- Oral glucagon-like peptide-1 (GLP-1) drugs are increasingly replacing insulin for type 2 diabetes (T2D) treatment

- Replacement will accelerate from 8% of global diabetes prescriptions in 2023 to 12% by 2026F due to a drug launch in 2H24 and expected positive clinical data in 1H25

- Negative for insulin makers with high reliance on insulin sales, due to global insulin sales expected to fall at -3.4% CAGR from 2023-26F

- Insulin pump makers will also be negatively impacted by the sluggish insulin sales

Related Insights

- Cloudy Outlook Ahead30 Aug 2024

- FX Tactical Ideas: Long AUD-NZD at Bottom of Ascending Channel30 Aug 2024

- CDL Hospitality Trusts30 Aug 2024

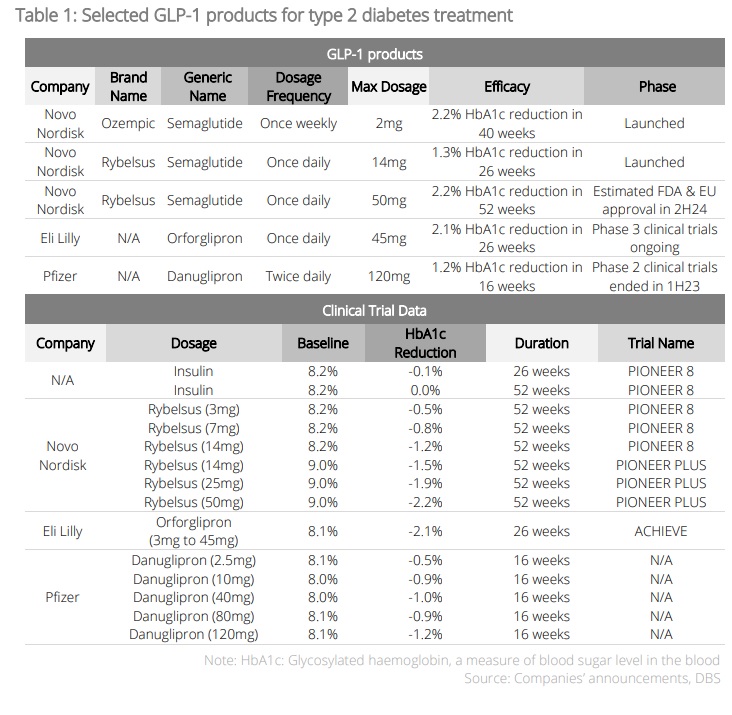

Oral glucagon-like peptide-1 (GLP-1) drugs are accelerating replacement of insulin. GLP-1 drugs have been gaining popularity for the treatment of type 2 diabetes (T2D) due to once-weekly injections vs thrice-daily for insulin, replacing insulin in 8% (or 35mn) of global diabetes prescriptions in 2023. This is expected to accelerate to 12% (or 62mn) by 2026F due to developments in oral GLP-1 drugs, including a new drug launch in 2H24 and expected positive clinical trial readout in 1H25.

Negative for insulin makers. With insulin slowly being replaced in the context of diabetes treatment, insulin makers with high reliance on insulin sales have taken a hit, some with share prices falling over 50% in the past three years. With the introduction of high efficacy oral GLP-1 drugs expected in 2H24, insulin sales are expected to continue experiencing a cut of -3.4% CAGR from 2023-26F. Additionally, oral GLP-1 patents will expire in China in 2026. Cheaper generics are expected to bring oral GLP-1 cost down from 7.5x that of insulin to 1.3x, increasing GLP-1 uptake and putting insulin makers at a higher disadvantage.

Insulin pump makers would take a deeper cut on sluggish insulin sales. Insulin pumps are small devices used for periodic insulin delivery. In 2018, 2.8mn adults in the US used insulin pumps, half of which are T2D patients. On 1 Jan 2025, US insurance coverage plans will set new coverage terms and are expected to increase GLP-1 coverage, dealing a deeper cut to insulin sales. Insulin pump makers will also be negatively impacted by the sluggish insulin sales.

Topic

The information published by DBS Bank Ltd. (company registration no.: 196800306E) (“DBS”) is for information only. It is based on information or opinions obtained from sources believed to be reliable (but which have not been independently verified by DBS, its related companies and affiliates (“DBS Group”)) and to the maximum extent permitted by law, DBS Group does not make any representation or warranty (express or implied) as to its accuracy, completeness, timeliness or correctness for any particular purpose. Opinions and estimates are subject to change without notice. The publication and distribution of the information does not constitute nor does it imply any form of endorsement by DBS Group of any person, entity, services or products described or appearing in the information. Any past performance, projection, forecast or simulation of results is not necessarily indicative of the future or likely performance of any investment or securities. Foreign exchange transactions involve risks. You should note that fluctuations in foreign exchange rates may result in losses. You may wish to seek your own independent financial, tax, or legal advice or make such independent investigations as you consider necessary or appropriate.

The information published is not and does not constitute or form part of any offer, recommendation, invitation or solicitation to subscribe to or to enter into any transaction; nor is it calculated to invite, nor does it permit the making of offers to the public to subscribe to or enter into any transaction in any jurisdiction or country in which such offer, recommendation, invitation or solicitation is not authorised or to any person to whom it is unlawful to make such offer, recommendation, invitation or solicitation or where such offer, recommendation, invitation or solicitation would be contrary to law or regulation or which would subject DBS Group to any registration requirement within such jurisdiction or country, and should not be viewed as such. Without prejudice to the generality of the foregoing, the information, services or products described or appearing in the information are not specifically intended for or specifically targeted at the public in any specific jurisdiction.

The information is the property of DBS and is protected by applicable intellectual property laws. No reproduction, transmission, sale, distribution, publication, broadcast, circulation, modification, dissemination, or commercial exploitation such information in any manner (including electronic, print or other media now known or hereafter developed) is permitted.

DBS Group and its respective directors, officers and/or employees may have positions or other interests in, and may effect transactions in securities mentioned and may also perform or seek to perform broking, investment banking and other banking or financial services to any persons or entities mentioned.

To the maximum extent permitted by law, DBS Group accepts no liability for any losses or damages (including direct, special, indirect, consequential, incidental or loss of profits) of any kind arising from or in connection with any reliance and/or use of the information (including any error, omission or misstatement, negligent or otherwise) or further communication, even if DBS Group has been advised of the possibility thereof.

The information is not intended for distribution to, or use by, any person or entity in any jurisdiction or country where such distribution or use would be contrary to law or regulation. The information is distributed (a) in Singapore, by DBS Bank Ltd.; (b) in China, by DBS Bank (China) Ltd; (c) in Hong Kong, by DBS Bank (Hong Kong) Limited; (d) in Taiwan, by DBS Bank (Taiwan) Ltd; (e) in Indonesia, by PT DBS Indonesia; and (f) in India, by DBS Bank Ltd, Mumbai Branch.

Related Insights

- Cloudy Outlook Ahead30 Aug 2024

- FX Tactical Ideas: Long AUD-NZD at Bottom of Ascending Channel30 Aug 2024

- CDL Hospitality Trusts30 Aug 2024

Related Insights

- Cloudy Outlook Ahead30 Aug 2024

- FX Tactical Ideas: Long AUD-NZD at Bottom of Ascending Channel30 Aug 2024

- CDL Hospitality Trusts30 Aug 2024