- China: Strong stimulus, from rate cuts to public outlays, are expected to support economy growth of 5.0% in both 2024 and 2025

- Japan: Preliminary estimates saw the economy grow by 0.9% q/q sa, marking the second quarter of positive growth

- Hong Kong: Export growth remained strong at 10.7% y/y from 1Q-3Q, driven primarily by the electronics sector

- India: Supply-side pressures, driven by unseasonal rains and import tax hikes, are expected to push near-term inflation above RBI's projections for a second consecutive quarter

Related Insights

- Global Credit 1Q25 – Making Bonds Great Again23 Dec 2024

- Alternatives 1Q25: Gold – Resilience with Alternatives20 Dec 2024

- CIO Insights 1Q25: Game Changers20 Dec 2024

China: Signs of stabilisation on decisive stimulus. Resilient external trade stayed as a bright spot in October. Exports growth increased from 2.4% y/y in September to 12.7%, resulting in a 5.1% y/y growth YTD. Major products such as high-tech products, electronics, and automobiles recorded a YTD improvement during the month. Aligned with the uptick of exports shipments, both SME exporter-focused Caixin and official manufacturing PMI also rebounded back to expansion territories in October.

Chinese exporters face several risks, in particular, elevated trade tension as the new US administration will likely raise further tariffs against China. However, the actual impact may be less severe as the tariffs are being implemented in phases and the tariffs that are implemented on other countries will dilute the effect on China. Burgeoning demand from emerging markets and domestic stimulus could partly offset the loss of trade income from the US. Furthermore, there might be front loading of export orders as seen during Trump’s first term. keeping export from China to the US resilient.

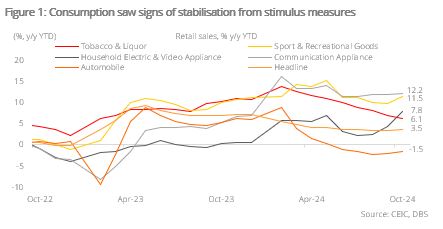

Retail sales growth accelerated from 3.3% y/y in the first nine months to 3.5% YTD in October as consumption sentiment saw signs of stabilising due to the stimulus measures. Spending on leisure, cosmetics, and household electronics surged by 26.7% , 40.1%, and 39.2% y/y respectively. However, a negative wealth effect from asset markets continues to dampen consumption sentiment with sales of big-ticket items, luxuries, and construction materials declining further. Hopefully, the CNY300bn consumption upgrade subsidy, equivalent to 0.6% of retail sales, will cushion the downtrend.

Persistently weak aggregate demand indicates the need for further loosening of monetary policy. This is evidenced by the 6.1% y/y contraction in M1 in October. Meanwhile, M2 growth rebounded from an all-time low of 6.2% y/y in June to 7.5%. The gap between short-term M1 and time deposit M2 growth widened to 13.6 %pts, hovering around its highest level since May 2012. This implies households and corporations are reluctant to hold liquid cash for consumption and investment. However, it is worth noting, both M1 and M2 growth show early signs of bottoming out as a result of ongoing stimulus.

Strong stimulus measures, from rate cuts to public outlays, have been the hallmark of China’s policy stance since September. This ought to help the economy maintain 5.0% growth in 2024 and 2025, though China's economy will continue facing risks from property market to strained local government finance due to persistently weak aggregate demand and a very likely escalation of trade and tech war. We see room for a 10 bps 1Y LPR cut in this quarter and another 50 bps cut in 2025.

Download the PDF to read the full report which includes coverage on Credit, FX, Rates, and Thematics.

Topic

The information published by DBS Bank Ltd. (company registration no.: 196800306E) (“DBS”) is for information only. It is based on information or opinions obtained from sources believed to be reliable (but which have not been independently verified by DBS, its related companies and affiliates (“DBS Group”)) and to the maximum extent permitted by law, DBS Group does not make any representation or warranty (express or implied) as to its accuracy, completeness, timeliness or correctness for any particular purpose. Opinions and estimates are subject to change without notice. The publication and distribution of the information does not constitute nor does it imply any form of endorsement by DBS Group of any person, entity, services or products described or appearing in the information. Any past performance, projection, forecast or simulation of results is not necessarily indicative of the future or likely performance of any investment or securities. Foreign exchange transactions involve risks. You should note that fluctuations in foreign exchange rates may result in losses. You may wish to seek your own independent financial, tax, or legal advice or make such independent investigations as you consider necessary or appropriate.

The information published is not and does not constitute or form part of any offer, recommendation, invitation or solicitation to subscribe to or to enter into any transaction; nor is it calculated to invite, nor does it permit the making of offers to the public to subscribe to or enter into any transaction in any jurisdiction or country in which such offer, recommendation, invitation or solicitation is not authorised or to any person to whom it is unlawful to make such offer, recommendation, invitation or solicitation or where such offer, recommendation, invitation or solicitation would be contrary to law or regulation or which would subject DBS Group to any registration requirement within such jurisdiction or country, and should not be viewed as such. Without prejudice to the generality of the foregoing, the information, services or products described or appearing in the information are not specifically intended for or specifically targeted at the public in any specific jurisdiction.

The information is the property of DBS and is protected by applicable intellectual property laws. No reproduction, transmission, sale, distribution, publication, broadcast, circulation, modification, dissemination, or commercial exploitation such information in any manner (including electronic, print or other media now known or hereafter developed) is permitted.

DBS Group and its respective directors, officers and/or employees may have positions or other interests in, and may effect transactions in securities mentioned and may also perform or seek to perform broking, investment banking and other banking or financial services to any persons or entities mentioned.

To the maximum extent permitted by law, DBS Group accepts no liability for any losses or damages (including direct, special, indirect, consequential, incidental or loss of profits) of any kind arising from or in connection with any reliance and/or use of the information (including any error, omission or misstatement, negligent or otherwise) or further communication, even if DBS Group has been advised of the possibility thereof.

The information is not intended for distribution to, or use by, any person or entity in any jurisdiction or country where such distribution or use would be contrary to law or regulation. The information is distributed (a) in Singapore, by DBS Bank Ltd.; (b) in China, by DBS Bank (China) Ltd; (c) in Hong Kong, by DBS Bank (Hong Kong) Limited; (d) in Taiwan, by DBS Bank (Taiwan) Ltd; (e) in Indonesia, by PT DBS Indonesia; and (f) in India, by DBS Bank Ltd, Mumbai Branch.

Related Insights

- Global Credit 1Q25 – Making Bonds Great Again23 Dec 2024

- Alternatives 1Q25: Gold – Resilience with Alternatives20 Dec 2024

- CIO Insights 1Q25: Game Changers20 Dec 2024

Related Insights

- Global Credit 1Q25 – Making Bonds Great Again23 Dec 2024

- Alternatives 1Q25: Gold – Resilience with Alternatives20 Dec 2024

- CIO Insights 1Q25: Game Changers20 Dec 2024