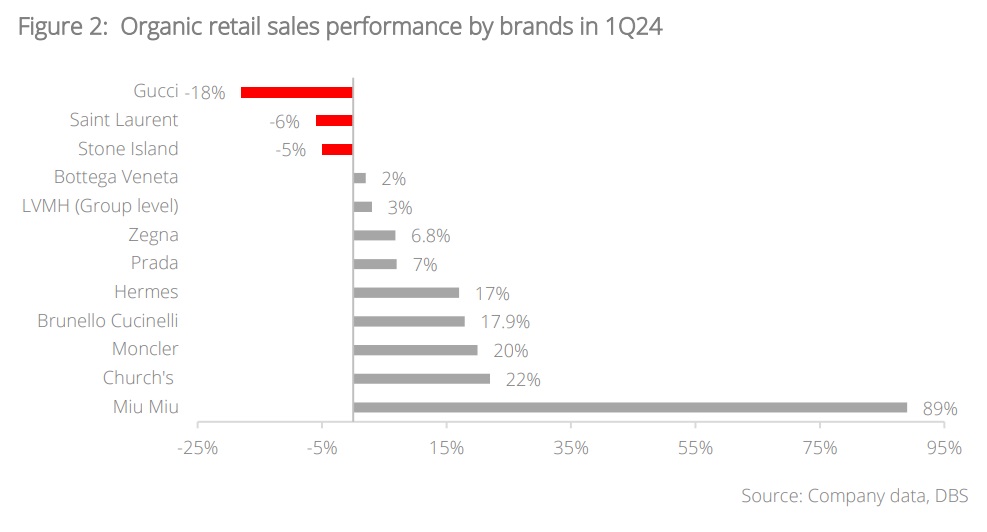

- 1Q24 earnings release shows clear bifurcation with quiet luxury brands recording double-digit organic retail sales growth while less exclusive brands faced downturns

- The global luxury industry is expected to see a mid- to high-single digit CAGR over the next five years, with China and India contributing significantly to its medium-term growth

- Luxury is a long-term structural growth sector poised to benefit from growing affluence; it serves as a diversifier that can help to buffer the portfolio from economic downturns

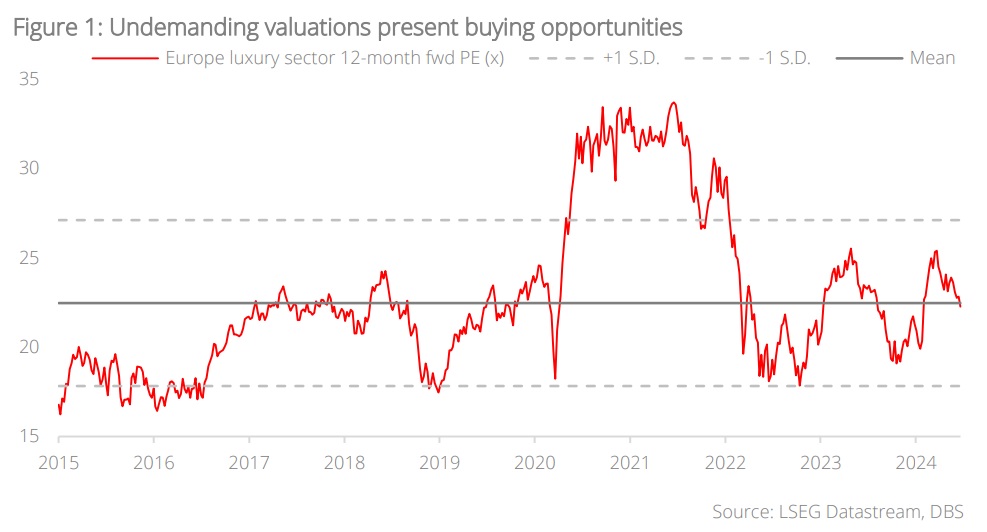

- We maintain our constructive stance on the sector, and continue to see selective buying opportunities

Related Insights

- Research Library17 Jul 2024

- Equities Weekly: Europe Equities – Market Resilience Despite Political Gridlock17 Jul 2024

- Moderna Inc 17 Jul 2024

French political risks unlikely to derail long-term profitability trends; buying opportunities remain. The share prices of major luxury brands, which are listed in France, were recently affected by political uncertainties that triggered a broad selloff across French stocks and bonds. While we do not rule out volatility from this week’s elections in France and the UK, global financial markets have demonstrated resilience and adaptability to geopolitical risks, such as trade tensions between the US/EU and China. We believe the electoral turmoil in France is a passing headwind that will not derail the long-term profitability of key luxury players, given their globally diversified sources of revenue. Given the sector’s mid- to high-single digit CAGR growth potential over the next five years, especially on the back of China’s recovery, we continue to see buying opportunities.

