- Trump’s tariff blitz was significantly worse than market expectations; huge downside impact on global economic and corporate earnings growth expected should things escalate from here

- Imposition of 10% universal levy suggests that Trump’s tariff is ideologically driven and designed to reset trade relationships and global world order

- Equities: Our equity strategies are (a) favour markets with room for fiscal stimulus, (b) favour companies with the capacity to shift production back to the US

- Bonds: Our credit strategies are (a) favour high quality credit in A/BBB, (b) maintain a duration barbell of 2-3Y and 7-10Y, and (c) favour long duration TIPS

- Gold: Overweight safe haven gold as volatility and uncertainty are tailwinds for bullion due to its non-market correlating characteristics

Confusion and chaos amid US tariff blitz. The moment has finally arrived with Trump announcing a tariff blitz on “Liberation Day”. This marks the Trump administration’s most aggressive assault on global world order to date and is coming at a time when the global economy is showing early signs of recessionary risks. Apart from a baseline universal tariff of 10% on imports from all countries, there are also targeted “reciprocal tariffs” of 10-50% on countries with which the US has the largest trade deficits. China, for instance, was hit with a 34% reciprocal tariff while 20% was imposed on the EU. Clearly, the magnitude of the latest trade salvo is significantly worse than market expectations and if the situation escalates from here, the negative downside impact on global economic and corporate earnings growth will be significant.

Trump’s tariffs: Negotiation tool or ideological? It was often said that Trump’s tariff threat is, perhaps, a negotiation tool for countries to come to the table and cut a “deal” with the president. But the imposition of a 10% universal tariff suggests that this could be ideological after all, with the US president potentially seeing tariffs as a perfect tool to reset trade relationships and the global world order. Now with the EU stating its intent to retaliate if negotiations fail, financial markets should brace for a period of turmoil in the age of disruption and our cross-assets recommendations are:

Equities: There are no winners in a tariff war. And escalating global trade tension will only mean that the global growth-inflation dynamics will deteriorate from here. Should the major economic blocs fail to cut a deal with Trump in lowering the tariffs, brace for negative economic and earnings shocks in the coming quarters. In such an environment, our equity strategies are:

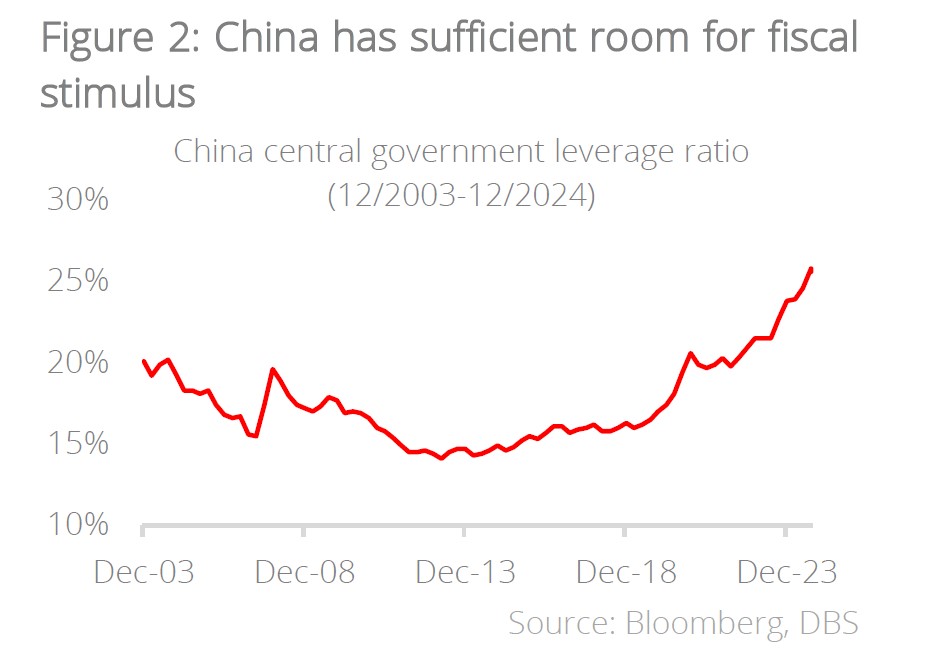

- Favour markets with room for fiscal stimulus: In such an environment, countries with the capacity to introduce fiscal stimulus will be better positioned as global aggregate demand slows and these include China and Europe. China, in particular, has significant leg room for fiscal stimulus given that its central government leverage ratio stands at only 25% of GDP (vs average of 75% for G20 peers). This provides additional flexibility for the government to introduce government-led stimulus and drive domestic consumption.

