- Investor optimism is moderating amidrising bond yields and lack of progress inrestoring P/B multiple

- BOJ to remain cautious on monetarypolicy; movements in Japanese yields willalign to the US

- On a sectoral basis, Tech and Industrialscontinue to shine while defensive sectorsregistered weak performance

- Stay with quality; focus on companies with sustainably high ROEs, Sumitoris, Techstocks exposed to AI-related demand

- Prefer upstream semiconductor supplychain given strong government support;Japan will stake out a dominant positionin the global chip marketplace

Related Insights

- Costco Wholesale15 Nov 2024

- Trade Protectionism in Focus15 Nov 2024

- Research Library15 Nov 2024

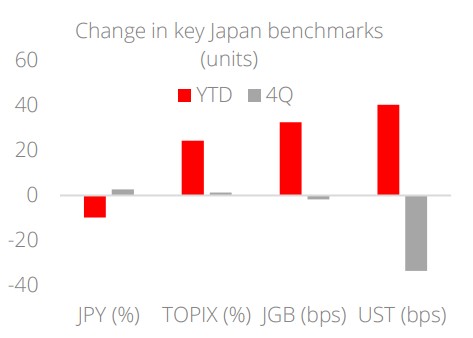

Stagnant stock performance. Japan Equities deteriorated in 4Q23 as investor optimism moderated amid rising long-term interest rates in both Japan and the US, and as geopolitical tension in the Middle East escalated. 10Y US Treasuries hit 5% for the first time since 2007; equivalent JGBs neared 1% as the BOJ lifted the “soft” 1% cap in the October monetary meeting. JPY hovered around, then broke through the 150 psychological resistance level. Foreign investors net sold through November in 4Q23 but maintained their net buying position firmly with a cumulative inflow of USD26t YTD.

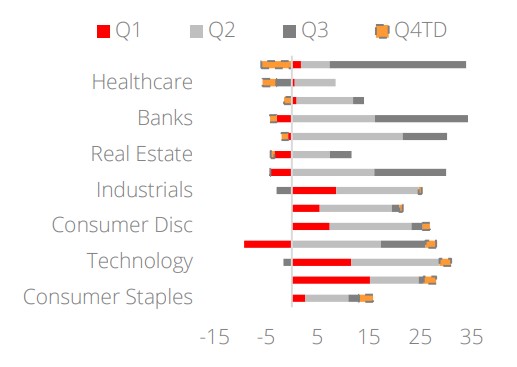

Tech and Industrials taking the lead. On a sectoral basis, the Energy and Banking sectors reversed their strong performance in 4Q23 as oil prices and bond yields show signs of peaking in the near term. Meanwhile, investors continue to pursue economically important sectors such as Tech and Industrials. On the other hand, defensive sectors including Healthcare and Telecommunications registered weak performance despite low investor risk appetite, while Consumer Discretionary and Staples both fared well. In the Basic Materials sector, chemicals outperformed.

Figure 1: 4Q characterised by big moves in UST

Source: LSEG Datastream, DBS

*as of 12 December

Figure 2: Sector performance YTD

Source: LSEG Datastream, DBS

Less compelling earnings trends and valuations. Companies started to release 3Q23 results in late October, where most beat expectations for sales and EPS. Forward guidance, however, was lowered due to weaker-than-expected recovery in China for export stocks. Yen assumptions stood at 135.75, approximately 10% stronger than current levels – this could provide some degree of buffer from translation gains. Meanwhile, domestic demand stocks could see some uplift from steep price increases. For example, the base price of the Japan Rail (JR) pass has barely changed in decades. However, with the yen’s decline, inflation of energy and maintenance costs, Japan Railways has deemed a price increase from 1 October 2023 necessary, with the largest being 77% for the 7-day Green pass.

