Related Insights

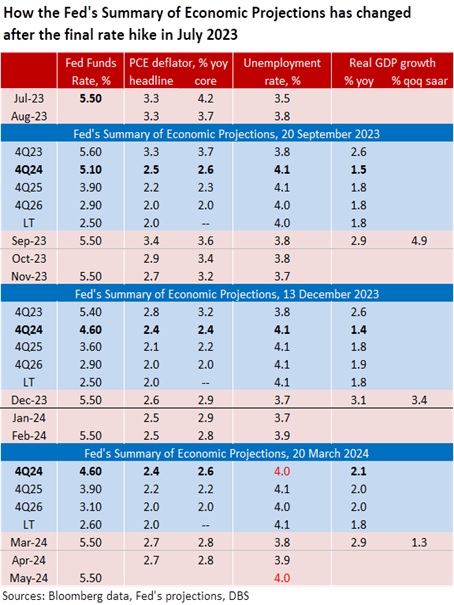

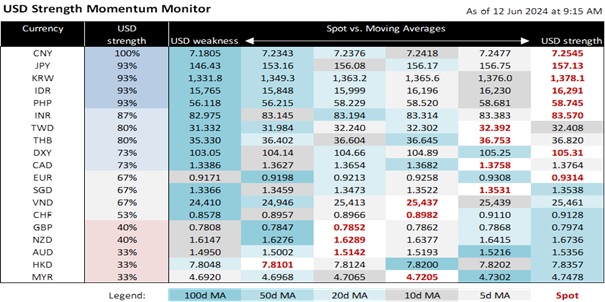

The DXY Index remains cautious ahead of today’s FOMC announcement after the release of US CPI data. DXY was barely changed at 105.23 on Tuesday. Monday’s 0.3% rise to 105.15 on France’s surprise snap election announcement was muted compared to last Friday’s 0.8% spike to 104.89 on the higher-than-expected US nonfarm payrolls. The US Federal Reserve should keep the Fed Funds Rate unchanged for a seventh meeting at 5.25-5.50% due to sticky US inflation in the first quarter. Today, the Fed should reduce the three rate cuts projected for 2024 in March’s dot plot, nearer the two cuts we projected for the second half of the year. Futures markets fluctuated between a single cut in September or two cuts in September and December.

Fed Chair Jerome Powell will unlikely expect the Fed’s next move to be an interest rate hike. Before the Fed’s blackout period, San Francisco Fed President John Williams shared Powell’s assessment that inflation will fall in 2H24. Williams reckoned that monetary policy was restrictive and well-positioned to lower PCE inflation to 2.5% this year, slightly higher than the 2.4% pencilled in March’s Summary of Economic Projections. Today, US CPI inflation data, which consensus sees slowing for a second month to 0.1% MoM in May from 0.3% in April, will be released before the FOMC announcement.

While the Fed will be patient in lowering rates to achieve its price stability mandate, the SEP also indicated that inflation need not be at 2% for the Fed to lower policy restriction. Looking at the totality of data, the Fed will note that US GDP growth has cooled to an annualized 1.3% QoQ saar in 1Q24 from the exceptional 3.4-4.9% growth rates in 2H23. Although US nonfarm payrolls were higher-than-expected at 272k in May, so was the unemployment rate at 4% in May, which hit the Fed’s projection for 4Q24.

According to the Fed’s Beige Book report, tight credit standards and high interest rates continued to constrain lending growth. Several Fed districts reported that wage growth was at or normalizing towards pre-pandemic historic averages, with employers experiencing more bargaining power than a year ago. The commercial real estate sector’s uncertain outlook was attributed to the uncertainties regarding the timing of Fed cuts and the outcome of the November US presidential election.

