- Equities: Global equities rallied last week, driven by PBOC’s policy stimulus and government’s strong commitment to meet its 2024 economic growth target

- Credit: With the Fed lowering rates, IG credit is catching up to short-dated credit due to its higher sensitivity to rate cuts; a barbell strategy, balancing both short and long durations, may optimise returns

- FX: DXY to test support level at 100 after failing to push above 101 over past fortnight; USD/CNH to extend its fall below 7.00 following last week’s 0.9% decline

- Rates: Loose financial conditions and stable data points to drive US yields higher; steepening—which played out significantly over past three months—to take a pause

- The Week Ahead: Keep a lookout for US Change in Nonfarm Payrolls; Japan Jobless Rate

Related Insights

- ECB Eases Amid Disinflation25 Oct 2024

- Mapletree Industrial Trust25 Oct 2024

- Singapore Equity Picks25 Oct 2024

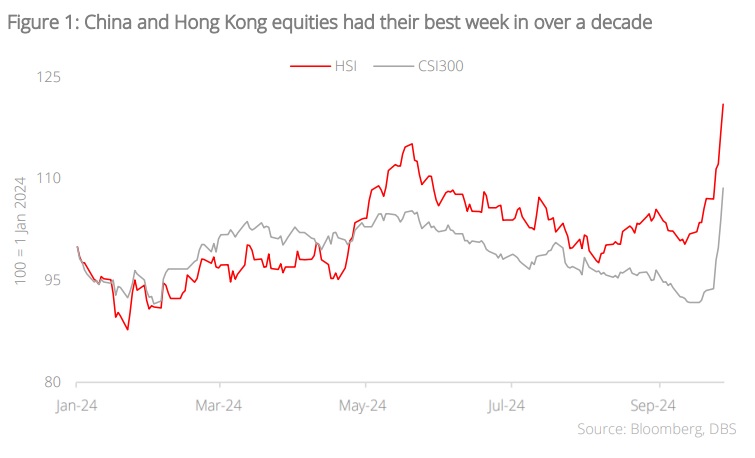

China’s supportive policies lift markets. Global equity markets extended their upward trajectory last week, buoyed by China’s policy stimulus aimed at reviving its struggling economy. The People’s Bank of China (PBOC) lowered its reserve requirement ratio (RRR) by 50 bps, reduced its seven-day reverse repo rate by 20 bps and cut its medium-term lending facility rate by 30 bps. Furthermore, in the Politburo meeting last Thursday, China’s leaders emphasised the need to drive recovery in their property market and vowed to deploy the necessary fiscal spending to achieve its 2024 economic growth target of 5%. This fuelled optimism in the China equities market with CSI 300 and SHCOMP surging 15.7% and 12.8% respectively.

Major equity indices across regions also notched positive performances last week. The NASDAQ gained 1.0% while the S&P 500 and Dow Jones were up 0.6%. In Europe, the Stoxx 600 and FTSE 100 rose 2.7% and 1.1% respectively. Markets also ended the week positively in Japan with the Nikkei-225 surging 5.6%.

Topic in focus: China Equities – Markets rally on policy easing. The PBOC has recently announced a series of policy easing measures, including the reduction of the RRR and adjustments to policy and mortgage rates. These efforts aim to stimulate investment, enhance liquidity, and restore confidence in financial markets. Coupled with other supportive tailwinds such as the US Fed’s rate cut cycle, a weakening dollar, and investors’ underweight positioning in China equities, China and Hong Kong equities rallied significantly last week; the Hang Seng Index and CSI300 gained 13.0% an 15.7% for the week ending 27 Sep.

While these policies take aim at the sustained recovery of the stock market and broader GDP growth, their effectiveness and successful implementation remain to be seen. Nonetheless, these recent steps have undoubtedly boosted near-term sentiment and raised market expectations. For clients who are underinvested in China equities, this presents an opportunity to add large-cap and index heavy-weights such as technology leaders and quality growth stocks that are at the fore of favourable liquidity flows. On the income side, stay invested in large state banks for reliable dividend yields amid a falling rate environment.

Download the PDF to read the full report which includes coverage on Credit, FX, Rates, and Thematics.

Topic

The information published by DBS Bank Ltd. (company registration no.: 196800306E) (“DBS”) is for information only. It is based on information or opinions obtained from sources believed to be reliable (but which have not been independently verified by DBS, its related companies and affiliates (“DBS Group”)) and to the maximum extent permitted by law, DBS Group does not make any representation or warranty (express or implied) as to its accuracy, completeness, timeliness or correctness for any particular purpose. Opinions and estimates are subject to change without notice. The publication and distribution of the information does not constitute nor does it imply any form of endorsement by DBS Group of any person, entity, services or products described or appearing in the information. Any past performance, projection, forecast or simulation of results is not necessarily indicative of the future or likely performance of any investment or securities. Foreign exchange transactions involve risks. You should note that fluctuations in foreign exchange rates may result in losses. You may wish to seek your own independent financial, tax, or legal advice or make such independent investigations as you consider necessary or appropriate.

The information published is not and does not constitute or form part of any offer, recommendation, invitation or solicitation to subscribe to or to enter into any transaction; nor is it calculated to invite, nor does it permit the making of offers to the public to subscribe to or enter into any transaction in any jurisdiction or country in which such offer, recommendation, invitation or solicitation is not authorised or to any person to whom it is unlawful to make such offer, recommendation, invitation or solicitation or where such offer, recommendation, invitation or solicitation would be contrary to law or regulation or which would subject DBS Group to any registration requirement within such jurisdiction or country, and should not be viewed as such. Without prejudice to the generality of the foregoing, the information, services or products described or appearing in the information are not specifically intended for or specifically targeted at the public in any specific jurisdiction.

The information is the property of DBS and is protected by applicable intellectual property laws. No reproduction, transmission, sale, distribution, publication, broadcast, circulation, modification, dissemination, or commercial exploitation such information in any manner (including electronic, print or other media now known or hereafter developed) is permitted.

DBS Group and its respective directors, officers and/or employees may have positions or other interests in, and may effect transactions in securities mentioned and may also perform or seek to perform broking, investment banking and other banking or financial services to any persons or entities mentioned.

To the maximum extent permitted by law, DBS Group accepts no liability for any losses or damages (including direct, special, indirect, consequential, incidental or loss of profits) of any kind arising from or in connection with any reliance and/or use of the information (including any error, omission or misstatement, negligent or otherwise) or further communication, even if DBS Group has been advised of the possibility thereof.

The information is not intended for distribution to, or use by, any person or entity in any jurisdiction or country where such distribution or use would be contrary to law or regulation. The information is distributed (a) in Singapore, by DBS Bank Ltd.; (b) in China, by DBS Bank (China) Ltd; (c) in Hong Kong, by DBS Bank (Hong Kong) Limited; (d) in Taiwan, by DBS Bank (Taiwan) Ltd; (e) in Indonesia, by PT DBS Indonesia; and (f) in India, by DBS Bank Ltd, Mumbai Branch.

Related Insights

- ECB Eases Amid Disinflation25 Oct 2024

- Mapletree Industrial Trust25 Oct 2024

- Singapore Equity Picks25 Oct 2024

Related Insights

- ECB Eases Amid Disinflation25 Oct 2024

- Mapletree Industrial Trust25 Oct 2024

- Singapore Equity Picks25 Oct 2024