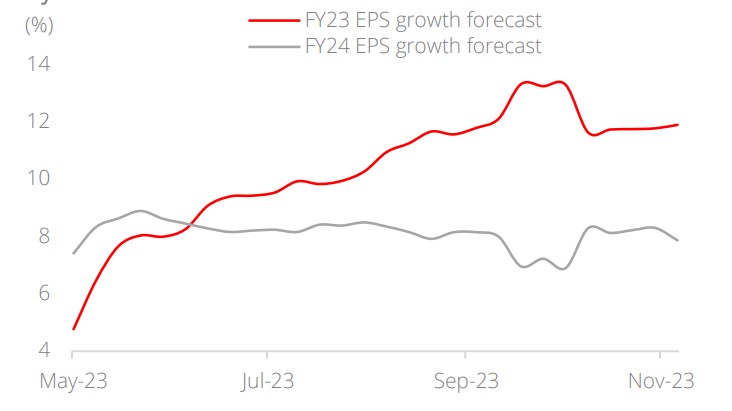

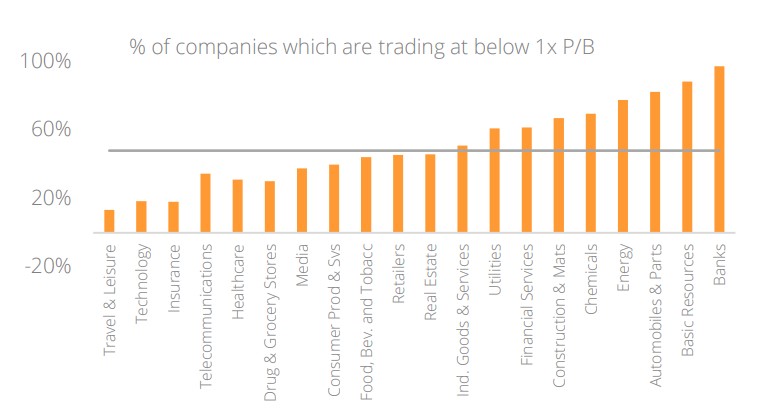

For the TOPIX, EPS growth forecasts have started to trend south, currently at +12% y/y for FY23, followed by +8% in FY24. 12-month forward PE is now at +1SD above average, rendering the market less attractive despite strong earnings growth and low JGB yields. In contrast, based on P/B ratios where we see room for further upside, returns are forecast to be positive. The Tokyo Stock Exchange (TSE) in March asked companies with P/B ratios below 1x to disclose specific policies and initiatives to lift their value as it sought to raise management awareness of capital costs and stock prices. The directive, although not binding, is also seen as a message to draw more interest from overseas investors.

Figure 3: Earnings trend starting to normalise after a strong start to the year

Source: LSEG Datastream, DBS

Figure 4: “Old economy” sectors with low P/B

Source: LSEG Datastream, DBS

Progress has been limited – currently, 48% of companies listed on the TOPIX are still trading below 1x, with most coming from Banks, Basic Resources, Autos, Energy Chemicals, and Utilities. Interestingly, these companies are ‘old economy’ stocks which have de-rated over the years due to poor ROE performance and the BOJ’s negative interest rate policy. Although there appears to be room for restoring P/B multiples through share buybacks and increased dividends, gains in these stocks are unlikely to be sustainable unless there are concerted efforts to expand profits and restructure businesses.

Equities dis-associated from YCC policy. The BOJ further increased its YCC flexibility during the October 2023 meeting. Instead of strictly capping the 10Y JGB yield at 1% through fixed-rate operations, the BOJ will now consider the 1% level as a reference in its market operations. This signifies that the BOJ is willing to allow the 10Y JGB yield to exceed 1%. However, it remains unclear to what extent the BOJ will tolerate a yield above 1%, as well as whether markets will chase yields or USD/JPY higher.

BOJ to remain cautious on monetary policy. To be sure, Japan is the only country to maintain a negative interest rate policy (NIRP) whereas central banks around the world have raised rates aggressively to rein in inflation. Having maintained the policy for more than 20 years, moving away from negative interest rates would have far-reaching effects on Japan’s economy, from corporate investment to household savings. We thus believe the BOJ will be very cautious before changing its monetary policy. For now, we anticipate that movements in Japanese yields will align with those of the US. Consequently, Japan’s equity market will be influenced by global risk sentiment, particularly in response to changes in US bond yields. This implies that the correlation between Japan Equities and US Equities should have increased. We observe US bond yields trading in the 4.5-5% range, but it is crucial to monitor fiscal constraints and the outcomes of debt auctions for potential spikes in bond yields.

