- Authorities expected to introduce more supportive measures to stabilise the real estate industry and prevent it from triggering contagion effects

- China’s economic transformation to continue with the establishment of new drivers in the development of next-gen technology, software, new energy, and new materials

- Semiconductors remain a priority, China is expected to continue deployment of expenditure to equipment procurement and reinforce homegrown R&D capabilities

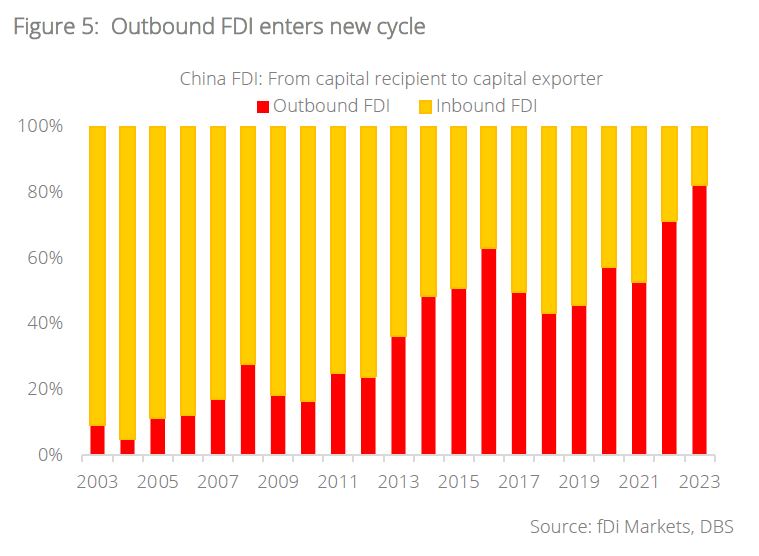

- China turned net outbound FDI since 2020 in a bid to diversify input sources, hedge against rising costs, and tap into new markets

- China’s floor valuations are backed by low-to-mid teens of earnings growth over the next two to three years

