- CFTC data shows that bearish bets against the yen have come down sharply in recent weeks, with the unwinding showing signs of fatigue

- Risk appetite should continue stabilising; markets are expecting normalcy to return, especially in the FX space

- As the JPY remains one of the lowest yielding currencies, yen carry trades should return to favour after this rout, especially as yields fall further, and the yen shows room to weaken; Japan equities to benefit the most

- Watch for Fed and BOJ interest rate changes which will contribute to yen volatility; our view remains for the Fed to begin rate cuts in September, and the BOJ to hike in 1Q25

Related Insights

- Fixed Income Weekly: Asia Takes Cue from Powell’s Pivot 29 Aug 2024

- Research Library29 Aug 2024

- USD consolidation amid caution 29 Aug 2024

Letting the dust settle. The double whammy of a US tech selldown on disappointing earnings and the BOJ’s surprise rate hike exacerbated the mass unwinding of yen carry trades, unnerving investors and sending global stocks into a sharp selloff. Borrowing at zero-bound interest rates in Japan to fund higher-yielding investments has long been a popular strategy among investors, but sharp appreciation of the yen in recent weeks had forced many to abruptly liquidate their short yen positions.

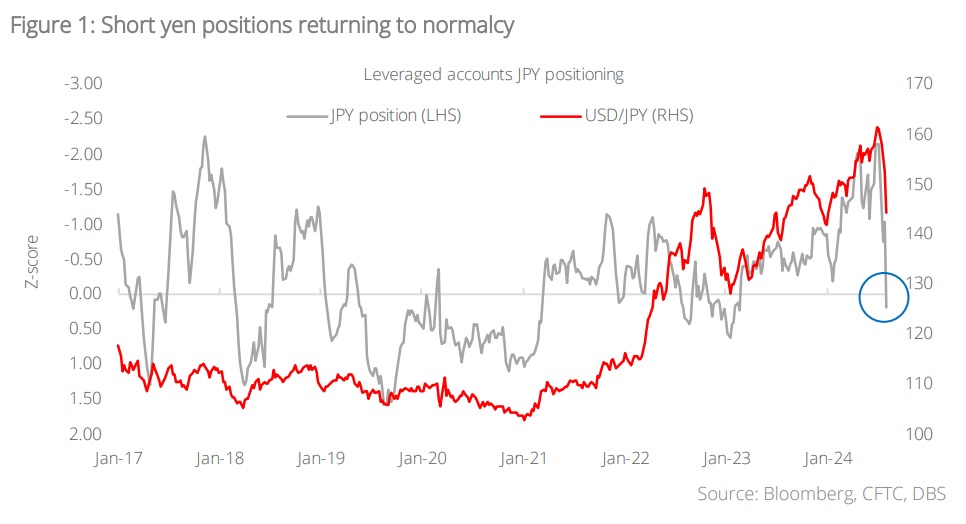

Fatigue in the carry unwind. Data from the Commodity Futures Trading Commission (CFTC) show bearish bets against the yen have come down sharply in recent weeks, with speculators having liquidated most of this year’s JPY carry trade positions. Latest CFTC readings indicate speculative and asset manager short JPY positions have reverted to the norm; markets are now expecting normalcy to return, especially in the FX space, barring major surprises from the US CPI readings that are to be released on 14 August 2024.

Data on Japanese bank lending to offshore borrowers can also help to gauge the appetite of foreign investors for yen carry trades. According to the Bank of International Settlements, following a pause in 3Q last year, yen-denominated credit outside Japan accelerated in 4Q due to a surge in bank loans. The outstanding stock, at JPY64tn (USD451bn), surged 16% from a year earlier. Moreover, brisk growth in yen credit from early 2022 coincided with sustained yen depreciation as the Bank of Japan kept interest rates below zero, keeping the yen as one of the cheapest funding sources.