Figure 5: TOPIX correlation with S&P 500 rising from low

Source: LSEG Datastream, DBS

Calculated from 52W rolling correlation of weekly returns

Figure 6: Japan Equities underperformed US in the past 30 years

Source: LSEG Datastream, DBS

Given a mixed bag of uncertain central bank policy as well as weak earnings trends and valuations, we emphasise the need to stay with quality names. We remain selective on Japan Equities, with a focus on companies which are:

- pushing for profit expansion and rationalising of businesses

- reaping sustainably high ROEs

- Sumotoris – economically important sectors such as semiconductors

- Tech stocks exposed to AI-related demand

- exposed to next-generation infrastructure such as cloud networks, energy transition, and logistics

Structural challenges ahead. Despite a vibrant history of technological innovation, Japan is often perceived to face challenges in keeping pace with innovation compared to some other economies. Deep-rooted traditions such as that in Japan’s corporate culture is a contributing factor – where stability and incremental progress are often valued over rapid yet potentially transformational bouts of innovation. While this approach has enabled the continuance of high-quality products, it may have hindered breakthrough advancements. Japan’s demographics (such as an ageing population) and a general reluctance to embrace startups and entrepreneurship which are crucial drivers of innovation have also set the economy back.

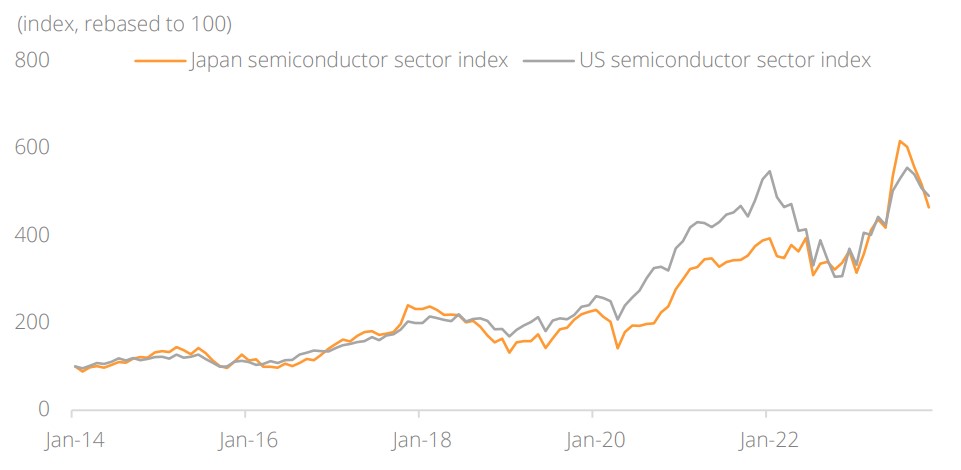

Reforms underway to maintain competitiveness. It is important to acknowledge varying perceptions, but Japan remains a significant player in various technological sectors today. For example, Japan maintains international competitiveness in specific semiconductor device types. However, as acknowledged by the Japanese government, the ongoing chip promotion effort may signify the country’s “last chance” to establish a robust position in the global chip marketplace. Initiatives in AI, robotics, and semiconductor technology are underway to foster innovation. Reforms, including an emphasis on international collaborations, represent a significant shift for the country, which had previously pursued a policy of achieving self-sufficiency.

Key sector recommendation: Japan’s semiconductor prowess Strong government support to drive sectoral growth. The semiconductor sector is one where there is strong will by the Japanese government to stake out a dominant position in the global chip marketplace. The core strategy has been set which includes the formation of a partnership with the US through the consortium Rapidus, which involves Japanese firms collaborating with IBM and Europe’s IMEC for next-gen chip development. Besides, the country aims to create chip manufacturing bases for legacy devices, partnering with foreign players, such as Taiwan’s TSMC, to establish Japan Advanced Semiconductor Manufacturing. The Japanese government plans to subsidise domestic and foreign manufacturers, covering one-third of capital costs, to produce specific semiconductor devices, materials, and equipment, with a 10-year domestic production requirement.

