- Asia’s structural opportunities to drive lifers’ growth; easing inflation pressure to improve P&C underwriting performance

- Gains from high reinvestment yields to continue in 2024 after multi-year low or negative rates in developed countries

- Remain cautious on headwinds from China insurers, JPY appreciation against the USD, declining interest rates leading to book value retracement

- Prefer selective names with robust earnings growth in L&H and P&C segments and fewer concerns on macro headwinds

Related Insights

- Alternatives 1Q25: Gold – Resilience with Alternatives20 Dec 2024

- CIO Insights 1Q25: Game Changers20 Dec 2024

- Bank of America19 Dec 2024

Recovery trend for underwriting expected in 2024. Despite the global economy being expected to cool down in 2024 due to tightening monetary conditions amid the burden of high rates, premium growth of insurers under our coverage is likely to remain robust in both the life and health (L&H) and property and casualty (P&C) segments.

In the life segment, the Asia market will continue to lead in 2024 with double-digit value of new business (VNB) growth, mainly driven by HK, China, and ASEAN with their fast-growing affluent and middle-class customers and huge protection gap. In Europe, we expect rising demand for savings insurance due to better policy returns and a low base effect, supporting single-digit premium growths for large European insurers. In the P&C segment, benefiting from premium repricing, we expect premiums to expand with single-digit y/y growth in 2024 for insurers under our coverage. This will offset pressures from economic slowdown across major markets. We also expect their combined ratio (COR) to improve, driven by easing inflation pressure, resulting in an improved loss ratio and higher underwriting profit.

