- The IMF annual meetings, held at Washington DC last week, were characterised by relief over global economic resiliency, juxtaposed by heightened concerns about a variety of risks

- Global growth is expected to remain stable between 2024 and 2025

- Concerns about inflation have receded, but we caution against a victory lap

- USD weaponisation and trade wars are causing investor strategies to shift

- EM resilience would be tested by the outcome of the US elections

Related Insights

- Rate Cut Outlook on Track13 Dec 2024

- CIO Insights 1Q25: Game Changers13 Dec 2024

- China Central Economic Work Conference and 3 objectives for 202513 Dec 2024

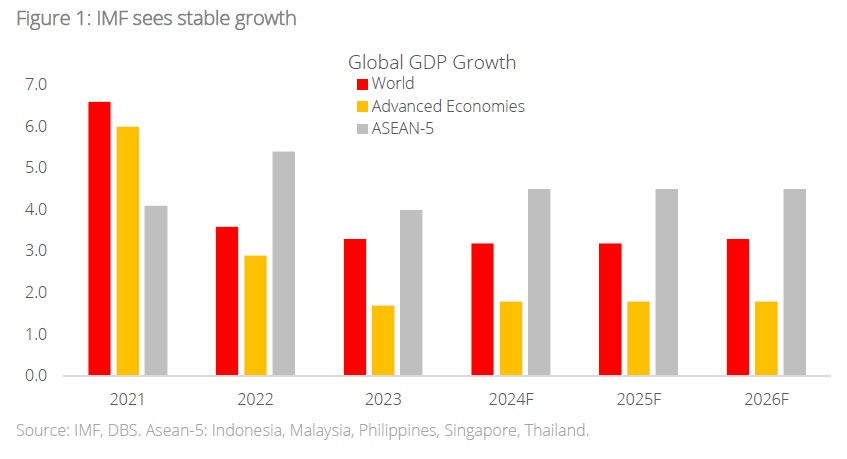

Resilience ahead. A variety of omnipresent risks notwithstanding, global and Asean-5 growth is expected to remain stable between 2024 and 2025. In the World Economic Outlook forecasts released during the recently concluded IMF annual meetings in Washington DC, global real GDP is expected to rise by 3.2% in both 2024 and 2025, while Asean-5 is slated to rise by 4.5% in both years. Some slowing of China and India’s economies could be in store, but overall, global consumption and investment would chug along, as per the IMF. This relief, however, was juxtaposed by heightened concerns over a variety of risks.

Soft landing optimism. There was an element of satisfaction among DM and EM government officials that the post-pandemic rebound-led inflation has largely abated, and the sharp interest rate increase phase has come and gone without causing economic growth to stumble. This is a sharp departure from the case just two years ago, when there was near-panic about the stickiness of inflation, and the likely spike in unemployment that would be caused by necessary monetary policy tightening.

It has turned out to be quite different; labour markets have barely loosened and asset markets are buoyant, while goods inflation has dissipated considerably. China, a major source of commodity demand, has been on a slowing path, a contrast from the US economy, which has been going strength to strength. This opposing dynamic has offered a degree of balance to the global supply-demand picture. A stable commodity price environment, despite escalating warfare in the Middle-East, has also been a source of support.

Global and Asean-5 growth is expected to remain stable between 2024 and 2025. In the IMF’s World Economic Outlook forecasts released during meetings, global real GDP is expected to rise by 3.2% in both 2024 and 2025, while Asean-5 is slated to rise by 4.5% in both years. Some slowing of China and India’s economies could be in store (about 50bps each from 4.8% and 7%, respectively), but overall, global consumption and investment would chug along, as per the IMF.

We think it may be too early to declare victory over inflation or take comfort in the apparent resiliency from higher rates. Services inflation remains on the sticky side, strong growth may spill over into higher prices, and the tensions in the Middle-East could reach a tipping point. Already, in recent weeks, the overwhelming expectations of sustained rate cuts have begun to recede, with a great deal of uncertainty building up over how many rate cuts are possible next year. One or two more strong jobs numbers and higher-than-expected CPI prints could cause a sharp change in rates pricing for next year. The recent rise in long-term US interest rates, which has resulted in mortgage rates rising as well, could be a harbinger for things to come.