Japan holds unrivalled best-in-class competencies. As it is, Japan has a strong chip infrastructure and global industry leaders are reportedly coming to view Japan as an alternative chip production hub to China. Japan has extraordinary competencies in the tools and materials necessary for the most advanced forms of chipmaking, with Japanese suppliers often best-in-class in their areas of specialisation. For example, for the EUV lithography equipment, which is essential for advanced chipmaking, Tokyo Electron (TEL) leads with near 100% market share in in-line coaters/developers, and Japanese firms JEOL and NuFlare hold a 91% share of the global market for mask-making. Japan is the largest maker of semiconductor materials in the world – a status it has held for decades – holding over a 50% share of 14 of the most critical materials needed for chipmaking, including photomasks, photoresist, and silicon wafers.

Figure 7: Japan plays a key role in the semiconductor sector

Source: LSEG Datstream, DBS

Topic

The information published by DBS Bank Ltd. (company registration no.: 196800306E) (“DBS”) is for information only. It is based on information or opinions obtained from sources believed to be reliable (but which have not been independently verified by DBS, its related companies and affiliates (“DBS Group”)) and to the maximum extent permitted by law, DBS Group does not make any representation or warranty (express or implied) as to its accuracy, completeness, timeliness or correctness for any particular purpose. Opinions and estimates are subject to change without notice. The publication and distribution of the information does not constitute nor does it imply any form of endorsement by DBS Group of any person, entity, services or products described or appearing in the information. Any past performance, projection, forecast or simulation of results is not necessarily indicative of the future or likely performance of any investment or securities. Foreign exchange transactions involve risks. You should note that fluctuations in foreign exchange rates may result in losses. You may wish to seek your own independent financial, tax, or legal advice or make such independent investigations as you consider necessary or appropriate.

The information published is not and does not constitute or form part of any offer, recommendation, invitation or solicitation to subscribe to or to enter into any transaction; nor is it calculated to invite, nor does it permit the making of offers to the public to subscribe to or enter into any transaction in any jurisdiction or country in which such offer, recommendation, invitation or solicitation is not authorised or to any person to whom it is unlawful to make such offer, recommendation, invitation or solicitation or where such offer, recommendation, invitation or solicitation would be contrary to law or regulation or which would subject DBS Group to any registration requirement within such jurisdiction or country, and should not be viewed as such. Without prejudice to the generality of the foregoing, the information, services or products described or appearing in the information are not specifically intended for or specifically targeted at the public in any specific jurisdiction.

The information is the property of DBS and is protected by applicable intellectual property laws. No reproduction, transmission, sale, distribution, publication, broadcast, circulation, modification, dissemination, or commercial exploitation such information in any manner (including electronic, print or other media now known or hereafter developed) is permitted.

DBS Group and its respective directors, officers and/or employees may have positions or other interests in, and may effect transactions in securities mentioned and may also perform or seek to perform broking, investment banking and other banking or financial services to any persons or entities mentioned.

To the maximum extent permitted by law, DBS Group accepts no liability for any losses or damages (including direct, special, indirect, consequential, incidental or loss of profits) of any kind arising from or in connection with any reliance and/or use of the information (including any error, omission or misstatement, negligent or otherwise) or further communication, even if DBS Group has been advised of the possibility thereof.

The information is not intended for distribution to, or use by, any person or entity in any jurisdiction or country where such distribution or use would be contrary to law or regulation. The information is distributed (a) in Singapore, by DBS Bank Ltd.; (b) in China, by DBS Bank (China) Ltd; (c) in Hong Kong, by DBS Bank (Hong Kong) Limited; (d) in Taiwan, by DBS Bank (Taiwan) Ltd; (e) in Indonesia, by PT DBS Indonesia; and (f) in India, by DBS Bank Ltd, Mumbai Branch.

Related Insights

- Costco Wholesale15 Nov 2024

- Trade Protectionism in Focus15 Nov 2024

- Research Library15 Nov 2024

Related Insights

- Costco Wholesale15 Nov 2024

- Trade Protectionism in Focus15 Nov 2024

- Research Library15 Nov 2024