- Despite recent share price volatility, we remain structurally bullish on Big Tech and AI on the basis of the latter’s deeply transformative nature

- In addition to technology, energy and healthcare are the non-tech sectors that are set to benefit from AI

- Healthcare is embracing digital enabling. AI, with its ability to analyse vast datasets, will turbocharge drug development

- In the energy space, AI will prove invaluable in unearthing green metal deposits and enhancing electrical grid management

- Whether it is Big Tech or non-tech adjacent expressions, AI plays continue to be a mainstay on growth side of Barbell Strategy

Related Insights

- Global Credit 1Q25 – Making Bonds Great Again23 Dec 2024

- Alternatives 1Q25: Gold – Resilience with Alternatives20 Dec 2024

- CIO Insights 1Q25: Game Changers20 Dec 2024

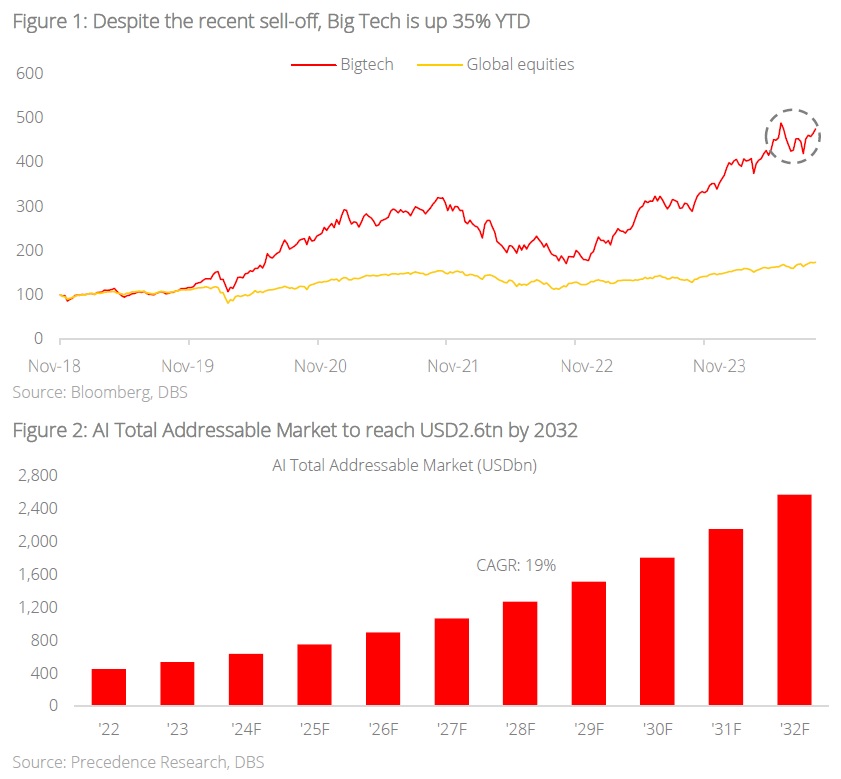

Big Tech under recent scrutiny. As Big Tech and Artificial Intelligence (AI) become increasingly established in the current investing zeitgeist, the associated shine and hype has been called into question. The past two earnings seasons have seen a palpable change in investor sentiment, from exuberance and optimism to that of increasing scrutiny and skepticism; will lofty investments in AI technology translate to earnings growth? This change in sentiment triggered a sharp tech-led market sell-down in July. While markets have since recovered, it is undeniable that the lens through which investors view this sector has become increasingly critical.

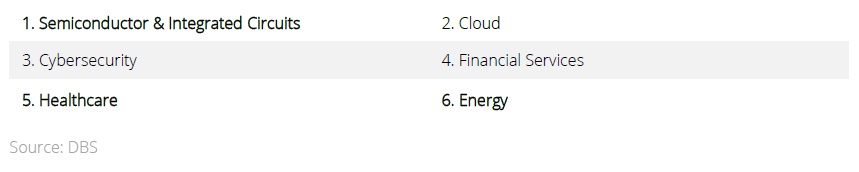

Look past market noise; AI is a multi-decade megatrend. Considering how AI is still in its nascent stages, it is not surprising that healthy skepticism comes on the back of AI’s initial hype. Nonetheless, it is important to keep sight of the long-term trajectory and runway for AI. Here at the DBS CIO office, we remain structurally and long-term bullish on the technology space as well as its adjacent expressions on the basis of AI’s deeply transformative nature. We believe that the commercialisation of AI will present numerous monetisation opportunities, and drive earnings growth and shareholder return across various sectors and verticals. Performance wise, Big Tech (as represented by the NYFANG Index) and the wider US technology sector remain up 35% and 32% on a YTD basis, suggesting that investors still possess a healthy dose of optimism when it comes to the technology sector and its AI-related prospects.

