- Equities: Earnings report from companies continue to show signs of weakening consumer demand; US markets rebounded on better-than-expected initial jobless claims data

- Credit: Fixed income investments can yield higher returns than cash without requiring precise timing of the upcoming rate cuts

- FX: Speculators have liquidated most of this year’s JPY carry trade positions; NZD/USD to extend its recovery after rising 0.7% to 0.60 last week

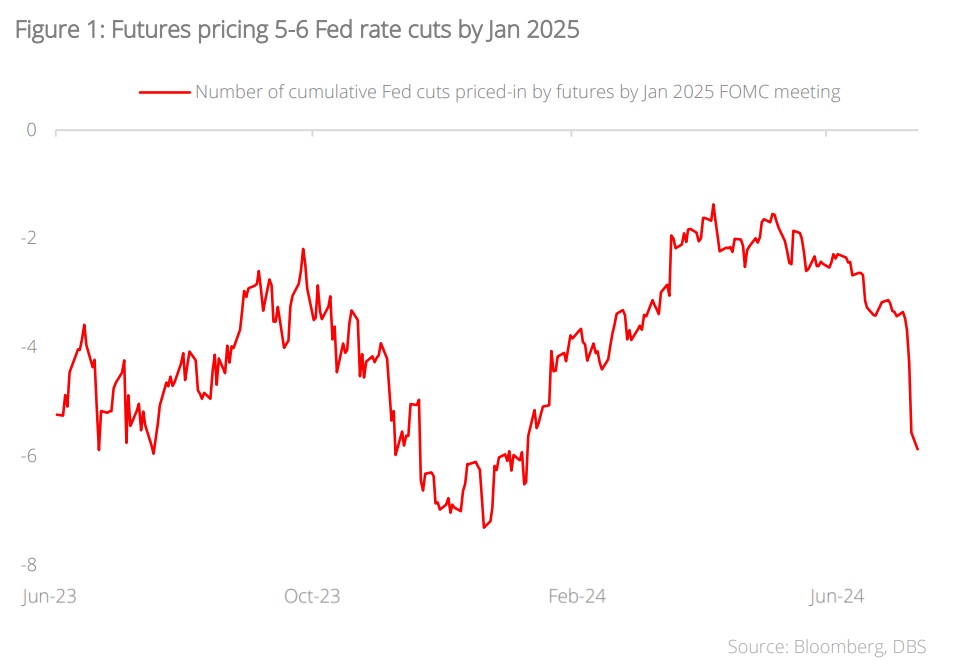

- Rates: Modest upside to short-dated yields if sentiment stays stable; inflation fear is low with 10Y breakevens hovering around 2.1%

- The Week Ahead: Keep a lookout for US Change in Initial Jobless Claims; Japan Industrial Production Number

Related Insights

- Cloudy Outlook Ahead30 Aug 2024

- FX Tactical Ideas: Long AUD-NZD at Bottom of Ascending Channel30 Aug 2024

- CDL Hospitality Trusts30 Aug 2024

Volatile week amid economic concerns. Worries over a weaker-than-expected US jobs report coupled with a sudden BOJ interest rate hike triggered an unwinding of the yen carry trade, sparking a massive sell-off on Monday. The CBOE Volatility Index (VIX), often referred to as the 'fear index,' briefly surged to 65.73, its third highest mark since records started in 1992. Furthermore, the sell-off was exacerbated after earnings releases from Disney and Airbnb that revealed signs of weakening consumer demand.

Despite the turbulence, markets were able to recover most of its losses for the week, following the release of better-than-expected US initial jobless claims data (233k vs consensus 240k). The S&P 500 was flat, while the NASDAQ and Dow Jones fell 0.2% and 0.6% respectively for the week. Investors will be paying close attention to Wednesday’s US CPI data and Thursday’s retail sales data to gauge the economy’s resilience.