In the near term, we expect tailwinds from the 2024 Summer Olympics held in Paris between July and August, where demand for luxurious experiences will be amplified. Such products and services are plentiful in Europe, given the region’s rich history, sophisticated culture, and unparalleled commitment to quality and exclusivity. We maintain our constructive stance on European luxury players that demonstrate high brand desirability, strong pricing power, and superior profitability.

Evolving fortunes. From Hermès to Chanel, and Gucci to Louis Vuitton, the world of fashion has traditionally been dominated by heritage names patronised by generations of wealthy individuals. Today, driven by macroeconomic pressures and shifting consumer preferences, the global luxury sector has become increasingly nuanced. We had at the start of this year highlighted quiet luxury as an investment theme – instead of chasing the latest fad with loud prints, consumers continue to favour goods that emphasise excellent workmanship and branding that goes beyond an end-product. 1Q24 earnings results highlight the divergence between the financial performance of quiet luxury brands vs their ‘louder’ counterparts – Miu Miu and Church’s of the Prada Group emerged as winners, closely followed by Hermès with double-digit organic retail sales growth. In contrast, Kering's Gucci and Saint Laurent faced downturns.

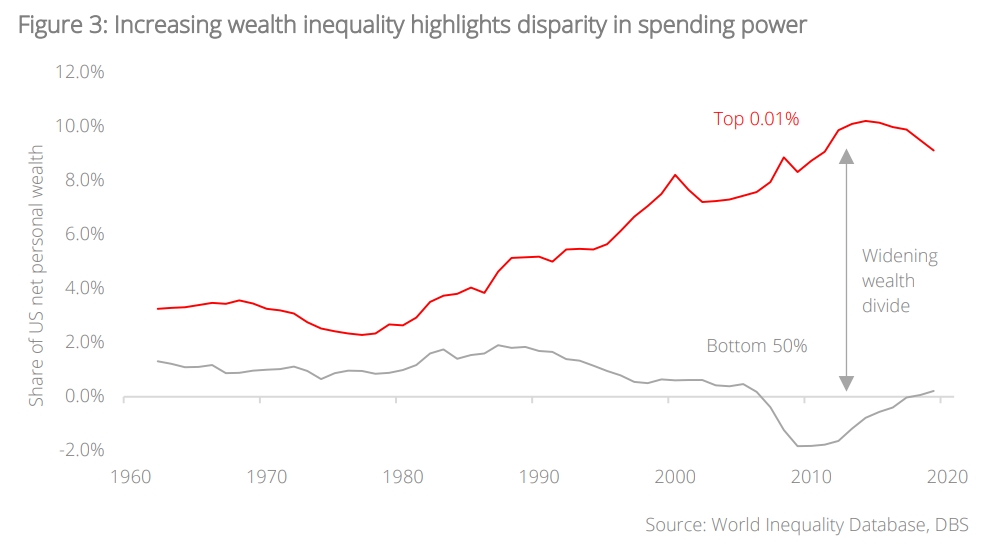

Diversification in true fashion. Driven by momentum over artificial intelligence, US technology stocks – the Magnificent Seven in particular – have accelerated to outsized positions in the US stock market, giving rise to concerns over concentration risk. While we maintain that their share price performances are underpinned by strong earnings and balance sheets, portfolio diversification remains crucial – especially in an increasingly bifurcated world where geopolitical risk and asset correlation can rise abruptly. Luxury is a long-term structural growth sector poised to benefit from increasingly affluent populations, especially among millennials and Gen Zs. Given surrounding uncertainties, demand from ultra-high net worth spenders for quiet luxury brands will be less price-sensitive and more bolstered against economic downturns.