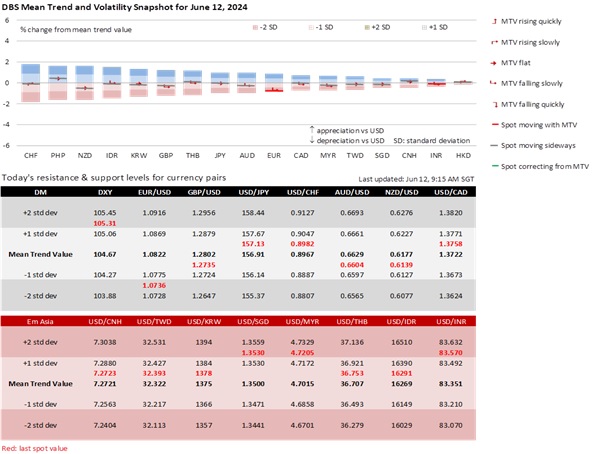

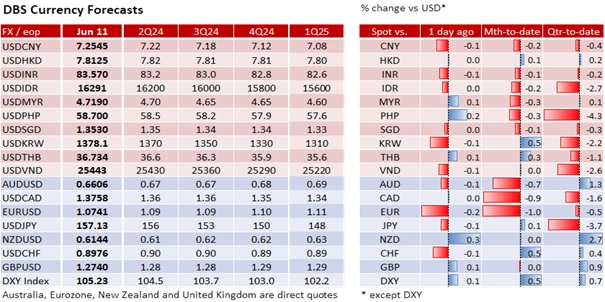

The market is well prepared for the Fed to project fewer, i.e., one-two interest rate cuts this year. Our medium-term view has not changed that the USD will depreciate once inflation resumes its fall for the Fed to prepare the ground for rate cuts. However, the DXY’s short-term outlook is uncertain due to the political volatility in the EUR and GBP ahead of the surprise snap elections in France on June 30 and the UK on July 4. Beyond that, EUR and GBP should be underpinned by their economies exiting technical recessions. The EU Sentix Investor Confidence turned positive in June for the first time since February 2022. European Central Bank President Christine Lagarde signalled that the governing council would likely keep rates unchanged for more than one meeting after this month’s rate cut. The US elections in November will probably matter more, given the recent worries over US fiscal sustainability and de-dollarisation. In Asia, USD/SGD is one of the most correlated currency pairs with the DXY Index, keeping to a 1.33-1.37 range on a DXY’s 102.5-106.5 range.

Quote of the day

“When it is obvious that the goals cannot be reached, don’t adjust the goals, adjust the action steps.”

Confucius

12 June in history

Boris Yeltsin won Russia’s first presidential election with 57% of the vote in 1991.

Topic

The information herein is published by DBS Bank Ltd and/or DBS Bank (Hong Kong) Limited (each and/or collectively, the “Company”). This report is intended for “Accredited Investors” and “Institutional Investors” (defined under the Financial Advisers Act and Securities and Futures Act of Singapore, and their subsidiary legislation), as well as “Professional Investors” (defined under the Securities and Futures Ordinance of Hong Kong) only. It is based on information obtained from sources believed to be reliable, but the Company does not make any representation or warranty, express or implied, as to its accuracy, completeness, timeliness or correctness for any particular purpose. Opinions expressed are subject to change without notice. This research is prepared for general circulation. Any recommendation contained herein does not have regard to the specific investment objectives, financial situation and the particular needs of any specific addressee. The information herein is published for the information of addressees only and is not to be taken in substitution for the exercise of judgement by addressees, who should obtain separate legal or financial advice. The Company, or any of its related companies or any individuals connected with the group accepts no liability for any direct, special, indirect, consequential, incidental damages or any other loss or damages of any kind arising from any use of the information herein (including any error, omission or misstatement herein, negligent or otherwise) or further communication thereof, even if the Company or any other person has been advised of the possibility thereof. The information herein is not to be construed as an offer or a solicitation of an offer to buy or sell any securities, futures, options or other financial instruments or to provide any investment advice or services. The Company and its associates, their directors, officers and/or employees may have positions or other interests in, and may effect transactions in securities mentioned herein and may also perform or seek to perform broking, investment banking and other banking or financial services for these companies. The information herein is not directed to, or intended for distribution to or use by, any person or entity that is a citizen or resident of or located in any locality, state, country, or other jurisdiction (including but not limited to citizens or residents of the United States of America) where such distribution, publication, availability or use would be contrary to law or regulation. The information is not an offer to sell or the solicitation of an offer to buy any security in any jurisdiction (including but not limited to the United States of America) where such an offer or solicitation would be contrary to law or regulation.

This report is distributed in Singapore by DBS Bank Ltd (Company Regn. No. 196800306E) which is Exempt Financial Advisers as defined in the Financial Advisers Act and regulated by the Monetary Authority of Singapore. DBS Bank Ltd may distribute reports produced by its respective foreign entities, affiliates or other foreign research houses pursuant to an arrangement under Regulation 32C of the Financial Advisers Regulations. Singapore recipients should contact DBS Bank Ltd at 65-6878-8888 for matters arising from, or in connection with the report.

DBS Bank Ltd., 12 Marina Boulevard, Marina Bay Financial Centre Tower 3, Singapore 018982. Tel: 65-6878-8888. Company Registration No. 196800306E.

DBS Bank Ltd., Hong Kong Branch, a company incorporated in Singapore with limited liability. 18th Floor, The Center, 99 Queen’s Road Central, Central, Hong Kong SAR.

DBS Bank (Hong Kong) Limited, a company incorporated in Hong Kong with limited liability. 13th Floor One Island East, 18 Westlands Road, Quarry Bay, Hong Kong SAR

Virtual currencies are highly speculative digital "virtual commodities", and are not currencies. It is not a financial product approved by the Taiwan Financial Supervisory Commission, and the safeguards of the existing investor protection regime does not apply. The prices of virtual currencies may fluctuate greatly, and the investment risk is high. Before engaging in such transactions, the investor should carefully assess the risks, and seek its own independent advice.