Over in Europe, Germany recently approved a EUR500bn infrastructure fund that aims to modernise key areas like transport, energy, and digitalisation, which will drive economic growth. This move has also prompted discussion within the EU about loosening fiscal constraints, signalling a shift from its traditionally cautious fiscal stance. - Favour companies with the capacity to shift production back to the US: Escalating global trade tension has triggered a rethink of manufacturing strategies (what was once deemed undoable), with companies moving production back to the US now being actively pursued. Indeed, a growing number of companies have pre-emptively begun shifting operations back to the US, especially those with high profit margins and high-entry-barrier sectors (such as semiconductors, pharmaceuticals, aerospace, and defence).

Companies within these industries can absorb higher costs due to demand inelasticity which accords them higher pricing power. Above all, access to government incentives such as the Inflation Reduction Act will also tilt the economics of domestic production through generous subsidies. While these are still in its early days, the US could actually emerge from the trade war not just as a global consumer market, but also as production hub for strategic industries in semiconductors, healthcare, and aerospace.

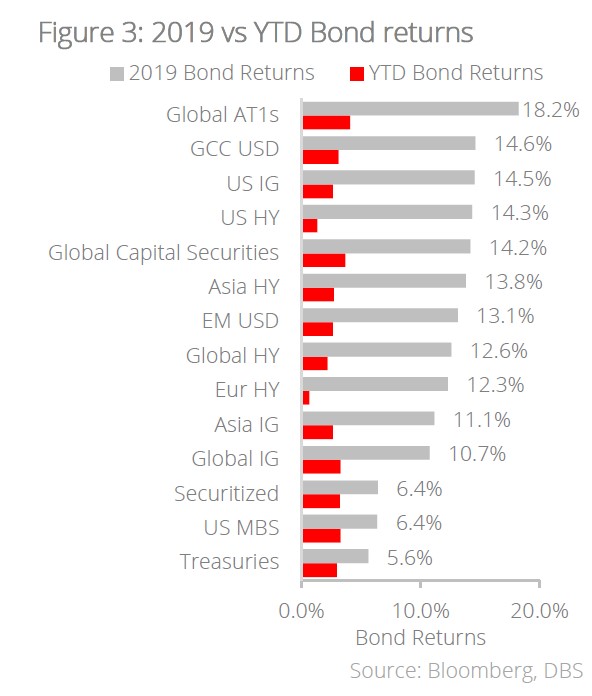

Bonds: Coming into 2025, we had proposed against consensus that a Trump presidency may not lead to the higher-and-higher yield environment that fixed income investors feared. Rather, tariff policies would lead to a drag on growth which requires a lower rate environment, against the popular opinion that tariffs would lead to inflation which in turn leads to higher rates. The market reaction post liberation day appears to be aligned to this narrative with the application of universal tariffs. As such, our credit strategies remain applicable:

- Favour high quality credit in A/BBB: Stick with high quality credit in the A/BBB bucket, as lower growth expectations could lead to more quality discrimination in credit. IG credit fundamentals are improving and would better withstand a tariff shock.

- Duration barbell of 2-3 and 7-10 years: Maintain a duration barbell of 2-3 and 7-10 years, there is still opportunity to extend duration given the steeper credit curves. A bull steepening of the curve would still benefit both the short and long ends.

- Favour long duration TIPS: TIPS continue to be a tactically appropriate expression for an environment of lower growth and higher inflation. We favour long duration TIPS (>10 years) for the higher absolute level of real yields, given the steep real yield curve.

Gold: Gold has long been touted as an important portfolio risk diversifier and we reiterated an overweight call for the metal in our article "Cross-Asset Strategies for Market Sell-down on Growth & Policy Fears". The call has proven prescient, with gold climbing to new record highs (19 and counting so far this year) amid tariff and trade war worries post-Liberation Day.

In a world where the US president can threaten the sovereignty of its closest neighbour one day and declare sweeping tariffs on its trade partners the next, gold has strengthened its foothold among investors as the favoured 'Trump put'. Gold should continue to be well bid amid troubled times, with the following as potential tailwinds/catalysts:

- Growth risks and monetary easing: Tariff wars and rising growth risks will likely see central banks turn more dovish. Rising rate cut expectations and looser monetary policy should be a positive for non-interest-bearing gold.

- Higher physical demand: General policy uncertainty under Trump 2.0 has seen increasing demand for physical gold; COMEX gold inventories, which represents the amount of gold that is available for physical delivery, have soared by more than 150% since the US election in Nov 2024.

- Revaluation of US gold reserves: Rumblings of a potential revaluation of US gold reserves (from current statutory price of USD42.22/oz.) could be another positive catalyst for bullion; history has shown marked price appreciation of gold following revaluations done in 1934, 1972, and 1973.

- De-dollarisation: Rising global fragmentation adds to gold's appeal from a de-dollarisation angle as central banks continue to add to their gold holdings.

