- Global: China should have the means to counter a wider trade war under Trump 2.0; CPI release brings relief, but sticky inflation worries linger

- China: Supportive policies to offset headwinds remain critical; the economy will continue facing risks from the property market and weak demand

- India: Better-placed among Asian peers amid heightened US-China trade tension; persistently high inflation rules out near-term rate cuts

- Malaysia: Positive growth drivers likely to sustain into 2025; a favourable base effect in 4Q24 should see real GDP growth recover to 5.3% for full-year 2024

Related Insights

- Alternatives 1Q25: Gold – Resilience with Alternatives20 Dec 2024

- CIO Insights 1Q25: Game Changers20 Dec 2024

- Bank of America19 Dec 2024

Global: Trump’s world and the trade landscape in the coming years. Last week’s US elections, which delivered an emphatic victory for Donald Trump and the Republican party, have brought in a sense of déjà vu for Asia. Eight years ago, the region’s commitment to a global rules-based order and open trade was challenged by the surprising victory of Trump who came into office with commitments to a trade war. Since then, through Trump and Biden, tariffs, restrictions on tech access, and scrutiny on investments have been ramped up progressively. Most of these were aimed at China. Though hurt from these actions, China has the wherewithal to counter them to some extent.

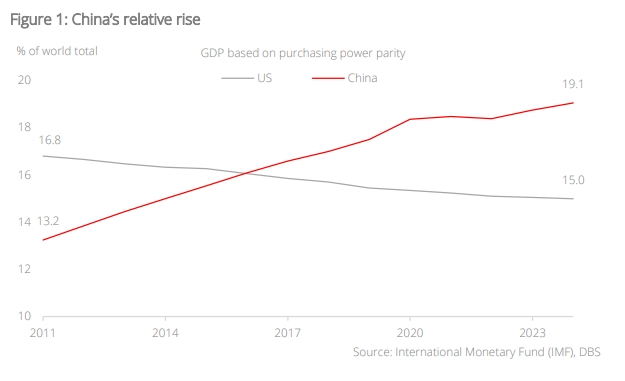

The US remains equipped with the world’s most impactful and advanced military, capital markets, science, and technology. Yet, on purchasing power parity basis, China’s economy now makes up a substantially larger share of global GDP. While it is likely the US would intensify the pushback against China’s rise in the coming years ( and they are considerably richer per capita), we do not think the US will manage to make China less consequential to the global economy.

This week’s US CPI release came out in line with consensus expectations (headline: 0.2% m/m, core: 0.3% m/m), but we are not convinced that the report will quell longer-term inflation worries. Notably, core services ex-housing inflation has been running above 0.3% m/m for three consecutive months, suggesting that there is some stickiness in prices. The Fed does get one more set of NFP and CPI prints in early December before the next Federal Open Market Committee meeting (outcome due 19 Dec). Assuming that data does not materially change, we think that the Fed will deliver one final cut for the year, taking the Fed Funds rate to 4.50%.

Download the PDF to read the full report which includes coverage on Credit, FX, Rates, and Thematics.

Topic

The information published by DBS Bank Ltd. (company registration no.: 196800306E) (“DBS”) is for information only. It is based on information or opinions obtained from sources believed to be reliable (but which have not been independently verified by DBS, its related companies and affiliates (“DBS Group”)) and to the maximum extent permitted by law, DBS Group does not make any representation or warranty (express or implied) as to its accuracy, completeness, timeliness or correctness for any particular purpose. Opinions and estimates are subject to change without notice. The publication and distribution of the information does not constitute nor does it imply any form of endorsement by DBS Group of any person, entity, services or products described or appearing in the information. Any past performance, projection, forecast or simulation of results is not necessarily indicative of the future or likely performance of any investment or securities. Foreign exchange transactions involve risks. You should note that fluctuations in foreign exchange rates may result in losses. You may wish to seek your own independent financial, tax, or legal advice or make such independent investigations as you consider necessary or appropriate.

The information published is not and does not constitute or form part of any offer, recommendation, invitation or solicitation to subscribe to or to enter into any transaction; nor is it calculated to invite, nor does it permit the making of offers to the public to subscribe to or enter into any transaction in any jurisdiction or country in which such offer, recommendation, invitation or solicitation is not authorised or to any person to whom it is unlawful to make such offer, recommendation, invitation or solicitation or where such offer, recommendation, invitation or solicitation would be contrary to law or regulation or which would subject DBS Group to any registration requirement within such jurisdiction or country, and should not be viewed as such. Without prejudice to the generality of the foregoing, the information, services or products described or appearing in the information are not specifically intended for or specifically targeted at the public in any specific jurisdiction.

The information is the property of DBS and is protected by applicable intellectual property laws. No reproduction, transmission, sale, distribution, publication, broadcast, circulation, modification, dissemination, or commercial exploitation such information in any manner (including electronic, print or other media now known or hereafter developed) is permitted.

DBS Group and its respective directors, officers and/or employees may have positions or other interests in, and may effect transactions in securities mentioned and may also perform or seek to perform broking, investment banking and other banking or financial services to any persons or entities mentioned.

To the maximum extent permitted by law, DBS Group accepts no liability for any losses or damages (including direct, special, indirect, consequential, incidental or loss of profits) of any kind arising from or in connection with any reliance and/or use of the information (including any error, omission or misstatement, negligent or otherwise) or further communication, even if DBS Group has been advised of the possibility thereof.

The information is not intended for distribution to, or use by, any person or entity in any jurisdiction or country where such distribution or use would be contrary to law or regulation. The information is distributed (a) in Singapore, by DBS Bank Ltd.; (b) in China, by DBS Bank (China) Ltd; (c) in Hong Kong, by DBS Bank (Hong Kong) Limited; (d) in Taiwan, by DBS Bank (Taiwan) Ltd; (e) in Indonesia, by PT DBS Indonesia; and (f) in India, by DBS Bank Ltd, Mumbai Branch.

Related Insights

- Alternatives 1Q25: Gold – Resilience with Alternatives20 Dec 2024

- CIO Insights 1Q25: Game Changers20 Dec 2024

- Bank of America19 Dec 2024

Related Insights

- Alternatives 1Q25: Gold – Resilience with Alternatives20 Dec 2024

- CIO Insights 1Q25: Game Changers20 Dec 2024

- Bank of America19 Dec 2024