Soft-landing scenario beneficial for the sector, new frontiers oncoming. According to a study by Bain & Company in collaboration with Altagamma, the global luxury market had shown stable growth in the face of geopolitical and economic turbulence in 2023, exceeding a record EUR1.5tn. We see this growth continuing, driven by strong tourism inflows in 1Q24 to Europe and Japan; in particular, Japan flourished on the back of a weak yen and pent-up demand. In the meantime, investors evaluate how brands navigate subdued spending among Chinese shoppers, which is historically a key driver of luxury growth. With Fed rate cuts and a US soft-landing in sight, laggard sectors such as luxury and healthcare should benefit from a broadening market rally.

Aligned with our views in Luxury, Redefined published earlier this year, Bain and Altagamma’s research also highlight a continuing trend favouring experiential offerings over tangible goods; particularly notable is the steady growth in exclusive hospitality and gourmet dining, fuelled by a rebound in tourism and growing demand for immersive experiences. The price tag of something, while still relevant, is no longer the final arbiter of value – artisanal spirit and exclusivity are just as important in determining the success of a luxury offering.

Topic

The information published by DBS Bank Ltd. (company registration no.: 196800306E) (“DBS”) is for information only. It is based on information or opinions obtained from sources believed to be reliable (but which have not been independently verified by DBS, its related companies and affiliates (“DBS Group”)) and to the maximum extent permitted by law, DBS Group does not make any representation or warranty (express or implied) as to its accuracy, completeness, timeliness or correctness for any particular purpose. Opinions and estimates are subject to change without notice. The publication and distribution of the information does not constitute nor does it imply any form of endorsement by DBS Group of any person, entity, services or products described or appearing in the information. Any past performance, projection, forecast or simulation of results is not necessarily indicative of the future or likely performance of any investment or securities. Foreign exchange transactions involve risks. You should note that fluctuations in foreign exchange rates may result in losses. You may wish to seek your own independent financial, tax, or legal advice or make such independent investigations as you consider necessary or appropriate.

The information published is not and does not constitute or form part of any offer, recommendation, invitation or solicitation to subscribe to or to enter into any transaction; nor is it calculated to invite, nor does it permit the making of offers to the public to subscribe to or enter into any transaction in any jurisdiction or country in which such offer, recommendation, invitation or solicitation is not authorised or to any person to whom it is unlawful to make such offer, recommendation, invitation or solicitation or where such offer, recommendation, invitation or solicitation would be contrary to law or regulation or which would subject DBS Group to any registration requirement within such jurisdiction or country, and should not be viewed as such. Without prejudice to the generality of the foregoing, the information, services or products described or appearing in the information are not specifically intended for or specifically targeted at the public in any specific jurisdiction.

The information is the property of DBS and is protected by applicable intellectual property laws. No reproduction, transmission, sale, distribution, publication, broadcast, circulation, modification, dissemination, or commercial exploitation such information in any manner (including electronic, print or other media now known or hereafter developed) is permitted.

DBS Group and its respective directors, officers and/or employees may have positions or other interests in, and may effect transactions in securities mentioned and may also perform or seek to perform broking, investment banking and other banking or financial services to any persons or entities mentioned.

To the maximum extent permitted by law, DBS Group accepts no liability for any losses or damages (including direct, special, indirect, consequential, incidental or loss of profits) of any kind arising from or in connection with any reliance and/or use of the information (including any error, omission or misstatement, negligent or otherwise) or further communication, even if DBS Group has been advised of the possibility thereof.

The information is not intended for distribution to, or use by, any person or entity in any jurisdiction or country where such distribution or use would be contrary to law or regulation. The information is distributed (a) in Singapore, by DBS Bank Ltd.; (b) in China, by DBS Bank (China) Ltd; (c) in Hong Kong, by DBS Bank (Hong Kong) Limited; (d) in Taiwan, by DBS Bank (Taiwan) Ltd; (e) in Indonesia, by PT DBS Indonesia; and (f) in India, by DBS Bank Ltd, Mumbai Branch.

Related Insights

- Research Library17 Jul 2024

- Equities Weekly: Europe Equities – Market Resilience Despite Political Gridlock17 Jul 2024

- Moderna Inc 17 Jul 2024

Related Insights

- Research Library17 Jul 2024

- Equities Weekly: Europe Equities – Market Resilience Despite Political Gridlock17 Jul 2024

- Moderna Inc 17 Jul 2024