Related Insights

- Cloudy Outlook Ahead30 Aug 2024

- FX Tactical Ideas: Long AUD-NZD at Bottom of Ascending Channel30 Aug 2024

- CDL Hospitality Trusts30 Aug 2024

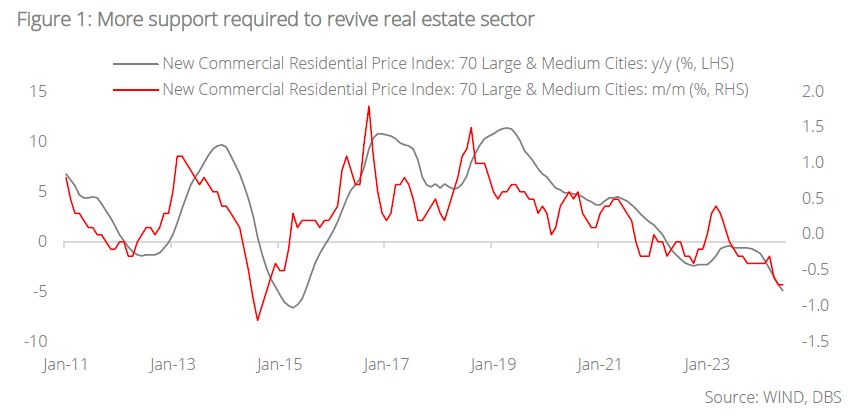

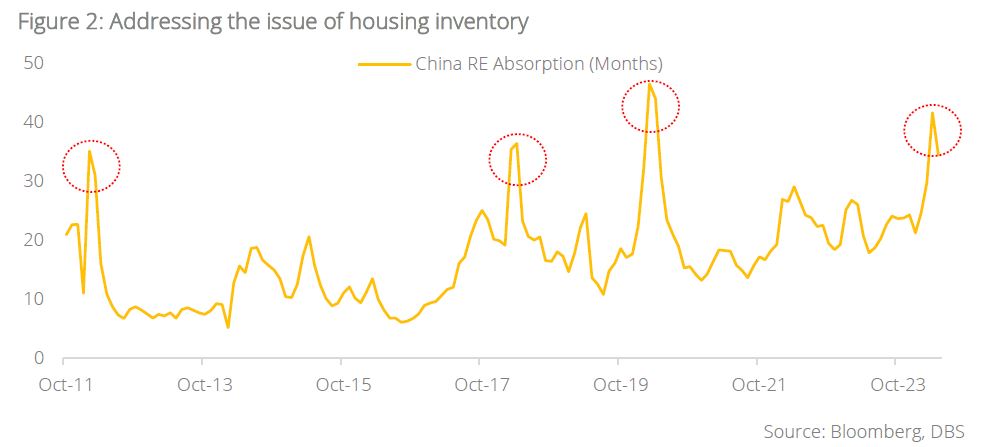

Current stimulus insufficient to turn around the property sector, expect more support. The Chinese government has rolled out a series of stimulus measures to stabilise the waning real estate sector. These policies include the removal of a floor on mortgage rates, adjustments to downpayment ratios, and absorption of unsold units. However, an ongoing weakness in home prices indicates that more support measures are needed.

Measures to absorb excess property inventory is timely and on the right track. The move to distribute a CNY300bn relending package for local State Owned Enterprises (SOEs) to purchase unsold properties and convert them into social housing underscores the authority’s determination to ensure housing delivery, digest inventory, as well as alleviate developers' balance sheets and cash flow burdens. As real estate accounts for a substantial proportion of household assets, a gradual stabilisation of the property sector will ease the public’s stance on precautionary savings and boost consumption.

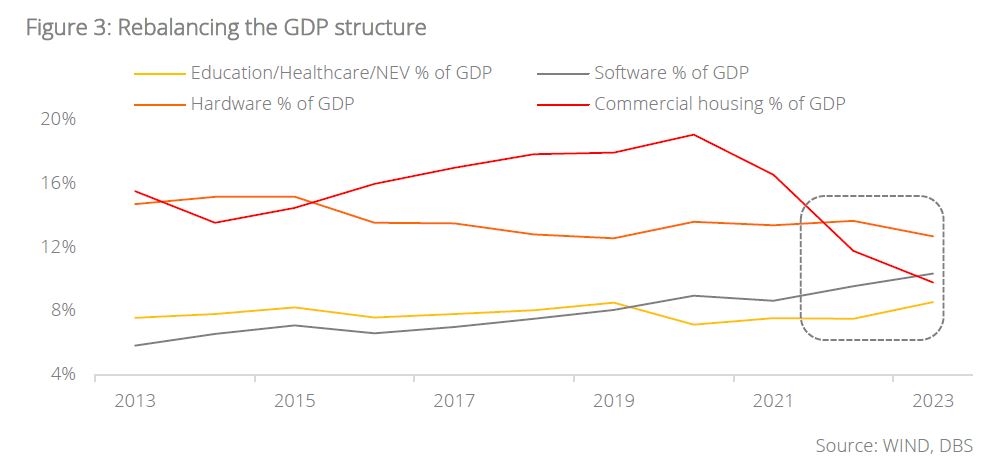

Strategic shift in growth drivers. The country continues to transform into a new economic model which reduces its dependence on traditional industries. Against this backdrop, there has been an ongoing shift into new growth drivers such as upstream technology components, software, and education, healthcare, and new energy transition.

In 2023, technology components accounted for 13% of GDP while software made up 10%, both at levels above the contribution of real estate. Similarly, the combined weight of education, healthcare, and new energy reached a consequential 9%.

China's accelerating innovations in next-generation technology, software, artificial intelligence, quantum science, biotechnology, new energy, and new materials (solar, batteries) will play integral roles in the advancement of digitalisation and the new energy transition, thus aligning with the government’s “New Productive Force” blueprint. This phenomenon points towards the emergence of new industries bolstered by strong policy support to provide a substantial runway for future growth, plugging the gap resulting from the decline in real estate.

