- Europe equities were not spared from the recent market selldown despite cheaper valuations

- After a positive start to the year, the Eurozone economy is showing disappointing growth; unremarkable earnings season fails to lift valuations

- Our economists expect softer growth conditions to outweigh price concerns, leading to a second rate cut in September

- Escalating geopolitical risks and trade tension further add to the bleak growth outlook

- Stay defensive in volatile times; focus on tech, healthcare, and luxury for long-term gains

Related Insights

- Cloudy Outlook Ahead30 Aug 2024

- FX Tactical Ideas: Long AUD-NZD at Bottom of Ascending Channel30 Aug 2024

- CDL Hospitality Trusts30 Aug 2024

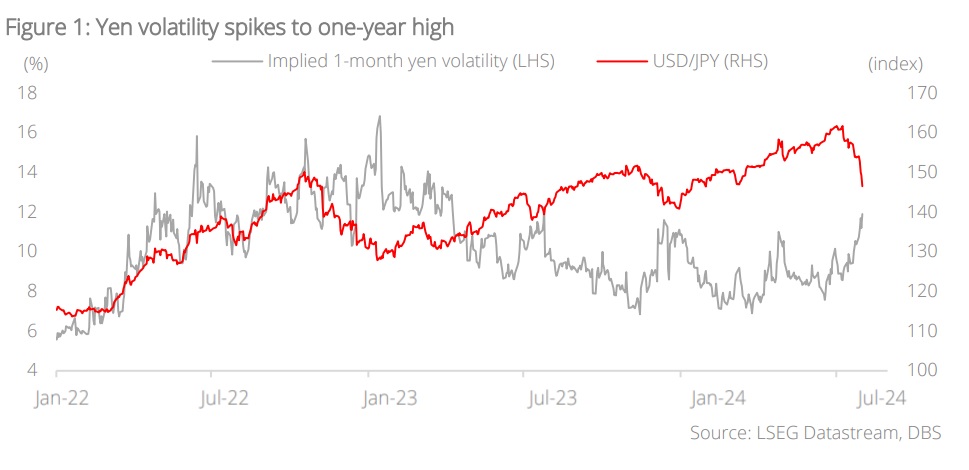

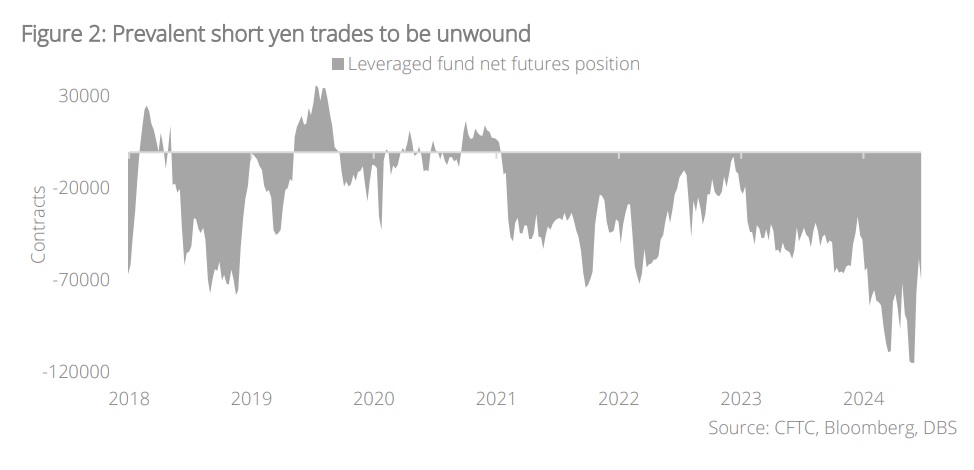

Turbulent times. The twin headwinds of US labour market weakness and the massive unwinding of yen carry trades sent stock markets plummeting across the board early this week. Despite cheaper valuations, Europe equities were not spared from the rout – the STOXX 600 index hit a six-month low amid a global retreat sparked by concerns of a US economic slowdown, before inching higher as markets showed signs of stabilising. Although rate cut hopes and generally improving investor confidence had fuelled optimism on Europe equities in the earlier half of this year, they continue to trade at steep discounts to US stocks.

