- Oil prices to bounce back from recent lows of USD70 per barrel

- Crisis in the Middle East has been contained so far, but further escalation cannot be ruled out, which would drive up oil and gas prices

- US election outcome will be keenly watched from the perspective of the energy sector; a Trump win could improve sentiment for US fossil fuel plays

- US oil and gas plays are well off their highs earlier this year, attractive entry points to play on potentially firmer oil and gas prices in the near term

Related Insights

- Global Credit 1Q25 – Making Bonds Great Again23 Dec 2024

- Alternatives 1Q25: Gold – Resilience with Alternatives20 Dec 2024

- CIO Insights 1Q25: Game Changers20 Dec 2024

Oil prices taking a dip but should bounce off recent lows. Brent crude oil prices have fallen more than 15% since start of 3Q24 to recent lows of around USD70/bbl, compared to an average of USD85.0/bbl in 2Q24. The recent weakness was driven by rising demand risks, and the risk of a full-blown crisis in the Middle East has been averted so far. Iran and Israel have deployed limited strike options against each other, averting further damage on energy infrastructure. Meanwhile, negative demand trends from China, tepid demand in US and other developed economies and the spectre of looming production increase from OPEC+ have kept a lid on oil price trends. We have recently lowered our average base-case Brent crude oil price forecast to USD77-82/bbl in 2024 and USD70-75/bbl in 2025, from USD80-85/bbl and USD72-77/bbl earlier, given the prevailing demand risks. However, at USD70/bbl, oil prices look oversold and hence there is room for a bounce back.

A Trump win could boost US oil and gas share prices. The US Presidential race has been too close to call for some time. In the event of a Trump victory, we believe sentiment for US oil and gas stocks could see a near term uplift. Separately, US shale oil production is not as dependent on politics as much as market factors, with production increasing sharply under Biden’s administration. On the gas front, the ban on export terminals may be lifted and higher export volume should be beneficial for shale gas producers, both from a volume and price perspective. Diplomatic efforts behind the scenes have possibly reined in Israel’s attacks on Iran and reciprocal actions, ahead of the US elections. However, once the elections are over, the possibility of geopolitical risks resurfacing cannot be ruled out entirely as Israel remains on the offensive in the Gaza theatre as well as in Lebanon and Iran, with no signs of a ceasefire yet.

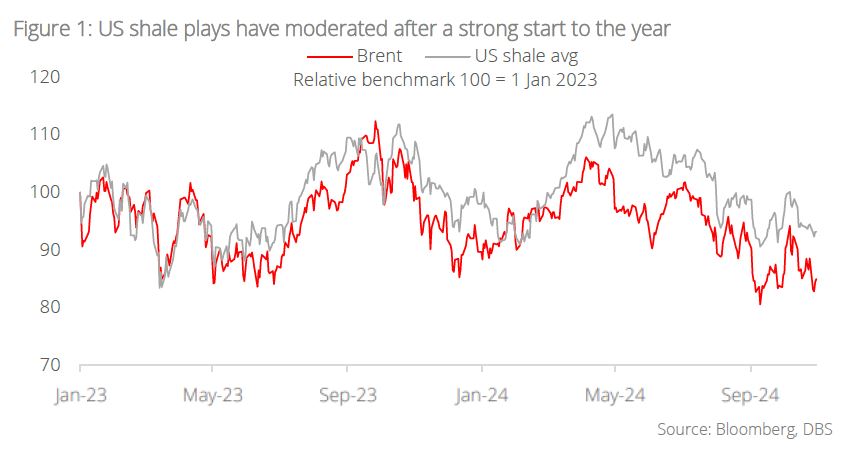

Oil and gas share prices have moderated since 2Q24, better entry points now. Overall, we believe market pessimism may be unwarranted at USD70/bbl oil levels. Recent stimulus measures rolled out by the Chinese government could mean a better 2025 for Chinese oil demand. In addition, OPEC+ retains the flexibility to stabilise markets and thus we expect reasonable support for oil prices in near term, with potential further Fed rate cuts and a weaker US dollar on the horizon. US oil and gas plays have since given off much of the gains for the year, down around 18% on average from the highs in April. Thus, current levels seem a safe bet to accumulate names like ExxonMobil, Chevron, ConocoPhillips or EOG Resources. We believe US oil majors and shale plays will continue to see upside from both organic and inorganic volume growth starting next year.