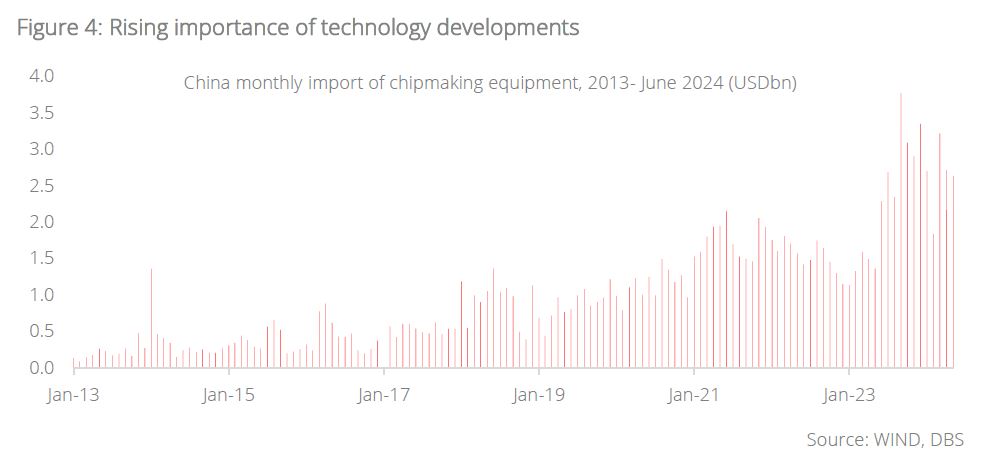

Intensifying semiconductor innovations and homegrown R&D. The strategic goal of establishing China as a science and technology powerhouse by 2035 is evident. To support the development of integrated circuit (IC) design, including manufacturing, design, packaging and testing, the government established three National IC Industry Investment Funds, with investments of USD22bn in 2014, USD30bn in 2019, and USD50bn in 2023. Remarkably, in 2023, imports of semiconductor manufacturing equipment reached USD27.4bn, an annual increase of 28.7%.

In the first five months of 2024, the number increased to a monthly average of USD2.53bn, representing a 10% growth from last year’s monthly average, and 2.5x of the past 10 years’ monthly average of USD1bn. We expect R&D efforts to intensify, targeting bottlenecks and technology development constraints in areas such as integrated circuits, semiconductor equipment, advanced materials, and wafer foundry. With a proper implementation roadmap, coupled with the tailwinds of global semiconductor demand, China is set to capture the wave of next-generation technology innovation and emerge as a significant player, building a formidable homegrown semiconductor supply chain, thereby aligning with its strategic goals for higher technological self-reliance and economic transformation.

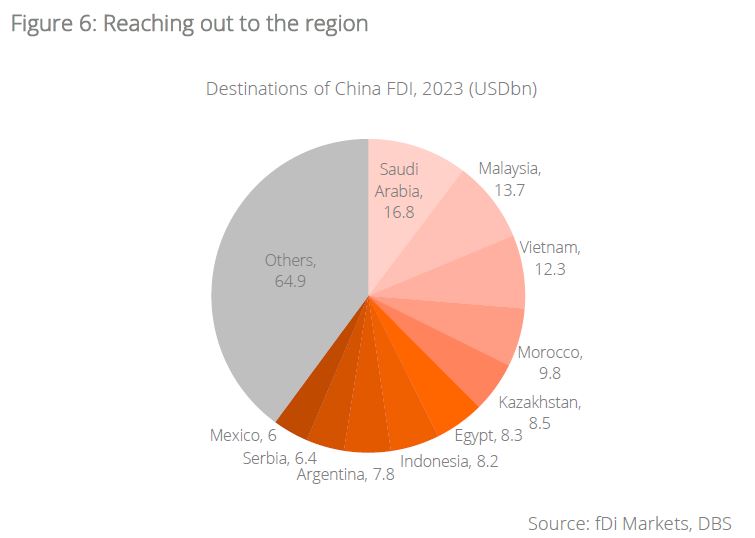

FDI: from recipient to contributor. Over the years, China has transitioned from a net FDI recipient to a net capital exporter as local firms leveraged the "China+1" trend to embark on regional expansions. The creation of world-class companies across various industries has facilitated this shift where neighboring countries including Malaysia, Vietnam, and Indonesia account for a considerable proportion of China's immense outbound foreign direct investment (FDI). The Middle East, rich in oil and gas resources, has also been a major recipient of China outbound FDI.