Growth stuck in flatline. The Eurozone economy expanded 0.3% q/q in 2Q, the same pace as the quarter before, suggesting the economy is recovering from last year’s stagnation. Yet, incoming data has been less inspiring, including weakening PMIs and soft industrial production readings. Economic activity in Germany has been anemic, marked by the 0.1% decline in 2Q despite inflation coming off highs. In contrast, Spain registered a +0.8% q/q increase, followed by France at +0.3%. On the back of higher energy costs, inflation unexpectedly ticked up to 2.6% y/y in July from 2.5% the month before.

Further rate cuts to catalyse recovery. Back in June, subdued economic activity and easing power prices saw the European Central Bank (ECB) taking its foot off the monetary policy bra e, ahea of the Fe eral Reserve. While the region’s economic malaise shoul arrant further interest rate cuts over the remainder of the year, the mix of tentative growth signs alongside firm inflation poses a dilemma for the next rate review. While the rate reduction in September is not a done deal, our economists expect softer growth conditions to outweigh price concerns and result in the second small cut next month. As banks remain the key source of funding for European companies, further rate cuts will facilitate stronger balance sheets, improve returns for shareholders, and encourage investment activities. Further rate cuts should provide relief to corporates and households.

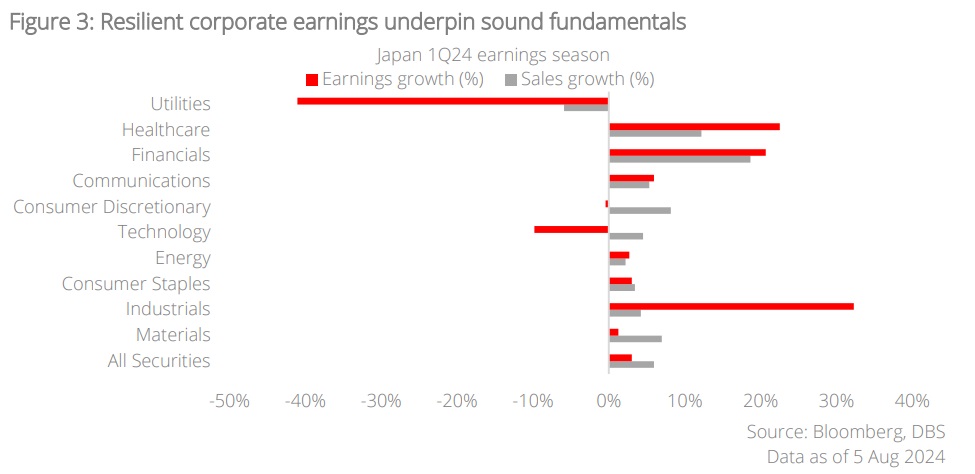

Earnings muted. Although the year began on a positive note, the current earnings season has not significantly boosted valuations. So far, 58% of companies have reported their earnings, with only 5% exceeding expectations, mainly in the financials, healthcare, and utilities sectors. We are optimistic about the utilities sector which is likely to benefit from lower costs through cheaper oil prices, materials, and lower interest rates, while AI-driven demand is expected to enhance the energy consumption outlook. Financials have surprised positively but growth is weak, and net interest margins are likely to be compressed by further rate cuts. The consumer discretionary sector has been negatively impacted by underperformance in the automotive and selected luxury segments. As a result, the region’s full-year earnings growth forecast for 2024 has been downgraded to 3% with a recovery now anticipated next year.

Maintain cautious stance; stay with resilient sectors. With its strong value proposition, European stocks may demonstrate defensiveness in these turbulent times, but its rebound from the rout may be relatively weak due to the absence of growth. European stock markets have a higher concentration of traditional industries, such as manufacturing and utilities, compared to those in the US. These sectors typically have low growth and low valuation metrics and could serve as safe havens during periods of heightened volatility.

