- Year-to-date US auto sales volume remains stable at +0.6% y/y growth, with hybrid sales a bright spot with expanding market share

- The US Presidential Election presents uncertainties to the US EV industry; a Trump presidency could potentially weaken emission regulations and repeal EV tax credits, hurting EV companies like Tesla

- The US-China trade war also poses risks, as a ban on Chinese vehicles and technology could impact OEMs that export from China, such as Tesla, General Motors, and Ford

- Prefer Japanese automakers given their broad product line-up (e.g., ICE, hybrid, BEVs) and localised US vehicle production

Related Insights

- Alternatives 1Q25: Gold – Resilience with Alternatives20 Dec 2024

- CIO Insights 1Q25: Game Changers20 Dec 2024

- Bank of America19 Dec 2024

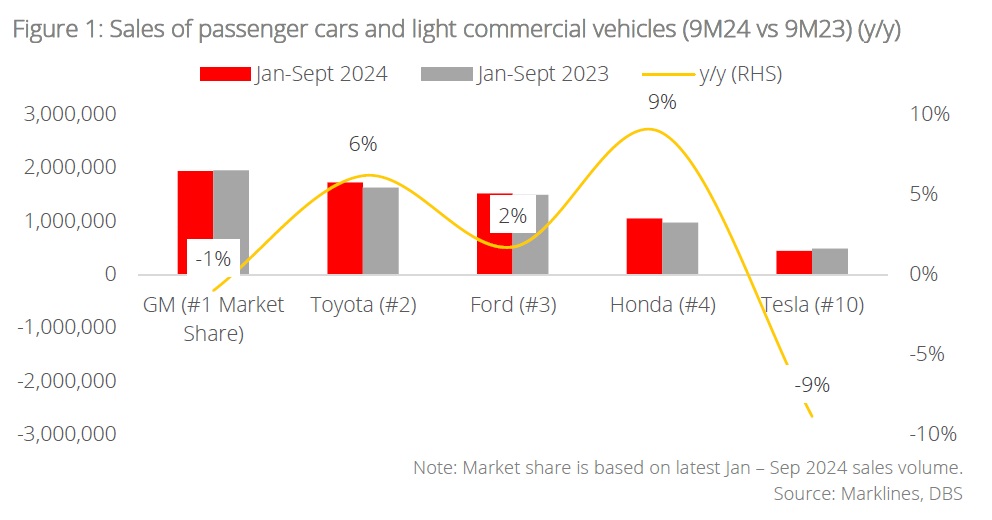

US auto sales volumes have remained stable, backed by robust hybrid demand. 9M24 light vehicle sales volume grew +0.6% y/y despite disrupted sales in Florida, Georgia, South Carolina, North Carolina, and Tennessee due to Hurricane Helene in Sep-24. Hybrid demand remains a bright spot in recent months, expanding its market share to 10% in 2Q24 (from 8.6% in 1Q24), compared to the slowing EV market with its flattish market share of 7%. Japanese automakers are major beneficiaries of the US’ burgeoning hybrid demand, with 9M24 sales growth rates ahead of its US peers (see Figure 1).

The US Presidential Election and ongoing US-China trade war present near-term uncertainties for US automakers. With Donald Trump being a vocal opponent against EVs, a Trump presidency could result in a setback for the US EV industry via a potential watering-down of (i) emission rules and/or (ii) Inflation Reduction Act (IRA) EV purchase tax credit (of up to USD7,500), which would negatively impact EV players. The ongoing US-China trade war is another headwind to watch, with the US Commerce Department’s latest proposal to ban Chinese vehicles and ‘connected car’ technology from US roads due to national security concerns. Given that “any vehicles that is manufactured in China would likely fall under the prohibitions”, according to the regulator, automakers that export cars out of China for sale in the US may see some impact.

Prefer Japanese automakers for hybrid-led growth and localised US manufacturing exposure. In view of the current uncertainties that lie ahead for US automakers, we recommend investors position themselves in Japanese automakers, due to their strategic advantage rising from a diverse product portfolio and localised US production, supported by the fact that North America accounts for >50% of their overall revenue. Furthermore, Japanese automakers offer a broad product line-up across ICE, hybrid and EVs, which makes them more resilient towards any changes in US emission rules and/or IRA EV tax credits. Their significant investments in US manufacturing will also mitigate the impact of the US-China trade war.

Topic

The information published by DBS Bank Ltd. (company registration no.: 196800306E) (“DBS”) is for information only. It is based on information or opinions obtained from sources believed to be reliable (but which have not been independently verified by DBS, its related companies and affiliates (“DBS Group”)) and to the maximum extent permitted by law, DBS Group does not make any representation or warranty (express or implied) as to its accuracy, completeness, timeliness or correctness for any particular purpose. Opinions and estimates are subject to change without notice. The publication and distribution of the information does not constitute nor does it imply any form of endorsement by DBS Group of any person, entity, services or products described or appearing in the information. Any past performance, projection, forecast or simulation of results is not necessarily indicative of the future or likely performance of any investment or securities. Foreign exchange transactions involve risks. You should note that fluctuations in foreign exchange rates may result in losses. You may wish to seek your own independent financial, tax, or legal advice or make such independent investigations as you consider necessary or appropriate.

The information published is not and does not constitute or form part of any offer, recommendation, invitation or solicitation to subscribe to or to enter into any transaction; nor is it calculated to invite, nor does it permit the making of offers to the public to subscribe to or enter into any transaction in any jurisdiction or country in which such offer, recommendation, invitation or solicitation is not authorised or to any person to whom it is unlawful to make such offer, recommendation, invitation or solicitation or where such offer, recommendation, invitation or solicitation would be contrary to law or regulation or which would subject DBS Group to any registration requirement within such jurisdiction or country, and should not be viewed as such. Without prejudice to the generality of the foregoing, the information, services or products described or appearing in the information are not specifically intended for or specifically targeted at the public in any specific jurisdiction.

The information is the property of DBS and is protected by applicable intellectual property laws. No reproduction, transmission, sale, distribution, publication, broadcast, circulation, modification, dissemination, or commercial exploitation such information in any manner (including electronic, print or other media now known or hereafter developed) is permitted.

DBS Group and its respective directors, officers and/or employees may have positions or other interests in, and may effect transactions in securities mentioned and may also perform or seek to perform broking, investment banking and other banking or financial services to any persons or entities mentioned.

To the maximum extent permitted by law, DBS Group accepts no liability for any losses or damages (including direct, special, indirect, consequential, incidental or loss of profits) of any kind arising from or in connection with any reliance and/or use of the information (including any error, omission or misstatement, negligent or otherwise) or further communication, even if DBS Group has been advised of the possibility thereof.

The information is not intended for distribution to, or use by, any person or entity in any jurisdiction or country where such distribution or use would be contrary to law or regulation. The information is distributed (a) in Singapore, by DBS Bank Ltd.; (b) in China, by DBS Bank (China) Ltd; (c) in Hong Kong, by DBS Bank (Hong Kong) Limited; (d) in Taiwan, by DBS Bank (Taiwan) Ltd; (e) in Indonesia, by PT DBS Indonesia; and (f) in India, by DBS Bank Ltd, Mumbai Branch.

Related Insights

- Alternatives 1Q25: Gold – Resilience with Alternatives20 Dec 2024

- CIO Insights 1Q25: Game Changers20 Dec 2024

- Bank of America19 Dec 2024

Related Insights

- Alternatives 1Q25: Gold – Resilience with Alternatives20 Dec 2024

- CIO Insights 1Q25: Game Changers20 Dec 2024

- Bank of America19 Dec 2024