Related Insights

- Global Credit 1Q25 – Making Bonds Great Again23 Dec 2024

- Alternatives 1Q25: Gold – Resilience with Alternatives20 Dec 2024

- CIO Insights 1Q25: Game Changers20 Dec 2024

US will release the PCE deflator and jobless claims data earlier today because of the Thanksgiving holiday weekend starting tomorrow. Assuming PCE headline and core inflation to stay unchanged in October at 0.2% MoM and 0.3%, respectively, the Fed appears divided over a third rate cut at its December 18 FOMC meeting. The FOMC Minutes for the November 6-7 meeting showed broader support for a gradual pace of rate cuts because of greater uncertainty over the neutral rate amid a resilient US economy. Another reading below 200k for initial jobless claims will ease the Fed’s worries over the labour market weakness that drove the 50 bps cut in September.

The US Conference Board’s consumer confidence index improved a second month to 111.7 in November, its highest reading since July 2023, most likely driven by the Trump Trade. The cutoff date for the survey was November 18, after Trump won the US elections held on November 5. Besides becoming substantially more optimistic about future job availability, consumers expected their financial situation to improve in six months. The perceived likelihood of a US recession over the next 12 months fell to a new low in November, with a record 56.4% of the respondents expecting US equities to rise over the year ahead. The Board also asked a special question about 2025, in which consumers overwhelmingly cited higher prices as their top worry and lower prices as their top wish.

Ironically, Trump’s vow to impose harsh tariffs on America’s top three trading partners – 25% on all goods from Mexico and Canada and an additional 10% on Chinese imports – threatened consumers’ aspirations. Minneapolis Fed President Neel Kashkari was worried that a tit-for-tat tariff war would reignite inflation. Mexican President Claudia Sheinbaum threatened to respond with retaliatory tariffs. In 2023, America imported USD475bn, USD418bn, and USD427bn of goods from Mexico, Canada, and China, respectively. These three countries accounted for more than 40-45% of the US’s total imports. With some 80% of Mexico’s exports and 75% of Canada’s exports heading to the US, the tariffs would also hurt the economies of America’s neighbours.

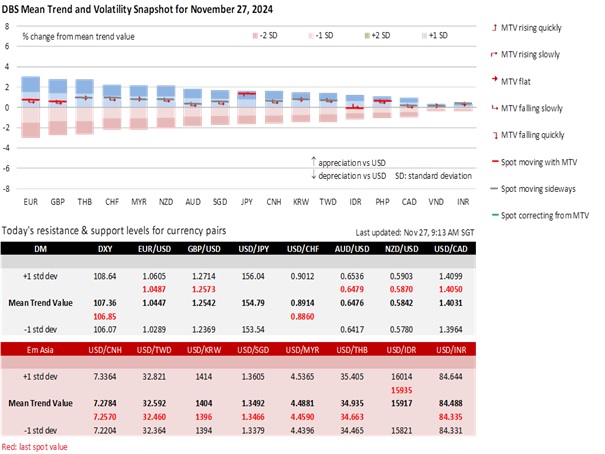

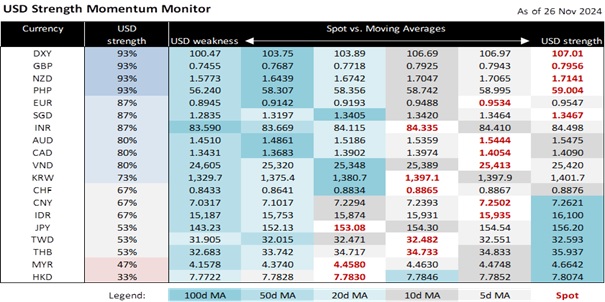

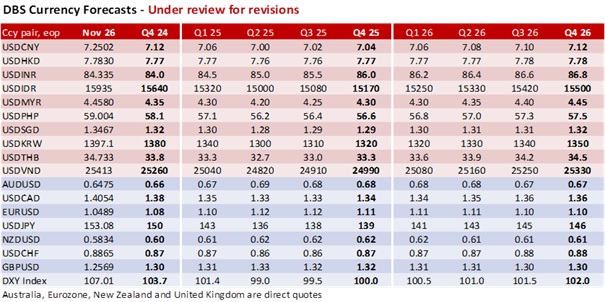

The greenback struggled to extend gains after its knee-jerk spike on Trump’s tariff pledge. Markets are digesting the DXY’s 6-7% rally, driven by the Trump Trade, ahead of the long Thanksgiving weekend. The Mexican peso has already depreciated more than 20% this year, mainly in the past six months. Interestingly, the Japanese yen has bucked the trend by appreciating this week, probably as a haven. Having traded below 153 this morning, USD/JPY could target its early November low of 151.30.

