- Equities: US equity markets fell despite positive news of banks passing Fed’s annual stress test; major US banks announced plans to increase dividends to return excess capital to shareholder

- Credit: Analysis of past yield curve reactions to rate cuts suggests high probability of bull steepening, indicating potential for capital gains in credit markets at the end of a tightening cycle

- FX: USD to depreciate amid expectations of two Fed cuts in 2H24; Fed cuts to eclipse efforts of other central banks in removing top-level restrictions in their monetary policies

- Rates: Bear steepening drove 2Y/10Y spread to -35 bps; US Treasuries curve factoring base case of Trump returning as President

- The Week Ahead: Keep a lookout for US Change in Nonfarm Payrolls; Singapore PMI number

Related Insights

- Research Library17 Jul 2024

- Equities Weekly: Europe Equities – Market Resilience Despite Political Gridlock17 Jul 2024

- Moderna Inc 17 Jul 2024

US Equities fell despite US banks passing stress test. On Wednesday (26 Jun 2024), the Fed announced that all 31 banks passed this year’s annual stress test. This test aims to assess the banks’ ability to handle a major financial crisis via a hypothetical scenario where commercial real estate value plummets by 40%, housing price declines by 36%, and unemployment rises to 10%. The result demonstrated the resiliency of the banking sector as the banks have sufficient capital to navigate significant economic changes and meet the Fed’s minimum capital level. As a result, large banks like Citigroup, Goldman Sachs, JP Morgan, Morgan Stanley, and Wells Fargo announced plans to increase dividends as they would be able to return some excess capital to shareholders. Despite the positive announcement, S&P 500 and Dow Jones both reported a loss of 0.1% for the week.

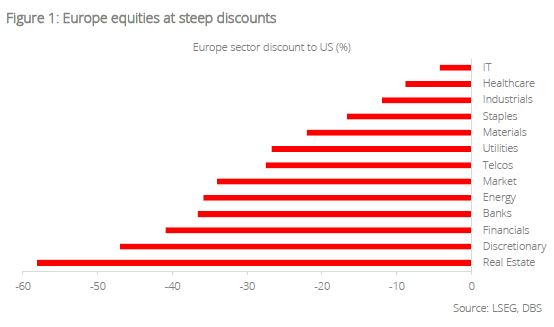

Topic in focus: Europe equities – Strong value proposition. The European equity market has shown mixed performance with the Stoxx Europe 600 up 6.8% YTD, lagging the S&P 500's 14.5%. This underperformance can be partly attributed to France's snap elections which stoked fears in their equity markets and impacted overall European sentiment. Despite these challenges, certain sectors within European equities continue to show strength:

- Luxury: European luxury brands dominate the "Quiet Luxury" trend, showing resilience to economic fluctuations. These stocks appeal to affluent millennials and benefit from strong pricing power. The sector is poised for growth, driven by global affluence, tourism, and events like the 2024 Paris Olympics.

- Technology: European tech companies are well-positioned to capitalise on AI advancements, particularly in IT services. The region is home to the world's leading semiconductor lithography tool manufacturer, crucial for developing next-generation electronic devices.

- Healthcare: European pharmaceutical giants like Roche, Novartis, and Novo Nordisk are at the forefront of AI-powered drug development. The sector is exploring promising areas such as cancer vaccines, leveraging mRNA technology.

These industries are attracting increased investor attention due to their strong fundamentals, growth prospects, and potential for innovation. As global investors seek to diversify and capitalise on European equities' relatively lower valuations, these sectors are likely to benefit from increased capital inflows.

Download the PDF to read the full report which includes coverage on Credit, FX, Rates, and Thematics.

Topic

The information published by DBS Bank Ltd. (company registration no.: 196800306E) (“DBS”) is for information only. It is based on information or opinions obtained from sources believed to be reliable (but which have not been independently verified by DBS, its related companies and affiliates (“DBS Group”)) and to the maximum extent permitted by law, DBS Group does not make any representation or warranty (express or implied) as to its accuracy, completeness, timeliness or correctness for any particular purpose. Opinions and estimates are subject to change without notice. The publication and distribution of the information does not constitute nor does it imply any form of endorsement by DBS Group of any person, entity, services or products described or appearing in the information. Any past performance, projection, forecast or simulation of results is not necessarily indicative of the future or likely performance of any investment or securities. Foreign exchange transactions involve risks. You should note that fluctuations in foreign exchange rates may result in losses. You may wish to seek your own independent financial, tax, or legal advice or make such independent investigations as you consider necessary or appropriate.

The information published is not and does not constitute or form part of any offer, recommendation, invitation or solicitation to subscribe to or to enter into any transaction; nor is it calculated to invite, nor does it permit the making of offers to the public to subscribe to or enter into any transaction in any jurisdiction or country in which such offer, recommendation, invitation or solicitation is not authorised or to any person to whom it is unlawful to make such offer, recommendation, invitation or solicitation or where such offer, recommendation, invitation or solicitation would be contrary to law or regulation or which would subject DBS Group to any registration requirement within such jurisdiction or country, and should not be viewed as such. Without prejudice to the generality of the foregoing, the information, services or products described or appearing in the information are not specifically intended for or specifically targeted at the public in any specific jurisdiction.

The information is the property of DBS and is protected by applicable intellectual property laws. No reproduction, transmission, sale, distribution, publication, broadcast, circulation, modification, dissemination, or commercial exploitation such information in any manner (including electronic, print or other media now known or hereafter developed) is permitted.

DBS Group and its respective directors, officers and/or employees may have positions or other interests in, and may effect transactions in securities mentioned and may also perform or seek to perform broking, investment banking and other banking or financial services to any persons or entities mentioned.

To the maximum extent permitted by law, DBS Group accepts no liability for any losses or damages (including direct, special, indirect, consequential, incidental or loss of profits) of any kind arising from or in connection with any reliance and/or use of the information (including any error, omission or misstatement, negligent or otherwise) or further communication, even if DBS Group has been advised of the possibility thereof.

The information is not intended for distribution to, or use by, any person or entity in any jurisdiction or country where such distribution or use would be contrary to law or regulation. The information is distributed (a) in Singapore, by DBS Bank Ltd.; (b) in China, by DBS Bank (China) Ltd; (c) in Hong Kong, by DBS Bank (Hong Kong) Limited; (d) in Taiwan, by DBS Bank (Taiwan) Ltd; (e) in Indonesia, by PT DBS Indonesia; and (f) in India, by DBS Bank Ltd, Mumbai Branch.

Related Insights

- Research Library17 Jul 2024

- Equities Weekly: Europe Equities – Market Resilience Despite Political Gridlock17 Jul 2024

- Moderna Inc 17 Jul 2024

Related Insights

- Research Library17 Jul 2024

- Equities Weekly: Europe Equities – Market Resilience Despite Political Gridlock17 Jul 2024

- Moderna Inc 17 Jul 2024