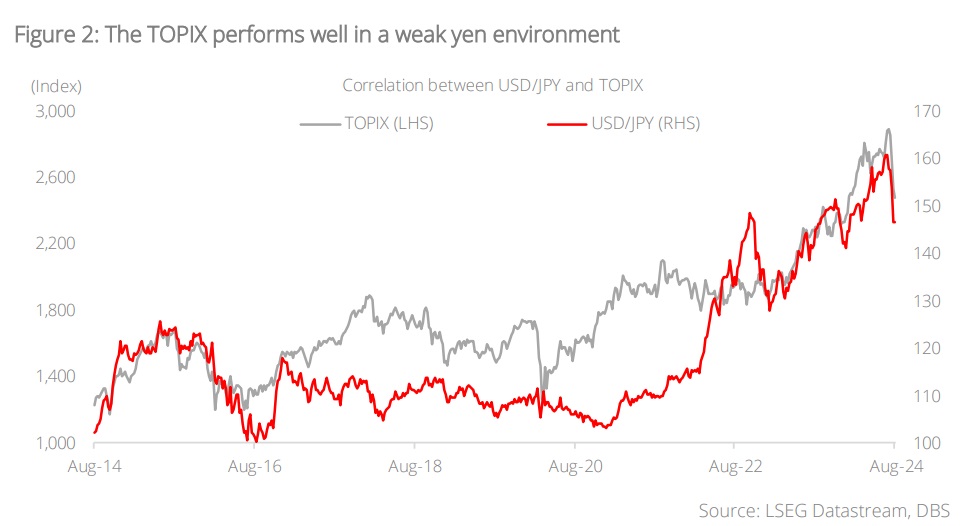

Tip of the iceberg. The estimates above are likely merely brushing the surface. The carry trade is a strategy widely used by institutional investors, hedge funds, and corporations worldwide to enhance returns by investing in assets with higher yields, such as those in emerging markets or other developed economies. It is tricky to estimate the total size of the yen carry trade, given that there are still over-the-counter transactions and other leverage plays which may be unaccounted for. Warren Buffett said in his annual letter in February this year that Berkshire Hathaway funded most of its investments in Japanese companies through yen bond offerings; the firm is a regular issuer of yen bonds, and has tapped the market every year through trillions of dollars since 2019. This type of long/short strategy is common, and largely explains the inverse correlation between the yen and Japan equities.

To put things into context, the meltdown erased some USD6.4tn from global stock markets in the span of three weeks, though most major indexes began to recover steadily in the days that followed. Although markets have stabilised, the dramatic selloff has left investors on edge over how much of the world’s funds are tied up in yen carry trades.

Carry trades to return. As the JPY remains one of the lowest yielding currencies, we believe yen carry trades will return to favour after this market rout. Although the BOJ has recently moved on from its negative interest rate policy, Japan’s interest rates remain much lower than in most other developed economies; the significant interest rate differential will keep the yen carry trade attractive. This is especially so as yields fall further, and the yen shows room to weaken. Key risk events adding to yen volatility include the Fed’s first rate cut and further interest rate hikes by the BOJ. Our view remains for Fed to cut 25 bps commencing in eptember, while BOJ’s next rate hike move is likely to be in 1Q25 .

Japan equities are key beneficiaries of yen carry trades. We stay constructive on Japan in the long run, with a focus on the semiconductor and IT services sectors as beneficiaries of increased AI adoption, and the financials sector which will gain tailwinds from Japan’s interest rate normalisation and reflation story.

Topic

The information published by DBS Bank Ltd. (company registration no.: 196800306E) (“DBS”) is for information only. It is based on information or opinions obtained from sources believed to be reliable (but which have not been independently verified by DBS, its related companies and affiliates (“DBS Group”)) and to the maximum extent permitted by law, DBS Group does not make any representation or warranty (express or implied) as to its accuracy, completeness, timeliness or correctness for any particular purpose. Opinions and estimates are subject to change without notice. The publication and distribution of the information does not constitute nor does it imply any form of endorsement by DBS Group of any person, entity, services or products described or appearing in the information. Any past performance, projection, forecast or simulation of results is not necessarily indicative of the future or likely performance of any investment or securities. Foreign exchange transactions involve risks. You should note that fluctuations in foreign exchange rates may result in losses. You may wish to seek your own independent financial, tax, or legal advice or make such independent investigations as you consider necessary or appropriate.

The information published is not and does not constitute or form part of any offer, recommendation, invitation or solicitation to subscribe to or to enter into any transaction; nor is it calculated to invite, nor does it permit the making of offers to the public to subscribe to or enter into any transaction in any jurisdiction or country in which such offer, recommendation, invitation or solicitation is not authorised or to any person to whom it is unlawful to make such offer, recommendation, invitation or solicitation or where such offer, recommendation, invitation or solicitation would be contrary to law or regulation or which would subject DBS Group to any registration requirement within such jurisdiction or country, and should not be viewed as such. Without prejudice to the generality of the foregoing, the information, services or products described or appearing in the information are not specifically intended for or specifically targeted at the public in any specific jurisdiction.

The information is the property of DBS and is protected by applicable intellectual property laws. No reproduction, transmission, sale, distribution, publication, broadcast, circulation, modification, dissemination, or commercial exploitation such information in any manner (including electronic, print or other media now known or hereafter developed) is permitted.

DBS Group and its respective directors, officers and/or employees may have positions or other interests in, and may effect transactions in securities mentioned and may also perform or seek to perform broking, investment banking and other banking or financial services to any persons or entities mentioned.

To the maximum extent permitted by law, DBS Group accepts no liability for any losses or damages (including direct, special, indirect, consequential, incidental or loss of profits) of any kind arising from or in connection with any reliance and/or use of the information (including any error, omission or misstatement, negligent or otherwise) or further communication, even if DBS Group has been advised of the possibility thereof.

The information is not intended for distribution to, or use by, any person or entity in any jurisdiction or country where such distribution or use would be contrary to law or regulation. The information is distributed (a) in Singapore, by DBS Bank Ltd.; (b) in China, by DBS Bank (China) Ltd; (c) in Hong Kong, by DBS Bank (Hong Kong) Limited; (d) in Taiwan, by DBS Bank (Taiwan) Ltd; (e) in Indonesia, by PT DBS Indonesia; and (f) in India, by DBS Bank Ltd, Mumbai Branch.

Related Insights

- Fixed Income Weekly: Asia Takes Cue from Powell’s Pivot 29 Aug 2024

- Research Library29 Aug 2024

- USD consolidation amid caution 29 Aug 2024

Related Insights

- Fixed Income Weekly: Asia Takes Cue from Powell’s Pivot 29 Aug 2024

- Research Library29 Aug 2024

- USD consolidation amid caution 29 Aug 2024