- China Technology to experience massive re-rating amid revival of interest in China equities

- China internet players’ earnings largely above consensus forecasts in 2Q24

- Competition heating up amongst e-commerce players as the latter set sights on market share gains

- Benign competition in local life services, food delivery, and online travel is positive for earnings outlook

- Preference for: (1) Companies that benefit from cloud-driven growth, and (2) diversified global e-commerce business with exposure to Asia and Latin America

Related Insights

- ECB Eases Amid Disinflation25 Oct 2024

- Mapletree Industrial Trust25 Oct 2024

- Singapore Equity Picks25 Oct 2024

2Q24 earnings mostly ahead of expectations despite weak economy. The latest quarterly earnings of China internet companies were above expectations and this is largely due to operating efficiency gains. Margin improvement and benign competitive backdrop more than offset adverse revenue impact from end demand weakness. Notably, e-commerce industry leaders signalled their intent for market share gains that will inevitably translate to margin headwinds.

Huge focus on monetisation and revival in cloud growth. We see benign competition across local consumer services, food delivery, and online travel industries. This stands in stark contrast to last year’s aggressive posture from Douyin – a company grappling with severe cash burn. Douyin doubled the take rate in hotel booking services, dining verticals, and various offline to online services. Rising competition in these areas led to higher cash burn and this explains the need for Douyin to re-focus on monetisation.

Updates on the competitive environment in other segments:

- Food Delivery: Competition in the food delivery segment remains rational. Market leader, Meituan, is able to group multiple customers in real-time to reduce the unit cost of delivery, making it more affordable for budget-conscious customers.

- Cloud Services: Revenue is expected to accelerate in the second half of 2024, led by higher demand for Gen-AI. Chinese regulators recently commented in August that market leader, Alibaba, has completed three years of "rectification" following a fine levied in 2021 for monopolistic behaviour. That said, competition in the e-commerce space is expected to remain intense as Alibaba plans to maintain its market share.

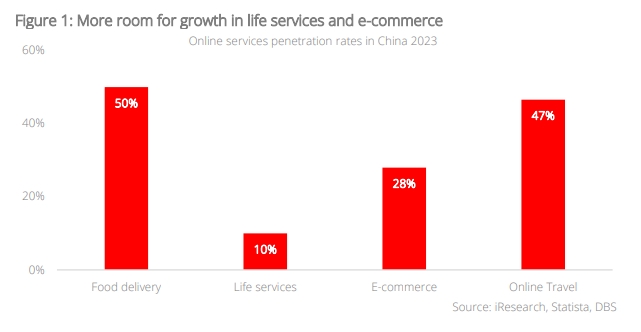

Focus on market leaders in local-life services, food delivery, cloud, and online travel industries; preference for select diversified e-commerce players. Local life services and food delivery offer higher growth potential as competition is limited to only two main players. We also favour online travel players amid staff-cost reduction with the implementation of AI at their contact centres.

Focus on market leaders in local-life services, food delivery, cloud, and online travel industries; preference for select diversified e-commerce players. Local life services and food delivery offer higher growth potential as competition is limited to only two main players. We also favour online travel players amid staff-cost reduction with the implementation of AI at their contact centres.

Topic

The information published by DBS Bank Ltd. (company registration no.: 196800306E) (“DBS”) is for information only. It is based on information or opinions obtained from sources believed to be reliable (but which have not been independently verified by DBS, its related companies and affiliates (“DBS Group”)) and to the maximum extent permitted by law, DBS Group does not make any representation or warranty (express or implied) as to its accuracy, completeness, timeliness or correctness for any particular purpose. Opinions and estimates are subject to change without notice. The publication and distribution of the information does not constitute nor does it imply any form of endorsement by DBS Group of any person, entity, services or products described or appearing in the information. Any past performance, projection, forecast or simulation of results is not necessarily indicative of the future or likely performance of any investment or securities. Foreign exchange transactions involve risks. You should note that fluctuations in foreign exchange rates may result in losses. You may wish to seek your own independent financial, tax, or legal advice or make such independent investigations as you consider necessary or appropriate.

The information published is not and does not constitute or form part of any offer, recommendation, invitation or solicitation to subscribe to or to enter into any transaction; nor is it calculated to invite, nor does it permit the making of offers to the public to subscribe to or enter into any transaction in any jurisdiction or country in which such offer, recommendation, invitation or solicitation is not authorised or to any person to whom it is unlawful to make such offer, recommendation, invitation or solicitation or where such offer, recommendation, invitation or solicitation would be contrary to law or regulation or which would subject DBS Group to any registration requirement within such jurisdiction or country, and should not be viewed as such. Without prejudice to the generality of the foregoing, the information, services or products described or appearing in the information are not specifically intended for or specifically targeted at the public in any specific jurisdiction.

The information is the property of DBS and is protected by applicable intellectual property laws. No reproduction, transmission, sale, distribution, publication, broadcast, circulation, modification, dissemination, or commercial exploitation such information in any manner (including electronic, print or other media now known or hereafter developed) is permitted.

DBS Group and its respective directors, officers and/or employees may have positions or other interests in, and may effect transactions in securities mentioned and may also perform or seek to perform broking, investment banking and other banking or financial services to any persons or entities mentioned.

To the maximum extent permitted by law, DBS Group accepts no liability for any losses or damages (including direct, special, indirect, consequential, incidental or loss of profits) of any kind arising from or in connection with any reliance and/or use of the information (including any error, omission or misstatement, negligent or otherwise) or further communication, even if DBS Group has been advised of the possibility thereof.

The information is not intended for distribution to, or use by, any person or entity in any jurisdiction or country where such distribution or use would be contrary to law or regulation. The information is distributed (a) in Singapore, by DBS Bank Ltd.; (b) in China, by DBS Bank (China) Ltd; (c) in Hong Kong, by DBS Bank (Hong Kong) Limited; (d) in Taiwan, by DBS Bank (Taiwan) Ltd; (e) in Indonesia, by PT DBS Indonesia; and (f) in India, by DBS Bank Ltd, Mumbai Branch.

Related Insights

- ECB Eases Amid Disinflation25 Oct 2024

- Mapletree Industrial Trust25 Oct 2024

- Singapore Equity Picks25 Oct 2024

Related Insights

- ECB Eases Amid Disinflation25 Oct 2024

- Mapletree Industrial Trust25 Oct 2024

- Singapore Equity Picks25 Oct 2024