Election risks. Higher rates could also materialise under a Trump election victory, which could lead to expectations of higher US fiscal deficit and erosion of Fed independence. That, plus Trump’s tariff plans, could lead to firming of the USD, hurting some USD-borrowing sovereigns, firms, and households. These risks will need to be assessed in light of the result of the November US presidential elections.

There was no shortage of concerns over the US, ranging from an increasingly untenable fiscal position, impact of higher tariffs on the rest of the world, and a possible re-acceleration in inflation under a no-landing scenario. We even heard ideas akin to an EU-style carbon border adjustment tax on imports being floated by some Trump loyalists. While such things are less likely under a Harris presidency, no one expects a meaningful improvement in the frictions characterising US trade and commerce.

There was however also some degree of comfort with the US outlook, given the strong state of asset markets, a buoyant investment environment, commanding lead on the global AI race, and sound corporate and household balance sheets.

Split on China. As has been the case lately, the meetings contained a great deal of discussions and presentations on geoeconomic fragmentation, climate finance, and of course, China. From the so-called “excess capacity” charges to the scale and effectiveness of the ongoing stimulus measures, from the security environment, external and internal, to the China plus one dynamic, the arguments were unfortunately largely binary. There is a great deal of groupthink among DM economies about China, and the thinking is largely about the threats and risks, rather than opportunities and gains from cooperation. We expect this polarisation to persist, with more tariffs and other restrictive measures in the pipeline. The key is to do the best given that inevitable and adverse dynamic.

This is where opportunities for EM are being seen. Supply chain relocation should help India, Mexico, South-East Asia, and a few other countries. Investments from western MNCs, as well as from Chinese companies, are being spread more widely around the world. It remains to be seen if this relocation process would take place without a drop in productivity displayed by China’s manufacturing stack, but the choices to do so have been made, no doubt.

Weaponisation of the USD was another widely discussed theme. Surveys show that central banks are increasingly inclined to hold more gold and non-USD assets. Fintech solutions make “deferred barter” feasible, under which countries running trade deficits vis-à-vis China can receive RMB for what they sell to China and send those RMB proceeds back through the import channel. This is not a theoretical construct, it is an increasingly deepening phenomenon, especially in the Middle-East.

US-EU efforts to seize or freeze the assets of the central banks of Afghanistan and Russia, along with a multitude of restrictions over western payment systems like SWIFT, are adding impetus for many governments to reduce over-reliance on the USD. There are already cases where central banks are repatriating their gold reserves custody from London/New York to their home jurisdictions.

Reducing the reliance on the USD is akin to the de-risking of supply chain strategy that is touted a great deal. Just like the pandemic pushed companies to reconsider the efficiency-resiliency trade-off over nodes of manufacturing, similar considerations are at play with regard to the risks of holding USD assets. Alternatives like barter, purchase and localisation of gold holdings , and adding EUR or RMB to reserves are second best, with associated frictions, but they are now very much on the table. The extraordinary rise in US debt issuance adds to these considerations in many corners around the world.

GFSR chapter on AI and GenAI. The meetings also featured the release of the IMF’s Global Financial Stability Report, which contained an interesting chapter on the potential impact of artificial intelligence (AI and GenAI) on capital markets. The premise of the analysis was that AI and related breakthroughs have the potential to increase the efficiency of capital markets—trading, investment, and asset allocation—through assisted process automation and analysis of complex unstructured data.

The report cited early evidence that these effects are already being felt in the financial sector. Financial firms are hiring large number of AI talent, developers’ filing for patents are up sharply, while pricing patterns and trading dynamics already show changes in some markets consistent with the adoption of these new technologies. Major gains from such a wave would materialise in the medium term; for the time being, the typical use case of AI is extension of existing trends in the use of machine learning and other advanced analytical tools.

IMF researchers argue in the report that AI may reduce financial stability risks by enabling superior risk management, deepening market liquidity, and improving market monitoring.

AI pitfalls surfaced. The risk is however that if trading strategies of AI models all respond to a shock in a similar manner, creating exaggerated price movements or market disruptions. Also, there could be further migration of market-making and investment activities to hedge funds, proprietary trading firms, and other nonbank financial intermediaries, creating a greater degree of opacity in the financial sector.