Topic

The information published by DBS Bank Ltd. (company registration no.: 196800306E) (“DBS”) is for information only. It is based on information or opinions obtained from sources believed to be reliable (but which have not been independently verified by DBS, its related companies and affiliates (“DBS Group”)) and to the maximum extent permitted by law, DBS Group does not make any representation or warranty (express or implied) as to its accuracy, completeness, timeliness or correctness for any particular purpose. Opinions and estimates are subject to change without notice. The publication and distribution of the information does not constitute nor does it imply any form of endorsement by DBS Group of any person, entity, services or products described or appearing in the information. Any past performance, projection, forecast or simulation of results is not necessarily indicative of the future or likely performance of any investment or securities. Foreign exchange transactions involve risks. You should note that fluctuations in foreign exchange rates may result in losses. You may wish to seek your own independent financial, tax, or legal advice or make such independent investigations as you consider necessary or appropriate.

The information published is not and does not constitute or form part of any offer, recommendation, invitation or solicitation to subscribe to or to enter into any transaction; nor is it calculated to invite, nor does it permit the making of offers to the public to subscribe to or enter into any transaction in any jurisdiction or country in which such offer, recommendation, invitation or solicitation is not authorised or to any person to whom it is unlawful to make such offer, recommendation, invitation or solicitation or where such offer, recommendation, invitation or solicitation would be contrary to law or regulation or which would subject DBS Group to any registration requirement within such jurisdiction or country, and should not be viewed as such. Without prejudice to the generality of the foregoing, the information, services or products described or appearing in the information are not specifically intended for or specifically targeted at the public in any specific jurisdiction.

The information is the property of DBS and is protected by applicable intellectual property laws. No reproduction, transmission, sale, distribution, publication, broadcast, circulation, modification, dissemination, or commercial exploitation such information in any manner (including electronic, print or other media now known or hereafter developed) is permitted.

DBS Group and its respective directors, officers and/or employees may have positions or other interests in, and may effect transactions in securities mentioned and may also perform or seek to perform broking, investment banking and other banking or financial services to any persons or entities mentioned.

To the maximum extent permitted by law, DBS Group accepts no liability for any losses or damages (including direct, special, indirect, consequential, incidental or loss of profits) of any kind arising from or in connection with any reliance and/or use of the information (including any error, omission or misstatement, negligent or otherwise) or further communication, even if DBS Group has been advised of the possibility thereof.

The information is not intended for distribution to, or use by, any person or entity in any jurisdiction or country where such distribution or use would be contrary to law or regulation. The information is distributed (a) in Singapore, by DBS Bank Ltd.; (b) in China, by DBS Bank (China) Ltd; (c) in Hong Kong, by DBS Bank (Hong Kong) Limited; (d) in Taiwan, by DBS Bank (Taiwan) Ltd; (e) in Indonesia, by PT DBS Indonesia; and (f) in India, by DBS Bank Ltd, Mumbai Branch.

Related Insights

- Global Credit 1Q25 – Making Bonds Great Again23 Dec 2024

- Alternatives 1Q25: Gold – Resilience with Alternatives20 Dec 2024

- CIO Insights 1Q25: Game Changers20 Dec 2024

Related Insights

- Global Credit 1Q25 – Making Bonds Great Again23 Dec 2024

- Alternatives 1Q25: Gold – Resilience with Alternatives20 Dec 2024

- CIO Insights 1Q25: Game Changers20 Dec 2024