Energy and healthcare are non-tech sectors that will benefit from AI. Previously, in part two of this series (published 31 July 2024), we detailed how the financial services and cybersecurity industries were set to be key beneficiaries of the second leg of the AI-led Tech boom.

In the third and final part of this AI-focused series, we examine how non-tech sectors will also benefit from AI’s commercialisation, specifically the energy and healthcare sectors.

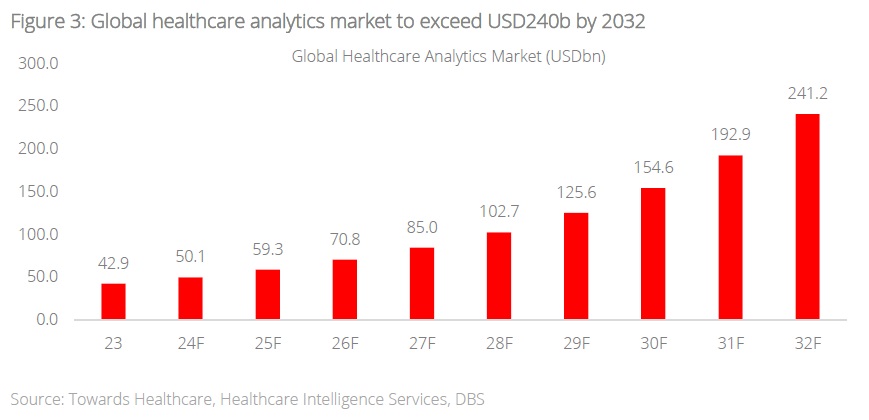

Healthcare – embracing digital disruption. AI’s reinvention of the healthcare industry is one of the biggest trends that will shape the future. The sector’s evolution has been kickstarted by the rapid integration of big data and analytics across various subsectors and applications, marking a transition from rudimentary digitalisation to sophisticated data-driven precision medicine. Big data in the healthcare space is expected to continue growing significantly; the global market for analytics in healthcare is expected to exceed USD240bn by 2032. Additionally, the widespread adoption of data analytics in healthcare is also laying the foundation for AI integration within the sector – the availability, quality, quantity, and relevance of data all directly impact the proper development and functioning of AI models.

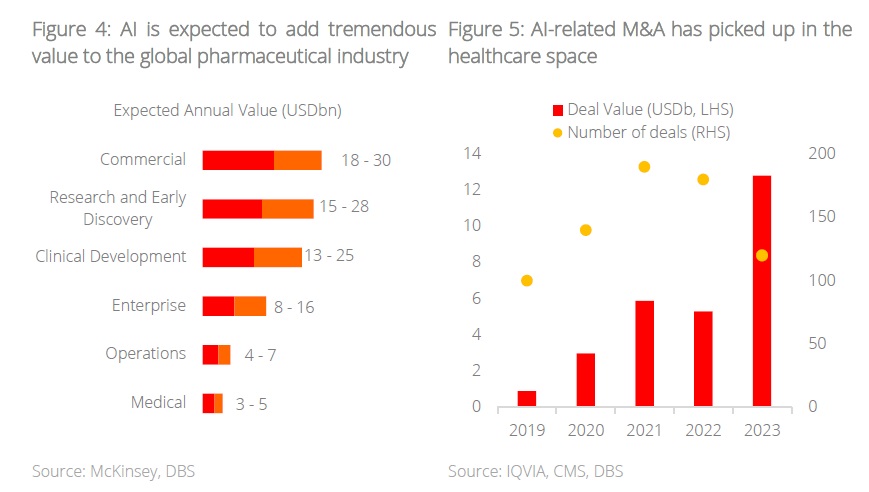

AI to turbocharge drug development. Pharmaceuticals is a healthcare subsector expected to benefit greatly from developments in AI. According to McKinsey, AI is slated to add USD60bn − USD110bn to the global pharmaceutical industry annually, with a large part of this figure attributed to research and early discovery. Identifying biological targets for drugs by way of traditional methods is a slow and expensive process; AI can expedite the process by analysing vast datasets of genetic and molecular information to pinpoint promising targets. For example, Insilico Medicine leveraged its AI platform to identify novel G protein-coupled receptors linked to Parkinson’s disease as potential targets for anti-inflammation and anti-cancer therapies. AI can also help to repurpose existing drugs and identify new use cases for them. Take for example South Korean biotech company Pharos iBio, which utilised its AI drug discovery platform Chemiverse to repurpose Phi-101 (a drug originally developed for leukemia) for the potential treatment of ovarian cancer.