Topic in focus: Steep sell-offs, stable outlook. Despite heightened market volatility, the sharp sell-off has little bearing on corporate fundamentals, given the resilient corporate earnings outlook and undemanding valuations. Based on consensus forecast, the S&P 500 is expected to register earnings growth of 10% this year. Despite the low base effect from the earnings recession in 2023, the outlook for 2025 is equally upbeat – US earnings growth is forecast at 13%, buoyed by inventory restocking, technology-related capex, and increased construction spending.

Amid softening economic conditions and impending rate cuts, it is crucial for investors to stay with long-term secular trends beyond policy shifts. We maintain our conviction on Big Tech companies with huge cash holdings and strong balance sheets as they are poised to continue benefitting from the adoption of artificial intelligence (AI) technologies across industries. Additionally, rising oil prices, as a result of geopolitical uncertainty, augur well for the outlook of upstream energy companies.

Topic

The information published by DBS Bank Ltd. (company registration no.: 196800306E) (“DBS”) is for information only. It is based on information or opinions obtained from sources believed to be reliable (but which have not been independently verified by DBS, its related companies and affiliates (“DBS Group”)) and to the maximum extent permitted by law, DBS Group does not make any representation or warranty (express or implied) as to its accuracy, completeness, timeliness or correctness for any particular purpose. Opinions and estimates are subject to change without notice. The publication and distribution of the information does not constitute nor does it imply any form of endorsement by DBS Group of any person, entity, services or products described or appearing in the information. Any past performance, projection, forecast or simulation of results is not necessarily indicative of the future or likely performance of any investment or securities. Foreign exchange transactions involve risks. You should note that fluctuations in foreign exchange rates may result in losses. You may wish to seek your own independent financial, tax, or legal advice or make such independent investigations as you consider necessary or appropriate.

The information published is not and does not constitute or form part of any offer, recommendation, invitation or solicitation to subscribe to or to enter into any transaction; nor is it calculated to invite, nor does it permit the making of offers to the public to subscribe to or enter into any transaction in any jurisdiction or country in which such offer, recommendation, invitation or solicitation is not authorised or to any person to whom it is unlawful to make such offer, recommendation, invitation or solicitation or where such offer, recommendation, invitation or solicitation would be contrary to law or regulation or which would subject DBS Group to any registration requirement within such jurisdiction or country, and should not be viewed as such. Without prejudice to the generality of the foregoing, the information, services or products described or appearing in the information are not specifically intended for or specifically targeted at the public in any specific jurisdiction.

The information is the property of DBS and is protected by applicable intellectual property laws. No reproduction, transmission, sale, distribution, publication, broadcast, circulation, modification, dissemination, or commercial exploitation such information in any manner (including electronic, print or other media now known or hereafter developed) is permitted.

DBS Group and its respective directors, officers and/or employees may have positions or other interests in, and may effect transactions in securities mentioned and may also perform or seek to perform broking, investment banking and other banking or financial services to any persons or entities mentioned.

To the maximum extent permitted by law, DBS Group accepts no liability for any losses or damages (including direct, special, indirect, consequential, incidental or loss of profits) of any kind arising from or in connection with any reliance and/or use of the information (including any error, omission or misstatement, negligent or otherwise) or further communication, even if DBS Group has been advised of the possibility thereof.

The information is not intended for distribution to, or use by, any person or entity in any jurisdiction or country where such distribution or use would be contrary to law or regulation. The information is distributed (a) in Singapore, by DBS Bank Ltd.; (b) in China, by DBS Bank (China) Ltd; (c) in Hong Kong, by DBS Bank (Hong Kong) Limited; (d) in Taiwan, by DBS Bank (Taiwan) Ltd; (e) in Indonesia, by PT DBS Indonesia; and (f) in India, by DBS Bank Ltd, Mumbai Branch.

Related Insights

- Cloudy Outlook Ahead30 Aug 2024

- FX Tactical Ideas: Long AUD-NZD at Bottom of Ascending Channel30 Aug 2024

- CDL Hospitality Trusts30 Aug 2024

Related Insights

- Cloudy Outlook Ahead30 Aug 2024

- FX Tactical Ideas: Long AUD-NZD at Bottom of Ascending Channel30 Aug 2024

- CDL Hospitality Trusts30 Aug 2024