This geographical diversification not only enables China industries to hedge input costs, but also tap into new end markets in recipient countries and strengthen bilateral ties, enhancing Chinese corporates' long-term revenue mix and growth opportunities. By investing in other countries, China can navigate global trade patterns and secure crucial resources, circumventing potential tariffs and sanctions

Valuation support. We anticipate stabilisation in Chinese equities, poised for further rerating. At 10x forward PER, the China market is supported at 1SD below historical mean, while backed by projected earnings growth of 11% and 12% in 2024 and 2025 respectively.

This backdrop presents an attractive opportunity for re-rating, as fundamentals continue to improve on the back of policy support and market reforms. We remain constructive on China, focusing on thematic positioning in domestic consumption, technology development, platform companies, software, energy transition, and dividend yielding large cap financials.

Topic

The information published by DBS Bank Ltd. (company registration no.: 196800306E) (“DBS”) is for information only. It is based on information or opinions obtained from sources believed to be reliable (but which have not been independently verified by DBS, its related companies and affiliates (“DBS Group”)) and to the maximum extent permitted by law, DBS Group does not make any representation or warranty (express or implied) as to its accuracy, completeness, timeliness or correctness for any particular purpose. Opinions and estimates are subject to change without notice. The publication and distribution of the information does not constitute nor does it imply any form of endorsement by DBS Group of any person, entity, services or products described or appearing in the information. Any past performance, projection, forecast or simulation of results is not necessarily indicative of the future or likely performance of any investment or securities. Foreign exchange transactions involve risks. You should note that fluctuations in foreign exchange rates may result in losses. You may wish to seek your own independent financial, tax, or legal advice or make such independent investigations as you consider necessary or appropriate.

The information published is not and does not constitute or form part of any offer, recommendation, invitation or solicitation to subscribe to or to enter into any transaction; nor is it calculated to invite, nor does it permit the making of offers to the public to subscribe to or enter into any transaction in any jurisdiction or country in which such offer, recommendation, invitation or solicitation is not authorised or to any person to whom it is unlawful to make such offer, recommendation, invitation or solicitation or where such offer, recommendation, invitation or solicitation would be contrary to law or regulation or which would subject DBS Group to any registration requirement within such jurisdiction or country, and should not be viewed as such. Without prejudice to the generality of the foregoing, the information, services or products described or appearing in the information are not specifically intended for or specifically targeted at the public in any specific jurisdiction.

The information is the property of DBS and is protected by applicable intellectual property laws. No reproduction, transmission, sale, distribution, publication, broadcast, circulation, modification, dissemination, or commercial exploitation such information in any manner (including electronic, print or other media now known or hereafter developed) is permitted.

DBS Group and its respective directors, officers and/or employees may have positions or other interests in, and may effect transactions in securities mentioned and may also perform or seek to perform broking, investment banking and other banking or financial services to any persons or entities mentioned.

To the maximum extent permitted by law, DBS Group accepts no liability for any losses or damages (including direct, special, indirect, consequential, incidental or loss of profits) of any kind arising from or in connection with any reliance and/or use of the information (including any error, omission or misstatement, negligent or otherwise) or further communication, even if DBS Group has been advised of the possibility thereof.

The information is not intended for distribution to, or use by, any person or entity in any jurisdiction or country where such distribution or use would be contrary to law or regulation. The information is distributed (a) in Singapore, by DBS Bank Ltd.; (b) in China, by DBS Bank (China) Ltd; (c) in Hong Kong, by DBS Bank (Hong Kong) Limited; (d) in Taiwan, by DBS Bank (Taiwan) Ltd; (e) in Indonesia, by PT DBS Indonesia; and (f) in India, by DBS Bank Ltd, Mumbai Branch.

Related Insights

- Cloudy Outlook Ahead30 Aug 2024

- FX Tactical Ideas: Long AUD-NZD at Bottom of Ascending Channel30 Aug 2024

- CDL Hospitality Trusts30 Aug 2024

Related Insights

- Cloudy Outlook Ahead30 Aug 2024

- FX Tactical Ideas: Long AUD-NZD at Bottom of Ascending Channel30 Aug 2024

- CDL Hospitality Trusts30 Aug 2024