A deluge of AI-related M&A in the pharmaceutical space. The benefits of AI in drug discovery have triggered a wave of M&A activity in 2023. According to IQVIA, AI-related M&A transactions performed by pharmaceutical companies totalled USD12.8bn in 2023, more than double the transactions in 2021 and 2022. Value per deal also more than tripled from an average of USD27mn in 2021 to USD98mn in 2023.

Enabling the transition to green energy. The global energy sector is arguably at a pivotal juncture; traditional fossil fuels remain a crucial primary energy source, but renewables are starting to form an increasing proportion of the global energy mix thanks to advancements in technology and an increasingly pressing need to address climate change. In the coming decades, the sector will increasingly embrace the “energy 3-D” ( Decentralisation, Digitalisation and Decarbonisation) and AI will be pivotal in this transformation.

AI is key in the search for green metal deposits. Historically, the success rate of mining exploration projects that eventually convert into operational mines has been low, with estimates of between 0.5% to 1.0%. To address this challenge, mining companies are now leveraging AI to increase their success rate and locate resources that have eluded traditional geological methods. Two notable examples of companies utilising AI to increase mining efficiency and profitability are KoBold Metals, and VerAI:

- KoBold Metals’ Mingomba project: KoBold Metals, a mining startup backed by Bill Gates and Jeff Bezos, uses AI to process diverse data sources including satellite imagery, drilling results and historical documents to build comprehensive maps of the Earth’s crust and increase the chances of finding metal deposits. One of the company’s most prominent projects is the Mingomba mine in Zambia, which is projected to be country’s largest copper mine once fully operational.

- VerAI’s ability to reduce exploration time and costs: VerAI has developed AI models based on known economic deposits to rapidly identify similar geological patterns in new datasets. It reportedly cuts the exploration timeline from 3-4 years to two months, while significantly reducing single exploration costs from USD3-5mn to USD250,000.

The increasing adoption of AI-powered mining will help to bridge the projected supply deficits for many green metals such as copper, nickel, cobalt, and lithium. Copper, in particular, is expected to face shortfalls as early as 2030. According to Bloomberg NEF, global copper mining output is expected to decline from 25mn tonnes in 2022 to 22mn tonnes by 2050 unless new geological discoveries and projects replenish existing reserves.

AI driving efficiency in smart power grids. AI’s ability to analyse vast datasets, encompassing consumption patterns and weather forecast, significantly boosts smart grid efficiency by anticipating and optimising electricity flow. Data from the International Energy Agency (IEA) indicates a notable trend in electricity grid investments, with a growing emphasis on digitalisation in recent years. The proportion of digital spending in grid investments rose from 14% in 2018 to 20% in 2022, highlighting the growing emphasis on smart grid technologies.

Beneficiaries include infrastructure and utility players. The increasing digitalisation of electric grids will also benefit the development of power utilities sector, specifically energy management analytics companies that provide solutions for energy distribution optimisation and waste reduction such as Schneider Electric and Ltron. Hardware and infrastructure providers will also benefit as utilities providers upgrade to smart grids - companies such as Hubbell, General Electric and ABB are likely to see increased demand for their products.