In the long term, we favour the IT, healthcare, and luxury sectors in Europe which are poised to benefit from structural demand trends. The IT sector is set to thrive with the accelerating global adoption of AI, while the healthcare sector will gain momentum from the rising number of medical solutions aimed at enhancing the quality of life. Luxury is a long-term structural growth sector poised to benefit from increasingly affluent populations. In particular, given surrounding uncertainties, demand from ultra-high net worth spenders for quiet luxury brands is noteworthy as the demographic is less price-sensitive and bolstered against economic downturns.

Topic

The information published by DBS Bank Ltd. (company registration no.: 196800306E) (“DBS”) is for information only. It is based on information or opinions obtained from sources believed to be reliable (but which have not been independently verified by DBS, its related companies and affiliates (“DBS Group”)) and to the maximum extent permitted by law, DBS Group does not make any representation or warranty (express or implied) as to its accuracy, completeness, timeliness or correctness for any particular purpose. Opinions and estimates are subject to change without notice. The publication and distribution of the information does not constitute nor does it imply any form of endorsement by DBS Group of any person, entity, services or products described or appearing in the information. Any past performance, projection, forecast or simulation of results is not necessarily indicative of the future or likely performance of any investment or securities. Foreign exchange transactions involve risks. You should note that fluctuations in foreign exchange rates may result in losses. You may wish to seek your own independent financial, tax, or legal advice or make such independent investigations as you consider necessary or appropriate.

The information published is not and does not constitute or form part of any offer, recommendation, invitation or solicitation to subscribe to or to enter into any transaction; nor is it calculated to invite, nor does it permit the making of offers to the public to subscribe to or enter into any transaction in any jurisdiction or country in which such offer, recommendation, invitation or solicitation is not authorised or to any person to whom it is unlawful to make such offer, recommendation, invitation or solicitation or where such offer, recommendation, invitation or solicitation would be contrary to law or regulation or which would subject DBS Group to any registration requirement within such jurisdiction or country, and should not be viewed as such. Without prejudice to the generality of the foregoing, the information, services or products described or appearing in the information are not specifically intended for or specifically targeted at the public in any specific jurisdiction.

The information is the property of DBS and is protected by applicable intellectual property laws. No reproduction, transmission, sale, distribution, publication, broadcast, circulation, modification, dissemination, or commercial exploitation such information in any manner (including electronic, print or other media now known or hereafter developed) is permitted.

DBS Group and its respective directors, officers and/or employees may have positions or other interests in, and may effect transactions in securities mentioned and may also perform or seek to perform broking, investment banking and other banking or financial services to any persons or entities mentioned.

To the maximum extent permitted by law, DBS Group accepts no liability for any losses or damages (including direct, special, indirect, consequential, incidental or loss of profits) of any kind arising from or in connection with any reliance and/or use of the information (including any error, omission or misstatement, negligent or otherwise) or further communication, even if DBS Group has been advised of the possibility thereof.

The information is not intended for distribution to, or use by, any person or entity in any jurisdiction or country where such distribution or use would be contrary to law or regulation. The information is distributed (a) in Singapore, by DBS Bank Ltd.; (b) in China, by DBS Bank (China) Ltd; (c) in Hong Kong, by DBS Bank (Hong Kong) Limited; (d) in Taiwan, by DBS Bank (Taiwan) Ltd; (e) in Indonesia, by PT DBS Indonesia; and (f) in India, by DBS Bank Ltd, Mumbai Branch.

Related Insights

- Cloudy Outlook Ahead30 Aug 2024

- FX Tactical Ideas: Long AUD-NZD at Bottom of Ascending Channel30 Aug 2024

- CDL Hospitality Trusts30 Aug 2024

Related Insights

- Cloudy Outlook Ahead30 Aug 2024

- FX Tactical Ideas: Long AUD-NZD at Bottom of Ascending Channel30 Aug 2024

- CDL Hospitality Trusts30 Aug 2024