Firms and governments should also take into cognizance the increase in operational risks as there are only a handful of key third-party AI service providers. There is also the risk that AI-enabled bad actors would carry out cyberattacks and market manipulation with a far greater degree of potency. Global regulators are working on creating a framework to address these risks. Considerations include calibration of circuit breakers and a review of margining practices in case of rapid AI-driven price moves, as well as enhanced monitoring and data collection of the activity of large traders, including nonbank financial intermediaries.

There will be an increasing need to stay on top of dependency on data, models, and technological infrastructure. Firms should be expecting regulators to demand risk mapping, covering internal and external data interconnections and interdependencies.

To conclude, the IMF meetings did not bring forth any new, ambitious calls to action. Key cyclical and structural issues remain the same, from sustainable growth to dealing with climate change. Thorny issues like increasing the voice of developing economies in the multilateral system remain on the sideline. The continuous erosion of a rule-based, free trade oriented global system is noted, and those costs are highlighted, but there is little in the power of the well-meaning staff of the World and IMF to push back against the trend. In the coming meetings, more of the same can be expected.

Topic

The information published by DBS Bank Ltd. (company registration no.: 196800306E) (“DBS”) is for information only. It is based on information or opinions obtained from sources believed to be reliable (but which have not been independently verified by DBS, its related companies and affiliates (“DBS Group”)) and to the maximum extent permitted by law, DBS Group does not make any representation or warranty (express or implied) as to its accuracy, completeness, timeliness or correctness for any particular purpose. Opinions and estimates are subject to change without notice. The publication and distribution of the information does not constitute nor does it imply any form of endorsement by DBS Group of any person, entity, services or products described or appearing in the information. Any past performance, projection, forecast or simulation of results is not necessarily indicative of the future or likely performance of any investment or securities. Foreign exchange transactions involve risks. You should note that fluctuations in foreign exchange rates may result in losses. You may wish to seek your own independent financial, tax, or legal advice or make such independent investigations as you consider necessary or appropriate.

The information published is not and does not constitute or form part of any offer, recommendation, invitation or solicitation to subscribe to or to enter into any transaction; nor is it calculated to invite, nor does it permit the making of offers to the public to subscribe to or enter into any transaction in any jurisdiction or country in which such offer, recommendation, invitation or solicitation is not authorised or to any person to whom it is unlawful to make such offer, recommendation, invitation or solicitation or where such offer, recommendation, invitation or solicitation would be contrary to law or regulation or which would subject DBS Group to any registration requirement within such jurisdiction or country, and should not be viewed as such. Without prejudice to the generality of the foregoing, the information, services or products described or appearing in the information are not specifically intended for or specifically targeted at the public in any specific jurisdiction.

The information is the property of DBS and is protected by applicable intellectual property laws. No reproduction, transmission, sale, distribution, publication, broadcast, circulation, modification, dissemination, or commercial exploitation such information in any manner (including electronic, print or other media now known or hereafter developed) is permitted.

DBS Group and its respective directors, officers and/or employees may have positions or other interests in, and may effect transactions in securities mentioned and may also perform or seek to perform broking, investment banking and other banking or financial services to any persons or entities mentioned.

To the maximum extent permitted by law, DBS Group accepts no liability for any losses or damages (including direct, special, indirect, consequential, incidental or loss of profits) of any kind arising from or in connection with any reliance and/or use of the information (including any error, omission or misstatement, negligent or otherwise) or further communication, even if DBS Group has been advised of the possibility thereof.

The information is not intended for distribution to, or use by, any person or entity in any jurisdiction or country where such distribution or use would be contrary to law or regulation. The information is distributed (a) in Singapore, by DBS Bank Ltd.; (b) in China, by DBS Bank (China) Ltd; (c) in Hong Kong, by DBS Bank (Hong Kong) Limited; (d) in Taiwan, by DBS Bank (Taiwan) Ltd; (e) in Indonesia, by PT DBS Indonesia; and (f) in India, by DBS Bank Ltd, Mumbai Branch.

Related Insights

- Rate Cut Outlook on Track13 Dec 2024

- CIO Insights 1Q25: Game Changers13 Dec 2024

- China Central Economic Work Conference and 3 objectives for 202513 Dec 2024

Related Insights

- Rate Cut Outlook on Track13 Dec 2024

- CIO Insights 1Q25: Game Changers13 Dec 2024

- China Central Economic Work Conference and 3 objectives for 202513 Dec 2024