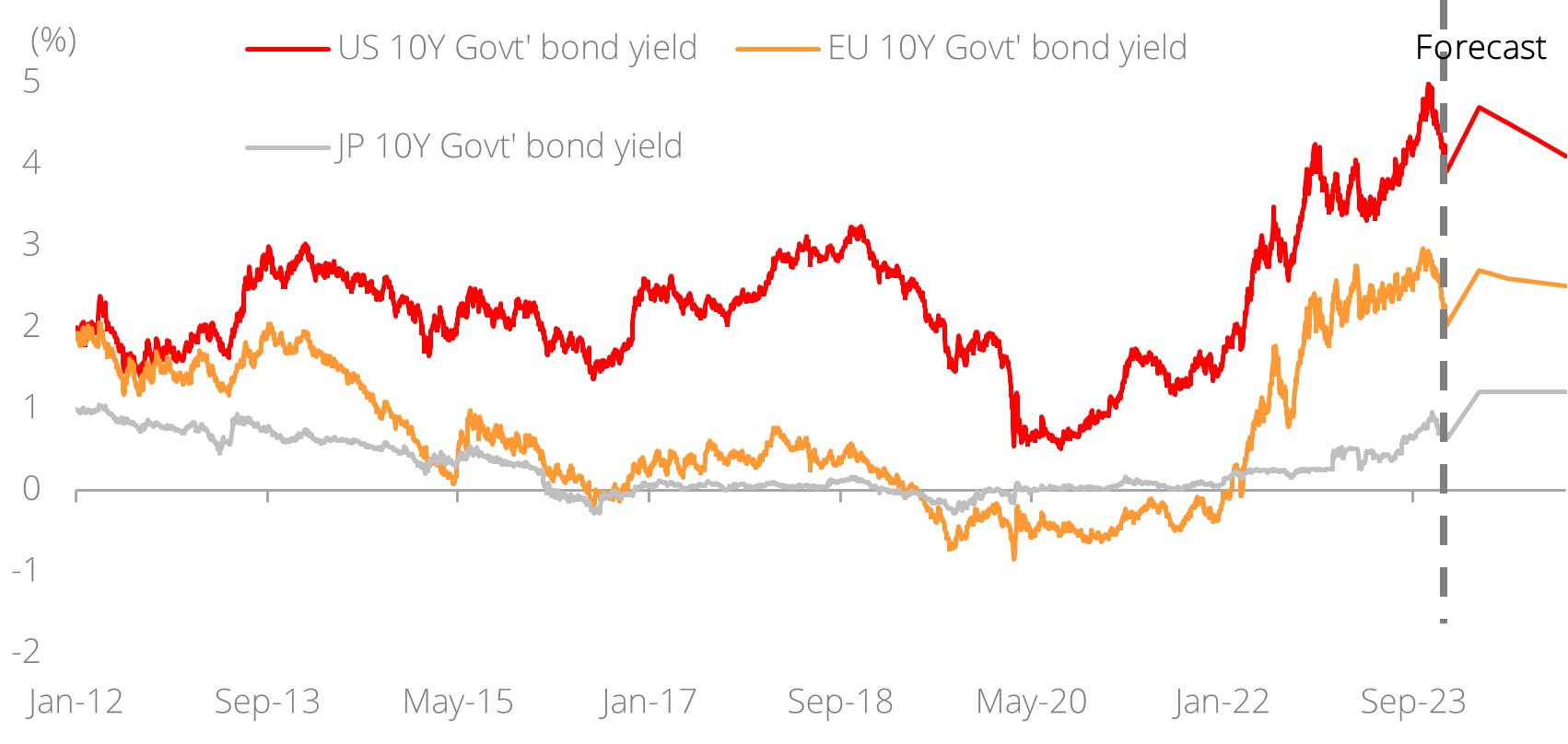

Investment returns to increase, benefiting from elevated interest rates. After multi-year lows or negative interest rates in major developed countries, 10Y government bond yields are expected to stay elevated in 2024 compared to the past 10-year average (est. 4.4%/2.6%/1.2% on average in US/EU/JP in 2024 vs. past 10-year average of 2.3%/ 0.5%/0.2% respectively), despite 100 bps policy rate cuts being expected in the US and the EU in 2024. We expect gains from higher reinvestment yields to continue accruing for average portfolio yields in 2024, with new money investing at higher rates than those of the current portfolio, translating into higher investment results for insurers under our coverage. We also expect investment results to be a more important component of industry returns in the coming years.

We prefer names with robust earnings growth and fewer concerns on macro headwinds. Given the mixed macro picture for 2024, we remain cautious on headwinds from: 1) China insurers’ exposure to property and trust, where the turmoil is likely to persist in 2024, despite their exposure being limited and risks being manageable; 2) JPY appreciation against the USD resulting in FX losses for Japanese insurers due to their high exposure to overseas business; and 3) declining interest rates leading to book value retracement due to negative duration gap for life insurers.

We hence prefer selective names with 1) robust growth of underwriting performance in L&H and P&C segments, 2) low asset-liability duration gap and interest rate sensitivity to mitigate impact from declining interest rates, and 3) an improving investment return outlook with fewer concerns about macro headwinds.

Figure 1: US/EU/JP 10-year government bond historical yield and DBS forecasts

Topic

The information published by DBS Bank Ltd. (company registration no.: 196800306E) (“DBS”) is for information only. It is based on information or opinions obtained from sources believed to be reliable (but which have not been independently verified by DBS, its related companies and affiliates (“DBS Group”)) and to the maximum extent permitted by law, DBS Group does not make any representation or warranty (express or implied) as to its accuracy, completeness, timeliness or correctness for any particular purpose. Opinions and estimates are subject to change without notice. The publication and distribution of the information does not constitute nor does it imply any form of endorsement by DBS Group of any person, entity, services or products described or appearing in the information. Any past performance, projection, forecast or simulation of results is not necessarily indicative of the future or likely performance of any investment or securities. Foreign exchange transactions involve risks. You should note that fluctuations in foreign exchange rates may result in losses. You may wish to seek your own independent financial, tax, or legal advice or make such independent investigations as you consider necessary or appropriate.

The information published is not and does not constitute or form part of any offer, recommendation, invitation or solicitation to subscribe to or to enter into any transaction; nor is it calculated to invite, nor does it permit the making of offers to the public to subscribe to or enter into any transaction in any jurisdiction or country in which such offer, recommendation, invitation or solicitation is not authorised or to any person to whom it is unlawful to make such offer, recommendation, invitation or solicitation or where such offer, recommendation, invitation or solicitation would be contrary to law or regulation or which would subject DBS Group to any registration requirement within such jurisdiction or country, and should not be viewed as such. Without prejudice to the generality of the foregoing, the information, services or products described or appearing in the information are not specifically intended for or specifically targeted at the public in any specific jurisdiction.

The information is the property of DBS and is protected by applicable intellectual property laws. No reproduction, transmission, sale, distribution, publication, broadcast, circulation, modification, dissemination, or commercial exploitation such information in any manner (including electronic, print or other media now known or hereafter developed) is permitted.

DBS Group and its respective directors, officers and/or employees may have positions or other interests in, and may effect transactions in securities mentioned and may also perform or seek to perform broking, investment banking and other banking or financial services to any persons or entities mentioned.

To the maximum extent permitted by law, DBS Group accepts no liability for any losses or damages (including direct, special, indirect, consequential, incidental or loss of profits) of any kind arising from or in connection with any reliance and/or use of the information (including any error, omission or misstatement, negligent or otherwise) or further communication, even if DBS Group has been advised of the possibility thereof.

The information is not intended for distribution to, or use by, any person or entity in any jurisdiction or country where such distribution or use would be contrary to law or regulation. The information is distributed (a) in Singapore, by DBS Bank Ltd.; (b) in China, by DBS Bank (China) Ltd; (c) in Hong Kong, by DBS Bank (Hong Kong) Limited; (d) in Taiwan, by DBS Bank (Taiwan) Ltd; (e) in Indonesia, by PT DBS Indonesia; and (f) in India, by DBS Bank Ltd, Mumbai Branch.

Related Insights

- Alternatives 1Q25: Gold – Resilience with Alternatives20 Dec 2024

- CIO Insights 1Q25: Game Changers20 Dec 2024

- Bank of America19 Dec 2024

Related Insights

- Alternatives 1Q25: Gold – Resilience with Alternatives20 Dec 2024

- CIO Insights 1Q25: Game Changers20 Dec 2024

- Bank of America19 Dec 2024