Quote of the Day

“I intend to leave after my death a large fund for the promotion of the peace idea, but I am skeptical as to its results.”

Alfred Nobel

November 27 in history

The Nobel Prize was established in 1895 according to Swedish chemist Alfred Nobel’s will, which was written a year before his death. The first Nobel Prizes were awarded in 1901, on the fifth anniversary of his death.

Topic

GENERAL DISCLOSURE/ DISCLAIMER (For Macroeconomics, Currencies, Interest Rates)

The information herein is published by DBS Bank Ltd and/or DBS Bank (Hong Kong) Limited (each and/or collectively, the “Company”). It is based on information obtained from sources believed to be reliable, but the Company does not make any representation or warranty, express or implied, as to its accuracy, completeness, timeliness or correctness for any particular purpose. Opinions expressed are subject to change without notice. This research is prepared for general circulation. Any recommendation contained herein does not have regard to the specific investment objectives, financial situation and the particular needs of any specific addressee. The information herein is published for the information of addressees only and is not to be taken in substitution for the exercise of judgement by addressees, who should obtain separate legal or financial advice. The Company, or any of its related companies or any individuals connected with the group accepts no liability for any direct, special, indirect, consequential, incidental damages or any other loss or damages of any kind arising from any use of the information herein (including any error, omission or misstatement herein, negligent or otherwise) or further communication thereof, even if the Company or any other person has been advised of the possibility thereof. The information herein is not to be construed as an offer or a solicitation of an offer to buy or sell any securities, futures, options or other financial instruments or to provide any investment advice or services. The Company and its associates, their directors, officers and/or employees may have positions or other interests in, and may effect transactions in securities mentioned herein and may also perform or seek to perform broking, investment banking and other banking or financial services for these companies. The information herein is not directed to, or intended for distribution to or use by, any person or entity that is a citizen or resident of or located in any locality, state, country, or other jurisdiction (including but not limited to citizens or residents of the United States of America) where such distribution, publication, availability or use would be contrary to law or regulation. The information is not an offer to sell or the solicitation of an offer to buy any security in any jurisdiction (including but not limited to the United States of America) where such an offer or solicitation would be contrary to law or regulation.

[#for Distribution in Singapore] This report is distributed in Singapore by DBS Bank Ltd (Company Regn. No. 196800306E) which is Exempt Financial Advisers as defined in the Financial Advisers Act and regulated by the Monetary Authority of Singapore. DBS Bank Ltd may distribute reports produced by its respective foreign entities, affiliates or other foreign research houses pursuant to an arrangement under Regulation 32C of the Financial Advisers Regulations. Where the report is distributed in Singapore to a person who is not an Accredited Investor, Expert Investor or an Institutional Investor, DBS Bank Ltd accepts legal responsibility for the contents of the report to such persons only to the extent required by law. Singapore recipients should contact DBS Bank Ltd at 65-6878-8888 for matters arising from, or in connection with the report.

DBS Bank Ltd., 12 Marina Boulevard, Marina Bay Financial Centre Tower 3, Singapore 018982. Tel: 65-6878-8888. Company Registration No. 196800306E.

DBS Bank Ltd., Hong Kong Branch, a company incorporated in Singapore with limited liability. 18th Floor, The Center, 99 Queen’s Road Central, Central, Hong Kong SAR.

DBS Bank (Hong Kong) Limited, a company incorporated in Hong Kong with limited liability. 11th Floor, The Center, 99 Queen’s Road Central, Central, Hong Kong SAR.

Virtual currencies are highly speculative digital "virtual commodities", and are not currencies. It is not a financial product approved by the Taiwan Financial Supervisory Commission, and the safeguards of the existing investor protection regime does not apply. The prices of virtual currencies may fluctuate greatly, and the investment risk is high. Before engaging in such transactions, the investor should carefully assess the risks, and seek its own independent advice.

Related Insights

- Global Credit 1Q25 – Making Bonds Great Again23 Dec 2024

- Alternatives 1Q25: Gold – Resilience with Alternatives20 Dec 2024

- CIO Insights 1Q25: Game Changers20 Dec 2024

Related Insights

- Global Credit 1Q25 – Making Bonds Great Again23 Dec 2024

- Alternatives 1Q25: Gold – Resilience with Alternatives20 Dec 2024

- CIO Insights 1Q25: Game Changers20 Dec 2024