- US: Fed leaves interest rates unchanged in latest FOMC meeting but set the stage for rate cuts in September, if incoming economic data a supportive

- Japan: BOJ takes key step in monetary policy normalisation with 15 bps interest rate hike to 0.25%, reduction of monthly JGB purchases

- Hong Kong: Better-than-expected growth supported by strong exports; investments remain tepid amid high borrowing costs

- Taiwan: Significant rebound in industrial output and import of capital goods fuel broader manufacturing recovery, supporting GDP growth

Related Insights

- US CPI and Rubio’s confirmation hearing today 15 Jan 2025

- CNY rates: Weak credit data and easing bias 15 Jan 2025

- Global Oil & Gas: Resurgence of US Upstream Players 15 Jan 2025

Global: Rate cuts in play. Federal Reserve officials on Wednesday (31 Jul) held short-term interest rates steady but indicated that inflation was nearing its target. Fed Chair Jerome Powell said that an interest rate cut on 18 Sep is “on the table”, on the condition that incoming US data further increases confidence in inflation moving sustainably towards the 2% target or signals the urgency to avert a potentially sharp downturn in the labour market.

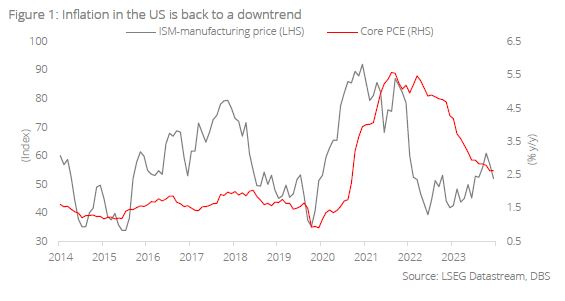

US inflation markers are back to a downtrend that began more than a year ago. Key measures of inflation like the core PCE and trimmed-mean PCE, both on a y/y and m/m basis, seasonally adjusted, annualised basis, have eased to the 2.6%-2.8% range. Signs of cooling in the labour market are also starting to translate into less purchasing power – wages and salaries rose 0.3% in June, half the prior month’s pace. On an inflation-adjusted basis, disposable income growth slowed to 0.1%.

The US economy continues to deliver better-than-expected data – real gross GDP grew at an annual rate of 2.8%, double that of the 1Q24 outturn of 1.4%. This increase primarily reflected increases in consumer spending, inventory investment, and business investment. Imports increased as well, reflecting rising domestic demand. Accordingly, our view of calibrated cuts (beginning in September) still appears to be the most likely scenario going forward.

Meanwhile, the Bank of England (BOE) delivered its first interest rate cut in over four years, taking the key rate to 5%, though policymakers remain divided on whether inflation pressures had eased sufficiently. CPI returned to the BOE's 2% target in May and stayed there in June; however, the BOE expects headline inflation to rise to 2.75% in the final quarter of the year as the effect of last year's steep falls in energy prices fades, before returning to its 2% target in early 2026.

Download the PDF to read the full report which includes coverage on Credit, FX, Rates, and Thematics.

Topic

The information published by DBS Bank Ltd. (company registration no.: 196800306E) (“DBS”) is for information only. It is based on information or opinions obtained from sources believed to be reliable (but which have not been independently verified by DBS, its related companies and affiliates (“DBS Group”)) and to the maximum extent permitted by law, DBS Group does not make any representation or warranty (express or implied) as to its accuracy, completeness, timeliness or correctness for any particular purpose. Opinions and estimates are subject to change without notice. The publication and distribution of the information does not constitute nor does it imply any form of endorsement by DBS Group of any person, entity, services or products described or appearing in the information. Any past performance, projection, forecast or simulation of results is not necessarily indicative of the future or likely performance of any investment or securities. Foreign exchange transactions involve risks. You should note that fluctuations in foreign exchange rates may result in losses. You may wish to seek your own independent financial, tax, or legal advice or make such independent investigations as you consider necessary or appropriate.

The information published is not and does not constitute or form part of any offer, recommendation, invitation or solicitation to subscribe to or to enter into any transaction; nor is it calculated to invite, nor does it permit the making of offers to the public to subscribe to or enter into any transaction in any jurisdiction or country in which such offer, recommendation, invitation or solicitation is not authorised or to any person to whom it is unlawful to make such offer, recommendation, invitation or solicitation or where such offer, recommendation, invitation or solicitation would be contrary to law or regulation or which would subject DBS Group to any registration requirement within such jurisdiction or country, and should not be viewed as such. Without prejudice to the generality of the foregoing, the information, services or products described or appearing in the information are not specifically intended for or specifically targeted at the public in any specific jurisdiction.

The information is the property of DBS and is protected by applicable intellectual property laws. No reproduction, transmission, sale, distribution, publication, broadcast, circulation, modification, dissemination, or commercial exploitation such information in any manner (including electronic, print or other media now known or hereafter developed) is permitted.

DBS Group and its respective directors, officers and/or employees may have positions or other interests in, and may effect transactions in securities mentioned and may also perform or seek to perform broking, investment banking and other banking or financial services to any persons or entities mentioned.

To the maximum extent permitted by law, DBS Group accepts no liability for any losses or damages (including direct, special, indirect, consequential, incidental or loss of profits) of any kind arising from or in connection with any reliance and/or use of the information (including any error, omission or misstatement, negligent or otherwise) or further communication, even if DBS Group has been advised of the possibility thereof.

The information is not intended for distribution to, or use by, any person or entity in any jurisdiction or country where such distribution or use would be contrary to law or regulation. The information is distributed (a) in Singapore, by DBS Bank Ltd.; (b) in China, by DBS Bank (China) Ltd; (c) in Hong Kong, by DBS Bank (Hong Kong) Limited; (d) in Taiwan, by DBS Bank (Taiwan) Ltd; (e) in Indonesia, by PT DBS Indonesia; and (f) in India, by DBS Bank Ltd, Mumbai Branch.

Related Insights

- US CPI and Rubio’s confirmation hearing today 15 Jan 2025

- CNY rates: Weak credit data and easing bias 15 Jan 2025

- Global Oil & Gas: Resurgence of US Upstream Players 15 Jan 2025

Related Insights

- US CPI and Rubio’s confirmation hearing today 15 Jan 2025

- CNY rates: Weak credit data and easing bias 15 Jan 2025

- Global Oil & Gas: Resurgence of US Upstream Players 15 Jan 2025