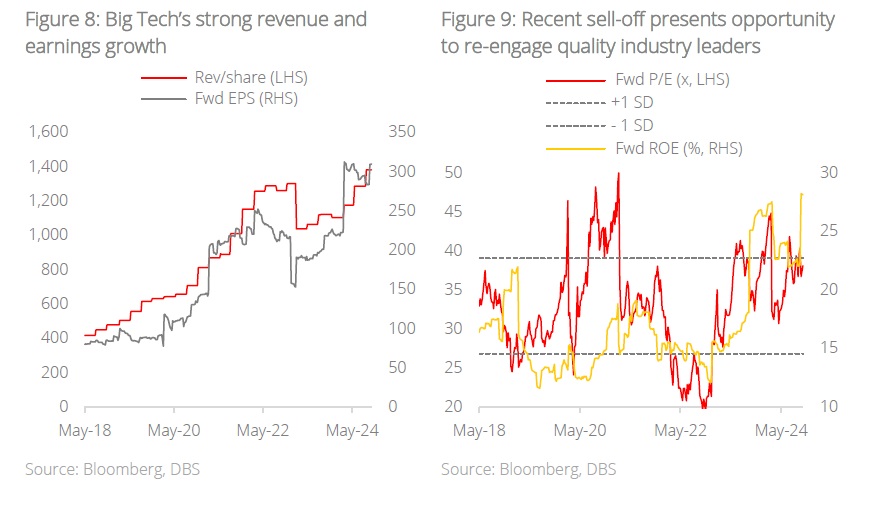

AI plays a mainstay on growth side of CIO Barbell Strategy. We continue to advocate for Big Tech as an expression of the AI megatrend on the growth end of the CIO Barbell Strategy. Despite recent retracements, its value proposition remains more compelling than ever. While some may argue that Big Tech’s valuations are stretched at 31x of 2025 earnings, we believe that its robust revenue and EPS growth justify its relatively premium valuations. When considering Big Tech’s superior growth, quality, pricing power and presence of economic moats, such valuation levels seem very reasonable.

In addition to Big Tech, investors should also look into specific verticals as well as non-tech adjacent sub-sectors highlighted in this series of reports (published 7 June 2024 and 31 July 2024) for additional growth opportunities with strong underlying growth fundamentals. Utilise the CIO I.D.E.A. framework to identify potential winners in the form of “Adaptors” and “Enablers” in the healthcare and energy sectors.

Topic

The information published by DBS Bank Ltd. (company registration no.: 196800306E) (“DBS”) is for information only. It is based on information or opinions obtained from sources believed to be reliable (but which have not been independently verified by DBS, its related companies and affiliates (“DBS Group”)) and to the maximum extent permitted by law, DBS Group does not make any representation or warranty (express or implied) as to its accuracy, completeness, timeliness or correctness for any particular purpose. Opinions and estimates are subject to change without notice. The publication and distribution of the information does not constitute nor does it imply any form of endorsement by DBS Group of any person, entity, services or products described or appearing in the information. Any past performance, projection, forecast or simulation of results is not necessarily indicative of the future or likely performance of any investment or securities. Foreign exchange transactions involve risks. You should note that fluctuations in foreign exchange rates may result in losses. You may wish to seek your own independent financial, tax, or legal advice or make such independent investigations as you consider necessary or appropriate.

The information published is not and does not constitute or form part of any offer, recommendation, invitation or solicitation to subscribe to or to enter into any transaction; nor is it calculated to invite, nor does it permit the making of offers to the public to subscribe to or enter into any transaction in any jurisdiction or country in which such offer, recommendation, invitation or solicitation is not authorised or to any person to whom it is unlawful to make such offer, recommendation, invitation or solicitation or where such offer, recommendation, invitation or solicitation would be contrary to law or regulation or which would subject DBS Group to any registration requirement within such jurisdiction or country, and should not be viewed as such. Without prejudice to the generality of the foregoing, the information, services or products described or appearing in the information are not specifically intended for or specifically targeted at the public in any specific jurisdiction.

The information is the property of DBS and is protected by applicable intellectual property laws. No reproduction, transmission, sale, distribution, publication, broadcast, circulation, modification, dissemination, or commercial exploitation such information in any manner (including electronic, print or other media now known or hereafter developed) is permitted.

DBS Group and its respective directors, officers and/or employees may have positions or other interests in, and may effect transactions in securities mentioned and may also perform or seek to perform broking, investment banking and other banking or financial services to any persons or entities mentioned.

To the maximum extent permitted by law, DBS Group accepts no liability for any losses or damages (including direct, special, indirect, consequential, incidental or loss of profits) of any kind arising from or in connection with any reliance and/or use of the information (including any error, omission or misstatement, negligent or otherwise) or further communication, even if DBS Group has been advised of the possibility thereof.

The information is not intended for distribution to, or use by, any person or entity in any jurisdiction or country where such distribution or use would be contrary to law or regulation. The information is distributed (a) in Singapore, by DBS Bank Ltd.; (b) in China, by DBS Bank (China) Ltd; (c) in Hong Kong, by DBS Bank (Hong Kong) Limited; (d) in Taiwan, by DBS Bank (Taiwan) Ltd; (e) in Indonesia, by PT DBS Indonesia; and (f) in India, by DBS Bank Ltd, Mumbai Branch.

Related Insights

- Global Credit 1Q25 – Making Bonds Great Again23 Dec 2024

- Alternatives 1Q25: Gold – Resilience with Alternatives20 Dec 2024

- CIO Insights 1Q25: Game Changers20 Dec 2024

Related Insights

- Global Credit 1Q25 – Making Bonds Great Again23 Dec 2024

- Alternatives 1Q25: Gold – Resilience with Alternatives20 Dec 2024

- CIO Insights 1Q25: Game Changers20 Dec 2024