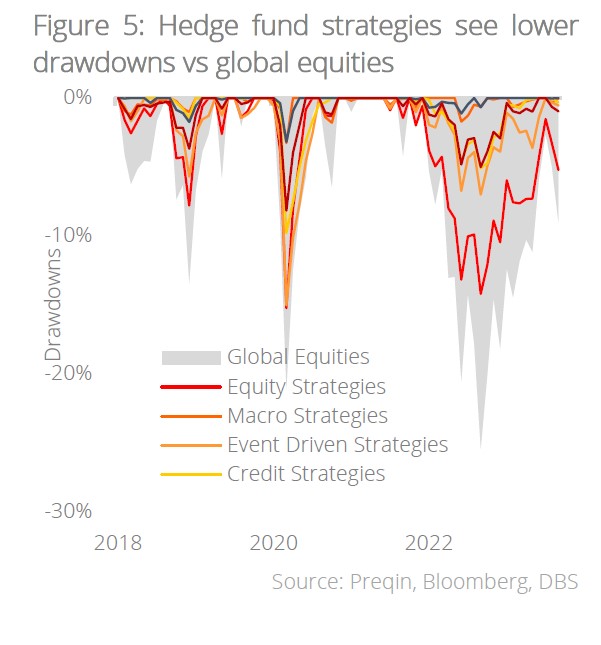

Alternatives: Alternatives, especially hedge funds, are well suited for environments where (a) volatility is elevated and (b) geopolitical risk is uncertain, giving managers who have unconstrained discretion the ability to take positions nimbly and capitalise on market distortions. Moreover, they have low correlations to the broader market which could mitigate the extent of drawdown in a risk-off environment. Under the implemented tariffs, we believe the following strategies are particularly well suited:

- Global macro hedge funds: These funds take positions in pivotal global trends, which is relevant as universal tariffs have an outsized influence on macro developments. They also present a good complementary alternative to long-only funds which does not adapt quickly to geopolitical risk.

- Relative value hedge funds: Tariffs would likely produce winners and losers in the medium

Topic

The information published by DBS Bank Ltd. (company registration no.: 196800306E) (“DBS”) is for information only. It is based on information or opinions obtained from sources believed to be reliable (but which have not been independently verified by DBS, its related companies and affiliates (“DBS Group”)) and to the maximum extent permitted by law, DBS Group does not make any representation or warranty (express or implied) as to its accuracy, completeness, timeliness or correctness for any particular purpose. Opinions and estimates are subject to change without notice. The publication and distribution of the information does not constitute nor does it imply any form of endorsement by DBS Group of any person, entity, services or products described or appearing in the information. Any past performance, projection, forecast or simulation of results is not necessarily indicative of the future or likely performance of any investment or securities. Foreign exchange transactions involve risks. You should note that fluctuations in foreign exchange rates may result in losses. You may wish to seek your own independent financial, tax, or legal advice or make such independent investigations as you consider necessary or appropriate.

The information published is not and does not constitute or form part of any offer, recommendation, invitation or solicitation to subscribe to or to enter into any transaction; nor is it calculated to invite, nor does it permit the making of offers to the public to subscribe to or enter into any transaction in any jurisdiction or country in which such offer, recommendation, invitation or solicitation is not authorised or to any person to whom it is unlawful to make such offer, recommendation, invitation or solicitation or where such offer, recommendation, invitation or solicitation would be contrary to law or regulation or which would subject DBS Group to any registration requirement within such jurisdiction or country, and should not be viewed as such. Without prejudice to the generality of the foregoing, the information, services or products described or appearing in the information are not specifically intended for or specifically targeted at the public in any specific jurisdiction.

The information is the property of DBS and is protected by applicable intellectual property laws. No reproduction, transmission, sale, distribution, publication, broadcast, circulation, modification, dissemination, or commercial exploitation such information in any manner (including electronic, print or other media now known or hereafter developed) is permitted.

DBS Group and its respective directors, officers and/or employees may have positions or other interests in, and may effect transactions in securities mentioned and may also perform or seek to perform broking, investment banking and other banking or financial services to any persons or entities mentioned.

To the maximum extent permitted by law, DBS Group accepts no liability for any losses or damages (including direct, special, indirect, consequential, incidental or loss of profits) of any kind arising from or in connection with any reliance and/or use of the information (including any error, omission or misstatement, negligent or otherwise) or further communication, even if DBS Group has been advised of the possibility thereof.

The information is not intended for distribution to, or use by, any person or entity in any jurisdiction or country where such distribution or use would be contrary to law or regulation. The information is distributed (a) in Singapore, by DBS Bank Ltd.; (b) in China, by DBS Bank (China) Ltd; (c) in Hong Kong, by DBS Bank (Hong Kong) Limited; (d) in Taiwan, by DBS Bank (Taiwan) Ltd; (e) in Indonesia, by PT DBS Indonesia; and (f) in India, by DBS Bank Ltd, Mumbai Branch.