2025 could herald a shift in the aerospace sector, with aircraft OEMs poised to outpace engine OEMs. Although we remain positive on the overall sector, we believe engine OEMs, after a stellar run, will take a step back in 2025, allowing aircraft OEMs to take centre stage as supply chain conditions progressively stabilise, enabling meaningful production increases. Boeing’s production lines are now fully operational, and we are optimistic that its quality enhancements, corrective measures, and stronger balance sheet (following its equity fundraising) will drive an earnings inflection (deliveries +35–40% y/y) from 2025. Similarly, we expect Airbus’s earnings to surge alongside an estimated 10.0% increase in deliveries in 2025, compared to approximately 4% in 2024, supported by a projected 15– 20% boost in engine output from RTX and GE Aerospace/Safran. While sector fundamentals remain favourable in the aftermarket, we believe moderating earnings growth momentum could cause engine OEMs to underperform compared to their counterparts.

Topic

The information published by DBS Bank Ltd. (company registration no.: 196800306E) (“DBS”) is for information only. It is based on information or opinions obtained from sources believed to be reliable (but which have not been independently verified by DBS, its related companies and affiliates (“DBS Group”)) and to the maximum extent permitted by law, DBS Group does not make any representation or warranty (express or implied) as to its accuracy, completeness, timeliness or correctness for any particular purpose. Opinions and estimates are subject to change without notice. The publication and distribution of the information does not constitute nor does it imply any form of endorsement by DBS Group of any person, entity, services or products described or appearing in the information. Any past performance, projection, forecast or simulation of results is not necessarily indicative of the future or likely performance of any investment or securities. Foreign exchange transactions involve risks. You should note that fluctuations in foreign exchange rates may result in losses. You may wish to seek your own independent financial, tax, or legal advice or make such independent investigations as you consider necessary or appropriate.

The information published is not and does not constitute or form part of any offer, recommendation, invitation or solicitation to subscribe to or to enter into any transaction; nor is it calculated to invite, nor does it permit the making of offers to the public to subscribe to or enter into any transaction in any jurisdiction or country in which such offer, recommendation, invitation or solicitation is not authorised or to any person to whom it is unlawful to make such offer, recommendation, invitation or solicitation or where such offer, recommendation, invitation or solicitation would be contrary to law or regulation or which would subject DBS Group to any registration requirement within such jurisdiction or country, and should not be viewed as such. Without prejudice to the generality of the foregoing, the information, services or products described or appearing in the information are not specifically intended for or specifically targeted at the public in any specific jurisdiction.

The information is the property of DBS and is protected by applicable intellectual property laws. No reproduction, transmission, sale, distribution, publication, broadcast, circulation, modification, dissemination, or commercial exploitation such information in any manner (including electronic, print or other media now known or hereafter developed) is permitted.

DBS Group and its respective directors, officers and/or employees may have positions or other interests in, and may effect transactions in securities mentioned and may also perform or seek to perform broking, investment banking and other banking or financial services to any persons or entities mentioned.

To the maximum extent permitted by law, DBS Group accepts no liability for any losses or damages (including direct, special, indirect, consequential, incidental or loss of profits) of any kind arising from or in connection with any reliance and/or use of the information (including any error, omission or misstatement, negligent or otherwise) or further communication, even if DBS Group has been advised of the possibility thereof.

The information is not intended for distribution to, or use by, any person or entity in any jurisdiction or country where such distribution or use would be contrary to law or regulation. The information is distributed (a) in Singapore, by DBS Bank Ltd.; (b) in China, by DBS Bank (China) Ltd; (c) in Hong Kong, by DBS Bank (Hong Kong) Limited; (d) in Taiwan, by DBS Bank (Taiwan) Ltd; (e) in Indonesia, by PT DBS Indonesia; and (f) in India, by DBS Bank Ltd, Mumbai Branch.

Related Insights

- Delta Air Lines Inc14 Jan 2025

- DBS Stock Pulse: Equity Picks - Add SembCorp Industries to Blue Chips14 Jan 2025

- Asia ex-Japan Equities13 Jan 2025

Related Insights

- Delta Air Lines Inc14 Jan 2025

- DBS Stock Pulse: Equity Picks - Add SembCorp Industries to Blue Chips14 Jan 2025

- Asia ex-Japan Equities13 Jan 2025